Summary:

- Tesla, Inc. stock has performed exceptionally well in the past, but is currently on a downward trajectory due to weak performance and increasing competition.

- From a technical standpoint, the stock shows strong bearish momentum and is trading below key resistance levels.

- Tesla is facing competition from companies like BYD Company and Volkswagen AG, which are eating into its market share and experiencing higher revenue growth.

Дмитрий Ларичев

Note: Coming right after the release for Q4 2023, this analysis couldn’t have arrived at a better moment. Its goal is to assess the current investment opportunities as well as the future performance of the organization.

Investment Thesis

Tesla, Inc. (NASDAQ:TSLA) has gained about 827.44% over the last five years, outperforming the S&P 500 (SP500) with a margin of about 742.45%. I believe this outstanding performance, among other factors, has been a result of its strong brand identity and innovation. However, despite this stellar performance, TSLA is currently on a downward trajectory which has been accelerated by its MRQ performance being below expectations. Further, the company is facing increasing competition, especially in the electric vehicle, or EV, sector from other companies such as BYD Company Limited (OTCPK:BYDDF) and Volkswagen AG (OTCPK:VWAGY), which appears to be eating its market share.

From a technical standpoint, TSLA has a strong bearish momentum, which I believe will be dominant at least in the short and maybe mid-terms due to its weak performance in MRQ and the increasing competition. In Q4 2023, its revenue came in at $25.17 billion missing expectations by $596.79 million and its EPS came in at 0.71, missing expectations by 0.03. To add to this, the management gave a bleak outlook for 2024 which could add to the downside pressure of this stock. However, from a long-term perspective, I am very optimistic about this company’s performance given its competitive advantages and new product launch, as will be discussed later in this analysis.

Given the company’s current downward trend and its weaker-than-expected results, I recommend patience before investing here. Alternatively, short positions can work here, as will be guided later. For long-term-oriented investors, hold for now.

Let’s Dissect The Chart Technically

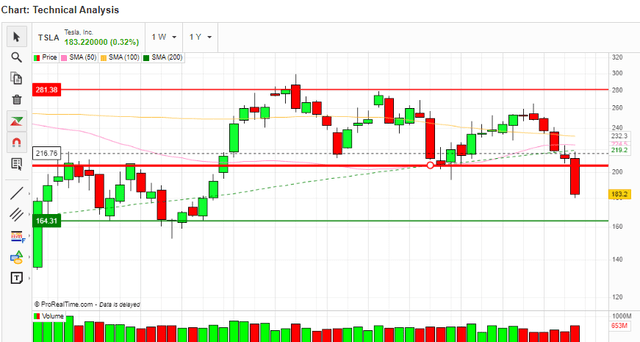

As I have alluded to above, Tesla is currently on a downward trajectory. Let’s dive deeper and evaluate this course. To begin with, between January 2023 and October 2023, the price formed a bearish flag pattern, which was complete when the price broke below the lower trend line of the flag, an indication that the downward trend is strong and is set to continue.

Author Analysis On TradingView

Further, the stock is trading below its 50-day, 100-day, and 200-day MAs, which are on a downward slope and acting as resistance levels. In addition, the price is below the first and second resistance levels of $281.38 and $216.76. This price action below the MAs and resistance zones is proof that the stock is on a strong downward trajectory.

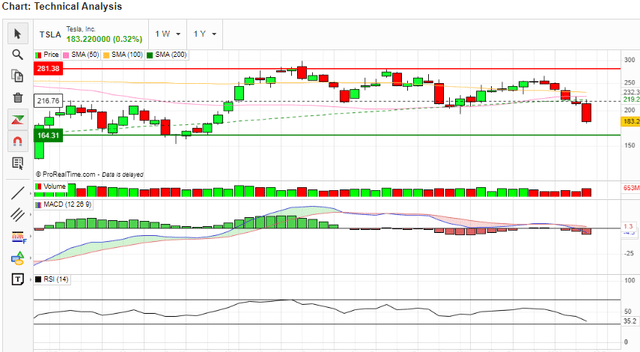

To support the strong downward momentum are the MACD and the RSI. The MACD is below the signal line and facing downwards with its histogram below the zero line and growing bigger on the bearish side. These two aspects are a confirmation that the bears are in control and the trend is very strong.

