Summary:

- Tesla, Inc. share price weakness YTD can continue into the remainder of the year, going by its increasing challenges.

- The company’s labor challenges drag on, while demand weakness and higher operating expenses have squeezed the operating profit margin.

- The stock’s market multiples also remain high compared to peers, even as it loses market share in its big U.S. market and despite the price decline.

- While there are some positives, like some easing of inflation in Sweden and Germany, the possibility of production normalizing and stabilization in profits as Tesla undertakes cost-cutting, it’s not enough to make a case for the stock for 2024.

JasonDoiy

In the past six months of tracking the Tesla, Inc. (NASDAQ:TSLA) stock here on Seeking Alpha, the first time in November last year and the second time in February, my focus has been on its labor related challenges. It would appear that the unrest that started in Sweden, before spreading to other Nordic countries, would be resolved by now. But that hasn’t quite happened.

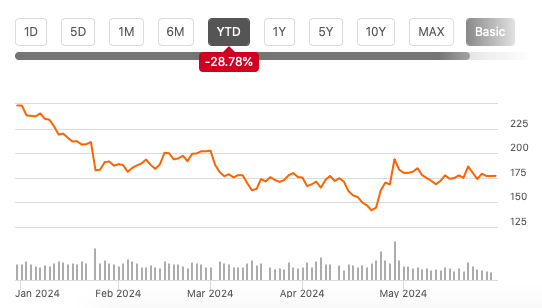

On the contrary, spillovers from labor challenges along with other company level and EV industry related issues have cascaded down into a very different labor related impact. Layoffs. It’s unsurprising that the stock has declined by close to 30% year-to-date YTD. Here, I take a closer look at the developments in the past months that have led to the current situation and assess whether there’s hope for an uptick in the stock for the remainder of 2024.

Price Chart (Source: Seeking Alpha)

Industrial action continues…

Last month, Tesla CEO Elon Musk made a hopeful observation on the Sweden labor union issue, saying that he thinks the “storm has passed.” But developments since indicate otherwise. The industrial action that started last October, leading to sympathetic actions by unions across industries in the Nordic countries, has now been joined in by the private labor union, Unionen, earlier in May.

For perspective, Unionen is the country’s biggest private labor union and also the largest for white collared workers in the world. This is expected to impact the company’s work at DEKRA Industrial AB, which provides independent inspection, testing and certification services for equipment across industries. In other words, the pressure on Tesla hasn’t let up in the region.

.. but economic conditions improve

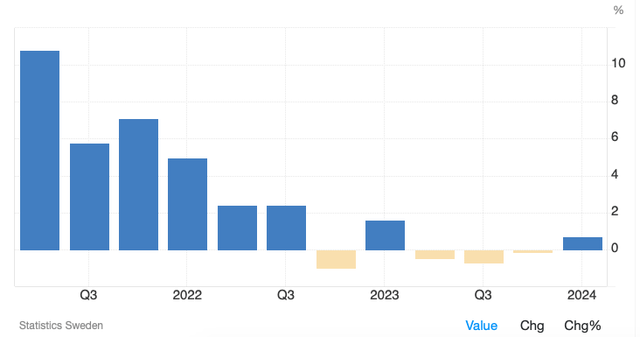

However, besides the fact that the Nordic region accounts for less than a 3% share of Tesla’s revenues, some letup in the cost of living crisis in Sweden can be a relief. Inflation dropped to 2.2% year-on-year (YoY) in April compared to 7.2% a year ago, and that may well create better conditions for negotiations. This is only half the macroeconomic picture, though, considering that Sweden has just come out of a technical recession (see chart above). Relatedly, small as the market is, the demand for cars is expectedly weak right now. Still, it’s some improvement over where the economy was at even a few months ago.

