Summary:

- Today, we will start with a brief consideration of Tesla, Inc.’s business through the lens of the nature of business broadly.

- I will then share the core pillars of the thesis.

- I will then walk you through a brief valuation exercise, which, at present, is necessarily a bit unorthodox.

- That said, I will provide concrete math that underlies the potential of the Tesla business.

- While nothing is guaranteed in equity investing (hence we generate return through risk, i.e., risk = return), I believe Tesla to be more compelling as a vehicle for capital allocation than it’s been in the last half decade.

martin-dm/E+ via Getty Images

Non-Linearity

I often share that business is non-linear, in the sense that no company on earth will grow sales at a steady 15% or 25% annually in perpetuity. Especially for companies that generate tens of billions in sales, as is the case for Tesla, Inc. (NASDAQ:TSLA), we should expect periods in which sales growth declines, accelerates meaningfully, and everything in between.

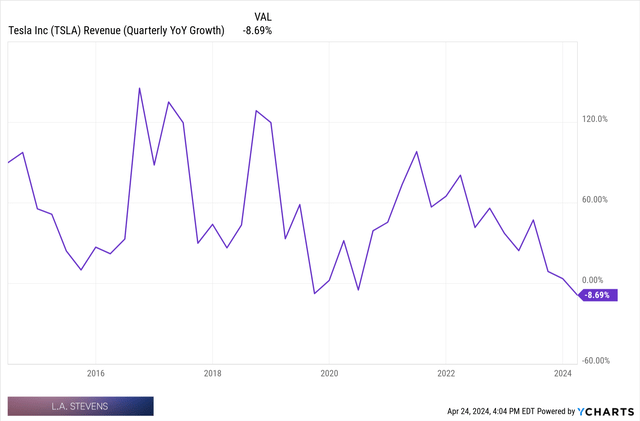

For Tesla specifically, it is undoubtedly going through a period of non-linearity presently, as most clearly communicated by its recent 8.5% decline in overall sales, which followed a year of steadily declining sales growth rate.

Tesla’s Quarterly Sales Growth Rate For The Last Ten Years

In late 2020 and 2021, the oft-sung refrain from Tesla bulls, of which I am one today to be sure, was that 50% annualized revenue growth should be expected in the years ahead. My belief was that the law of large numbers would prevent this from happening, as Tesla had achieved almost inconceivably large scale by 2020.

Moreover, the specter of rates rising, and the associated economic slowing, was something I believed could derail this 50% growth rate that market participants believed was attainable.

My perspective, in these respects, has, as of today, been vindicated.

