Summary:

- Tesla, Inc. is well positioned to dominate the high-end electric vehicle market and benefit from the global push towards EV adoption.

- The company’s innovative technologies, such as gigacasting and its Supercharger network, give it a competitive advantage over rivals.

- CEO Elon Musk’s controversial reputation poses a risk to the company, but his visionary leadership has contributed to Tesla’s success.

Justin Sullivan

While CEO Elon Musk remain a bit of a controversial figure, Tesla, Inc. (NASDAQ:TSLA) looks well set up to dominate the high-end electric vehicle (“EV”) market, while other growth areas are emerging. One area of particular advantage is its Supercharger network.

Company Profile

Tesla designs and manufactures battery electric vehicles (BEVs). It currently offers 5 models: Model 3, Y, S X, and Cybertruck.

It also offers lithium-ion battery energy storage through its Powerwall and Megapack products. Powerwall is designed for home use, while Megapack is a commercial grade solution. The company also sells solar systems.

Opportunities

When it comes to opportunities, TSLA has many. As a leader in electronic vehicles that has been at the forefront of advancing the technology, it should benefit as countries around the globe have set goals to increase EV production. Numerous nations have set goals to phase out the sale of combustible-engine vehicles, with the European Union having a mandate that all new vehicles sales be EVs by 2035. Only about 6% of cars sales in the U.S. are EVs, while the Europe Union is only about 12%. China, meanwhile, has become the largest EV market in the world. While other car companies will inevitably take some share, TSLA is still set to be one of the primary beneficiaries of the global push towards EVs.

The company also looks like it is on the precipice of transforming the car manufacturing process through its use of gigacasting, which replaces welded components through aluminum die casting. The aim is to reduce the cost the cost of a vehicle chassis by as much as 40%. TSLA can already manufacture its Model Y in only 10 hours, which is three times quicker than its competitors. This new technique would just give it an even bigger cost advantage over its rivals.

Autonomous driving and its FSD (full self-driving) platform is another potential growth driver. Version 12 of FSD is currently being tested by employees and is expected to be rolled out to the public soon. The company is lowering the price to get people to try the platform, although it indicated that the price will go up proportionate with its value. This is a cutting-edge feature this is a long time in the making that should draw a lot of interest from current TSLA drivers. It’s also a feature that should drive demand for its vehicles as well. TSLA has said that it is willing to license this technology to other OEMs as well.

Other areas of potential opportunity include its new supercomputer Tesla Dojo, as well as Megapack. Telsa Dojo is the supercomputer behind the machine learning and AI models for its self-driving system. It will be interesting to see if it takes this technology to other areas. Megapack, meanwhile, is a battery and storage system that can help prevent grid outages. Grid integrity is a huge global issue, and Megapack could play a big part in the solution. TSLA energy storage business has been strong, with record deployments of 4GWh in Q3, and it announced a huge order win in December.

Perhaps the opportunity I’m most excited about, though, is TSLA’s supercharging network. It has the largest charging network by far. In fact, its U.S. charging network is larger than all others combined. The company’s network now stands at 5,000 locations and 50,000 connectors. This has become a nicely profitable business, and it should become a huge grower in the years ahead. The company smartly opened up its network to other OEMs, which will only drive more usage. It could also help hasten even more EV adoption.

Owning the largest charging infrastructure network is a huge advantage for TSLA in my view. As countries push to 100% EV sales in the coming decades, these charging networks are likely to play a bigger and bigger role. The reason is simple, if you live in a major city or an apartment, in-home charging very well may not be an option. As charging tech gets better and faster in the years to come, these EV owners are going to have to use charging stations to power their cars.

It is also likely that while TSLA has opened up its charging network that its vehicles will most likely work best with the infrastructure it has built. At the same time, opening up its charging network likely means that it will significantly slow down the pace of other companies ramping up their charging networks now that they no longer have to spend the money. Years down the road, though, this should greatly benefit TSLA sales to the large percentage of the population where in-come charging is not an option.

This should eventually lead to a nice recurring revenue stream for the company. It would be very akin to Ford (F) or GM (GM) in the early days of the automobile taking control of the gas station and fueling infrastructure.

Risks

When it comes to risks, CEO Elon Musk is front and center. The early investor who wrest control of the company has an almost cult-like following. When it comes to key-man risk, there may not be company with a larger one at this time.

