Summary:

- The TSLA stock has been overly pummeled in the past year, with the perfect pessimistic storm delivering a tragic -65.47% stock decline thus far.

- As GM Cruise wins the robotaxi race and Ford holds on to its truck market, TSLA’s counter-fight remains to be seen, as the promised dates come and pass.

- Its market share in the US EV market also eroded from 79% in Q3’20 to 65% by Q3’22, with market analysts expecting another decline to below 20% by 2025.

- With the pessimistic sentiments surrounding the CEO’s Twitter purchase/political opinions, and macroeconomic indicators, it’s no wonder that Mr. Market is growingly bearish.

- Then again, we are cautiously nibbling here, due to the 22.18% upside potential to $150.51 we see against the 202.83% potential from the consensus target of $249.85.

Zinkevych/iStock via Getty Images

The FSD Investment Thesis Is Not Compelling Anymore

Tesla, Inc. (NASDAQ:TSLA) could likely see intense competition in its own backyard, seeing that General Motors’ (GM) Cruise has been approved for paid robotaxi service in Austin, where the former’s Gigafactory is located. Interestingly, Cruise commenced a similar service in San Francisco since June 2022, where the Twitter HQ is also located. The optics do not favor TSLA indeed, since the CEO initially unveiled its plans for robotaxi fleets in 2016, with the promise of a 2020 launch. However, after multiple delays, the company has committed to another steering-less robotaxi launch in 2024 instead. These are unfortunate developments, since federal regulators have also launched an investigation into its Autopilot functionality. Interested readers may refer here for a video demonstration of GM Cruise in Austin.

Furthermore, GM is already seeking regulatory approval in California to begin public testing of a steering-less shuttle, with submission already completed by August 2022. Once approval is obtained, the company seeks to test drive the vehicle in San Francisco. Assuming a similar two-year cadence as Cruise in the past, we may see an official launch of the service by 2024, if not earlier. It is also anticipated that GM may be able to reconfigure Cruise for commercial deliveries, thereby expanding its end-market reach. This is an exciting development indeed, since Ford (F) had recently recorded a massive $2.7B impairment on the self-driving ARGO platform.

It remains to be seen when TSLA will launch its robotaxi dreams, since GM proved more expedient in the matter, with the latter expecting to generate $1B in annual robotaxi revenue by 2025 and up to $50B by 2030 at an impressive CAGR of 118.6%. While these suggest a significant distance from consensus estimates of $51.44B for Uber (UBER) in 2025, things may improve once the authorities further expand Cruise’s service area and operating hours, as witnessed in San Francisco thus far. Readers interested in the economics of Cruise’s robotaxi may refer to this article here.

Then again, the first-mover advantage may not always be beneficial, as seen with Nokia’s (NOK)(OTCPK:NOKBF) rapid decline in market share after Apple (AAPL) released its first iPhone in 2007. As a result, GM’s early success in Cruise may not suggest its eventual dominance in the robotaxi market moving forward. There is an immense opportunity for multiple significant players in the global robotaxi market moving forward, as the market is projected to grow from 617 units in 2021 to 1.44M by 2030 at an accelerated CAGR of 136.8%. Naturally, we may also witness an aggressive consolidation phase as seen with UBER’s eventual exit from China, Russia, and Southeast Asia thus far. Only time will tell.

TSLA Is Also Rapidly Losing Its Market Lead And Share

We must also highlight BYD’s (OTCPK:BYDDF) (OTCPK:BYDDY) immense success thus far, since it is on track to deliver 1.9M vehicles in FY2022, while expanding its net income margins by 2 percentage points YoY to 2.6%. In addition, the bulls projected global delivery of up to 6M vehicles in 2024 against the management’s prudent guidance of 4M. Considering that these numbers outstrip TSLA’s market projections of 1.3M in FY2022 and 2.55M in FY2024 (based on annual growth of 40%), it may seem that Mr. Market intends to have the latter’s previous lofty valuation refunded. These may have triggered the stock’s freefall of -66.35% in the past year.