In addition, the RSI is at 35.2 and facing downwards. At this level, it shows that the stock is not yet in the oversold region of 30 and, therefore, it can still go down even further before reaching this zone where a reversal could be likely. With the RSI facing downwards, it appears that this stock is facing selling pressure at the moment and it can hit its oversold region.

Author Analysis On MarketScreener

So, with this background, what is there for investors? Here are my recommendations based on the above price actions. To begin with, my strategy here would be short positions with strict take profit and stop loss points. (Please fully understand the risks of shorting before opening any short trades.)

Based on my analysis, currently, I have three points of interest that would inform my investment decision. I find a strong support zone at around $117.42 and a strong resistance zone at about $281.92. The middle line is the first support zone from the strong resistance and the first resistance zone from the strong support.

Author Analysis On TradingView

With this information, I would recommend the following decisions;

You can sell below $202.92, set a stop loss at $210, and take a profit at $160. Also, you can buy at $117.42 and set a stop loss at $110, for this one, take a profit at about $198. In a nutshell, between these three major zones, open short positions with a strict stop loss slightly above or below the entry points depending on the decision and a take profit target slightly below or above the next target zone depending on the investment decision. If the price breaks below the $117.42 level, I would recommend selling because this would mark a break out towards bottoming at about $40.

For long-term oriented investors, $117.42 is a good long entry point because it is a major support zone where I expect a trend reversal. However, before opening a long-term position here, look at the technical indicators to confirm the bullish trajectory has set in. For example, make sure the MACD is above the signal line and its histogram is above the zero line and growing. Also, ensure the 50-day and the 100-day MAs have a bullish crossover or they are converging for the crossover and that the price is above the 50-day MA, or at the very least, both are converging.

Increasing Competition

While the MRQ performance came below expectations, I was keen to note the impact of the competition. To highlight this, I draw your attention to the company’s margins in the Q4 2023 results. Tesla reduced the global prices of its EV by about 20% to beat the competition. However, it has proven detrimental, as shown by its operating margin constricting by 784bps YoY. The company attributed this decline to reduced average per-selling price alongside operating expenses.

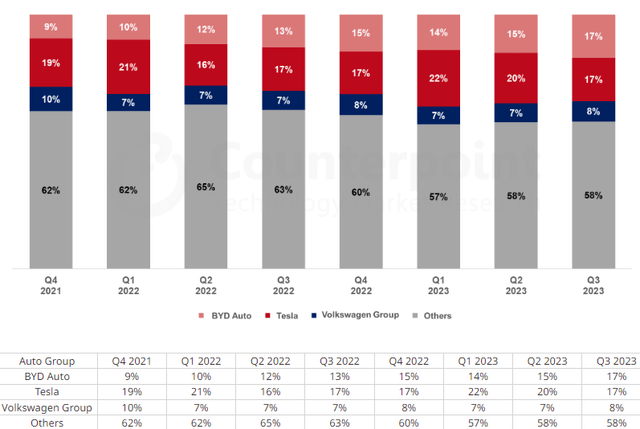

So, with this decision to cut prices to remain competitive, let’s evaluate how the competition is faring in terms of market share and sales growth. The image below shows how the relative market share of TSLA and its major competitors has been changing over time.

From this data, it is very clear that after a major market share growth from 17% in Q4 2022 to 22% in Q1 2023, Tesla has been losing its share consistently in 2023 from 22% in Q1 to 17% in Q3. On the contrary, its major competitors BYD Company and Volkswagen have either gained or maintained their market share when Tesla is losing. Indeed, BYD has grown its market share consistently in 2023, and as of Q3 2023, the company had an equal share with Tesla.

