Summary:

- Tesla, Inc. stock has been volatile recently, dropping to an ultra-low $110-100 buy-in range, then surging by about 180% in the last six months.

- Despite the significant rebound, Tesla remains one of my top long-term holdings.

- Tesla could report sales of more than two million cars this year.

- Yet, Tesla has considerable growth potential in the Model 3/Y segments and future sales growth potential with the Cybertruck, Tesla Semi, and other projects.

- Estimates may be too low. Tesla could beat in the upcoming quarter and future years, enabling its stock to move substantially higher as we advance in the coming years.

y_carfan

Tesla, Inc. (NASDAQ:TSLA) stock has been on a remarkable ride this year. I increased my position around the time I called for a bottom in Tesla’s stock in the $110-100 buy-in range. However, Tesla remains a core position in my All-Weather portfolio despite the EV giant’s shares skyrocketing 180% in the last six months. Tesla recently announced record deliveries, and Q2 revenue estimates appear low. Moreover, Tesla could report better-than-expected revenue and EPS figures for the full year.

Also, Tesla’s Semi and Cybertruck sales could contribute significantly to its revenues in the years ahead. Furthermore, Tesla should continue commanding a relatively high P/E multiple due to its remarkable growth prospects and considerable profitability potential. Therefore, Tesla’s stock price should go much higher as the company continues expanding in the coming years.

Record Deliveries – Should Enable Revenue Beats

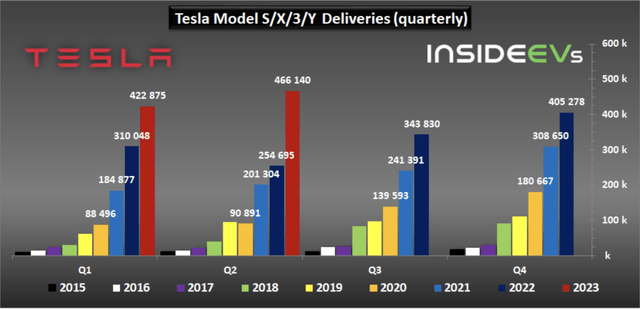

In the latest quarter (Q2 2023), Tesla produced 479,700 vehicles, delivering 466,140 cars. Tesla sold more than 19K Model S/X vehicles and about 447K Model 3/Y cars. Moreover, Tesla’s deliveries beat consensus estimate figures, surging by a staggering 83% YoY.

Tesla deliveries (Insideevs.com)

2023 should be a massive year for Tesla, as the company could deliver more than 2 million cars this year. The company delivered approximately 889,000 vehicles in the first half of the year, and H2 should provide even higher sales. Therefore, Tesla could sell around 2.1 million S/3/X/Y vehicles this year.

2023 Q2 – Earnings Preview

Tesla will report earnings early next week, and the company should provide better-than-expected revenues. The consensus estimate is for $24.68B in revenue for Q2, but Tesla likely performed better. Tesla delivered a record number of vehicles last quarter, including 19,225 Model S/X cars and 446,915 Model 3/Y vehicles.

Applying an ASP of approximately $120,000 for a Model S/X vehicle (minus 8% for lease accounting 17,687 cars), provides an estimate of roughly $2.2B in revenues for the Model S/X segment last quarter.

Once we adjust 5% for lease accounting in the Model 3/Y segment, we arrive at approximately 424,569 vehicles sold in Q2. If we apply a $47,000 ASP to this sector, we come to about 20.4B in sales for the Model 3/Y segment.

Therefore, Tesla’s Q2 revenues could come in as follows:

- Model S/X: $2.1B

- Model 3/Y: $19.9B

- Regulatory credits:$600M

- Leasing: $600M

- EG&S: $1.5B

- Services/other: $2B

- Q2 revenue est.: $26.7B.

Note: All estimates are based on information like Tesla’s 10-Q and other publicly available sources.

