Summary:

- BYD is challenging Tesla’s dominance in the electric vehicle market, surpassing Tesla in sales, technology, and global reach.

- China is rapidly advancing in the field of humanoid robotics, with initiatives like the National Humanoid Robot Innovation Center and impressive prototypes like the GR-1.

- Despite potential tariffs, Chinese companies like BYD and Fourier Intelligent are likely to prosper at the expense of Tesla.

style-photography/iStock via Getty Images

Preamble

Close followers of Tesla, Inc. (NASDAQ:NASDAQ:TSLA) will have noticed that tariffs on Chinese EVs are popping up all around the globe, well in Europe and the US anyway. The idea is that certain countries reckon that Chinese EVs are too cheap and so national car makers need some kind of protection, or a “level playing field.”

And no doubt, when Tesla introduces Optimus, which I have covered previously in my article titled, “Tesla’s Optimus To The Rescue,” I’m guessing there will be brand new tariffs on Chinese robots too.

I’m sorry to report that these tariffs will not save Tesla, either their EV segment, or their touted dominance in humanoid robots.

There are many popular Chinese EVs these days. There is SAIC Motor Corporation that owns the well-known “MG” brand and there is the Zhejiang Geely Holding Group (OTCPK:GELYF) that acquired Volvo from Ford in 2010. However, for this article I propose to focus on perhaps the largest Chinese EV company, BYD (OTCPK:BYDDF).

Even though BYD is the biggest Chinese EV company, it is still far behind Tesla in terms of market cap. Tesla remains the world’s most valuable car company with a market cap of $560 billion, whilst BYD is a relative minnow with a market cap of around $81 billion, although, it is still among the top 10 automakers globally.

As of today, as far as I’m aware, there are no dominant Chinese humanoid robotics companies, so I am only able to offer information about the current status of the industry in China.

This piece is divided into two halves; a review of Tesla versus BYD cars, which is followed by an investigation into the status of Chinese humanoid robotics developments as it relates to Tesla’s Optimus.

Tesla versus BYD

It has been widely reported that Tesla has reduced prices in China by almost $2,000 across its entire lineup, following similar price cuts in the United States. This move comes as Tesla faces declining sales and increased competition from the likes of BYD. In fact, according to Business Insider; “Confronted with unprecedented local competition amid weakened consumer sentiment in Asia’s largest economy, the market share of Elon Musk’s EV maker has shrunk from 10.5 per cent in the first quarter of 2023 to around 6.7 per cent for the quarter ended in December.”

The price reductions mentioned affect all models and are a response to the need to compete with rivals in China, who are introducing more affordable EV models. But Tesla are not losing market share on price alone, they are falling behind on deliveries, market reach, product range and technology.

Deliveries

BYD surpassed Tesla in global sales of battery electric vehicles in the last quarter of 2023, but Tesla regained the lead in the first quarter of 2024, as BYD’s sales dropped quite a bit.

Reviewing Tesla’s Q1 2024 report, the company delivered 422,875 vehicles a modest 2.5% higher than the same period last year. Whereas in the case of BYD, in April, it was reported that for “March, total vehicle sales were up 41% to 296,253, EV sales were up 28% to 134,352, and hybrid vehicle sales rose 55% to 161,073K.”

Financials

Comparing BYD’s financial report for the comparative quarter, there are even greater glaring differences (1 Yuan = 0.137849 USD).

Tesla’s earnings per share crashed from $0.80 per share to $0.37, which represents a fall of 53.8%. Whereas, EPS for BYD rose 10.62% over the same period.

Given the above, you would reasonably conclude that net profit also fell, and you would be right. In Q1 2023, net profit was $2,513 million, but the most recent quarter the figure was $1,129 million. While net profits for BYD rose to Yuan 4,568,793,000.00 ($629,803,546) from 4,130,063,000.00 ($569,325,054), which represents an increase of 10.6%

On a more positive note, Tesla had a slightly higher revenue growth compared to BYD when compared to the same quarter last year, +9.5% and +3.97% respectively.

Market Reach

BYD currently has manufacturing facilities in China, Brazil, and the United States. They have announced plans for future production facilities in Thailand, Hungary, Canada, Uzbekistan, Indonesia and Morocco. There have been reports of potential production plants in Mexico, but these have not been confirmed by BYD as yet.

