Summary:

- Tesla, Inc. will be reporting its Q1 FY23 results next week on Wednesday.

- Analysts are extremely divided on Tesla’s near-term prospects, and the stock is likely to remain volatile.

- Keep a close eye on customer deposits, segment financials and management outlook to get clarity on its growth trajectory.

jetcityimage

All eyes will be on Tesla, Inc. (NASDAQ:TSLA) when it reports its Q1 FY23 results on Wednesday next week. The electric vehicle (“EV”) manufacturer has delivered vehicles in record numbers once again, albeit at lower price points, so investors are curious to see how its revenue fares in its upcoming earnings report. But in addition to tracking its headline revenue figure, investors may also want to keep a close eye on its segment financials, its margin profile, customer deposits and its management’s outlook for the quarter ahead. These items will better highlight Tesla’s near-term growth prospects and stand to influence where its shares may head next. Let’s take a closer look at it all.

Gauging Customer Traction

Let me start by giving credit where it’s due — Tesla’s top brass has done a terrific job at growing their business so far. They’ve expanded production capacity when needed, pioneered new technologies and marketed their products well to catapult deliveries growth over the past decade. With recessionary pressures now weighing down on consumer budgets and rival brands creeping on, Tesla has announced prices cuts in multiple tranches in the past 3 months to reinvigorate consumer demand, bolster deliveries growth and keep competitors at bay. This is just smart decision making in my opinion.

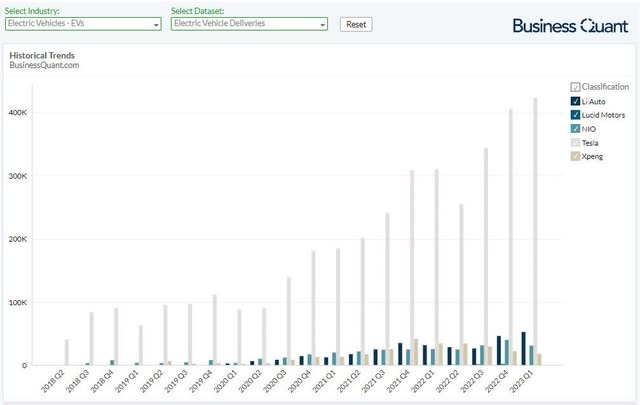

Since semiconductor shortages have begun easing, it has become relatively easier for electric vehicle manufacturers to source components and produce vehicles with ease. But note in the chart below that it’s not what happened. Tesla’s deliveries scaled new highs but its competitors struggled to grow. I evident that Tesla’s strategy of price cuts is the driving force behind these disparate delivery trends between different EV brands.

But there are a few factors that still remain to be seen.

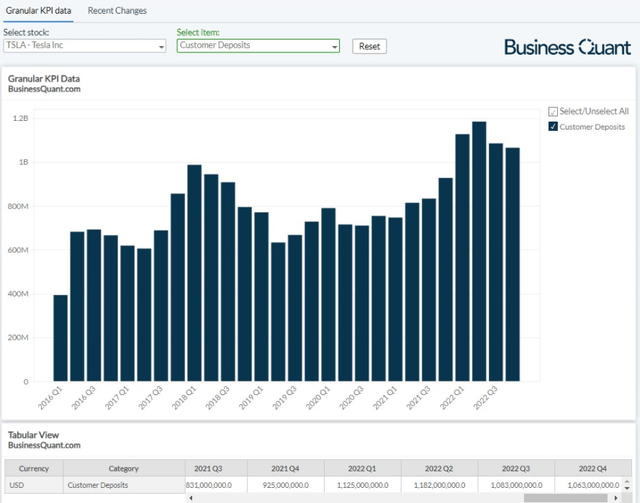

For starters, with recessionary pressures mounting and consumer budgets getting strained with every passing month, the demand for high-priced electric vehicles is likely to take a hit sooner or later. One way we can assess whether this dynamic is playing out, is by monitoring Tesla’s customer deposits. This metric is basically the cash payments that customers pay in advance to book their vehicles. These prepayments are cancellable and refundable, and may be subject to minor penalties in the form of cancellation fees.