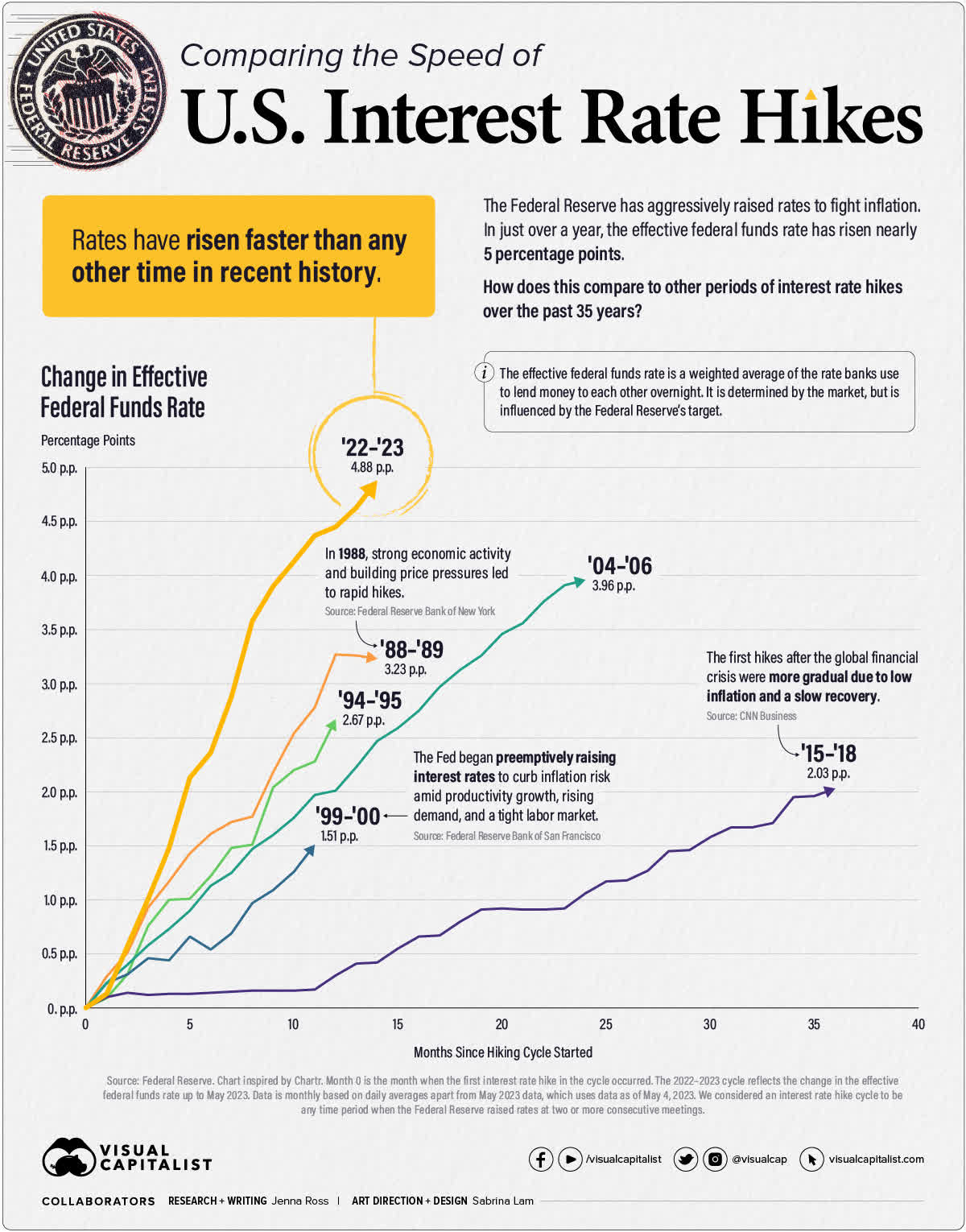

Today, we’re now in the thick of non-linearity, so to speak, in which Tesla is now actually experiencing negative growth, due in part to abutting the law of large numbers and, arguably more importantly, due to rates having risen at such a precipitous rate lately.

Interest Rates Have Risen Rapidly, Making Vehicles More Expensive To Purchase, Slowing Vehicle Sales

Visual Capitalist

As you know, cars are often financed, so higher rates have a significant impact on both Tesla sales, and vehicle sales broadly.

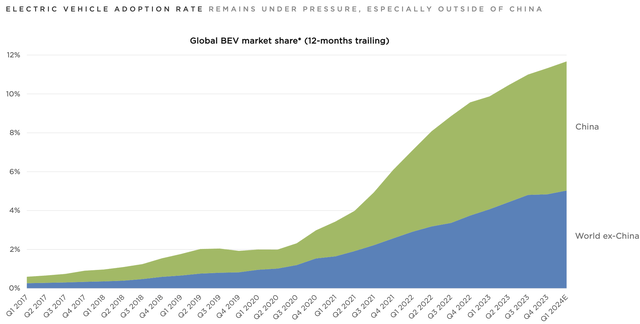

This dynamic, in my estimation, has resulted in the slowing of EV adoption that we’ve witnessed recently, which can be seen in the chart below.

The EV Adoption Curve Has Flattened As Rates Have Risen

Q1 2024 Tesla Investor Presentation

Quite notably, it’s not just Tesla that has seen slowing sales. I believe this is crucial to contextualize Tesla’s present growth rate and experience as a corporate entity broadly.

From Ford (F), which has experienced truly catastrophic slowing of its EV sales, to BYD Company (OTCPK:BYDDF), all EV OEMs have experienced slower or outright declining growth of EV sales, as the charts below depict.

