Summary:

- Tesla faces significant catalysts this month, including the robotaxi event on October 10, 2024, and Q3 earnings release shortly after.

- The robotaxi event could shift investor focus to Tesla’s autonomous vehicle potential, offering a new revenue stream and boosting the investment narrative.

- The event on Oct 10, 2024 is set to provide crucial details on FSD improvements and robotaxi market availability.

- Despite slowing EV growth and increased competition in the electric vehicle market, Tesla’s high gross margins and potential in the autonomous vehicle market remain strong.

- Shares of Tesla continue to have long-term revaluation potential as the company seg-ways into the next high-potential market opportunity of autonomous vehicles.

Hiroshi Watanabe

Electric vehicle, robotics and AI company Tesla (NASDAQ:TSLA) is facing numerous catalysts this month that include the highly anticipated robotaxi event which is scheduled for October 10, 2024 as well as the release of third-quarter results about a week later. The robotaxi event especially is a highly promising catalyst for Tesla’s shares as the company is likely going to give more details about the company’s full self-driving (FSD) accomplishments. Accompanying comments about the state of Tesla’s autonomous vehicle project as well as details about an official market introduction of robotaxis could help change the investment narrative for Tesla. I believe shares of Tesla have considerable revaluation momentum and the catalyst landscape remains favorable as well.

Previous rating

I rated shares of Tesla a buy after the electric vehicle company reported results for its second fiscal quarter which showed a lot of promise in terms of free cash flow. While the EV market slumped recently due to slowing demand and weakening adoption, leading to a deceleration of top-line growth, Tesla saw a very significant ramp in its free cash flow growth: Avalanche Of Catalysts which I felt investors were underestimating. While I don’t expect an acceleration of EV delivery growth and a massive top-line surge in FY 2024, the upcoming robotaxi event could be a major narrative changer. As investors have been chiefly concerned with Tesla’s electric vehicle growth, the focus is now set to shift to a new revenue opportunity for Tesla, autonomous vehicles.

Autonomous vehicles are going to be the next growth story for Tesla

While Tesla’s electric vehicle ramp has dominated the company’s growth story in the last several years, I believe we are at the cusp of a major narrative change: Tesla’s self-driving technology could open up a new revenue stream for the electric vehicle company and with the robotaxi event only a little more than a week away, the company could potentially move towards a potent catalyst event.

The robotaxi event — which is scheduled for October 10, 2024 — is widely expected to yield a demonstration of Tesla’s latest full self-driving technological capabilities. Specifically, I expect Tesla to showcase its fully autonomous robotaxi and submit a time-line for when the company expects its AV solution to be available in the market. The impact here could be a significant one, not only for Tesla’s share price, but also for the company itself.

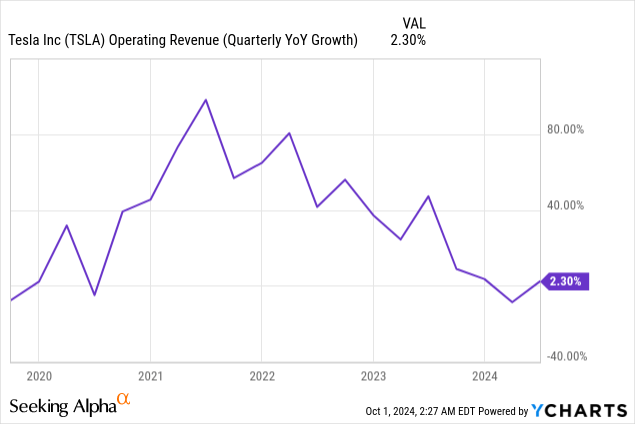

The reason is that Tesla’s top-line growth has slowed lately and investors have been concerned about slowing EV adoption for a while. Competition in China is also heating up drastically which has weighed on margins, although Tesla has been able to defend high vehicle margins and even managed to grow its free cash flow faster than its revenues. Nonetheless, revenue challenges related to Tesla’s EV delivery momentum have weighted, especially in the first half of the year, on Tesla’s share price. In Q2’24, Tesla’s top line growth slowed to just 2% year-over-year.