On a monthly basis, BYD remains unhindered in its production output as well, despite China’s Zero Covid Policy then. In October, the company delivered an impressive 217.8K vehicles (of which 103.1K are pure EVs) against TSLA’s 71.7K in China, NIO’s (NIO) 10.05K, Li’s (LI) 10.05K, and XPeng’s (XPEV) 5.1K at the same time. Impressive indeed, since the trend continued in November for BYD at 230.42K vehicles (113.91K of pure EVs), with TSLA reporting 100.29K, NIO 14.17K, LI 15.03K, and XPEV 5.81K. December proved stellar as well, with 235.19K vehicles (111.93K of pure EVs) against TSLA’s notable lag of 55.79K (MoM -44.3%, YoY -21%) in China. The others performed brilliantly for the month as well, with NIO delivering 15.81K, LI 21.23K, and XPEV 11.3K. There is no clear explanation as to why TSLA’s delivery in China declined for December indeed. We would likely hear more from the management during the upcoming earnings call, whether it is the result of a demand cliff in China, a resurgence of covid cases amongst workers, or the increased export to the US market.

In the meantime, most Chinese automotive companies, including TSLA’s Gigafactory in Shanghai, will likely have reduced production output for Q1’23, due to the Chinese New Year festivities. The latter has guided a factory closure from 20 January to 31 January 2023, though some market experts have suggested the possibility of an extended break through 05 February instead. The situation is further exacerbated by the company’s -30% reduction in output for Model Y in December and the unusual Christmas break from 25 December 2022 to 01 January 2023.

It is important to note these events did not occur last year, with some analysts suggesting the possibility of elevated COVID infections amongst TSLA’s workers in China. In addition, the company has been reporting elevated inventories over the past two quarters at an average of 52.75 days against a year ago at an average of 40.77% a year ago. It had to offer a rare $7.5K discount for the new Model 3 or Model Y, along with 10K miles of free Supercharging to incentivize US buyers. While it remains to be seen how the company performed in Q4’22, we do not expect to see a similar discount moving forward. This is attributed to the $7.5K tax credit under the IRA, which will kick in from January onwards, for certain vehicles under $55K.

On the other hand, TSLA’s Texas Gigafactory has successfully ramped up to 3K production output for the Model Y weekly, indicating 150K output annually, though notably still reduced compared to its design capacity of 250K annually. Its performance in Berlin Gigafactory is notably improved, at up to 4.5K vehicles weekly based on a three-shift system, suggesting an annual output of up to 225K. As a result, we believe that the US and EU consumer demand will still be sufficiently robust for some time.

Unfortunately, it is apparent that TSLA is losing its first-mover advantage, with its share of the EV market in the US declining rapidly from 79% in Q3’20, to 71% in Q3’21, and finally to 65% by FQ3’22. This is likely attributed to its limited model types of sedans and SUVs thus far, triggering headwinds as its Cybetruck is further delayed for 2024 delivery, despite the early unveiling back in 2019. The situation is further worsened by the excellent options in the global EV market, since users can now buy their favorite vehicles in EV formats, such as GM’s off-road Hummer, Ford’s F-150 as the best-selling full-sized truck in the US for the 45th year, Toyota’s (TM) Corolla as the world’s best-selling vehicle at 43M sold, amongst others.

According to S&P Global Mobility, TSLA’s market share will likely further plunge to less than 20% by 2025, with the number of EV models tripling from 48 in November 2022 to 159 over the next three years. This further undermines its stock sentiments and valuations moving forward, worsened by the CEO’s antics thus far.

So, Is TSLA Stock A Buy, Sell, or Hold?

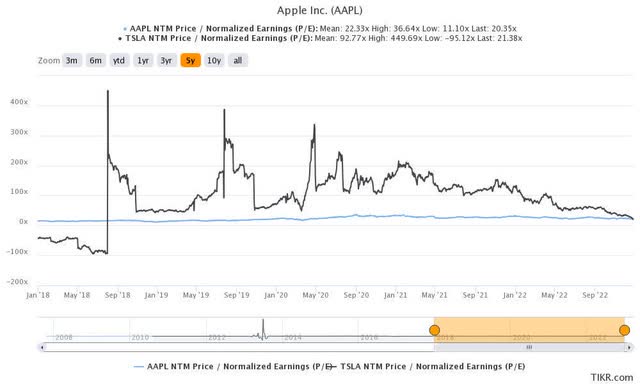

AAPL & TSLA 5Y P/E Valuations

S&P Capital IQ

While it remains to be seen how things will develop, we prefer to take a step back and assume the worst for now. With a 70% chance of a recession in 2023, the pessimistic macroeconomic outlook is unlikely to lift in the short term. This phenomenon has been witnessed in the fall of tech-related giants, namely AAPL and TSLA, thus far.

