Summary:

- Tesla, Inc. has struck a deal with General Motors to enable their EVs to use the supercharger network.

- Profits from this deal could be in the billions of dollars.

- But Tesla will be paying a hidden cost.

- Is it worth it?

Thaweesak Saengngoen/iStock via Getty Images

Thesis Summary

Tesla, Inc. (NASDAQ:TSLA) has been one of the best-performing stocks in the last month. Though this can be partly attributed to the AI-induced hype, we have actually seen significant good news for the world’s largest electric vehicle (“EV”) company. And by good news, I mean developments that will quantifiably increase the company’s revenues moving forward.

The launch of the Cybertruck later this year will be a true game changer and could bring in $30 billion in revenues.

On top of that, Tesla will also be supercharging its revenues, thanks to the deals struck with General Motors (GM) and Ford Motor Company (F), and this could only be the beginning.

In this article, I quantify these developments to calculate how much Tesla can gain and how this impacts its valuation.

Tesla Sets The Standard

Tesla made headlines on Thursday as a deal with General Motors was announced, which will allow GM customers to use Tesla’s supercharger network. This follows a similar deal struck with Ford at the end of May. Owners of EVs produced by these two companies will now be able to charge their cars at any of the 45,000+ superchargers. This will probably require the use of an adaptor.

Precise details of how these deals will work are still unclear, but we do know a couple of things. GM and Ford will not be paying Tesla directly for this privilege. Tesla will, however, receive all new revenues from the Superchargers.

Tesla will get better utilization of their network and all the new charging revenue, which will help them expand the network further. There are other opportunities both companies can take advantage of as a result of the agreement.

Source: GM spokesman Darryll Harrison.

It isn’t totally clear how GM users will pay for this, though. This could be done per charge or through a monthly fee.

We do know that queues for these Superchargers will be increasing, and unfortunately for Tesla owners, you don’t get preferential treatment.

I think people should feel comfortable buying a Tesla or a GM car, and we will provide support equally to both. So the most important thing is that we advance the electric vehicle revolution.

Source: Elon Musk on Twitter Spaces.

There are clearly benefits to both Tesla and the other car companies, though the market believes that Tesla will be the biggest winner from this. Let’s go ahead and crunch some numbers.

How Much Does Tesla Stand To Make?

This is the question that investors need to answer. A recent report by Piper Sandler claims that this could bring in close to $3 billion in revenues by 2030, from non-Tesla users, and $5.4 billion by 2032. Despite my best efforts, I have not been able to find the calculations behind this figure. Let’s try to crunch our own numbers.

So how much does Tesla actually make, now, from superchargers?