Musk has proven to be a visionary, and he has turned TSLA into one of the most valuable companies in the world. At the same time, Musk is a controversial figure. Regardless of whether you love him or hate him, Musk is the driving force at TSLA, and if anything happens that takes him away from his role as CEO, the stock would likely take a hit.

Another risk is the economy. TSLA still sells vehicles, so if the economy worsens, car sales can certainly go down as well. And as with any vehicle manufacturer, there can also be manufacturing and supply chain disruptions.

The EV market also has a bit of a used car problem, in that many buyers are a bit cautious buying used EVs. The battery makes up about 30% of the cost of an EV, and many buyers are reticent about used EVs given older battery tech and battery degradation over time. Used Teslas generally sell better than other used EVs, but the used EV market and its impact on the new EV market is something to watch in the years ahead.

And despite the global government push towards EV adoption, there are issues that stand in its way. One, as noted above, is that not everyone has access to home charging, with J.D. Power saying that only one in three car owners has the ability to charge a car at home. Given the time it currently takes to charge a vehicle, this become a big inconvenience if someone needs to only use supercharger stations. Meanwhile, even with government subsidies, prices for EVs are often more expensive than their combustible engine counterparts in many areas – although in some states they can be quite the bargain.

Being in an industry that is still reliant on subsidies is a risk as well. I don’t see subsidies going away given the government push to get more EVs sales, but it is not out of the realm of possibility and state subsidies also play a big role in EV sales as well.

Competition is a risk as well. Both traditional automakers and start-ups are putting more resources into EVs. However, TSLA has both the tech and brand lead in the space, which could be difficult to overcome. However, in China, it could be a different story, with domestic player BYD Company Limited (BYDDF, BYDDY) becoming the world’s largest producer of EVs in Q4.

Valuation

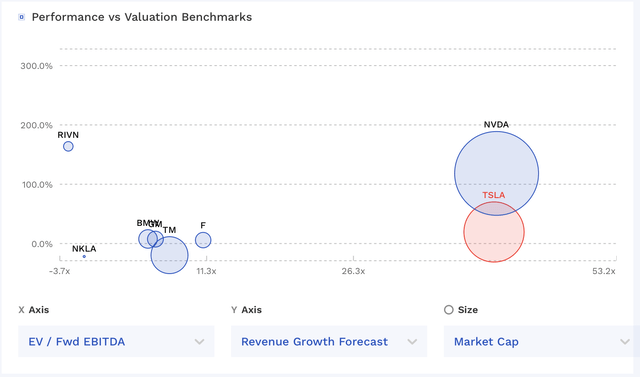

TSLA currently trades at an EV/EBITDA multiple of 33x the 2024 consensus of $20.56 billion. Based on 2025 EBITDA projections of $29.54 billion, it trades at a 23x multiple.

On a P/E basis, the company trades at 56.4x the 2024 consensus of $3.88 and 41.2x the 2025 consensus of $5.31.

Revenue is projected to grow over 20.8% in 2024 and 22.9% in 2025. Tesla reports its Q4 2023 results post-market on January 24th.

If you want to compare TSLA to other automakers, it trades at a huge premium. However, TSLA is more than a carmaker, it is a visionary company at the forefront of some major trends. And in that regard, it may be best to compare it to a company like Nvidia (NVDA), which is the dominant player in GPU chips being used to power AI applications. In that regard, the two companies trade at similar multiples, although NVDA is expected to grow more quickly next year before they both settle into that 20% range. You can read more on my thoughts on NVDA here.

TSLA Valuation Vs Peers (FinBox)

Given its growth and advantages, and understanding that TSLA is much more than a car company but a visionary company, I’d value the stock between 25-30x 2024 EBITDA. That could place a fair value range on the stock between $238-285.

Conclusion

After a difficult 2022 for the stock, TSLA rebounded nicely in 2023. With 2024 upon us, I think it is fair to say the stock had gotten ahead of itself at times after the pandemic. However, the company and Musk have been able to prove the doubters wrong, and TSLA has shown that it has consistently been able to grow into its valuation.

TSLA has a lot of innovation that looks like it should help power the company going forward, from self-driving, to its supercharger network, to supercomputers, to grid level battery storage. I’m particularly excited about its Supercharger network, but there are a number of reasons to be upbeat about the company. In fact, it may be one of the most exciting times to be a TSLA investor.

At this time, I’m going to start TSLA with a “Buy” rating and $285 price target, as I think the positives outweigh the risks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.