Summary:

- Tesla, Inc. shares lost momentum after the company delivered a relatively weak earnings report a couple of weeks ago.

- The declining margins and the rising geopolitical risks make it harder for Tesla to turn things around at this stage.

- Considering that Tesla trades at over 85 times its forward earnings and over 6 times its forward sales, it makes sense to assume that its shares are extremely overvalued.

AdrianHancu

After releasing a relatively poor earnings report two weeks ago, Tesla, Inc. (NASDAQ:TSLA) shares lost most of the momentum that was gained at the start of July when the electric vehicle (“EV”) deliveries data came out. While the company certainly has several growth catalysts going for it, which could prevent a further depreciation of its shares, the increased competition within the EV industry along with the rising geopolitical challenges could disrupt Tesla’s business model. This would make its stock a less attractive investment.

Tesla’s Challenges Continue To Mount

Back in May, I noted that the ongoing price war within the EV industry and the Sino-American trade war could disrupt Tesla’s business model and result in the contraction of the company’s margins. Despite this, I did not give the company’s stock a rating of SELL, since there was always the possibility that its shares could rally in the short term on any positive data.

That’s precisely what has happened. Since the publication of my latest article on Tesla in May, its shares have appreciated by ~20%. However, after the latest rally, the shares are once again starting to lose their momentum, primarily due to the release of the relatively weak earnings report for Q2 a couple of weeks ago. It indicated that the macro challenges are making it harder for the business to deliver a solid bottom-line performance.

While Tesla reported that its revenues during the recent quarter increased by 2.3% Y/Y to $25.5 billion and were above expectations by $760 million, its non-GAAP EPS of $0.52 was below the consensus by $0.10. At the same time, the company’s quarterly deliveries fell for the second quarter in a row as it delivered 443,956 vehicles in Q2, down 4.8% Y/Y. What’s more, is that Tesla has once again delayed its robotaxi event and at this point, it could take years before we see an actual robotaxi fleet on the streets. Moreover, there’s a possibility that Tesla will invest in AI startup xAI, which has already been receiving Nvidia (NVDA) chips that were meant for Tesla on Elon Musk’s orders.

However, what matters the most at this point is that the challenges that Tesla faces continue to mount, and no events or investments in other businesses are likely to help the company quickly improve its state of affairs. The biggest issue that Tesla currently faces is the compression of margins. If we look closely at the latest numbers, we’ll see that gross margins, operating margins, and EBITDA margins, all were down Y/Y in Q2. At the same time, Tesla has experienced a second straight quarterly net income decline and what’s worse is that out of $1.48 billion in net income, $890 million came as regulatory credits. This indicates that even the organic growth is relatively weak at this stage.

All of this is due to the rising competition within the EV industry and the ongoing price war between EV manufacturers, that has already diminished Tesla’s ability to expand its margins and deliver a solid bottom-line performance. The major problem here is that it’s unlikely that things are about to change for the better anytime soon.

In a recent conference call, CEO Elon Musk admitted that the discounting in the EV sector has made it difficult for Tesla to thrive. At the same time, the rise of affordable Chinese cars is likely partially responsible for the weaker guidance for the rest of the year. Recently, Tesla’s management noted that the company’s vehicle volume growth rate this year may be notably lower in comparison to the previous fiscal year.

On top of all of that, the rising geopolitical risks threaten to significantly disrupt Tesla’s business model, which is exposed to the globalized supply chain. The IMF warns that further trade restrictions could wipe out 7% of the global GDP and would likely prevent the recovery of the global economy. Tesla has already put on hold its plan to build a factory in Mexico, due to tariff concerns. Chinese policy analysts don’t believe that Sino-American relations will improve and lead to the end of the ongoing trade war after the Presidential elections in November.

At the same time, the European Union last month increased tariffs on most Chinese-made electric vehicles. Considering that Tesla produces only Model Y in Europe and imports Model 3 there from China, there’s a risk that its performance in Europe will be negatively affected in the future, as it already raised prices on the old continent. Given that the company is already experiencing a deterioration of margins, the worsening macro environment makes it even harder for Tesla to improve the situation to its favor.

What’s Next For Tesla’s Shares?

