Summary:

- Below, we discuss what Tesla, Inc. stock investors (and spectators) need to know going into Q1 Earnings in regards to the company’s make-or-break data points.

- Tesla potentially now has two levers it can pull to increase automotive gross margins – pricing and lower COGs per car.

- We believe Tesla is trading in line with tech equites, so it can be affected by deteriorating macro forces and have a buy level in mind, which we share with our premium research members. We believe this buy level will set us up for gains in Tesla stock.

Xiaolu Chu

Two months ago, we wrote that after realizing gains of 31%, it was time to take a time out on Tesla, Inc. (NASDAQ:TSLA) at the $208.31 price when our firm stated:

“Right now, our technical analysis is at odds with our fundamental analysis, which is often good news, as it means we will be afforded a lower entry on a stock position we plan to build.”

This analysis proved accurate as the stock topped around the time our last article was written and is trading at $180 today. Price action is key, yet what’s most important from our last article is that we clearly laid out the hurdle that is in front of Tesla – a hurdle that the Investor Day could not clear – as evidenced by a lower price following the action-packed annual event.

Rather than Investor Day, what is more important for Tesla are two key data points in the upcoming earnings report. In February, our firm stated:

“The stakes are high for Tesla because if the margins remain healthy, the stock will do quite well. However, if the margins contract, then the bears will be in control. This is a big moment for Tesla, as high average sales price has been a contentious issue for meeting its addressable market. Wall Street will want to see it’s possible to do both —- serve a wider total addressable market (TAM) with more affordable prices while maintaining a healthy bottom line.”

Automotive gross margins will be the key focus for the earnings call. There are two different metrics. Automotive gross margins, excluding leases and credits, and reported Automotive gross margins that are released with earnings.

Below, we discuss what Tesla stock investors (and spectators) need to know going into Q1 Earnings in regards to these make-or-break data points.

Production Target:

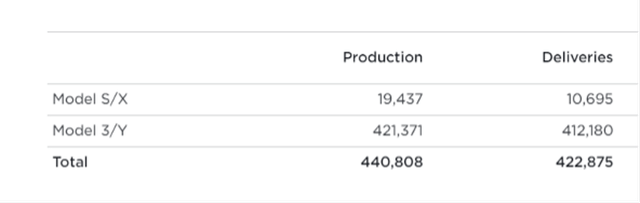

Tesla has a production target of 1.8m car units in 2023 and an average of 450,000 per quarter. On April 3, 2023, Tesla released their Q1 2023 production and deliveries. Although the 440,808 units is slightly below the quarterly average, it was in line with market expectations and on track to meet 2023 goal.

We will look for indications that quarterly production will increase, if it is 2nd half-weighted, and whether the 1.8m target is attainable.

Impact Of Price Cuts On Overall ASP:

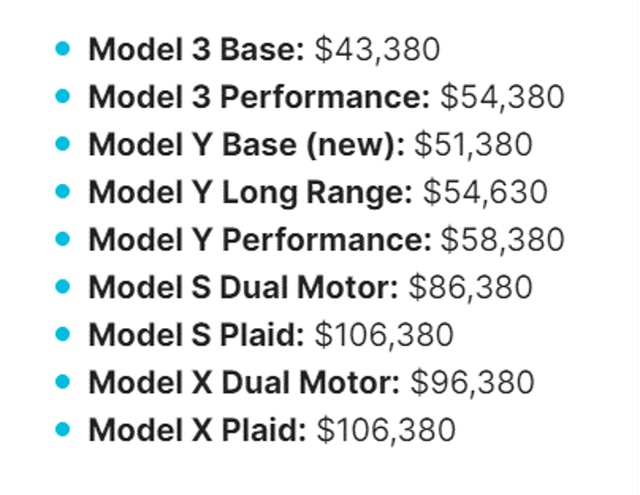

After announcing price cuts in January, Tesla announced price reductions before the Easter holiday. The April reductions were smaller than the January ones that were implemented so that certain models would qualify for the EV car tax credit. The April reductions were as follows

-

Model 3 by $1,000

-

Model Y by $2,000

-

Model S & Y range from between $5,000 to $10,000.

Models 3 and Y comprise the vast majority of overall production. After the announced price reductions, this is the estimated starting price levels as of 4/10/23 by cars.com.

After the January price reductions, Tesla stated that they expect ASP across all models to be above $47,000. After the April price reductions, we will monitor if Tesla reiterates this ASP target.

Automotive Gross Margins

Automotive gross margins will be the key focus for the earnings call. There are two different metrics. Automotive gross margins, excluding leases and credits, and reported Automotive gross margins that are released with earnings. The former ended q422 at about 18% and is typically discussed during the earnings question and answer. It is the margin we will focus on. Any improvement will be reflected in the reported Automotive gross margins which ended q422 at 25.9%.

The key to Automotive gross margins, excluding leases and credits, are ASPS and COGS per vehicle. In the Q4 2022 conference call, this is how Tesla guided future automotive gross margins. They stated ASPS will be above $47k and automotive margins above 20%.

