Summary:

- Rate cuts can boost demand as previous headwinds impacting affordability in a rate hike or higher-for-longer rates environment are put behind. Rate cuts also help long-duration equities such as Tesla.

- Wall St analysts seem to be banking on China’s deliveries strength, but I am not as gung ho on this bullish driver, as I don’t see meaningful outlier performance here.

- Tesla’s valuations are high as investors are more confidently baking in growth optionalities from Robotaxis amid a rates-easing environment.

- I think Tesla has a business model edge to capture and keep a dominant share of the robotaxis market for a long time.

- Encouraged by the presence of a technical buy trigger in TSLA vs. the S&P 500, I have added the stock to my portfolio.

gremlin

Performance Assessment

In my last thesis update on Tesla (NASDAQ:TSLA), I noted bullish fundamental drivers such as gross margin expansion but stopped short of rating the stock a ‘Buy’ considering the ‘higher-for-longer’ rates narrative and the lack of a technical buy trigger vs. the S&P 500 (SPY) (SPX).

Performance since Author’s Last Article on Tesla (Seeking Alpha, Author’s Last Article on Tesla)

Since then, Tesla has started a new period of outperformance vs the broader market index. Over the last few days, I have joined the buyers as I have added the stock to my portfolio.

Thesis

I am a confident buyer of Tesla now. My thesis is based on the following considerations:

- Rate cuts can boost demand

- Wall St analysts seem to be banking on China deliveries strength, but I am not as gung ho

- Valuations are more confidently baking in growth optionalities

- Relative technicals flash buy triggers

- Robotaxi unveil on October 10 is a key event monitorable

Rate cuts can boost demand

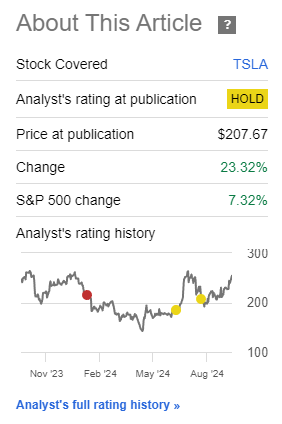

The US Federal Reserve implemented a 50bps rate cut in the September 2024 meeting. Currently, the Fed Funds rate stands at 475-500bps. Over the past few days, the market is pricing further cuts, with the chances of a further 50bps cut to 425-450bps increasing from ~30% levels to almost 60%:

Fed Funds Rate Decision Probability for the Nov 2024 Meeting (CME FedWatch, Author’s Annotations)

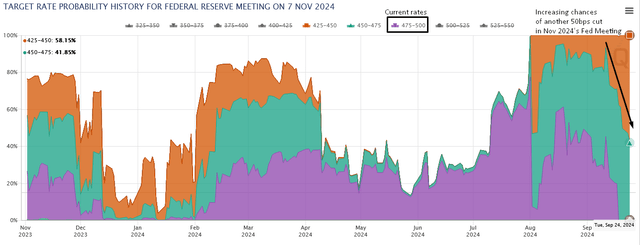

This may be due to anticipations of the Fed taking a cautious stance that supports the US labor market, since survey data from the Conference Board still shows a sharp decline in the net proportion of respondents who believe jobs are plentiful:

US Labor Market Differential (Conference Board, X (Twitter))

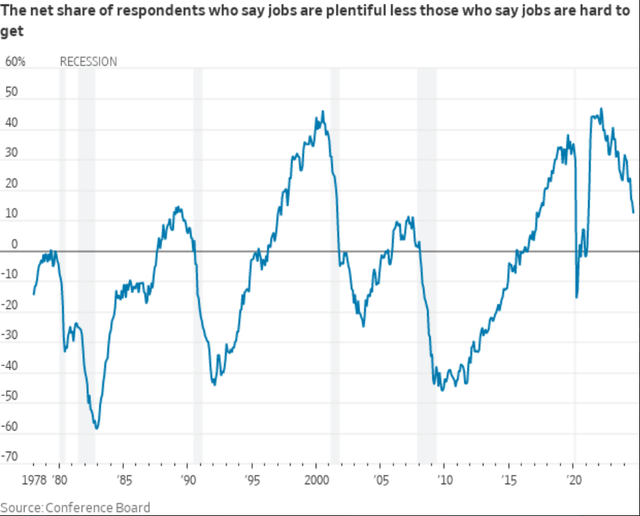

I expect this rate cut cycle to not only lead to continued stable pricing in Tesla models (see charts below), but also improve user demand.