Sweden, Quarterly GDP, %, YoY (Source: Trading Economics)

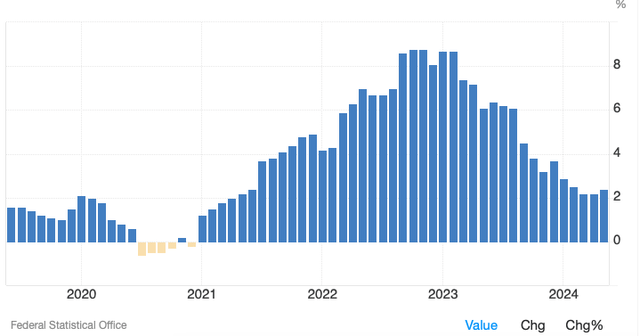

Eyes on Germany

In another bit of relief for Tesla, the risk of industrial action spilling over into the important German operations has not materialized. This could partly be due to the company’s own actions. Soon after industrial action started in Sweden, the company increased pay and also provided additional rewards to production workers in Germany, where it plans to increase production to a million cars a year. Also, much like in Sweden, inflation has slowed down as well. Germany’s inflation for April was down to 2.2%, less than a third of where it was last year at this time (see chart below).

Germany, CPI Inflation, %, YoY (Source: Trading Economics)

Even otherwise, things are looking up in the country for Tesla. The council of Grünheide, where its factory is located, recently approved of Tesla’s expansion. This is significant since it had faced obstacles earlier this year on the public’s environmental concerns and climate protests are still ongoing. While other approvals are required as well, including from environmental authorities, this is still a step forward, especially after the company’s production in the country suffered in Q1 2024. Deliveries were impacted by militants’ attacks at the Red Sea and an arson attack near its factory, resulting in an electricity outage.

Weak performance leads to layoffs

Even with steps towards expansion in Germany and lower probability of further industrial action, the drag from the company’s European operations has contributed to impacting its performance in Q1 2024. This is evident in lower production by 2%, affected also by a slower pace at Fremont, California. This, along with weakening EV demand, increasing competition and lower average selling price resulted in a revenue decline by 9%.

Still, it’s to Tesla’s credit that it kept an eye on profitability with cost-cutting measures, and it saw a 9% decline in cost of revenues. However, a 36% increase in operating expenses, which presumably includes the higher labor costs as well, still did the damage. The operating margin declined to a low of 5.5%, reversing the increase seen in Q4 2023 after four consecutive quarters of weakness. It also saw a 47% decline in non-GAAP earnings per share [EPS].

With the broader demand environment unlikely to stabilize soon, not with the US economy slowing down, Tesla’s taking hard measures. In the days that followed the results, it decided to lay off 10% of its workforce, and the number could be even higher going forward.

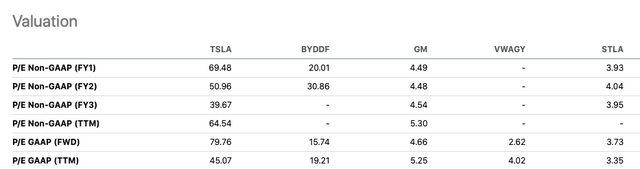

High market multiples

With this as the backdrop, it’s natural that the Tesla stock has seen difficult times in the past months. Since I last wrote about it in February, it’s down by 10%, and it has seen an even bigger 25% fall since I first covered it in October last year. Even then, it’s trading at valuations significantly higher than peers (see table below). The peers represent the four next biggest automobile manufacturers by EV market share: BYD Company (OTCPK:BYDDF), General Motors (GM), Volkswagen (OTCPK:VWAGY), and Stellantis (STLA).

While there has been a case for a premium on Tesla in the past considering its massive market share, the competition is catching up. This is evident from its reduced share in U.S. EV sales in Q1 2024 to 51.3% from 61.7% a year ago, making it even harder to justify the elevated multiples now.

What next?

In the past six months, Tesla, Inc. labor challenges have been sticky and more have cropped up. Even though it’s some consolation that strike action hasn’t spread as much as was earlier feared, higher worker payouts have likely spilled over into bigger costs in Q1 2024 at a time when Tesla’s production was disrupted and EV demand growth is slowing down. A disappointing financial performance in the quarter resulted in further layoffs.

To be fair, the company’s production can pick up from this quarter onwards and its cost-cutting measures can stabilize profits. But even then, the market multiples look high and this is not the year when EV demand is likely to grow fast. As such, for now, it’s difficult to see upside to Tesla stock now. I’m downgrading it to Sell, until concrete signs of improvement in both the industry and the company appear again.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—