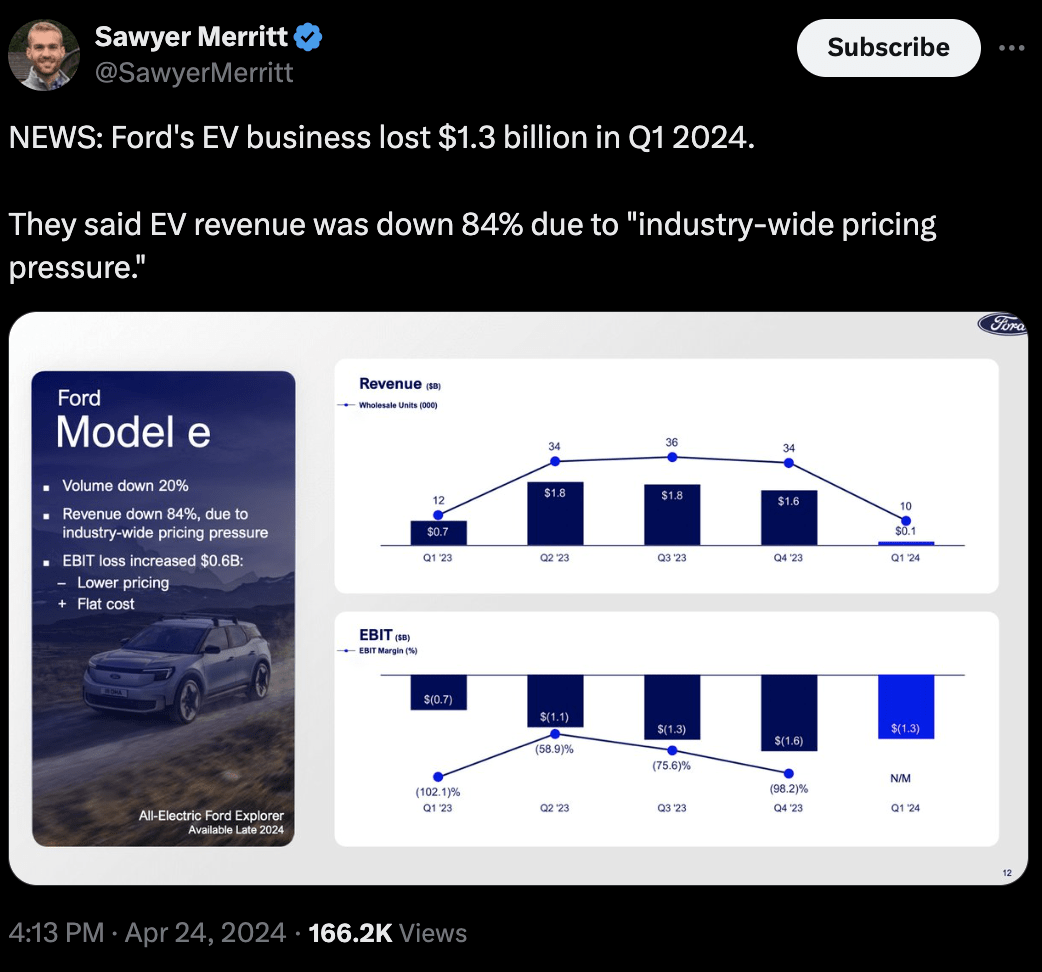

Ford EV Sales Collapse In Grand Fashion

X

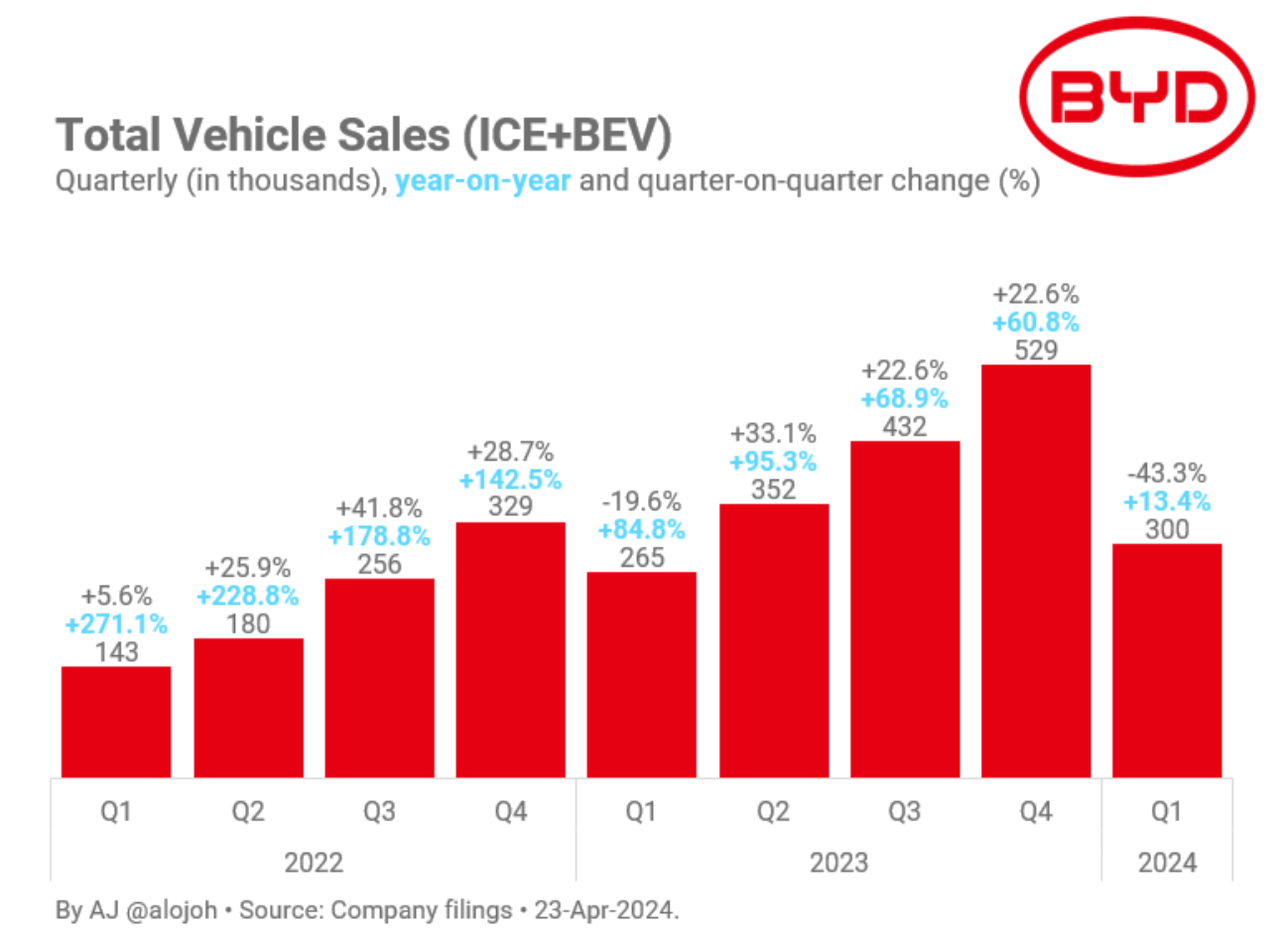

BYD Sales Decline Year Over Year

X

In short, higher rates have largely been the cause of Tesla’s sales stagnation, and I do not believe it should be cause for panic as it relates to the long-term thesis for the business.

There was, as we all have seen, the EV adoption rate globally is under pressure and a lot of other auto manufacturers are pulling back on EVs and pursuing plug-in hybrids instead. We believe this is not the right strategy and electric vehicles will ultimately dominate the market.

Elon Musk, CEO, Q1 2024 Tesla Earnings Call (emphasis added).