Note in the chart below how Tesla’s customer deposits have started to decline in the past 2 quarters straight, indicating that the demand for its vehicles isn’t growing at a breakneck pace anymore.

It’ll be interesting to see how the figure trends in Tesla’s upcoming earnings report, since the company has announced several price cuts in the past few weeks. If the figure remains at its elevated levels, or rises further, then we can conclude that customer interest in Tesla vehicles is rising and that its growth momentum is likely to remain intact. But what seems more probable in my opinion, is that Tesla’s customer deposits figure will decline in its Q1 FY23 earnings report as recessionary pressures weigh down on consumer spending budgets. This latter scenario implies that Tesla’s delivery (order) backlog will shrink and the company’s growth momentum will slow down in the near term.

But that’s just my guesstimate – readers may want to keep a close eye on Tesla’s customer deposits to get a clearer understanding about Tesla’s near-term growth prospects. Having said that, let’s now look at Tesla’s financials.

Financial Items To Watch

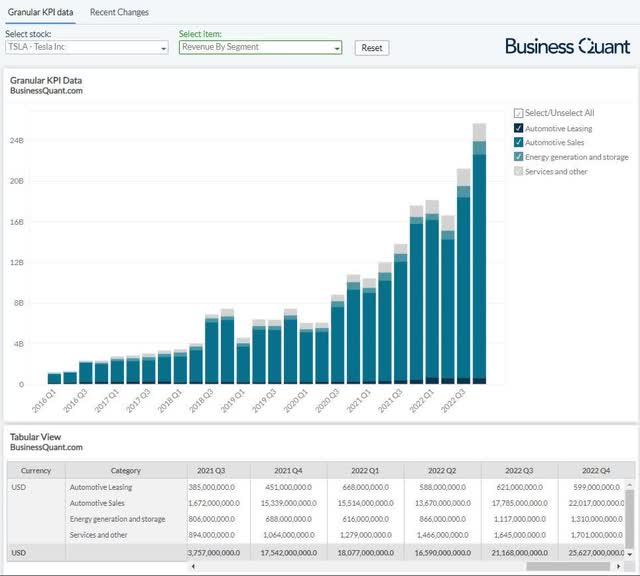

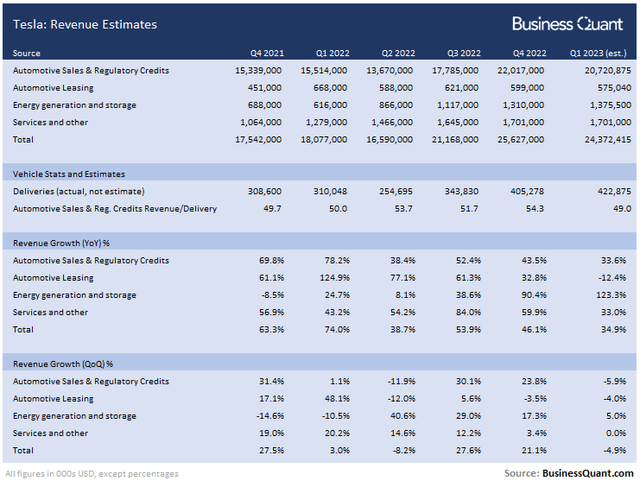

It’s worth noting that Tesla has broadly 4 sources of revenue. It earnt roughly 86% of total revenue last quarter through automobile sales and regulatory credits. This revenue stream has broadly 2 counteracting triggers at play. First, a barrage of recent price cuts will reduce the average revenue that Tesla recognized per vehicle during Q1 FY23. At the same time, record deliveries will push revenues higher. I’m anticipating an 9.8% sequential decline in Tesla’s blended average selling price during Q1 FY23, which means its automotive sales and regulatory credits revenue on 422.8k deliveries will amount to approximately $20.7 billion for the said quarter.

