Summary:

- Tesla’s Q4 earnings were disappointing, with sluggish growth in car sales and declining margins.

- The company faces growing competition and weaker demand, leading to price cuts to stimulate sales.

- Tesla’s valuation should primarily be based on its car segment, which has a fair value of $78 to $110 per share, well below the current price.

Michael M. Santiago

Dear readers,

I’ve been bearish on Tesla (NASDAQ:TSLA) stock for a while.

Most recently, I wrote on the stock in early November 2023, when I issued a SELL rating at $205 per share, after disappointing Q3 2023 earnings, released on October 18th. Since my last article, the stock has lost about 13%, while the S&P 500 (SP500) has rallied by 23%.

My thesis was simple. I liked the Tesla business and recognized that the company might see substantial growth in things like robotics, AI and self-driving. But at the same time, I realized that few of these promising business lines even existed, let alone generated any earnings. Whether you want to call Tesla a car company or not, the fact of the matter was that Tesla was generating about 85% of their earnings from car sales, while trading at a crazy expensive valuation of 70x earnings.

Not only that, but the company seemed to be steadily losing two things that justified (to a degree) a valuation premium. I’m talking about declining revenue growth and shrinking margins, both of which used to be significantly better than the industry average, but came down significantly over the course of the year.

Since then, Tesla has reported their Q4 2023 results. And unfortunately, I have to say that things have gotten worse. As a result, following the release, the stock tumbled by about 12% to the $180 level and has remained there until today.

In this article, I want to go over the most recent earnings, oppose the bulls’ view that the high valuation is justified by future explosive growth beyond car sales, and provide readers with a realistic calculation of fair value for 2024.

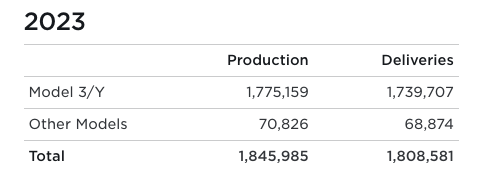

Q4 Earnings: the disappointment continues

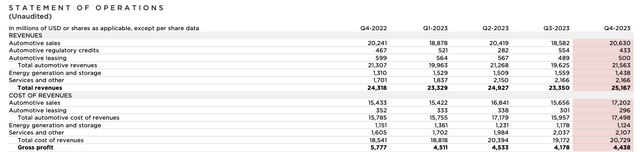

Tesla Q4 earnings were fairly disappointing with few positives, except for the fact that the company managed to accelerate production and deliveries in Q4 and hit its 2023 (revised) production target of 1.8 Million cars, up 35% year-over-year. Still, this was below the original target of 2 Million that CEO Elon Musk declared in January 2023.

Tesla Presentation

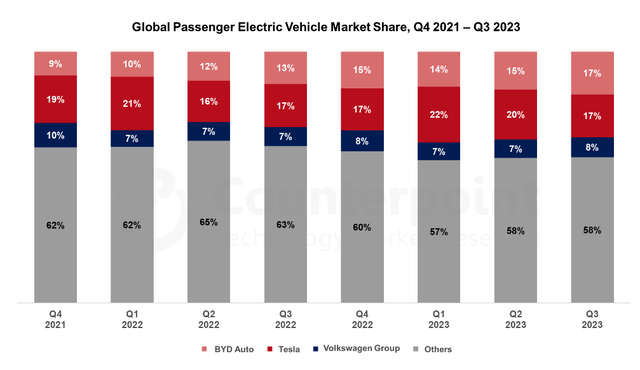

While Tesla’s production capacity has grown significantly over the year, so has the competition’s. During the fourth quarter, the Chinese manufacturer of EV vehicles BYD Company (OTCPK:BYDDF) actually surpassed Tesla with 526k. battery-only vehicles sold during the last three months of the year.

As a result, of growing competition and weaker demand due to persistently high borrowing costs, the company was forced to lower prices to stimulate demand. The popular Model Y, for example, has seen its price in the U.S. drop by as much as 26.5% over the course of the year.

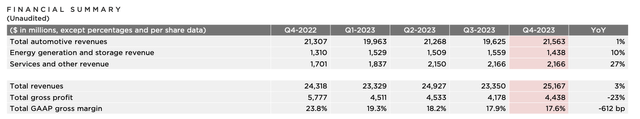

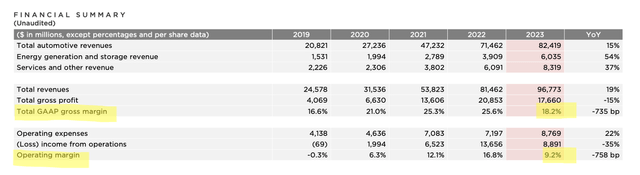

But despite lower prices, the company has failed to grow its auto revenues by more than 1% in Q4. And while energy and services revenues have grown faster at 10% and 27%, respectively, this wasn’t enough to offset sluggish growth in car sales. As a result, total revenue for the quarter grew by a meagre 3% YoY.