Compared to Tesla, one can see that BYD is building production facilities right across the globe, and generally in locations where costs of labour are cheaper. Bearing in mind that Tesla has trouble competing on cost, even in China.

Product Range

I think we can all agree that Tesla’s range of cars is limited to say the least, especially when you compare to BYD.

Budget

At the budget end of the spectrum, BYD have introduced the Seagull range, which has already been launched in Colombia. Seemingly, despite its $12,000 price tag, reviews have praised its quality, and the car has been compared favourably with American EVs costing three times as much. So, even with tariffs of 100%, the Seagull range could compete on price with US manufactured Teslas. The report goes on to suggest that the entry of Seagulls into the U.S. is inevitable.

Mid Range

BYD also have some pretty nice looking sedans that come at a fraction of the cost of any of Tesla’s range. The battery-powered Qin Plus EV Glory Edition, shown below, sells for around $15,000.

BYD sedans (Arens EV)

As far as I can see, in countries without tariffs, Tesla has an uphill battle competing with BYD on price.

Luxury

At the top end, BYD make high end vehicles that can cost up to $233K. The U9 is marketed under the catchy brand name YANGWANG.

Technology

It is often said that the key component of an EV is the battery, after all, one of the first questions people ask when purchasing a car is; “how far can I go on a single charge?”; right?

Well, BYD are planning to introduce their latest batteries in August this year. The new battery will be everything you could wish for. For a start, they will be lighter and smaller than BYD’s current range of batteries. Furthermore, they will have a power density of as much as 190 Wh/kg, which will enable even mid-range cars travel up to 1000km (621.37 miles) on a single charge and with improved safety.

For comparison, a Tesla Model 3 can cover only 272 miles on a single charge and at a cost of around $34,000. So, I ask you, would you prefer a sedan costing $15,000 that does 621 miles or pay $34,000 for a car that does 272 miles?

But, if your interest is range, how about BYD’s Qin.L, which is claimed can travel 2,000 km on a single tank of gas. According to reports, the vehicle will be fitted with BYD’s fifth generation DM-i hybrid system.

I’ve previously reported that BYD has hired 4,500 software engineers to embark on a project to enable Full Self Driving for their vehicles. Now it seems the company is out of the gate and has been given a licence by the government to test level 3 autonomous driving.

However, it has to be admitted that BYD is far behind Tesla when it comes to FSD, but there are other Chinese companies, which I have previously covered, that are hot on the company’s heels; Geely and Baidou (BIDU) for example.

In Summary

There is no doubt that BYD are gaining on Tesla, both in the number of units sold and technology. Indeed, in terms of battery technology, BYD are well ahead. If one assumes that the quality is not too far adrift of Tesla, even though tariffs are expected to be 100% on imports, a BYD is still exceptional value compared to a Tesla.

Where there are no tariffs, Australia for example, what can Tesla claim to be unique about their offerings that is worth paying approaching triple the price of a BYD?

Humanoid Robots

Tesla

Tesla’s humanoid robot, Optimus, represents Mr. Musk’s vision to revolutionize automation and workforce dynamics. Unveiled in 2022, Optimus is designed to handle tasks deemed dangerous, repetitive, or mundane for humans, and of course, to do these tasks a lot cheaper.

While not quite ready for deployment, Optimus has already demonstrated promising capabilities. Videos released by Tesla showcase its ability to saunter along without falling over, pick up eggs, and even perform basic tasks such as folding shirts.

Mr. Musk believes that humanoid robots could eventually become more commonplace than cars, revolutionizing industries and transforming society. That is to say, Optimus has the capacity to improve the profitability of great swathes of industry and give humans the opportunity to spend more time singing kumbaya on the beach.

Robotics In China

If anyone reading these lines has formed the opinion that Optimus is streets ahead of any competitor, I’m afraid I must disabuse you of this notion. In fact, China has instigated the type of infrastructure that will ensure that the country takes the lead in this futuristic sector.