There aren’t any major catalysts at play within its services division, that materially alter its prospects in the near-term. So, I expect its revenue to remain flat sequentially at $1.7 billion for the time being.

Moving on, Automotive leasing revenue was down 3.5% sequentially last quarter and I’m estimating the downward pressure will remain intact and this division will post revenue to the tune of $575 million for the quarter. Tesla’s energy generation and storage business, on the other hand, has seen its revenue growth slow down over time and I expect high interest rates to weigh down on its growth momentum even further. For this division, I estimate that its revenue will grow 5% sequentially in Q1 FY23, much lower than its usual pace of growth, and its revenue will amount to $1.375 billion for Q1 FY23.

This brings us to a Tesla-wide revenue estimate of $24.37 billion in Q1 FY23. Coincidentally, my estimate is in-line with the Street’s consensus that’s spanning from $20.32 billion and $25.02 billion at the time of this writing. There’s actually a 23% difference between the Street’s low and high-end revenue estimates for Tesla’s upcoming quarter. This is unusually high and it suggests the analyst community is extremely divided about the EV manufacturer’s near-term prospects. So, we can expect heightened volatility when Tesla reports its results next week.

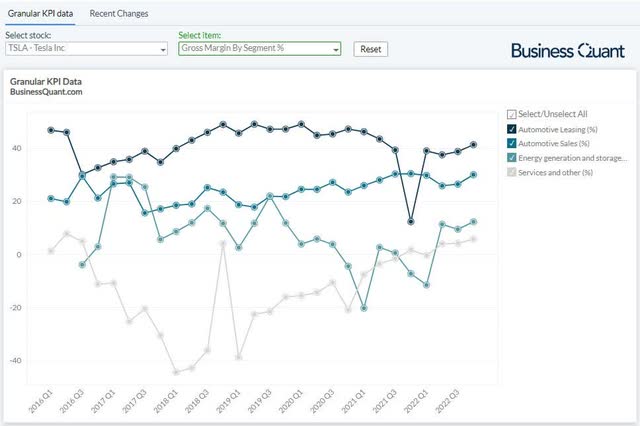

Moving on, we can also expect Tesla’s margins to compress due to its rampant price cuts. Bear in mind that the magnitude of margin compression won’t be linearly equal to the drop in average selling prices, since input costs have declined as well. For instance, global freight prices are down nearly 86% in the last 16 months and down 33% from last quarter. Lithium prices, too, have plummeted of late. So, I expect Tesla’s automotive sales gross margins to sequentially contract by 200-500 basis points in Q1 FY23. If gross margins compress beyond this range, then it’s bound to fuel bearish narratives.

Lastly, pay close attention to Tesla management’s outlook for Q2 FY23 and for FY23 in general. I think it’s needless to say but a conservative outlook would throw a spanner in Tesla’s capacity expansion plans and subdue its growth momentum. On the other hand, a robust growth outlook would dissuade bearish narratives, reassure its investors that the company is on the path to sustainable growth and it can also spark a rally in its shares. For reference, a consensus of 22 analysts is forecasting Tesla’s Q2 FY23 revenue to amount to $26.31 billion on average.

Final Thoughts

Tesla’s shares are trading at roughly 7-times the company’s trailing twelve months sales at the time of this writing. This may seem very high in isolation but note in the chart below how the figure is actually hovering near its 3-year lows. This suggests that Tesla’s stock is oversold at least when looking at its recent trading history.

Having said that, as we saw in this article, analysts have diverging opinions about Tesla’s Q1 FY23 results so expect heightened volatility in the next few trading sessions. Besides, pay close attention to Tesla’s segment financials, its margin profile, customer deposits and management’s guidance for the quarter ahead. These items will better highlight where Tesla, Inc. and its shares may head next. Good Luck!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.