Summary:

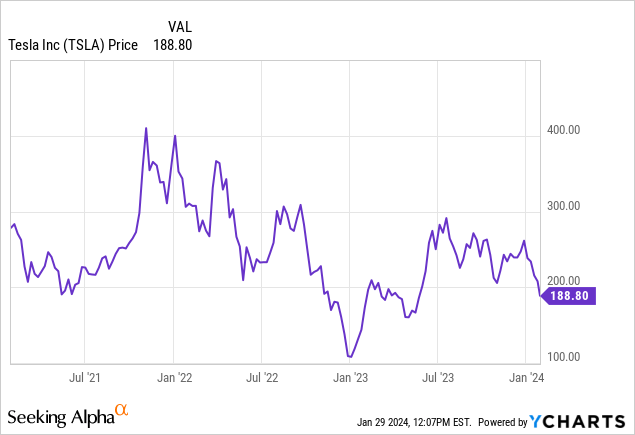

- Tesla, Inc. stock has dropped over 20% this year and more than 50% from its mid-2021 highs.

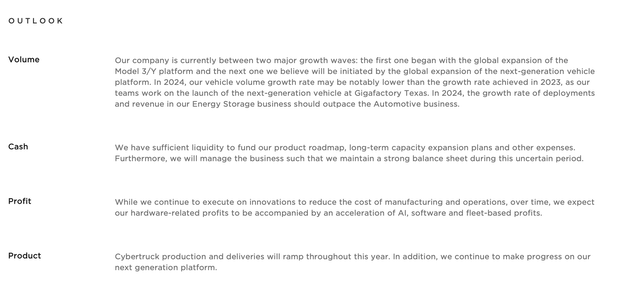

- The company has described itself as being “between growth cycles” as it prepares for the launch of its next-gen consumer vehicle.

- In the meantime, Tesla is favorably set up to beat expectations in 2024, as the price gap against traditional non-EV competitors has slimmed and federal incentives sweeten.

Justin Sullivan

The stock market has continued to rally this year, but electric vehicle (“EV”) stocks are in the dump – including and especially Tesla, Inc. (NASDAQ:TSLA). The category leader is down more than 20% year to date, driven by fears of softening demand and weak responses to the company’s latest price drops. And relative to mid-2021 highs above $400, shares of Tesla have dropped more than 50%.

I last wrote a bullish note on Tesla in November, when the stock was trading closer to $220 per share. Is the growth story broken? In my view, certainly not. It’s just that the stock market, especially in today’s more jittery age, has reverted almost entirely to short-term thinking: and Tesla has acknowledged it is “between growth cycles.” In the short term, weaker consumer incomes (driven by heavy layoffs especially in white-collar jobs in 2023) and higher interest rates have dented car sales; but long term, more government encouragement of EV adoption and a massive greenfield global opportunity still fosters the long-term growth story. As such, I still remain quite bullish on this name.

Tesla outlook (Tesla Q4 shareholder deck)

It’s important to note that Tesla has hinted at a “next generation vehicle” that may undercut even the Model 3 on price. Though it’s still uncertain when this new vehicle will launch, it’s not unreasonable to believe that a large swath of consumers have delayed their purchases in anticipation of the newest model.

So, amid incredible pessimism for Tesla and other EV counterparts, it’s important to note that EVs are still only a mid-teens percentage of all cars sold (and, it follows, an even lower percentage of all cars on the road). In this article, I’ll focus on two bull case drivers for Tesla in 2024:

- Prices between Tesla models and competing vehicles have compressed, which should help to sustain demand between vehicle launch cycles (especially 2024).

- Tesla has managed to maintain incredible profitability even with price drops, and profitability stands to benefit from A) greater scale from higher production volumes and B) greater attach rate of software and services sales.

Stay long here and take advantage of the dip as a buying opportunity.

Price compression should support baseline demand in 2024; as well as instant rebates on federal tax credits

Low inventory and pandemic-era inflation in supply chain parts have all worked in tandem to drive nosebleed price inflation for new cars. At the same time, Tesla has gone the other way: slicing prices especially in demand-stricken regions like China, and in other regions like the U.S. rolling back some of the prior years’ price increases / allowing customers to benefit from economies of scale gained in production.

Let’s compare the pricing of Tesla’s Model 3 first against similar gas-powered competitors. As a reminder, Model 3’s base price now starts at $38,990 for a rear-wheel drive model. But note as well that Model 3 qualifies under the Biden administration’s $7,500 EV credit as long as the buyer falls within the income limitations ($150,000 in annual income for a single filer, or $300,000 for a couple filing jointly), and the car’s sticker price is under $55,000 AND is manufactured in the U.S. (all but the most souped-up Model 3s and Model Ys will qualify under these restrictions).

It’s worth noting as well that the federal credit is now eligible for “instant rebates” starting in 2024: which means buyers can take advantage of the savings immediately at the dealership, instead of waiting until next year’s tax season to realize the savings. In a high interest-rate environment, that timing shift matters a lot to price-conscious customers.