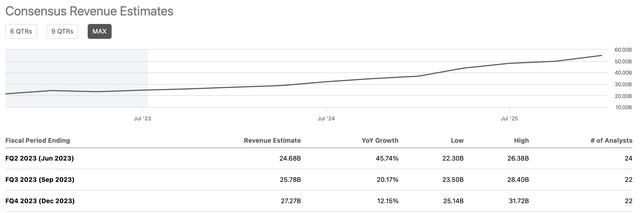

Q2 Consensus Revenue Estimates Likely Too Low

Revenue estimates (SeekingAlpha.com)

The consensus estimate is just $24.68B in revenues for Q2. Therefore, Tesla has a high probability of outperforming. Also, if the company achieves my revenue estimate, it would be an 8% beat over the consensus figure, and its stock could appreciate considerably post-Q2 results. Furthermore, higher-than-expected results could lead to more upward revenue growth and earnings revisions from the analyst community. EPS-wise, the consensus estimate is around $0.82, but Tesla’s EPS could be higher in the 90-cent to $1 range.

Tesla Semi Should Contribute to Revenue Growth

Tesla hopes to produce at least 50,000 Semi Trucks annually. Based on the estimated ASP of about $250,000, the Semi should provide roughly $12.5B in annual revenues in its first few years of production. Tesla has delivered the first Semi Trucks to PepsiCo (PEP), and other companies expecting their Tesla Semi trucks include Walmart (WMT), United Parcel Service, Inc. (UPS), and more.

In America, between 95,000 and 284,000 new semi trucks are sold each year (closer to the upper end in recent years). On average, a semi with a sleeper can cost about $150,000, and a fully loaded semi can cost more than $200K. Provided the substantial savings companies can achieve due to fuel savings, maintenance, and other costs, it is no wonder more and more companies are choosing the Tesla Semi. While we could see Semi production in the 10-20K annual range at first, Tesla could scale up to 50K relatively quickly, achieving the target production within the first few years of its launch.

Cybertruck Production to Begin Soon

The Tesla Cybertruck should enter production in September this year and could become a significant new revenue stream for the giant automaker. Tesla plans to produce the pure electric pickup truck in a limited capacity this year while scaling up production for next year as the company moves forward. Tesla’s CEO, billionaire Elon Musk was spotted driving a production-ready Cybertruck around Austin just months before production of the vehicle is set to begin.

So, how much revenue will the Cybertruck contribute to Tesla?

Initially, when the prices for the Cybertruck were introduced in 2019, the starting prices for the different truck variants ranged from about $40,000-70,000. However, this was around four years ago, and due to inflation and other factors, we could see the Cybertruck price range around $55,000-$85,000. Moreover, the average selling price may be around $70,000-75,000 for the Cybertruck.

In comparison, the ASP for a Ford Motor Company (F) F150 looks to be in the $50-60K range, significantly lower than the likely ASP of Tesla’s Cybertruck. Therefore, we may have relatively low demand in the early stages of the Cybertruck. However, demand in the U.S. should increase in future years. Another factor to consider is that the Cybertruck could primarily be a U.S. vehicle in the next several years.

Nevertheless, the U.S. pickup truck market revenue is expected to eclipse $74B this year and could increase to around $80B in 2027. Therefore, if Tesla’s Cybertruck can achieve a 10% market share (dollar-wise), it can equate to about $7-8B in annual revenues in the coming years. The $7-8B figure is also consistent with around 100,000 Cybertruck units, a likely production/delivery target in the near term for Tesla.

Full Year 2023 – Revenue Estimates

Tesla delivered approximately 30K Model S/X vehicles in the first half, and the full-year deliveries could arrive at around 80K. Provided that roughly 8% of Model S/X deliveries are subject to lease accounting, Tesla could sell about 75,000 luxury Model S/X cars this year. Utilizing an average selling price “ASP” of roughly $125,000 suggests we could see sales of approximately $9.4B this year in the Model S/X space.

Incredibly, Tesla could deliver close to two million Model 3/Y vehicles in 2023. I want to stress how wildly popular the Model 3/Y models are now, as Toyota’s (TM) Camry sold fewer than 300,000 units last year. Also, if we adjust 5% for lease accounting, we will arrive at approximately 1.9 million in unit sales this year. Utilizing an ASP of around $48,000 implies 2023 revenues of about $91.2B this year.

