Summary:

- Tesla has officially showcased working prototypes of the long-awaited Cybercab at its 10/10 “We Robot” event. A surprise debut of a 20-seat Robovan was also present.

- The presentation was brief and direct, with Elon Musk reiterating Tesla’s vision for an autonomous future that also includes its “Optimus” humanoid robots.

- New pieces of critical information provided include the estimated production and operating costs of Cybercab at scale, as well as its anticipated timeline to volume production.

- However, a deeper dive into the presentation continues to reveal extensive uncertainties in the deployment and revenue recognition timeline for Tesla’s ambitions in autonomous technologies.

- This is expected to harbinger near-term volatility in the stock, as markets correct the lofty premium that’s been ballooning since April.

Sundry Photography

Tesla’s (NASDAQ:TSLA) 10/10 “We Robot” launch event was short, but encompassed a showstopping presentation that celebrated the company’s accomplishments in AI robotic technologies. CEO Elon Musk’s purpose was direct – he introduced the long-awaited “Cybercab” alongside an unexpected debut for the “Robovan”. The event included 20 Cybercabs and a fully autonomous fleet that included 30 other Model Ys for attendees to test out. There was also a crew of “Optimus” humanoid robots ready to serve and dance during the event. From a financial standpoint, Musk also ballparked the anticipate cost of both products when produced at scale, which is a welcomed detail to better gauge their future values.

But a deeper dive into the information from We Robot unveils lacking support for Tesla’s valuation premium that has been ballooning since Musk first touted the event back in April. The “more affordable” model that Musk had brought back into the conversation earlier this year to restore confidence in Tesla’s vehicle sales growth outlook was also absent from the event.

The lacking momentum from We Robot also precedes a potentially weak earnings report later this month. What we already know is that Tesla’s Q3 delivery numbers missed estimates and energy storage deployments dropped 27% q/q. This combination is expected to weigh on margins further, and drive-up execution risks as Tesla enters the end of the year.

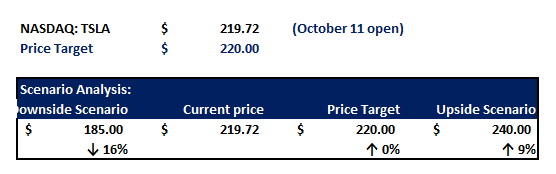

As a result, we expect volatility to remain the near-term theme for Tesla, especially as markets correct expectations coming out of the robotaxi launch event and ahead of the upcoming earnings release. We are maintaining our price target for the stock at $220, as the latest robotaxi launch event does not justify a material uplift from our previous fundamental projections attributable to Tesla’s autonomous mobility efforts.

The Cybercab and Robovan

The robotaxi unveiling event largely entailed a working prototype of autonomous mobility technology that Musk has long been promising, showcasing a sleek exterior that Tesla followers have already been speculating in recent months. The Cybercab borrowed some of the futuristic curbs of the Cybercab, and worked out to be a two-seater with no pedals nor steering wheels, accompanied by wing-like doors and a large trunk.

And for a surprise, Musk also introduced Tesla’s first robovan. Dubbed a “futuristic art deco bus”, which is also absent of a steering wheel and pedals, the robovan is expected to seat up to 20 passengers, addressing high density autonomous mobility needs.

Both products feature no plugs and will depend on inductive wireless charging to juice up their batteries. Musk anticipates volume production of the Cybercab to start “before 2027” after retracting an initial estimate for 2026 on potential over optimism. The Cybercab will both be used by Tesla as part of its fully owned and operated robotaxi fleet. The Cybercab will also be available for sale to consumers.

Now down to the financial aspect of Tesla’s robotaxi aspirations, which currently underpins the stock’s lofty premium, Musk expects the Cybercab to cost about $30,000 to produce. And operating it as part of the robotaxi fleet will cost about $0.20 per mile. Key selling points include unmatched safety, which Musk has recycled his “automated elevator” analogy for, and significant lifetime value generated from driving time saved and optimized vehicle utilization.

