Summary:

- Tesla, Inc. will report its Q2 delivery updates in about two weeks. The consensus estimates suggest a favorable report.

- Tesla’s rivals partnering with the company to gain access to its fast-charging infrastructure demonstrates the significance of its EV ecosystem leadership.

- Tesla dip buyers have proved their point, as they bought more at its April lows, overwhelming sellers and outperforming the market since then.

- With Tesla primed to reverse from a downtrend to an uptrend, you shouldn’t sell too early and miss the explosive upside that could come later.

Justin Sullivan/Getty Images News

Tesla, Inc. (NASDAQ:TSLA) stock has significantly outperformed the market since my previous update. I must admit that I failed to give sufficient credit to Tesla Bulls, who supported its bottoming process in April, post-earnings.

I wanted a much better discount before adding further, but I should have followed TSLA’s buying sentiments more closely, which showed a decisive bullish reversal in April (more on that later).

It also brought into mind the words of esteemed fellow Seeking Alpha contributor Avi Gilburt, who aptly highlighted in a recent market analysis:

Valuations based upon earnings seem to be one of the biggest factors making people disbelieve the recent rally and view that the market is getting this wrong. It’s not the market that is getting it wrong… it is you. I propose that anyone that is basing their investment thesis on valuations is looking in the wrong place. – Sentiment Speaks: A New Bull Market Has Begun.

Tesla Bears are right to question why TSLA continued to surge higher, even though it traded at more than 40x forward earnings at its April lows. As of yesterday (June 13), TSLA’s forward adjusted P/E multiple has surged to nearly 70x. Expensive? It’s getting increasingly hard to say it’s cheap. If I predicate my TSLA thesis solely based on valuation, TSLA is very expensive, not merely expensive.

But where are the TSLA bears? Have they gone into hiding as TSLA surged? Probably. The most recent data shows that TSLA’s short interest as a percentage of its float fell further at the end of May. Moreover, with a metric of just 3.4%, TSLA bears likely don’t have sufficient conviction to stick around for long these days in fear of getting overwhelmed by ardent TSLA investors.

Tesla’s aggressive pricing strategy has likely worked. Analysts’ estimates for Tesla’s upcoming Q2 delivery update have remained relatively robust since early April. The latest update shows a projection of 447K, up from Q1’s 423K. It’s also way above the 405K in deliveries that Tesla mustered in Q4’22. As such, I think TSLA dip buyers have proven their point, as TSLA bottomed out in early January. Dip buyers will likely point to the company’s improving operating performance as a sign of strength, not weakness, even as the EV market competition intensifies.

Furthermore, investors are likely buoyed by the recent pivotal development in the EV charging infrastructure space. Tesla announced partnerships with Ford Motor Company (F) and General Motors (GM), corroborating the immense market leadership of Tesla’s well-defined ecosystem.

Ford CEO Jim Farley’s initial salvo against his crosstown rival could have compelled GM CEO Marry Barra to follow suit. And for Barra to announce the partnership on Twitter Spaces as the host, joined by Tesla CEO Elon Musk as her guest while praising Musk and his team as “fantastic,” would have been “unthinkable” in late 2022, when she indicated that GM had paused advertising on Twitter.

Tesla has demonstrated the significant competitive moat of its ecosystem that even America’s leading auto OEMs must also acknowledge is very significant. Tesla’s North American Charging Standard, or NACS, is well-primed to assume leadership as the national charging standard in the future. With nascent pure-play charging players also adopting the NACS plugs in their bid to compete for market share, Tesla’s lead will widen further.

However, I think it’s essential for Tesla investors to question critically who are the biggest beneficiaries of this partnership. Analysts have rave reviews on how it could benefit Tesla. Piper Sandler suggested it could help Tesla generate $3B in revenue in 2030 before increasing to $5.4B in 2032. In other words, the near- to medium-term impact is likely insignificant. Moreover, Tesla is expected to generate nearly $160B in revenue by FY25. Hence, Tesla likely doesn’t depend on revenue from charging to drive top line growth significantly. Morningstar also cautioned Tesla investors from going FOMO on the partnerships, as it opined:

While this is positive for the industry, we see less of a positive impact to Tesla. Arguably, access to Tesla’s fast charging network could be considered an advantage that would cause a consumer to choose a Tesla over other EVs. – Morningstar.

Fellow contributor Anton Wahlman argued in his case that Tesla “surrendered its key competitive advantage” to its rivals by opening up its dominant fast-charging network.

I concur that Tesla has made it easier for EV customers who previously had range anxiety in deciding not to buy a Tesla. With the company now supporting GM and F in their pursuit of transforming their business models, what was Elon Musk thinking?

However, Wedbush’s Dan Ives also reminded everyone that several key factors undergird Tesla’s significant moat. He stressed the value of Tesla’s ecosystem, “including car sales, solar roofs, battery storage products, autonomous driving software, insurance, and EV-charging stations.”

Ives also correctly pointed out that Tesla “is playing chess while others play checkers.” While there’s likely insignificant near- and medium-term impact on Tesla’s revenue, Tesla’s ecosystem demonstrated that its EV peers are still far behind.

That perception of ecosystem leadership is important and could also work to strengthen what customers think of America’s EV leader. While it seems like Tesla is lowering “switching” costs for its customers, I believe it could also be argued that Tesla is so confident of its superior product ecosystem that customers will likely remain loyal.

And what does the market think? I believe TSLA is now at a critical point. Let me explain TSLA’s price action.

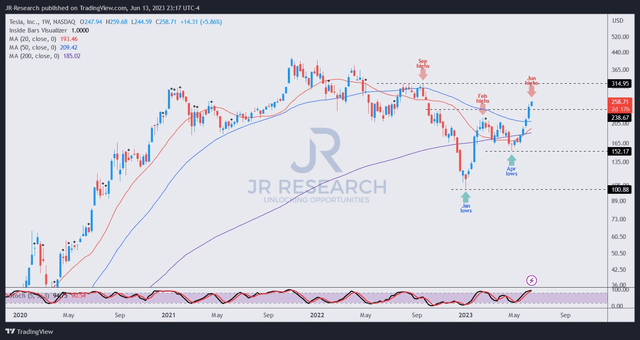

TSLA price chart (weekly) (TradingView)

TSLA broke through its February highs, although the momentum could also reverse, given the surge. However, the momentum spike from its late April lows is significant for buyers/sellers.

Momentum buyers have likely returned in force, following through the stout defense executed by dip buyers at TSLA’s April lows. Moreover, you could also notice that TSLA’s medium-term downtrend could stage a reversal moving forward.

Yes, TSLA has been on a downtrend since topping out in September 2022, before the massive collapse leading to its peak pessimism in January 2023. However, that could reverse if more dip buyers could return to bolster TSLA holding above the 50-week moving average or MA (blue line).

With TSLA still trading (40.5x) below its 10Y EBITDA multiple average of 47x, I assessed that there’s still potential for more buyers to return, as TSLA’s valuation seems far below the FOMO levels we saw in late 2021.

Hence, the subsequent Tesla pullback is pivotal and could ascertain whether dip buyers are confident enough to help TSLA reverse decisively from its downtrend bias.

My view is it looks increasingly likely. But, as I don’t buy on momentum spikes, I would likely join the dip buyers at the next steep Tesla pullback. However, you probably don’t want to sell TSLA yet, as TSLA is primed to potentially stage a reversal from a downtrend to an uptrend bias.

Rating: Hold (On watch for a change)

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, F either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!