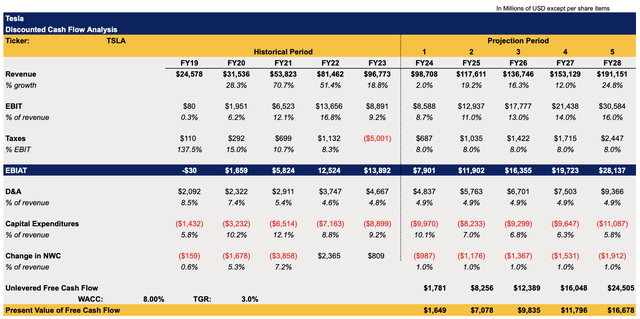

With all of that in mind, it makes sense to assume that Tesla, at the very least, would be an extremely volatile investment in the foreseeable future. To figure out whether its shares offer any margin of safety, I’ve updated my DCF model, which can be seen below.

The model from the previous article from May showed Tesla’s fair value to be $128.49 per share. The major thing that was changed in the updated model below is the revenue growth rate for FY24 and beyond, which was decreased and currently closely correlates with the street expectations. Recently, Tesla has received dozens of revenue downward revisions, which indicates that the street also expects weaker growth in part due to the rise of several challenges described earlier in this article. All the other assumptions in the model remained the same as before, as they’re unlikely to significantly change at this stage.

Tesla’s DCF Model ( Historical Data: Seeking Alpha, Assumptions: Author)

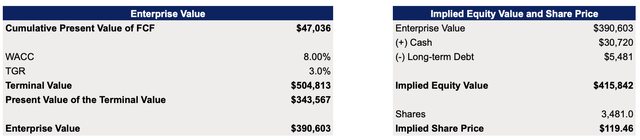

The updated model shows that Tesla’s fair value is $119.46 per share, which represents a downside of ~42% from the current market price.

Tesla’s DCF Model ( Historical Data: Seeking Alpha, Assumptions: Author)

Considering that Tesla currently trades at over 85 times its forward earnings and over 6 times its forward sales, while Seeking Alpha’s Quant system gives it a rating of F for valuation, it makes sense to assume that the company is extremely overvalued at the current price.

The Growth Opportunities Are Still Out There

While Tesla faces major challenges right now, there are nevertheless several positive developments going on that can help the company find a way to improve its performance in the future.

Considering that the American GDP is growing at a better-than-expected rate while interest rate cuts appear to be around the corner, there’s a possibility that the U.S. economy will accelerate even more in the second half of the year. This would help Tesla and all the other carmakers boost their sales. Even if we see an improvement in deliveries in Q3, then the shares could once again rally, as it could be interpreted as a sign that things are changing for the better.

At the same time, the potential release of a more affordable vehicle in 2025 could also help Tesla diminish the Chinese threat, outlive its weaker competitors due to its sizable war chest, and gain additional market share in the end. All of this could make investors once again excited about Tesla’s future and propel its shares to higher levels.

The Bottom Line

Despite facing a significant number of challenges, it would be ignorant not to pay attention to several growth catalysts that could revive the investors’ confidence and once again boost Tesla’s shares in the future.

However, it also makes no sense to believe that any momentum could be long-lived, given the recent weaker bottom-line performance and the deterioration of margins. That’s why it’s difficult to justify a long position in Tesla right now. This is especially true, since it’s not the same solid investment as it was during the pre-covid and early COVID-19 days. That was when the aggressive increase in sales in a much better environment propelled the shares to exuberant multiples at which they traded for a significant amount of time.

The environment is much different right now and the rising geopolitical challenges could negatively affect Tesla’s business model, which significantly relies on the undisrupted globalization, which appears to be fading away. The constant delay of its other products along with Elon Musk’s involvement in politics and his other business endeavors also make Tesla a less attractive investment.

The only reason why I’m not giving Tesla, Inc. a rating of Sell and stick with Hold is because it’s a battleground stock with a major cult following. Such stocks typically trade at an exuberant valuation for a long time and experience a major depreciation, mostly when there’s an overall market selloff or the underlying company reports weak earnings.

Recently, Tesla’s shares have already depreciated due to the overall selloff and a weak earnings report. However, they nevertheless could find a technical support level around the current market price and trade there until the next earnings report is released a few months from now. That’s why, even though Tesla’s fundamentals are relatively weak, its stock could continue to trade at exuberant multiples for a while.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.