At first glance, this looks like some competitive economics for spurring adoption. The Cybercab’s lower production costs when compared to elevated levels for the Tesla Model S during its initial debut, for example, is largely thanks to the company’s industry-leading manufacturing efficiencies achieved to date. The AI and camera vision technologies used to operate the Cybercabs also come at a nominal marginal cost, given the widespread scale of deployment across Tesla’s existing vehicle line-up.

However, the Cybercab will need to deliver substantial value as promised to make the unit economics make sense for consumer adoption. At a cost of $30,000 to produce, the Cybercab’s sticker price is likely to be higher. Even taking for instance that the Cybercab will be sold at $30,000 per unit, that would equate to $15,000 per seat. That compares to the average price per passenger seat of under $10,000 in Tesla’s cheapest long-range RWD Model 3 inclusive of FSD licensing ($29,990 post-incentive vehicle price + $8,000 FSD license, divided by four passenger seats). As for operating costs, the Cybercab is expected to cost $0.20 per mile. Meanwhile, charging the Model 3 costs under $0.10 per mile, leaving a substantial margin to account for maintenance and downtime.

As for Tesla’s owned and operated robotaxi fleet, the Cybercab would also cost more to produce compared to the existing Model 3. Essentially, a fully autonomous entry-level Model 3 could likely achieve the same form of value creation through FSD’s enhanced safety and time savings, but at a lower cost than the Cybercab.

As a result, spearheading consumer adoption of the Cybercab and ensuring its operating economics are margin accretive for Tesla would require substantial value creation. Specifically, narrowing the TCO gap between the Cybercab and a fully autonomous entry-level Model 3 would likely come from factors that include exceptional outperformance in range, and fast, low-cost wireless charging. Both pieces of information remain absent in the meantime, leading to uncertainties on the extent of which the Cybercab would be fundamentally accretive for Tesla.

Optimus Humanoid Robot

True to the We Robot theme, Tesla also included a fleet of Optimus robots to serve drinks and dance with attendees at the launch party. Musk expects Optimus to be the “biggest product ever of any kind” when it goes to market, due to the limitless range of products and services that the humanoid robot is designed to provide. Optimus is expected to cost consumers $20,000 to $30,000 per unit when produced at scale. Adoption will be primarily driven from substantial user cost-savings realized through the replacement of day-to-day tasks with autonomous assistance from Optimus.

However, Optimus’ specific capabilities remain limited, unlike the Cybercab which would primarily depend on Tesla’s evolving FSD technology. The humanoid robot’s production and commercial launch timeline also remains uncertain. As a result, this product is unlikely to be a material driver for Tesla’s fundamental and valuation outlook in the near-term.

Absent “More Affordable” Model

AI and robotics aside, the highly anticipated “more affordable” model that Musk had brought back into Tesla’s roadmap earlier this year was absent from the We Robot event. A more affordable vehicle is critical for restoring Tesla’s vehicle sales growth prospects, especially as more affluent early EV adopters have mostly already converted to electric. If this vehicle was referring to the $30,000 Cybercab, then investors are likely in for some disappointment, as the product category offers limited respite to near-term vehicle sales growth.

However, it is also likely that the We Robot event was reserved for focusing on Tesla’s robotaxi and humanoid robot achievements. The company is potentially currently in the works of planning a separate launch event for the upcoming affordable model(s). Specifically, Musk had previously confirmed that the “more affordable model” is on track to begin customer deliveries in 1H25. The affordable price point expected will be primarily made possible by economies of scale benefits, as the upcoming model will leverage existing Tesla vehicle platforms and share “the same manufacturing lines as [its] current vehicle line-up”.

In the meantime, Tesla’s recent elimination of its standard range RWD Model 3 in the U.S. is expected to compensate for the affordable model’s continued absence. Recall that this base trim model was previously priced at $38,990, and runs on lithium iron phosphate (“LFP”) battery cells from China. This had essentially precluded the standard range RWD Model 3 from taking advantage of the $7,500 incentive under the Inflation Reduction Act (“IRA”).

As a result, the newest entry-level model at Tesla in the U.S. has moved up to the long range RWD Model 3. With a MSRP of $42,490, the vehicle is powered by lithium-ion batteries made in the U.S., making it eligible for the $7,500 IRA credit and an additional $5,000 in five-year gas savings for Californian buyers. This essentially puts the starting price of Tesla U.S.’ entry-level model at as low as $29,990, undercutting the critical $30,000 threshold in the affordable compact vehicle segment.