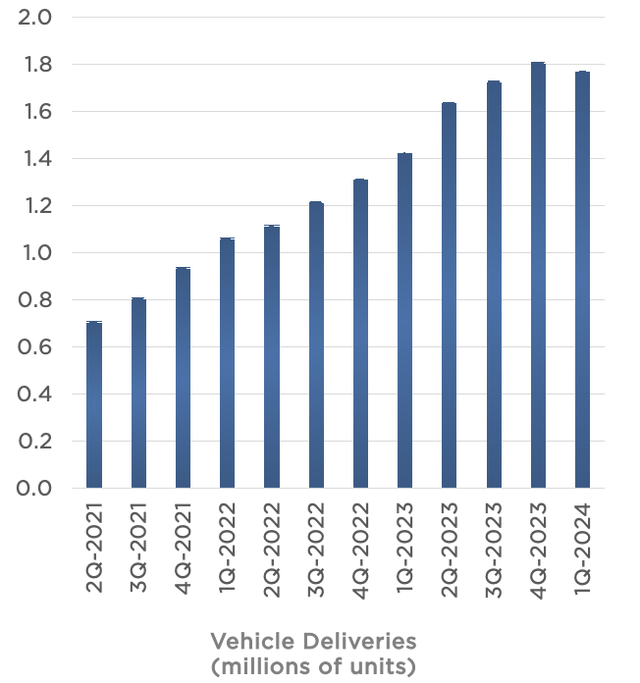

Tesla’s EV Deliveries On A Trailing Twelve Month Basis

Q1 2024 Tesla Investor Presentation

I believe it’s likely that Tesla’s vehicle sales, as measured by the delivery metrics presented above, will continue to grow, though I’ve always been incredulous about the 20M annual delivery metric the company and investors have bandied about. That said, as you will find in the material I will share in the concluding thoughts of this note, I do not believe in any sense that Tesla needs to achieve 20M annual deliveries for the investment to be a successful investment from its current enterprise value/stock price and for the thesis broadly to play out.

Speaking of the Tesla thesis, let’s now turn to a consideration of the overarching thesis for the business. As I’ve noted to you recently during this period of the stock declining, I believe we should lean on the principal pillars for the thesis that I have delineated for you in recent quarters. They are as follows:

- Tesla’s EV sales have been under pressure lately, but this is largely attributable to the rate at which interest rates have risen, which has put downward pressure on the entire EV industry’s growth. Tesla EV sales should continue to grow in the future, as the world achieves closer to 100% adoption of EVs, eliminating the use of ICEs (internal combustion engines) in the process. We’re currently at just 12% of total car sales annually that are EVs.