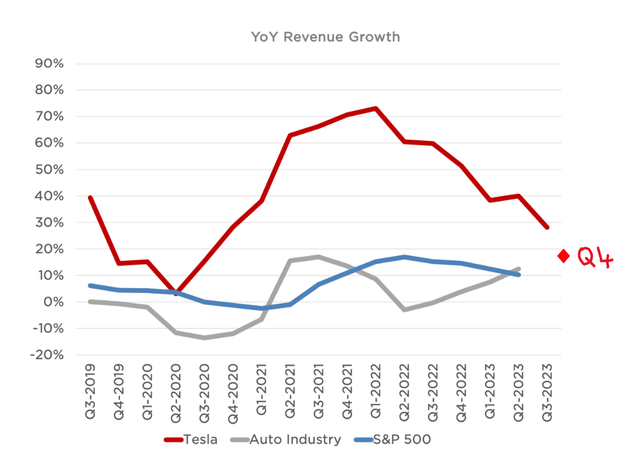

The full year revenue growth has been better at 19%, driven by 15% YoY growth in auto sales, 54% YoY growth in energy, and 37% YoY growth in Services. But this is nowhere near the 40%-60% annual growth we’ve seen over the past two years and is dangerously close to the auto industry average of 12%.

Moreover, the trend is unlikely to turn anytime soon as management has indicated that despite the price cuts, revenue growth may be notably lower in 2024 as the company finds itself in between two growth waves. My expectation is that the slowdown in demand will be short-lived and the EV industry will eventually return to its growth trajectory.

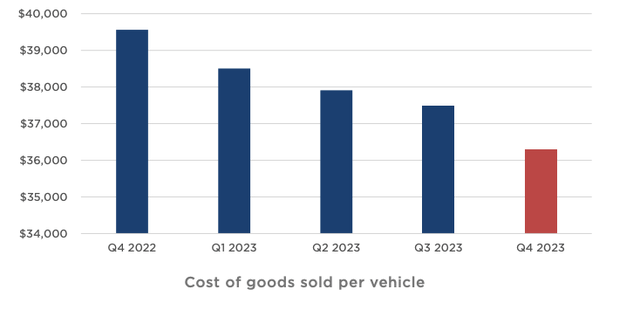

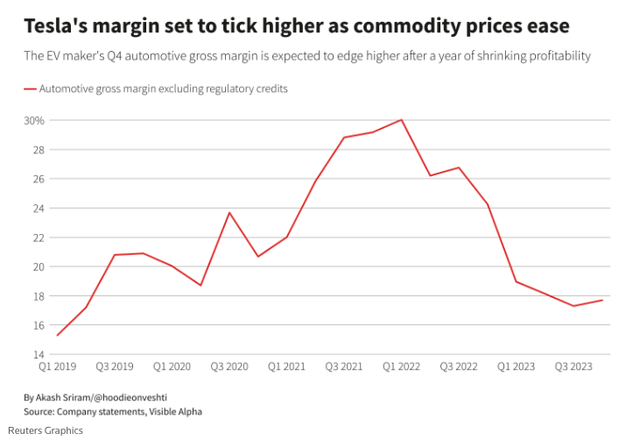

The aforementioned price cuts and significant production scale-up spending for the Cybertruck, which is unlikely to translate into higher earnings over the next 12-24 months, continued to put margins under significant pressure in Q4, despite a steady decline in the cost of goods sold (which are primarily a result of lower commodity prices and are mostly passed to the consumer anyway).

In Q4, gross and operating margins fell to 17.6% and 8.2%, respectively, down from 24% and 16% just one year ago.

Reuters Graphics

And on a full-year basis, the results were equally terrible with margins down over 700 bps YoY. I find this troubling, because recent results put Tesla’s operating margin right in line with the auto industry average of 8%. And although some analysts expect margins to rebound as commodity prices decline, with weaker than ever demand and higher than ever competition, I think it’s more likely that these savings will have to passed onto the consumer in a form of lower sale prices of cars.

As a result, I believe Tesla no longer deserves a premium for higher than average growth and higher profitability in its car segment.

Tesla Presentation

Notable recent developments

In addition to Q4 earnings, there are some recent events that are worth mentioning here. First, in late February, Apple (AAPL) decided to pull the plug on their 10-year effort to make an electric car which cost them $10 Billion in development costs. The move will result in about 2,000 people being laid off and is largely a result of the economic slowdown which has led to a drop in demand for EV vehicles and the company’s failure to develop a good enough product.

Second, just this week, Rivian (RIVN) revealed its new SUV R2 which will add to the competition for Tesla as it starts at a very competitive price of $45,000. The car will go on sale in the first half of 2026.

Finally, General Motors (GM) recently cut prices of Chevy Blazer which will now sell for $50,200, about $6,500 less than when it first went on sale in August.

Valuation: don’t pay for fairy-tale earnings

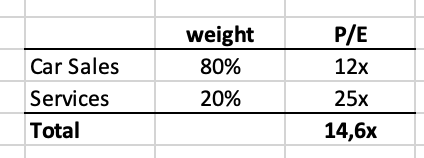

This time I am going to do things a little differently and look at Tesla’s valuation in two parts – the car segment and everything else.