In addition to upping the cheapest MSRP on its vehicle line-up, which would likely drive an artificial boost to vehicle sales growth later this year, Tesla has also been strategic with its sales promotions. Buyers of Model 3/Y with the additional purchase of a FSD license at $8,000 can benefit from financing at 0% APR for up to 72 months. This is likely to encourage purchases before the year ends, while also spurring FSD adoption without further compromising Tesla’s Vehicle ASP and margins.

Fundamental Considerations

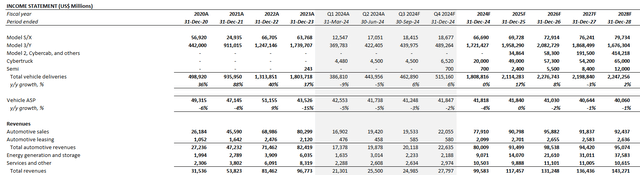

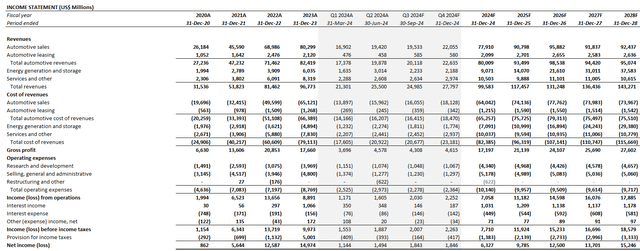

Updating our previous forecast for Tesla’s actual Q3 deliveries, we expect the company to narrow automotive revenue declines to -3% y/y to $75.5 billion this year. Tesla is expected to deliver 1.8 million vehicles this year, in line with previous year performance. The projected revenue is consistent with observations that the MSRP across Tesla’s vehicle line-up in core regions like the U.S. and China have largely stabilized in recent months following steep cuts earlier in the year. Meanwhile, the mix of lower-priced Model 3/Y sales versus the premium line-up has also been consistent with historical levels. Taken together with estimated energy generation and storage, and services and other sales, Tesla’s 2024 revenue is expected to reach $99.5 billion, representing y/y growth of 3%.

Meanwhile, profit margins are likely to remain pressured in the near-term due to limited relief to lowered vehicle ASP and the decline in energy storage volumes during Q3. Recall that Tesla had deployed 9.4 GWh of energy storage products in Q2, which resulted in a substantial uplift to consolidated profit margins. But with deployment falling -27% q/q to 6.9 GWh in Q3, Tesla’s bottom line is unlikely to find the same respite this time around.

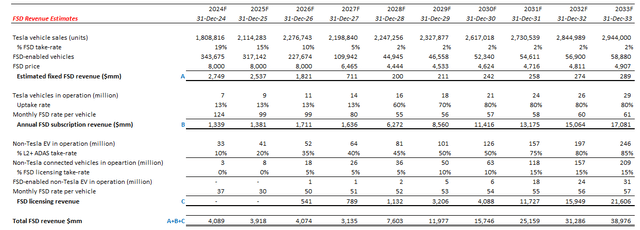

However, expectations for regulatory approval on “unsupervised” FSD in the medium term should bring some alleviation to the bottom-line. Specifically, Musk estimated during the We Robot event that the unsupervised version of FSD will start rolling out with the Model Y in Texas and California by 2026. This means the initial debut of unsupervised FSD would cover two of Tesla’s best-selling states and Tesla’s best-selling model. Put into better perspective, California currently accounts for more than half of Tesla vehicle sales in the U.S. and more than 10% of its global deliveries, thanks to the state’s expansive charging network and policy support for EV adoption.

The unsupervised version of FSD that Tesla expects to start rolling out by 2026 likely refers to level 3 autonomy, which still needs a human driver despite lifted requirements for hands on the steering wheel and eyes on the road. Level 3 is currently the highest level of fully regulator approved autonomy for carmakers. Only Mercedes (OTCPK:MBGAF / OTCPK:MBGYY) has reached the achievement today “in select vehicles under certain conditions in parts of Germany and the U.S.”. Achieving this level of regulatory approval for Tesla Model Ys in Texas and California would essentially unlock a substantial portion of high margin revenues that currently remain a deferred asset on its balance sheet.