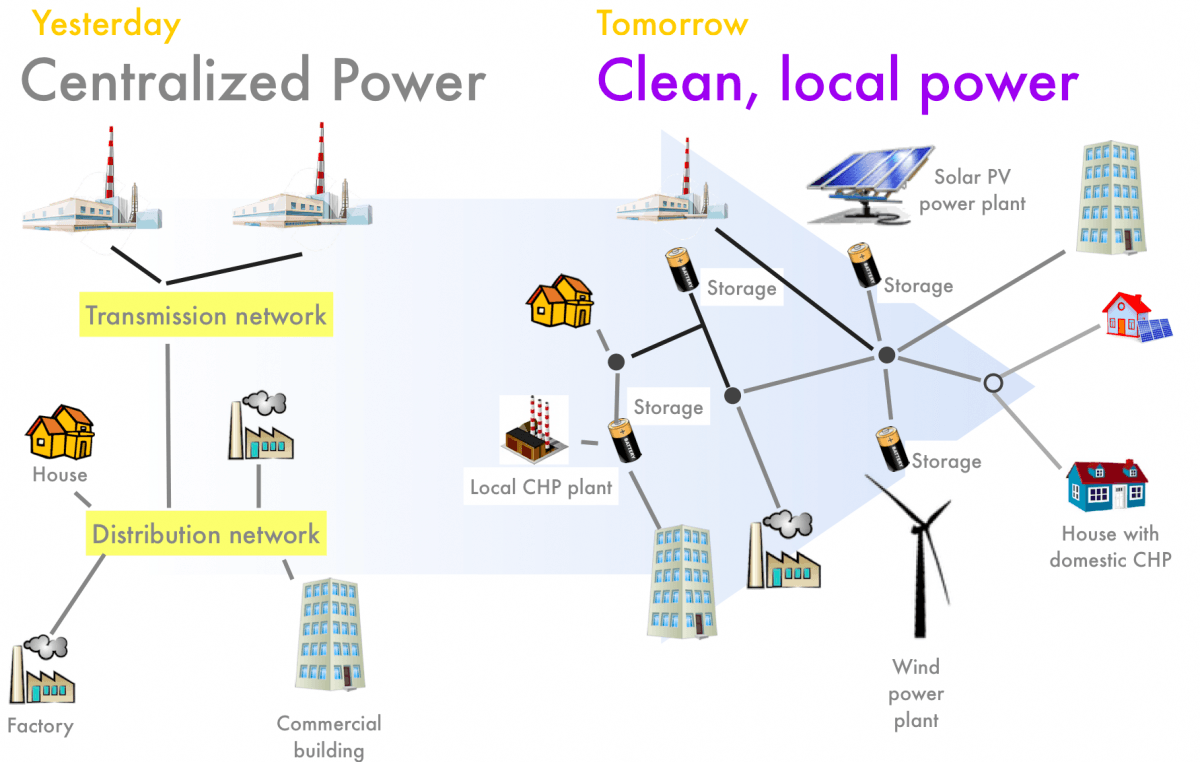

- As we approach 100% adoption of EVs, the conduit through which energy is delivered for transportation will shift away from gas stations and to the electrical grid, where EV owners will re-fuel vehicles from an outlet in their garage. This will create massive demand for energy through the electrical grid, which will create the need for more stationary storage, i.e., Tesla Megapack, which is a product within Tesla’s energy business. Tesla has stated that it plans to deploy 1,500 GWh of stationary storage per year by 2030, and, while that may not materialize perfectly on the timeline on which Tesla believes it will, if we get remotely close to those levels, this will result in a multi-hundred billion-dollar business, if not more, from its energy business alone.

- Tesla’s full self-driving, or FSD, product is the only remotely viable self-driving tech on the market. Today, Tesla has 1M+ vehicles that have been already fielded that are equipped with the hardware necessary to achieve intervention-less self-driving. It is already training its AI, used for the purposes of its full self-driving product, via these vehicles. We can see this reality through this link. No other OEM will be able to achieve this scale of training by way of vehicles equipped with the requisite hardware operating around the world in this decade, and they may never achieve this level of scale in this respect. This is a formidable hardware and software moat that Tesla has to a profound degree. Should Tesla genuinely complete this product to the degree that driver intervention is entirely unnecessary, which I believe it will, it will generate huge cash flows guarded by an unassailable moat. The other OEMs are too scared and have been caught flat-footed in this respect.

- Tesla’s Supercharger Network is the only one of its kind in terms of scale, and it could be worth large sums in the future, though this is difficult to determine. That said, it does act as a moat in that Tesla is the only EV OEM that has fielded a charging network at this scale, and it’s likely that no other OEM achieves this level of charging infrastructure, again, possibly ever, though certainly not in this decade.

- Tesla will also likely launch new products in the future, and, to this end, it’s worth noting that the company fits squarely within our third foundational investment framework.

Here are a few quotes that I found noteworthy as it relates to Tesla’s Energy business and FSD business:

The Demand For Stationary, Battery-Based Storage, Like Tesla Megapack, Is Set To Grow Immensely

Goldman Sachs has forecast that China alone will require about 520GW of energy storage by 2030, a 70-fold increase from battery storage levels in 2021, with as much as 410GW coming from batteries.

Financial Times.

CEO Elon Musk Describing The Possible Value Creation Associated With FSD

Yes. We’ll talk about this more on August 8. But really, the way to think of Tesla is almost entirely in terms of solving autonomy and being able to turn on that autonomy for a gigantic fleet. And I think it might be the biggest asset value appreciation history when that day happens when you can do unsupervised full self-driving.

Elon Musk, CEO, Q1 2024 Tesla Earnings Call.

CEO Elon Musk Describing The “Unassailable Moat” That Tesla Is Developing Via Its Fleet Of FSD Hardware Equipped Vehicles That Are On The Road As You Read This

So as our fleet grows, we have 7 million cars going to – 9 million cars going to, eventually tens of millions of cars worldwide. With a constant feedback loop, every time something goes wrong, that gets added to the training data and you get this training flywheel happening in the same way that Google Search has the sort of flywheel, it’s very difficult to compete with Google because people are constantly doing searches and clicking and Google is getting that feedback loop.

Elon Musk, CEO, Q1 2024 Tesla Earnings Call.

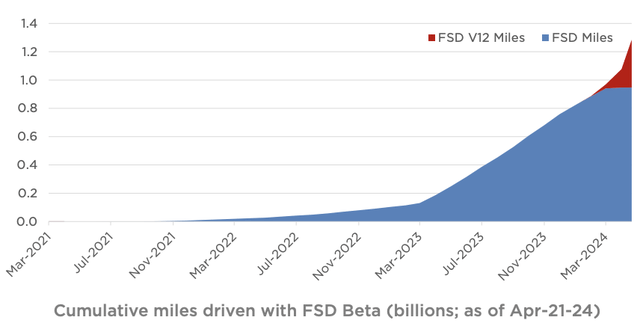

FSD Miles Driven Continue To Scale Now Parabolically

Q1 2024 Tesla Investor Presentation

Thoughts On Valuation

There are a number of lenses through which to think about Tesla’s valuation today, and I will discuss them with you in this section.