The smartphone giant is now trading at NTM P/E valuations of 20.35x, notably still higher than its FY2019 mean of 16.92x, though moderated from its 3Y pandemic mean of 26.63x and 1Y mean of 25.29x. On the other hand, the automaker has been subdued to a NTM P/E of 21.38x, a pale comparison against its FY2019 mean of 108.34x, 3Y pandemic mean of 114.33x, and 1Y mean of 64.71x. It is noteworthy that the latter has fallen closer to its lowest valuation of 20.31x as well.

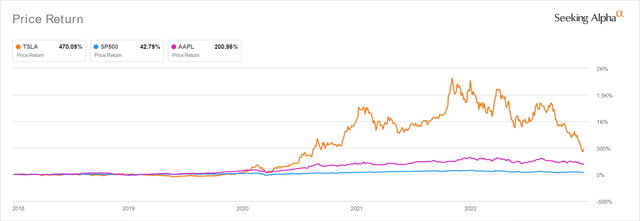

AAPL & TSLA 5Y Stock Price

Seeking Alpha

Nonetheless, it is also apparent that TSLA continues to trade with a massive baked-in premium compared to automaker peers, since GM reported a much lower NTM P/E valuation of 5.18x, F at 5.81x, and BYD at 31.94x. Assuming that the former is able to hold on to its current P/E valuations, we are looking at an ambitious price target of $150.51 indeed, based on its projected FY2026 EPS of $7.04. Interestingly, market analysts are more bullish, with a price target of $249.85, suggesting a 105.1% upside potential from current levels.

However, in a scenario where TSLA continues to free-fall and approach its legacy peers’ levels, a price target of $50 is not overly bearish indeed, since no one could have predicted that the stock might reach $121.82 at the time of writing. Even BYD continues to trade with a massive -67.2% geo-political discount at $24.80 against its promising price target of $75.67, based on FY2026 EPS of $2.37 and NTM P/E valuations of 31.93x. This is despite its excellent delivery numbers discussed above.

Additionally, with the TSLA CEO distracted with Twitter, sentiments have naturally plummeted, exacerbated by the broken promises of not selling more stocks. Some analysts have described the situation as treating TSLA as a personal ATM. Despite Elon Musk’s promises not to sell any more shares until 2024, his credibility remains tenuous for now. Furthermore, the CEO chose to express his political opinions during the recent midterm elections in November 2022, which may draw more volatility in the short term. While Elon Musk may have appointed a successor in Tom Zhu, it remains to be seen how market sentiments will improve, especially since Q4’22’s record-high deliveries of 405.27K have also missed consensus estimates of 420.76K.

This perfect storm may have contributed to TSLA’s deteriorating image, with negative perception expanding tremendously from 4.2% in November 2020 to 22% in November 2022. Notably, adults in the US are growing familiar with Elon Musk, expanding from 75% in 2021 to 94% in 2022, according to Mr. Marlatt of Morning Consult. Richard Levick, chairman of the PR firm Levick, said:

It’s very, very hard to separate the company from the man. He has a lot more critics than he used to. (The Wall Street Journal)

Naturally, it is impossible to predict when the market bottom will occur and whether TSLA will ever reach hyper-pandemic valuations again – unlikely in our opinion. This is likely one of Mr. Market’s last few rounds of normalization after three years of inflated stock valuations, significantly destabilized by the inflationary pressures and probable Fed hikes through 2023. As a result, the TSLA stock may, unfortunately, continue to retrace moderately.

On the other hand, given the relatively attractive risk/reward ratio, investors with a high-risk tolerance and long-term trajectory may consider adding here. Elon Musk himself has already committed to finding a new Twitter CEO, which should allay some worries in the short term. Our focus remains on its FSD and AI ambitions, thus, we are cautiously nibbling here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of TSLA, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.