There is a relatively new concept known as “Connected Knowledge Spillover.” This idea states that new technological breakthroughs can leak out from one company or group and then spread to others, like ripples in a pond. This spread of know how can help businesses improve without having to pay for it, sort of like getting something for free. And this concept works best when companies working in similar sectors are within close proximity to each other.

China has embraced this concept with gusto with the establishment of a National Humanoid Robot Innovation Center and encouraging robot development to take place in a single city; Shanghai.

As mentioned, Shanghai has emerged as a leading hub for intelligent robot development, boasting over 350 AI enterprises.

One of these companies is Fourier Intelligent, which recently showed off its new robot, GR-1. This human-like robot can walk quickly, avoid obstacles, and carry heavy loads. It is believed that this type of robot has a lot of potential for many different uses, like manufacturing, healthcare, household tasks, and research. Sound familiar?

It is certainly debatable whether Chinese companies are ahead in terms of robotics development. However, it is reported that at least one company, Alibaba, is well ahead of some of our leading lights in AI.

According to the article, Alibaba has launched Qwen2, the second iteration of its open-source large language model. This version reportedly features significant upgrades, including enhanced multilingual capabilities. The reporters assert that Qwen2 outperforms Meta’s Llama 3 in several benchmark tests, spanning areas such as mathematics, computer coding, and various academic fields. The model is said to be available in five variations, with the most advanced version featuring 72.7 billion parameters – a measure that typically indicates the model’s complexity and potential capabilities

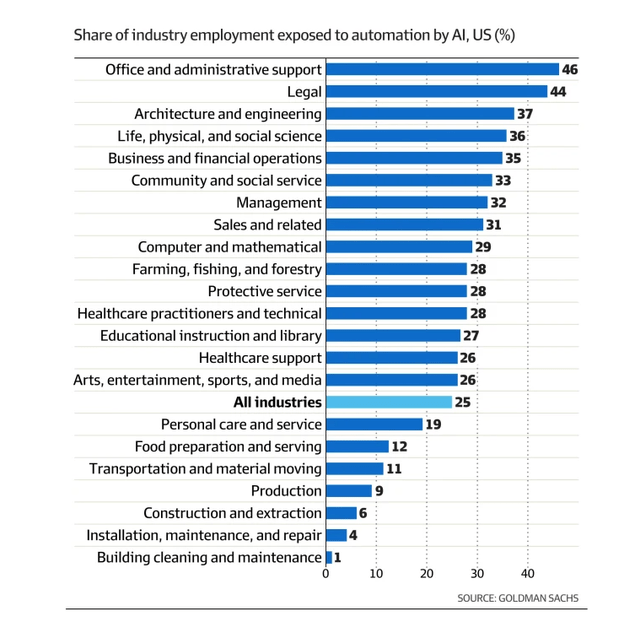

While AI can enhance productivity by automating repetitive tasks, it poses a threat to numerous jobs, including both low-skilled and white-collar positions. Jobs involving routine tasks, such as data analysis, content writing, and legal drafting, are particularly vulnerable. Even higher-skilled roles in fields like engineering and computer programming are not immune to the potential impact of AI.

Jobs threatened by AI (Financial Review)

One can well imagine that these robots, once firmly embedded in industry have the capacity to reduce costs for industry quite dramatically (Figures given in my previous article). And it’s not beyond anyone’s comprehension that robots manufactured in China will be considerably cheaper than those produced by Tesla.

I would argue that US manufacturers may have little option than to purchase, despite possible tariffs, Chinese robots given the potential efficiencies to be gained.

Summary

Tesla’s electric vehicle dominance is being challenged by BYD, a Chinese company outpacing Tesla in sales, product range, technology, and global reach. BYD’s upcoming battery technology and focus on affordability make them a formidable competitor, even with potential tariffs.

Meanwhile, in the field of humanoid robots, China is rapidly advancing with initiatives like the National Humanoid Robot Innovation Center and a concentration of robotics companies in Shanghai. Companies like Fourier Intelligent are already showcasing impressive prototypes like the GR-1, similar to Tesla’s Optimus.

While the race for dominance in this sector is ongoing, China’s advancements, coupled with its potential for cost-effective production, may give it an edge over Tesla, even with potential tariffs on imported robots.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.