As for the longer-term projections regarding Tesla’s robotaxi and FSD business, they remain largely unchanged from our previous forecast coming out of the We Robot event this week. The only piece of incremental information is that Tesla’s dedicated Cybercab model for its robotaxi fleet will also be available for consumer purchase. However, due to uncertainties in its unit economics as discussed in the earlier section, Cybercab volumes included in our longer-term delivery projections are expected to be nominal. The anticipated Cybercab deliveries are expected to complement expectations for greater uptake on the upcoming affordable models instead.

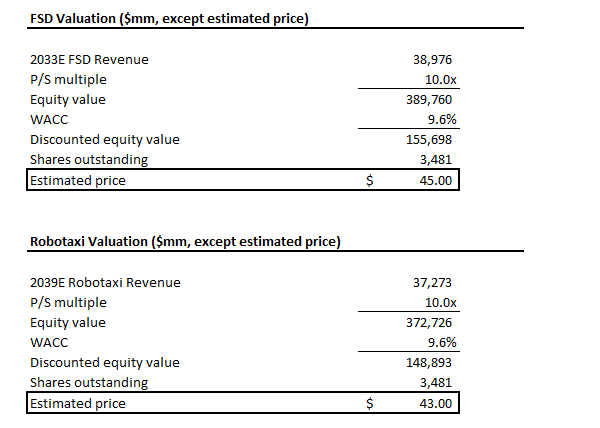

i. FSD Projections

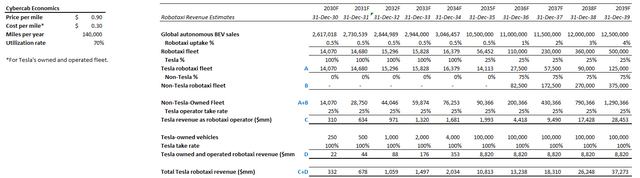

ii. Robotaxi Projections

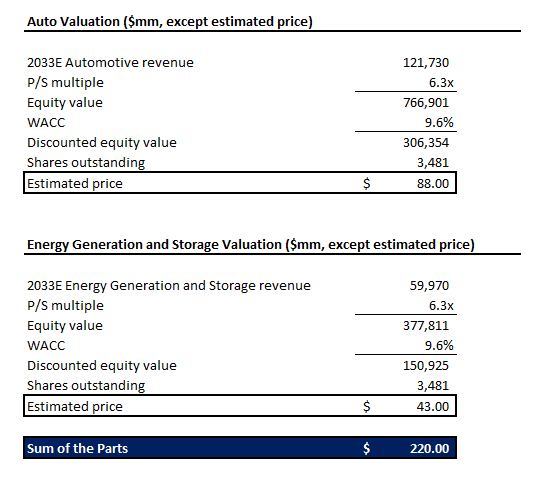

Valuation Considerations

We are maintaining our price target for Tesla at $220 a piece, as the robotaxi launch event has not introduced any items nor new information that would materially deviate our previous estimates for the segment’s growth prospects.

Author

The price target is derived using a sum-of-the-parts approach, which considers fundamental projections from each of Tesla’s core automotive, energy generation and storage, FSD, and robotaxi operations.

Author Author

Final Thoughts

Admittedly, the We Robot launch event was exciting as it provided a glimpse into what the future could potentially entail. In the words of Musk, “the future should look like the future”, and the sleek designs of the Cybercab and robovan, alongside early capabilities of Optimus support this vision.

But down to the fundamentals, the latest launch event has offered limited reinforcement beyond what the market had already been expecting from Tesla’s ambitions in monetizing autonomy through both transportation and humanoid robots. Meanwhile, regulatory hurdles remain the most significant overhang on realizing these ambitions. And they have yet to be fully addressed based on information from the latest launch event. Taken together, we believe the Tesla stock has outrun itself in recent months leading up to the 10/10 launch event, and is positioned for some incoming volatility as estimates correct.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.