Model Pricing Trends (Company Website, Author’s Analysis)

I recall that management’s consistent messaging to justify rate cuts were to make the cars more affordable amid a rate hike or higher-for-longer rates environment:

I just can’t emphasize this enough that the vast majority of people buying a car is about the monthly payment. And as interest rates rise, the proportion of that monthly payment that is interest increases naturally. So that’s — if interest rates remain high or if they go even higher, it’s that much harder to — for people to buy the car. They simply can’t afford it.

– CEO Elon Musk in the Q3 FY23 earnings call

As these conditions pass, I anticipate affordability to increase, lifting demand for Tesla’s cars.

Now, one counterargument could be offered is that if the job market worsens, that could detrimentally impact affordability too. However, I am skeptical about that hypothesis playing out since demographic data from more than 14,500 Tesla owners show that the brand’s user demographic tends to be upper-middle class Generation X people with an average household income of $150,015 who are also financially secure as 97% of Tesla’s owners also owned a home, compared to a much lower national homeownership rate of 64%.

Now, I should point out a nuance that more recently in 2023 and 2024, the incremental Tesla owners were Millennials or part of Generation Z. And this group’s income and wealth may not be as high as the Generation X demographic. However, I still think buyers of Tesla vehicles tend to be better off, less impacted by weaker labor economic conditions.

Lastly, I will also note that rate cuts are especially favorable for stocks whose valuations price in longer-duration growth. As much of Tesla’s value is in long-term growth levers such as robotaxis and robots, I view the stock as a big beneficiary of a rate cut environment.

Wall St analysts seem to be banking on China deliveries strength, but I am not as gung ho

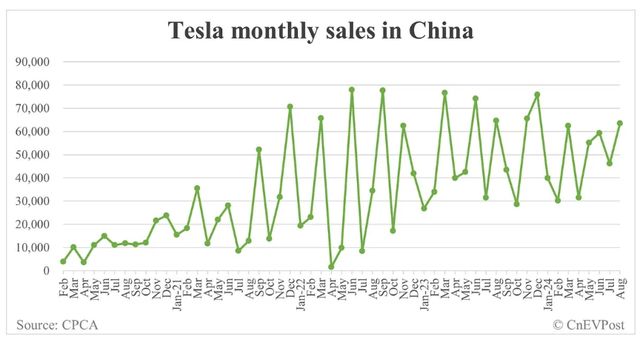

Recently, many Wall St analysts have upgraded their views on Tesla stock due to upgraded expectations of Q3 FY24 deliveries, driven by strength in China. However, I am not as gung ho about these trends.

Tesla Monthly Sales in China (CPCA)

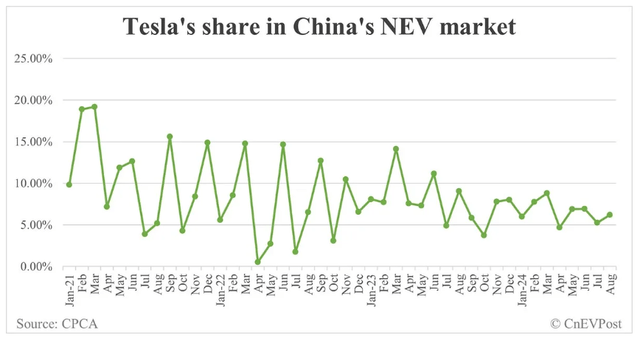

While it is true that Tesla’s monthly sales have increased in August 2024, I note that Tesla’s overall market share in China’s new electric vehicle (NEV) market has not had a material uptick:

Tesla’s share in China’s New Electric Vehicle (NEV) Market (CPCA)

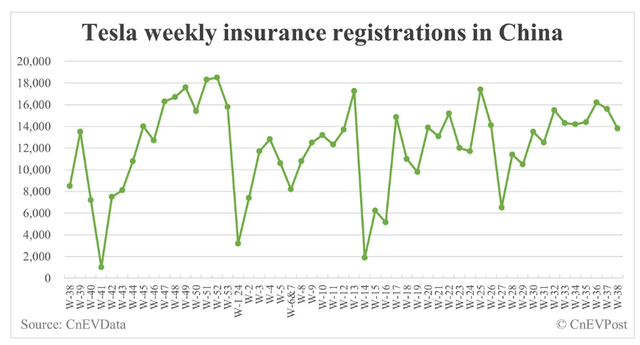

Furthermore, more recent September 2024 data on Tesla’s weekly insurance registrations (which tends to be a coincident indicator of sales) in China show a downtick again over the past 3 weeks:

Tesla Weekly Insurance Registrations in China (CnEVData)