- Model S/X: $9.4B

- Model 3/Y: $91.2B

- Regulatory credits:$2.4B

- Leasing: $2.5B

- EG&S: $5.5B

- Services/other: $8B

- 2023 Total Revenues:$116.5B.

We could see approximately $116.5B in total revenues from Tesla this year. My estimate is about 15% above the consensus estimate, which is only for about $101B in sales this year. Also, we can approximate Tesla’s gross margins, operating costs, and overall profitability for this year.

Gross Margin/Gross Profit Estimates

- Model S/X: 17% = $1.6B

- Model 3/Y: 22% = $20.1B

- Regulatory credits: N/A = $2.4B

- Leasing: 40% = $1B

- EG&S: 15% = $0.8B

- Services/other: 10% = $0.8B

- Gross Margin: 23%

- 2023 Gross Profit: $26.7B.

Operating Costs/Margin/Profit Estimates

- R&D costs: $3.3B

- SG&A expenses: $4.8B

- Total operating expenses: $8.1B

- Operating Margin: 16%

- Operating Profit: $18.6B.

2023 Net Income/EPS Estimate

- Net Income: $14.8B

- EPS: $4.25.

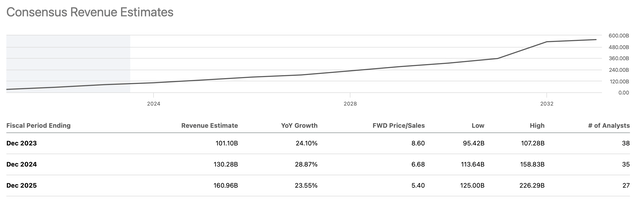

Valuation Perspective – Estimates Likely Too Low

Revenue estimates (SeekingAlpha.com)

Despite solid growth projections, many analysts may still be behind the curve on Tesla. The company has surprised to the upside many times, and its most recent delivery numbers came in better than expected. The company’s forecasts were for 440-450K vehicle deliveries in Q2, but it delivered around 466K cars instead, crushing its estimates for the second quarter. Also, we should consider future products like the Cybertruck and the Tesla Semi, providing tens of billions in additional revenues in the coming years.

Objectively, we could see the Tesla Semi and the Cybertruck bringing in about $20B in additional revenues in the next 2-3 years. Moreover, growth in Tesla’s Model S/3/X/Y segments should continue in the coming years, and we may see a return from price cuts as the economy resumes growth. Furthermore, there are future AI, self-driving, robotics, driverless taxi prospects, and other revenue possibilities to consider. Therefore, Tesla’s revenues could come in higher than expected this year and in the coming years.

This year’s consensus revenue estimates are at about $101B now. However, my estimate is approximately $116.5B, roughly 15% above the consensus figure. Moreover, with new products and services coming online soon, Tesla’s revenues and profitability could increase faster than anticipated in future years.

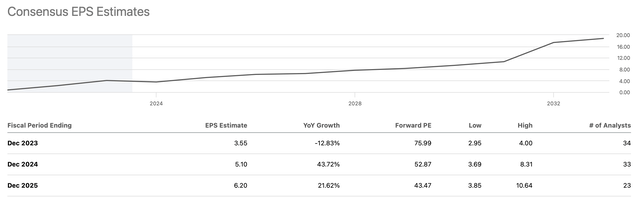

Lowballed EPS Estimates – Tesla Can Do Better

EPS estimates (SeekingAlpha.com )

This year’s consensus estimates have shrunk considerably during the slowdown process. The consensus EPS estimate for 2023 is only $3.55, suggesting a YoY drop of 13%. This ultra-low estimate also implies that Tesla trades around 76 times this year’s EPS figures. However, my 2023 EPS estimate is $4.25 on revenues of $116.5B. Therefore, Tesla could be trading at about 64 times this year’s estimates and could provide substantially more revenue growth than the analyst community projects here.

Moreover, next year’s EPS estimate range is vast ($3.70-8.30), suggesting the analyst community is undecided regarding the company’s profitability prospects in the next several years. We could see Tesla’s profitability surge faster than expected, with Tesla earning around $8 in EPS next year. This dynamic implies Tesla could be trading around 34 times forward earnings, suggesting the company’s valuation may be much more attractive than it appears at first glance.