To be sure, it’s a bit nebulous presently. Consensus analyst estimates are essentially worthless as the company is aggressively reinvesting in its business in a number of ways; most notably, by lowering the price of its vehicles, such that it can field more vehicles to increase the aforementioned training data network effects associated with FSD.

That said, I will give you the factors that lead me to feel compelled to purchase the business at these levels, even if more downside might lie around the corner.

The first factor is a rather simplistic one, and it relates to essentially every business I discuss with you.

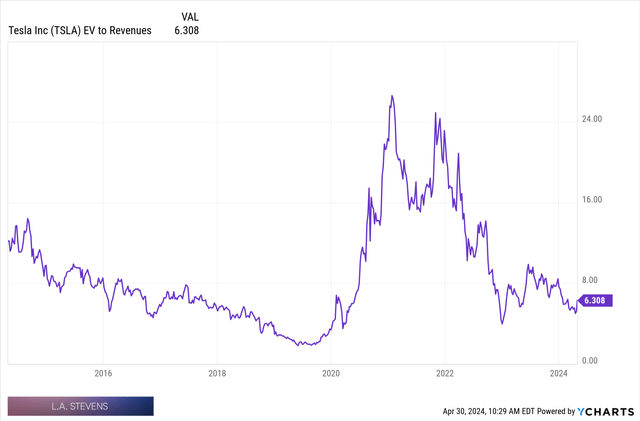

It is the idea that we can now buy Tesla at virtually its lowest valuation in half a decade. We can see this reality below.

Like so many adored businesses of the last half decade, the market went from wildly exuberant in its pricing to either extremely depressed, as in the case of Sea Ltd. (SE), or just unenthusiastic, as has been the case for Tesla.

At the very, very least, we’re buying the most promising businesses of the last 10–15 years at or very near their lowest valuations in their corporate histories, which implies that risk/return is or nearly is as attractive as it’s ever been.

Nothing is guaranteed, but this is something to consider for lots of software names and tech names out there.

The second factor is the growth of FSD.

I’ve shared the unit economics with you in the past, but I will very concisely articulate them here.

Should Tesla capture just 50M subscribers by 2035, which will be a small fraction of earth’s population by 2035, it will generate:

- 50M * $1,200/yr = $60B in high margin sales.

Let’s say free cash flow margins are 35% on these sales. We could imagine a scenario where just this business alone trades at $735B in market cap by that time, and this is just one line of business alongside EVs, Supercharger Network, future product lines, and, very, very notably, Energy.

Speaking of Energy, the third factor in the Tesla valuation equation is Tesla Energy.

As EV adoption inches closer to 100%, energy demand, as I noted earlier, on the residential electrical grid will explode higher.

This implies that stationary storage, like that which Tesla Energy sells via its Megapack business, will increase dramatically, which reflects Tesla’s prediction that it will achieve 1,500 GWh of annual energy storage deployments by 2030, and it also reflects Forbes’ forecast for the growth of energy storage requirements in China in the decade ahead (which I shared with you earlier).

This Diagram Illustrates The Growing Need For Stationary Storage Batteries

Diginomics

Here are the basic unit economics underlying this line of business:

- 1,000 GWH/year in production at $550/kwh (current Megapack unit economic) = $550B in ~25% gross margin energy deployment revenues

- 1,500 gwh/year in production at $550/kwh (current Megapack unit economic) = $825B in ~25% gross margin energy deployment revenues

Using 15% free cash flow margins on $825B in Energy sales and a 25x multiple, Tesla Energy alone could trade at ~$2.5T in market cap by the 2030s.

So just FSD and Energy alone could create a $3T business by the 2030s, and Tesla presently only trades at about $500B in enterprise value.

In closing, these realities cannot be seen in Tesla’s current economics of its business, though we currently have breadcrumbs foretelling their potential in the future.

And, with these ideas in mind and with the simplistic valuation thoughts with which I started, while I understand we must take a leap of faith here, I do think Tesla is the most compelling it’s been in over five years.

Concluding Thoughts

To close, I believe the Tesla thesis is more compelling than it’s ever been.

For those just joining me, I would strongly encourage you to read the multipart series that I penned in recent quarters, in which I delineated this thesis in great detail.

Thank you for reading, and have a great day.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.