The car segment accounts for 85% of all revenues and all earnings, because the remaining two segments, Energy and Services, are not profitable yet (i.e., their cost of revenue, even excl. R&D, more or less offsets all revenues).

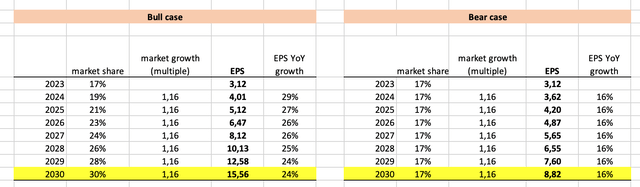

Therefore, the car segment effectively generated the entire EPS of $3.12 in 2023. Going forward, management has stated that they expect sluggish growth in 2024 and, perhaps, an acceleration in 2025 and beyond.

Currently Tesla’s global EV market share stands around 17%, which is in sharp contrast to the U.S. where the car maker dominates more than half of the EV market. With increasing competition worldwide, it will be difficult to capture as much as half of market share, though I do expect that Tesla could eventually get to something like 30%, once the second growth wave kicks in.

The EV market itself forecasted to grow at a CAGR of 16% for the next decade. Of course this is not set in stone, but if achieved, Tesla could see its car segment EPS rise to $15.50 by 2030 in the bull case, driven by increasing market share and EV market growth. This would correspond to EPS annual growth of 25-30%. In the bear case, Tesla’s market share, I estimate, would remain unchanged and EPS would be driven solely by market growth at 16% YoY growth.

To get a fair P/E multiple, I’ll look at BYD, which is no doubt the closest peer to Tesla. One of the biggest differences is that BYD has a lower operating margin of around 5%, largely a result of their desire to grow market share as fast as possible. Today, BYD trades at 20x earnings, despite growth prospects that are very similar to those of Tesla. Therefore, the highest multiple that I’m willing to value Tesla at today, given the growth profile in the bull case, is 25x earnings. Somewhat above BYD’s, thanks to Tesla’s higher operating margin.

With EPS of $3.12, that gives me fair value of $78 per share today.

Another way of looking at this is to fast forward to 2030. Assuming that Tesla hits EPS of $15.50, the market will have matured significantly by that point and growth will most likely slow significantly, maybe to high-single digits. At that point Tesla’s car business will be much closer to that of the legacy auto manufacturers such as Ford (F) or Toyota Motor (TM), which trade at only 8-10x earnings. I will assume a 12x P/E, above its legacy peers, assuming that Tesla is able to maintain higher margins, as they optimize and automate the production process.

Assuming EPS of $15.50 in 2023, a P/E multiple of 12x and an 8% discount rate, gives fair value of the car business today of around $110 per share. Between the two ways of valuing the car segment, it’s likely worth between $78 and $110 per share.

Tesla currently trades at $180 per share, still more than 60% above the (bull case) fair value. So, let’s see if the spread can be accounted for earnings outside of their car segment.

Like I already said, the remaining segments make no money today. Moreover, analysts’ estimates for the entire company, are looking for 2030e EPS of $11, below my bull case target for the car segment alone and about $2 per share above my bear case target. The way I see it is that this implies little added profit from the other segment before the end of the decade.

Seeking Alpha

What could happen, however, is that as the market gets saturated and car revenue growth comes down over time, lower sales could be offset by other sources of revenue. This is very similar to how Apple (AAPL) is still able to grow, even-though iPhone sales have been flat for a while. And it might be the reason why Tesla’s growth won’t slow as much as assumed above.

In fact, I would expect that by 2030, other segments (and especially Services) will comprise about 20% of earnings. These no doubt deserve a higher multiple than car sales and could increase the overall multiple of the stock close to 15x.

Author’s calculations

If that’s the case, then using the same 8% discount rate as above, I get a bull case price target for Tesla of $138 per share, more than 25% below the current price. This leaves no choice but to rate Tesla a STRONG SELL here, especially as weak demand is likely to continue in 2024, putting pressure on revenue growth and margins, which investors will not like.

Risks

As always, there are risks involved.

As it relates to my thesis, the biggest risk is that Tesla somehow manages to deliver greater than expected growth in earnings which would likely result in a higher multiple and therefore a higher price target. This could happen, for example, if Tesla manages to perfect the Full Self-Driving mode (“FSD”) and effectively becomes a monopoly for self driving cars. So far, though, I haven’t seen much evidence that the FSD will 100% functional any time soon.

Conclusion

In conclusion, I think that Tesla is a pretty good company, but it continues to trade at a stretched valuation even under pretty aggressive bull case growth assumptions. And while that valuation was somewhat justified in the past, recent slowdown in growth and declining margins simply make the stock look expensive. I might be a buyer if the stock ever dips below $100 per share, but at the current price I rate Tesla stock a STRONG SELL.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want to access my entire Portfolio and all my current Top Picks, feel free to join ‘High Yield Landlord’ for a 2-week free trial.

We are the largest and best-rated community of real estate investors on Seeking Alpha with 2,500+ members on board and a 4.9/5 rating from 500+ reviews:

![]()

You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.