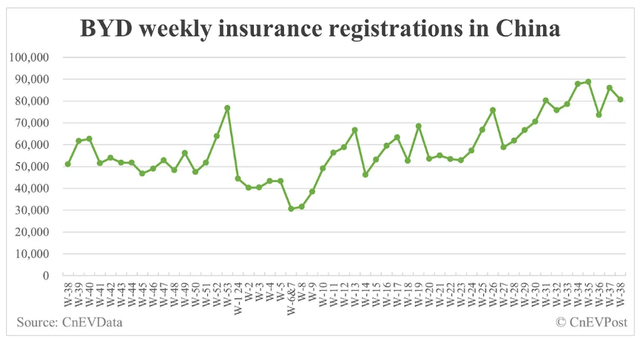

Overall, I don’t see Tesla’s performance to be an exceptional outlier. Look at Chinese EV maker BYD (OTCPK:BYDDF), which has seen a more steady increase in weekly insurance registrations:

BYD Weekly Insurance Registrations in China (CnEVData)

Therefore, although I recognize Tesla’s improved deliveries performance in China, I do not place much weight on these developments in my overall bullish view.

Valuations are more confidently baking in growth optionalities

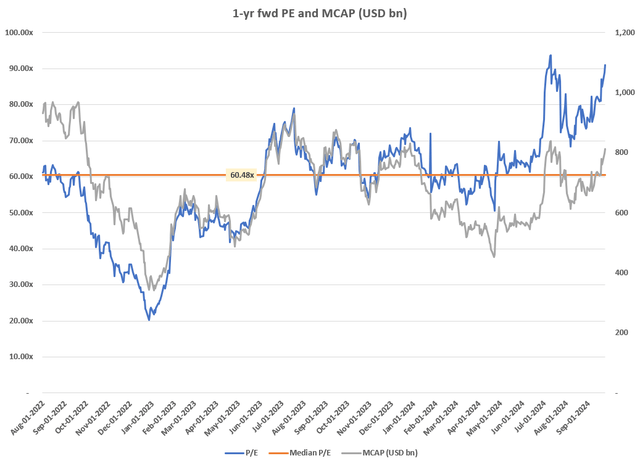

TSLA is trading at near peak valuations again at a 1-yr fwd PE of 91x. This is much higher than the company’s median PE of 60x over the past 2 years:

1-yr fwd PE and MCAP (USD bn) (Capital IQ, Author’s Analysis)

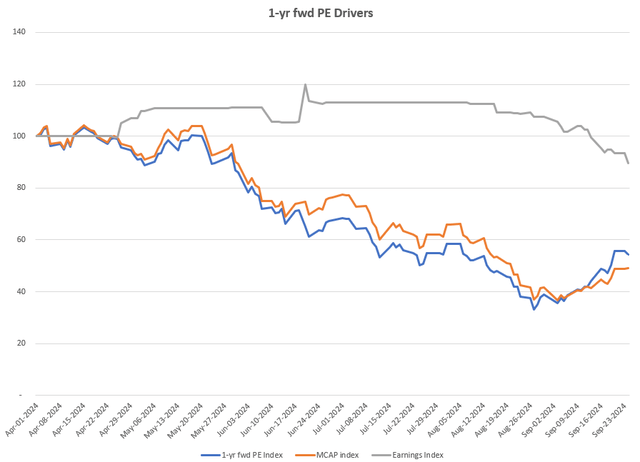

Dissecting the sources of the recent stock appreciation shows us that a re-rating of the multiple is the bigger driver, outweighing even the downticks in the earnings expectations index:

1-yr fwd PE Drivers (Capital IQ, Author’s Analysis)

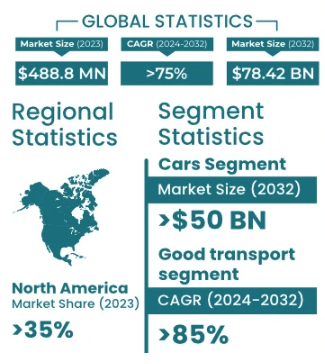

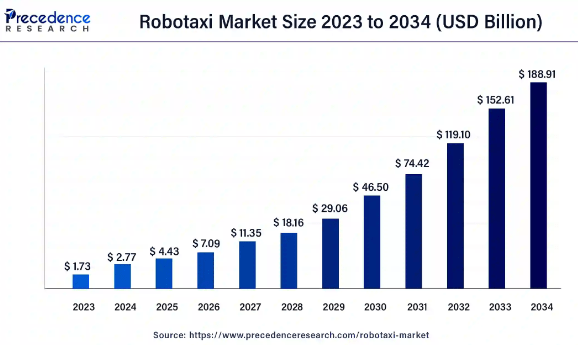

I believe this is evidence that the market is starting to more confidently bake in the large growth opportunities from Tesla’s Robotaxis, which is a market that is expected to grow to between $78 billion to $189 billion over the next 10 years, according to GM Insights and Precedence Research:

GM Insights’ Global Robotaxi Market Summary (GM Insights) Precedence Research’s Robotaxi Market Size Projection (Precedence Research)

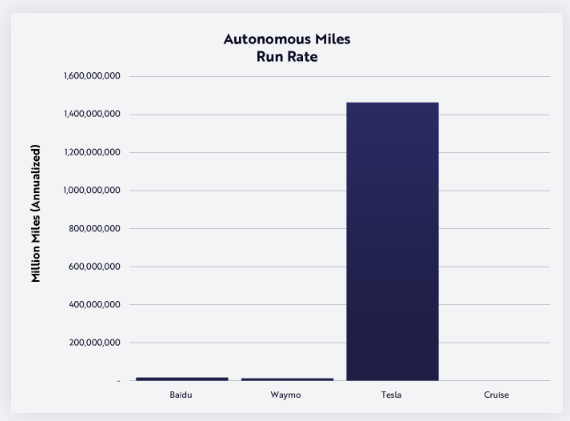

Tesla has a unique advantage in this market vs other players such as Google’s (GOOGL) (GOOG) Waymo since the former relies mostly on a greater sample of data (66x more) generated from 6 million cars on the road along with the vision to use cost-effective cameras instead of more expensive LIDAR technology for sensing the environment:

Tesla’s Massive Edge in Autonomous Miles Learnings vs Peers (Ark Invest)

I believe this advantage positions Tesla better for mass-scale commercialization of autonomous driving. Hence, I think it is highly likely that Tesla would be able to grab a dominant share of the robotaxi market and hold this lead for many years since it would take competitors time to accumulate a similar level of data to replicate Tesla’s data + cost-effective cameras approach to the autonomous problem.

Relative technicals flash buy triggers

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

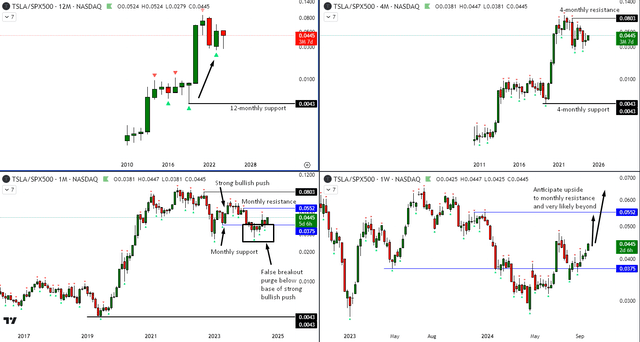

Relative Read of TSLA vs SPX500

TSLA vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

A large part of my confidence in adding Tesla to my personal portfolio is due to a clear bullish trigger seen in the relative charts of TSLA vs SPX500. Within the context of a broader 12-monthly and 4-monthly uptrend, the ratio prices have printed a purge below a bullish push on the monthly. After some basing, it has started moving up, and I anticipate this to continue till the monthly resistance is hit and very likely beyond that as well.

Robotaxi unveil on October 10 is a key event monitorable

After some delays, Tesla has picked October 10, 2024 to be the date of a much-anticipated Robotaxi unveil. This would be a key event monitorable since, as discussed a couple of sections before, much of the bullish arguments rest upon realization of Tesla’s growth potential in the robotaxis market. Indeed, as UBS analyst Joseph Spak described:

[The Robotaxi event is] an opportunity for Tesla to not only convince that investor base that the current valuation is justified, but that there is significant upside opportunity from here.

– UBS analyst Joseph Spak

Takeaway & Positioning

I am building upon my gradual bullish conversion to Tesla. Since my last article, I believe 2 positive drivers of the stock are a rates cut environment, which, I believe, can spur demand (in addition to giving a valuation boost to expected long-duration cash flows), and potential positive updates on Robotaxi. Tesla is arguably best positioned for mass-scale commercialization of robotaxis vs its peers due to its data + vision for usage of cost-effective cameras’ usage (instead of LIDAR) edge. Encouraged by the presence of a bullish trigger on the relative chart of TSLA vs the S&P500, I am rating the stock a ‘Strong Buy’.

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis, with higher than usual confidence. I also have a net long position in the security in the portfolios I manage.

Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P 500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to more than a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.