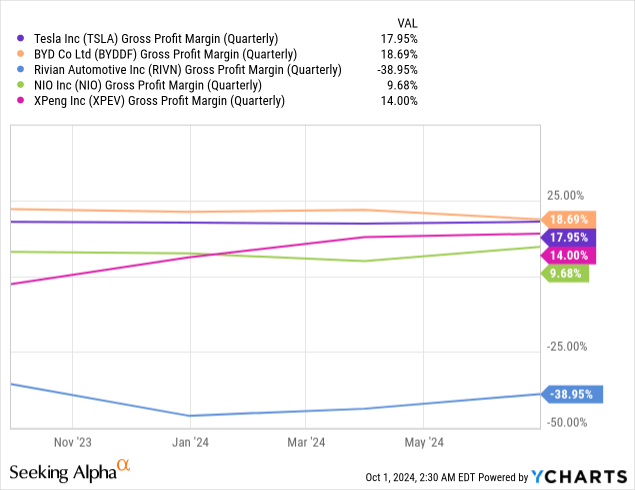

While Tesla’s (and the industry’s) challenges with regard to EV deliveries have been greatly discussed, it should be understood that Tesla is still offering some of the highest gross margins in the market… and I don’t expect this to have changed in Q3’24. Tesla’s gross margins remained fairly steady at ~18% in the last year which attests to the competitiveness and the attractiveness of Tesla’s product pipeline relative to rivals. Only BYD Company Limited (OTCPK:BYDDF) generated higher gross margins which is why I consider BYD to be a strong buy for electric vehicle investors as well: A Profitable EV Growth Play.

Autonomous vehicles are universally recognized as a huge growth opportunity, not just for Tesla, but for the auto industry at large. A successful demonstration of Tesla’s robotaxi capabilities next week could create additional positive sentiment overhang for Tesla and help the company to sustain its upward momentum.

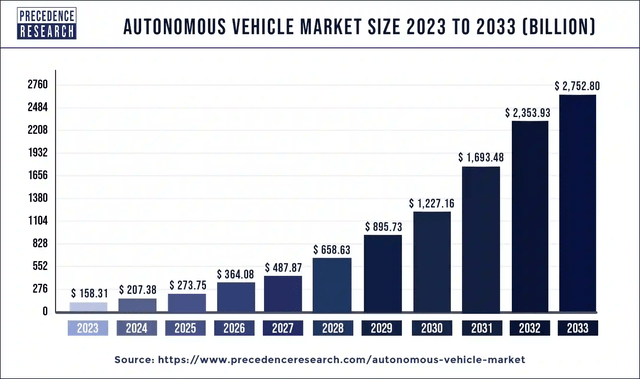

According to Precedence Research, the autonomous vehicle market size is expected to surge to $2.75T by the end of FY 2033 compared to just $158.3B in FY 2023. This means that the autonomous vehicle market is expected to expand at an average rate of approximately 33% annually. The research firm also projects a 23% annual average rate of growth for the EV market in the next decade, but with the electric vehicle market clearly getting more competitive, it could be a great time for Tesla to segue into a higher-potential market opportunity like autonomous vehicles.

Unfavorable estimate trend

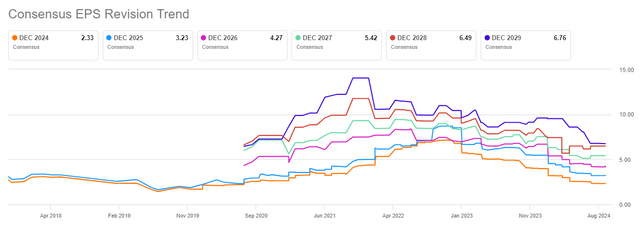

Tesla’s Q3’24 earnings release date is still about two weeks away, but I want to take the opportunity to quickly discuss the EPS revision trend. In the last ninety days, analysts have revised their EPS earnings estimates for Q3 upward 5 times and downward 14 times. The EPS estimate upward/downward revision ratio is therefore 0.36X which heavily disfavors Tesla heading into earnings.

Low EPS expectations, however, are driven mainly by challenges in the EV market and recent sales data from Chinese EV manufacturers showed that deliveries are rebounding hard, at least in China. If Tesla has a successful robotaxi event dishing up specifics and a concrete time-line for a market introduction, I believe Tesla’s longer term EPS estimates could rise nicely and also help boost shares ahead of the company’s Q3’24 earnings date.