Question (all emphasis added):

“The next question from investors is, after recent price cuts, analyst released expectations that Tesla automotive gross margin, excluding leasing and credits, will drop below 20% and average selling price around $47,000 across all models. Where do you see average selling price and gross margins after the price cuts?

Zachary Kirkhorn, CFO

So there is certainly a lot of uncertainty about how the year will unfold, but I’ll share what’s in our current forecast for a moment. So based upon these metrics here, we believe that we’ll be above both of the metrics that are stated in the question, so 20% automotive gross margin, excluding leases and rent credits and then $47,000 ASP across all models.

There was a follow-up if cogs could go back down to $36,000. This exchange provided further insight.

Excellent. Zach, actually, I’d like to follow up on the data point you just gave on cost. If I look back at the COGS per car, you guys bottom close to $36,000 in the middle of 2021. And then the number went up as you had to face with inflation in input costs and the ramp of Berlin and Texas. And this quarter, I think we are close to $40,000 and we peaked maybe close to $42,000 at some point last year.

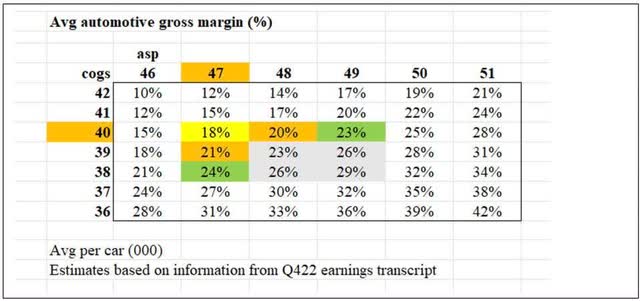

Based on this information, we put together a simple sensitivity analysis between average ASPs and COGs to determine a range of potential automotive gross margins. We estimate that margins ended q422 at 18% (yellow). Tesla has guided for ASPs greater than $47,000 and margins of greater than 20% (orange highlights). In our prior analysis, we assumed that COGs per car would remain at $40k and that higher ASP would result in margins above 20%. For example, an ASP of $48k and $49K result in 20% and 23% margins with COGS steady at $40k.

However, given the recent weakness in Lithium and Aluminum after the Q4 call. There is the potential that Tesla’s margins may benefit even if ASPs remain at $47k. For example, if ASPS remain at 47k and COG go down to $39k and $38k, margins improve to 21% and 24%, respectively. For reference, the recent low in COGS was $36k. Given timing differences, this COGS improvement may not be seen until after Q1. If it’s not seen in Q1, to the extent Tesla discusses the potential lower COGS benefit on automotive margins, the stock will react positively.

Put another way, Tesla potentially now has two levers in can pull to increase automotive gross margins – Pricing and lower COGs per car. Either one or both can contribute to higher automotive gross margins. The result will be the same in that a gross automotive above 20% will remove short-term uncertainty.

How Tech Insider Network Plans to Manage our Tesla Position:

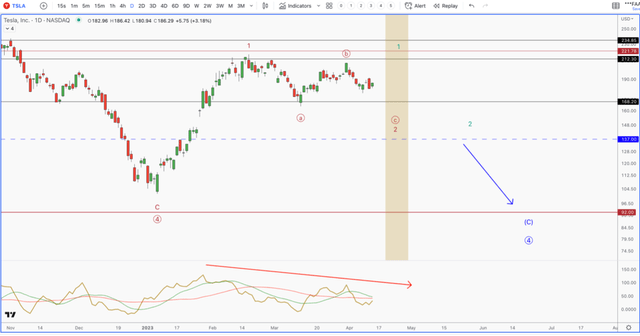

From a technical perspective, Tesla has bottomed out post-Investor Day. It appears to be setting up for a fresh high before seeing a bigger pullback on the horizon. Tesla is trading in line with tech equites, so it can be affected by deteriorating macro forces, if this happens, we could see $92 as the next likely target for a major low. As long as we hold $137, this scenario can be avoided.

We could see one more swing high into late April. We do not see this as a buying opportunity. The $231-$235 region will be very strong resistance, which will occur on lower momentum. If this happens, we will look for the following pullback to add.

We do have a buy level in mind, which we share with our premium research members. We believe this buy level will set us up for gains in Tesla stock in 2023. We provide in depth macro and individual stock analysis so that readers can better understand why we buy/sell. In this market, we frequently take gains. We also issue real-time trade alerts when we enter and exit stocks. YTD, our firm has held the two top performing assets in the tech industry – Nvidia (NVDA) and Bitcoin (BTC-USD) — at high allocations. You may learn more here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Check out my premium service “Tech Insider Network”

Check out my premium service “Tech Insider Network”

We were the first service to offer specialized tech sector coverage that combines fundamentals and technicals. After recommending a stock, we continually provide new entries and exits.

We are the only retail team that offers an audited portfolio and is featured regularly in Tier 1 media, such as Fox, CNBC, TD Ameritrade and more.

Our team offers two plans that work out to pennies an hour for a full-time analyst team.