Let’s take this deeper and evaluate these three giants’ revenue growth as of Q3 2023 because it’s the most recent data for the three companies, with some having not released their Q4 earnings report.

- Tesla – Its revenue came in at $23.35 billion an 8.84% growth YoY.

- Volkswagen – Revenue stood at $83.24 billion an 18.14% growth YoY.

- BYD – It reported revenue of $162.2 billion a 38.5% growth YoY.

Based on this information, it is apparent that TSLA is facing serious competition from the above major competitors both in terms of market share and revenue growth. While this could be concerning, I think one of the major reasons that can explain this is the fact that Tesla has been a premium brand in the EV industry where their target has been the middle and the upper class seeking for prestige. BYD, on the other hand, has a wide range of EV models and price ranges cutting across a larger customer segment. I believe this has handed its competitors a competitive advantage and it explains why Tesla is losing market share to its competitors.

With this background, what is Tesla doing to regain its market? Let’s find out in the section that follows.

Tesla Innovating Cheaper Brands: Matching Competition?

As I have highlighted earlier in this section, TSLA had to cut its global price significantly to match the competition. This has been costly, as shown by the shrinking margins in the MRQ. From where I stand; I don’t think this approach is sustainable. However, with the management aware that they have to compete in terms of pricing, they have decided to innovate a cheap brand, which I believe will help meet the non-premium market segment and remain competitive in the industry.

The company has a plan to produce a cheap car model named “Redwood” by mid-2025. The new model is expected to have an entry-level of $25,000, which is significantly down from its current cheapest model, which has an entry-level of $38,990. According to a Reuters report, the new price range will enable Tesla to compete with BYD head-on in terms of pricing. In my view, this innovation will be a breakthrough because it will enable TSLA to meet new market segments alongside its high-premium segments. This will translate to gaining a larger market share and increased sales growth.

In addition, the company has a very unique Cybertruck which I expect to complement this innovation and help in gaining a significant market share in the lucrative pickup truck segment, which accounts for about 20% of the U.S. vehicle sales. This higher market share would translate to higher revenues and hence improved financial performance in the coming quarters.

I believe the success of this new launch will be facilitated by the company’s competitive advantage which arises from its vertical integration. Through this model, the company achieves a higher efficiency arising from controlling its supply chain and controlling costs through eliminating the middlemen. Further, this model helps the company avoid overreliance on external suppliers, which on its own is a competitive advantage because it can help them overcome supply chain shocks.

In conclusion, TSLA is on the right trajectory now by producing a cheap model that will help it meet competition in the low-income market segments. I expect the success of its plan to be facilitated by its vertical integration model which acts as a major competitive advantage. In addition, I expect the company’s biggest loyal customer base to play a pivotal role in ensuring the success of this project especially when it’s launched. With such a higher degree of loyal customer base, I think TSLA has a leg up in terms of competition, and all they need to do is launch this affordable product and they could match and perhaps exceed market rivalry.

Let’s Wrap This Up

As I conclude, Tesla, Inc. appears to be on a strong downward trajectory backed by weaker-than-expected results, especially in the most recent quarters. This phenomenon among other factors seems to be fueled by the increasing competition in the EV sector, where the company is consistently losing its market share to its customers on account of pricing.

In the short term, TSLA has slashed its prices to match the competition but this has been costly as shown by its shrinking margin. I believe this is quite unsustainable and the only long-term remedy lies in its new launch in mid-2025. Until then, I expect the competitive pressure to be high and this company will experience weaker growth than its competitors. As a result, Tesla could keep experiencing consistent share declines till its financial performance improves and matches competition and expectations, perhaps, when its market share is restored higher than competitors.

With this background, I can recommend patience before investing in Tesla, Inc. stock here until the cheaper brand is launched and a trend reversal in share prices is confirmed, as discussed in the technical analysis section. Alternatively, investors can initiate short positions in Tesla as guided earlier.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.