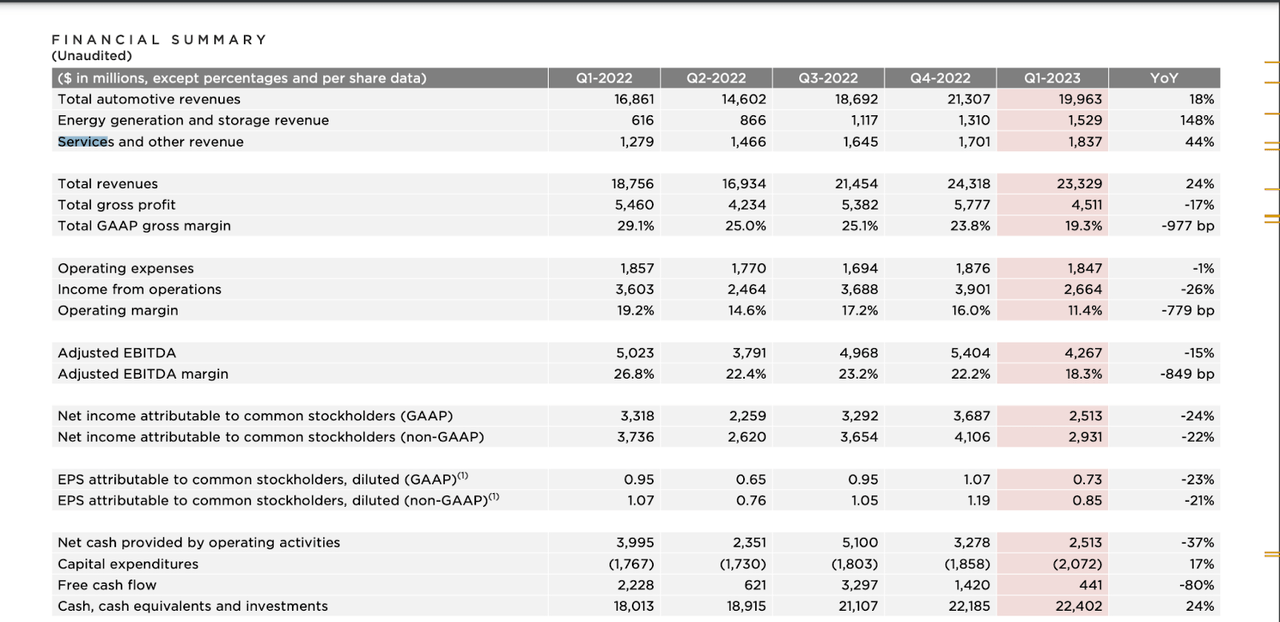

Revenue from supercharging falls under the Services and Other revenue segment. This also includes used car sales, repairs, and other ongoing services. In 2022, this segment contributed $4.39 billion in revenues in 2022. Having said this, we do not know exactly what proportion of this revenue comes from supercharging.

Back in 2021, Goldman Sachs (GS) also tried to calculate the value of Tesla’s supercharging network:

Goldman Sachs (Tesla charger forecast)

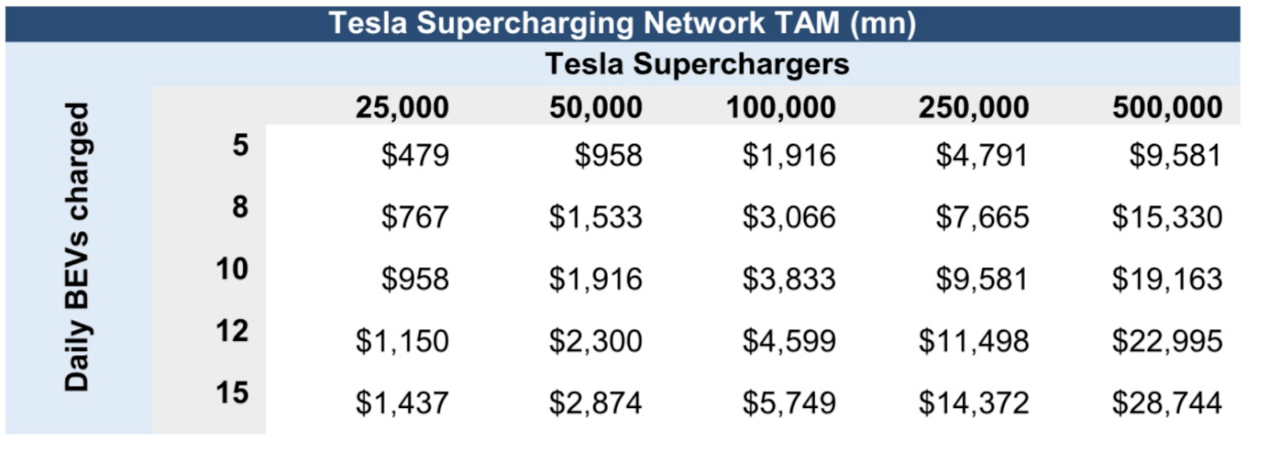

GS’s calculations were made in 2021, when Tesla had roughly 25,000 superchargers. According to GS, with 25,000 chargers and 5 daily BEVs being charged, per station, Tesla would be able to obtain revenues of $479 million.