Where Tesla’s stock price could be in future years:

| The year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $116 | $155 | $205 | $270 | $350 | $446 | $566 | $708 |

| Revenue growth | 42% | 33% | 32% | 31% | 30% | 28% | 27% | 25% |

| EPS | $4.25 | $8 | $11 | $15 | $20 | $26 | $33 | $40 |

| EPS growth | 4% | 88% | 38% | 36% | 33% | 30% | 28% | 24% |

| Forward P/E | 34 | 33 | 34 | 33 | 32 | 30 | 27 | 25 |

| Stock price | $270 | $333 | $510 | $660 | $832 | $990 | $1080 | $1200 |

Source: The Financial Prophet.

Tesla Stock Should Continue Higher Long-Term

If Tesla sustains a healthy revenue growth rate of 25-30% in future years, it can increase sales rapidly, and profitability should follow. EPS can grow significantly as the economic recovery progresses and Tesla continues becoming more profitable. Due to Tesla’s substantial sales growth rate and considerable profitability prospects, its stock should continue trading at a relatively high P/E multiple of around 25-35 in future years. Therefore, we could see Tesla’s share price climb considerably in the coming years, making Tesla one of the top buy-and-hold candidates for the next decade or longer.

Risks to Tesla Exist

Despite my bullish outlook for Tesla, there are numerous risks to consider before committing capital to this investment. A slowdown in demand, increased competition, supply issues, decreased growth, potential problems with regulators, foreign governments, and other variables are all valid risks. Mounting concerns could worsen sentiment, leading to multiple compression and possibly causing Tesla’s share price to head in reverse.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

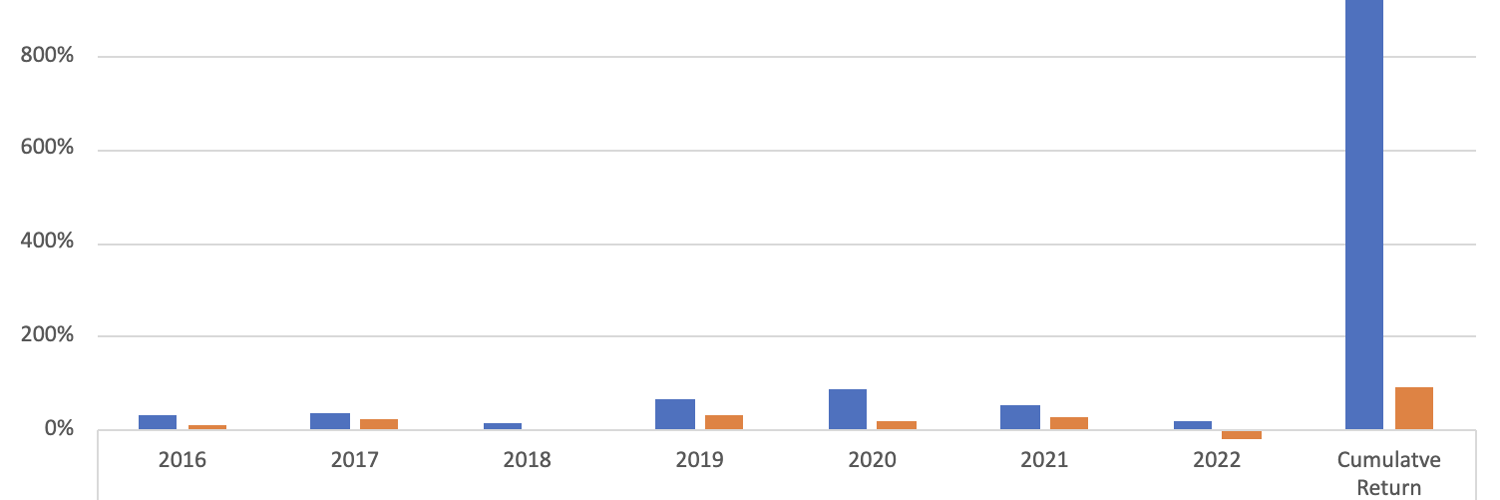

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!