Tesla’s valuation

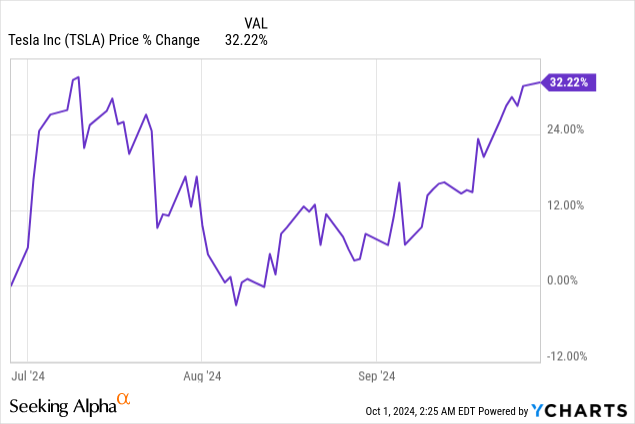

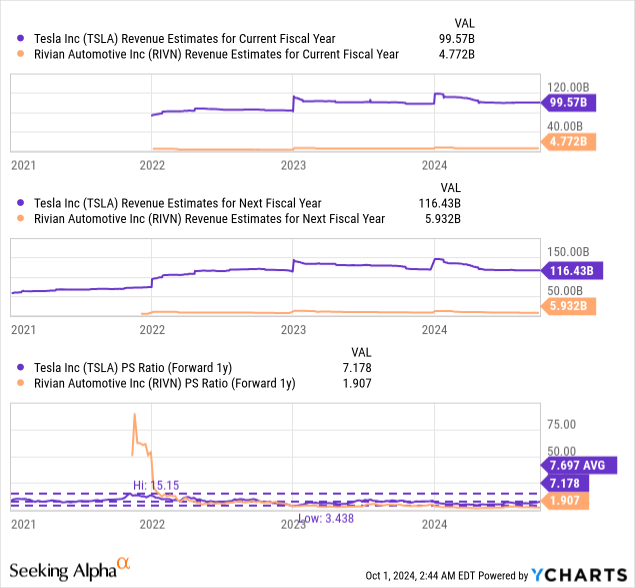

Although shares of Tesla have surged 32% in the third-quarter, Tesla has produced no real return in the last years (shares are +1% only during this time) chiefly because of growth concerns in the electric vehicle market. Tesla is currently valued at a price-to-revenue ratio of 7.2X, which is about 7% below the longer term P/S ratio of 7.7X.

Since Tesla is profitable, but its EV rivals mostly aren’t — with the exception of BYD Global — I am using a P/S ratio to value Tesla. The EV/AV company is trading at a way higher valuation than its rivals, which is not surprising since Tesla is the largest and most profitable EV company in the U.S. Most Chinese companies are start-ups that either have low delivery volumes or are not profitable. Rivian Automotive (RIVN) is the only major U.S. EV company with a considerable annual production volume (50k+ units) and the firm’s shares trade at 1.9X FY 2025 revenues, well below Tesla’s valuation level.

In my opinion, the robotaxi event especially has the potential to ignite a major sentiment and narrative shift for Tesla. In my last work on the EV company, I stated a fair value target of $288, based off of Tesla’s historical (5-year) P/S ratio of 7.8X. I confirm this price target ahead of the company’s robotaxi and Q3’24 earnings dates. However, a strong earnings report as well as a strong robotaxi event could push shares into a new up-leg and may also result in the revision of Tesla’s longer term EPS estimates.

Risks with Tesla

Tesla has numerous risks that, I believe, are well understood: primarily, slowing electric vehicle deliveries and top-line growth are major risks to the bull case here. Growing competition in the global EV market is set to pressure margins, which in turn could weigh heavily on Tesla’s earnings profile and free cash flow strength. However, I believe that the bigger risk for Tesla is to miss out on any kind of AV-related upside, especially with Tesla now just being at the brink of presenting a marketable autonomous driving solution.

Final thoughts

October is set to shape up to be a great month for Tesla, in my opinion: after a 32% share price gain in the third-quarter, the robotaxi event could be a major catalyst event for the electric-vehicle company. Earnings estimates are also low for Tesla, indicating that the market doesn’t expect much growth in the EV segment, which means the bar for Tesla sits pretty low right now. Investors have been waiting for new impulses for an upside breakout for a while and I believe the robotaxi event especially has the potential to give shares of Tesla a crucial lift just ahead of Q3 earnings: if Tesla’s robotaxi event includes material improvements with regard to FSD and if we are seeing a potentially accelerating time-line to market for Tesla’s AV product, I believe more investors are going to buy into a changing investment narrative.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, RIVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.