According to this data, there are roughly 4 million Teslas out there. If we refer back to our table, 4 million Teslas charging, say, twice a week, would imply 1.14 million daily charges.

With 50,000 superchargers today, that would mean 22.8 charges per station. This would imply Tesla is making, give or take, $3.3 billion. A 200-mile charge takes 15 minutes, so this means 342 minutes of charging per station daily, and there are 1440 minutes in a day. This level of charging would be possible without too much congestion.

It is possible that Tesla made $3.3 billion from charging, since the company made $4.39 billion from the segment in which supercharger revenue is included, though it seems like a high proportion of these revenues.

Let’s take these numbers at face value and see how realistic the Piper Sandler prediction of $3 billion by 2030 is. $3 billion by 2030 would mean around 100,000 chargers fueling 10 BEVs per day.

100,000 chargers seem more than doable and within the company’s plans. The company’s official charging Twitter said they would be doubling the amount of U.S. chargers. Given the worldwide ambitions to transition to EVs, doubling the 45,000 currently built out seems doable and to be expected.

This also seems reasonable from a timeline perspective. Tesla began building out its network in 2012. Ten years got them 45,000, 7 more years could get them to 100,000.

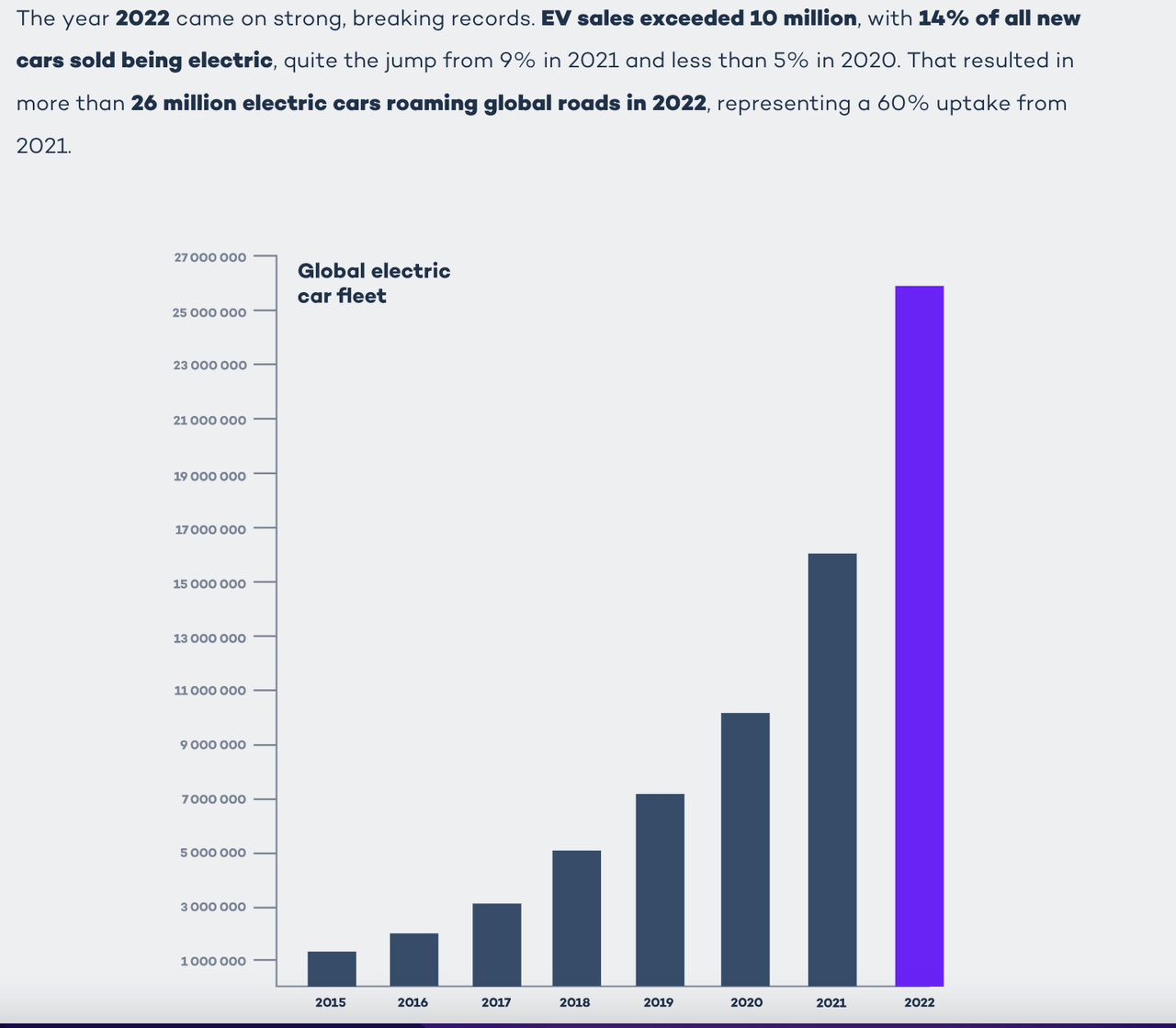

Now, let’s look at the potential number of charges per day. As of 2022, there are an estimated 26 million EVs roaming the streets.

Global Electric Vehicle Market (Virta)

So, there are 26 million EVs today, including 4 million Teslas, but this number should be much, much higher by 2030. The IEA predicts 350 million EVs will roam the streets by 2030, representing over 60% of cars sold globally.

350 million EVs, charging twice per week, gives us a nice round number of 100 million charges per day.

In the GS table, to make $3 billion, it takes 8 charges per day. 8 daily charges at 100,000 stations mean around 800,000 charges. That means to make $3 billion, Tesla would have to control around 0.8% of the total charging market. Seems more than feasible.

Realistically, Tesla could do a bit more as it opens up its infrastructure to other EVs. The only real limitation is the number of chargers. Each charger can handle 96 15-minute charges in a full day, but that’s an optimistic number. Most of the charging will happen at certain hours, and Tesla has to avoid overstretching its infrastructure or wait times could become too long.

Ultimately, $3 billion seems like a conservative figure for 2030. If each charger did 24 charges, that would be 2.4 million charges and $9 billion in revenue, with Tesla controlling 2.4% of the EV charging market.

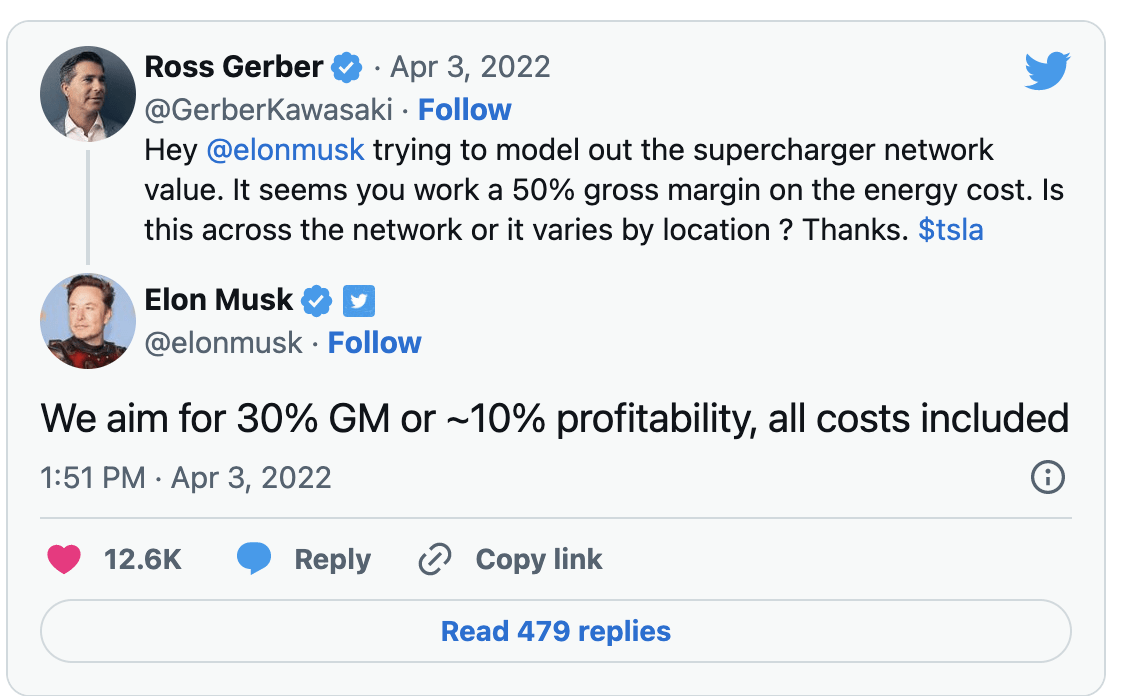

Lastly, we can also calculate the profitability, since Musk did say on Twitter that Tesla aims for a 30% gross margin or around 10% profitability from the superchargers.

This means the $3 billion could be $300 million in pre-tax earnings.

Twitter (Twitter)

What’s the real cost, though?

The question is, though, is this worth it? Tesla’s charging network is a big reason for the company’s success, and it sets Teslas apart from the competition. By opening up the network to its competitors, Tesla loses a big selling point. Potential EV buyers will be able to purchase a more affordable vehicle from competitors like Ford or GM and still enjoy the benefits of the Tesla network.

Furthermore, it might rub current Tesla owners the wrong way. One could argue that Tesla owners paid for the privilege of using these charging stations, and now they have to share them. Of course, this will only be a problem if waits at Tesla’s superchargers become too long.

Controlling the usage of the superchargers will be key if Tesla wants to open up its charging network successfully.

On the other hand, as other analysts pointed out, Tesla charging stations could work as a worldwide advert. Maybe you begin to wonder, why don’t I buy a Tesla as you charge your EV?

Is Tesla A Buy Today?

So, would I buy Tesla today? The answer is Yes. Though TSLA stock has run significantly in the last month, together with the overall tech segment, this is a stock worth holding for the long term.

Some investors like to point out that Tesla is priced too richly when compared to other car companies, but this misses the point completely.

Tesla is a lot more than a car company, something that I already pointed out in my last piece on Tesla. This company does a lot more than make cars. For one, it is a leading player in the development of driverless technology, and as pointed out in this article, it is developing key infrastructure that will become the backbone of the EV industry.

The beauty of this is that it is almost pure profit. Looking back at our most bullish example, if the company can seamlessly add close to $9 billion in revenues, that would imply almost $1 billion in pure profit, which is a little under 10% of today’s Net Income.

I believe the market isn’t pricing this in at the moment, which gives us a good opportunity. Piper Sandler has a target of $280 per share, which still implies 10% upside, but this is a short-term view.

When you look at a company like Tesla, you want to see what it could be worth 10 years from now because this is when EVs will dominate the market.

For these long-term investors, Tesla is now as strong as ever, while the price is significantly below its all-time highs. Momentum has shifted, both in stocks and the economy, and even if we still get a hard landing in the next year, this doesn’t change the Tesla story for the next ten.

Final Thoughts

The market rewarded Tesla after the GM agreement, and I have to agree. Whenever a company can get more from its assets, it is good. Tesla enjoys significant product differentiation and doesn’t think opening up the charging network will change that. Of course, the market for EV charging will likely heat up in the coming years, but Tesla already has a strong foothold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This is just one of many exciting and fairly priced tech stocks you can buy right now!

Join The Pragmatic Investor to stay ahead of the latest news and trends in the tech space and you will receive:

– Access to our Portfolio, which features “value tech stocks”.

– Deep dive reports on tech stocks.

– Regular news updates

Technology is changing the future, don’t just watch it, be a part of it!