So all in all, a Model 3 costs roughly ~$31k not including any state-level incentives (not to mention savings from converting from gas to electric).

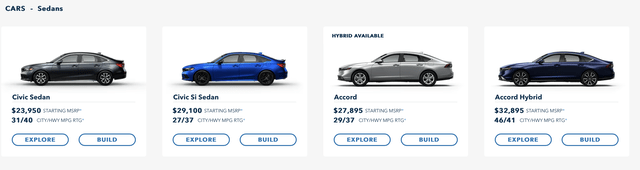

Let’s see how that compares against many popular sedan brands. Honda’s (HMC) lineup is shown up below: traditionally considered a more budget-friendly brand, the starting price of a 2024 model Honda Accord at $28k is within striking distance of a Model 3 after rebates:

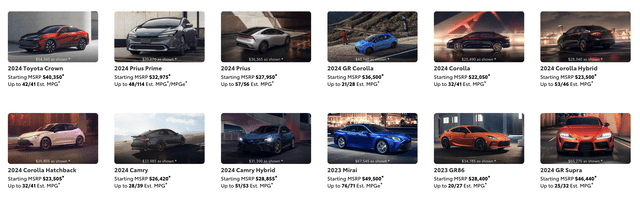

Ditto for Toyota (TM): a Model 3 isn’t materially more expensive than a Camry ($26k).

And against more luxurious compares (arguably a better compare for a brand like Tesla), Model 3 prices are well beneath the entry-level BMW 2 Series ($38k) or Audi A3 ($35k).

Model Y, meanwhile, makes for an even better compare. With starting prices now at $44k ($37k after rebates), Model Y stacks up quite nicely versus competitors.

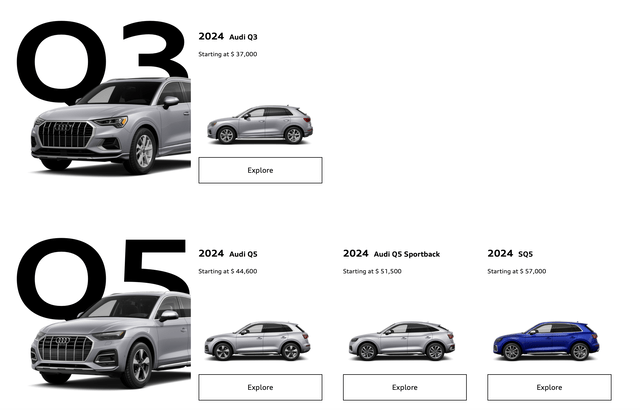

It’s on par with Audi’s cheapest SUV, the Q3 ($37k) and cheaper than the larger Q5 models.

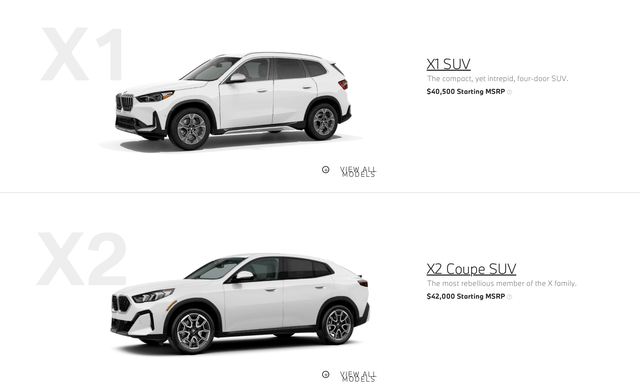

Ditto against the BMW (OTCPK:BMWYY) SUVs, which start above $40k:

The bottom line here: with prices inflating on competing brands while Tesla prices have moderated, there will be a population of buyers who will be enticed to buy Teslas even between launch cycles, especially as we head into an election year and the EV rebate rules may be set to change.

Tesla is still generating meaningful profitability, with several levers for further margin accretion

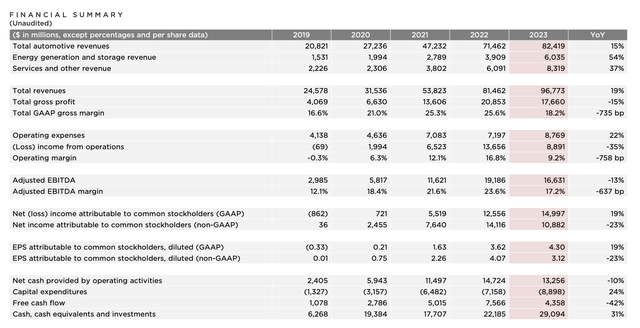

When we zoom out at FY23 as a whole, we find that Tesla still generated its highest-ever nominal GAAP income of $15.0 billion.

Tesla FY23 results (Tesla Q4 shareholder deck)

Despite the fact that gross margins fell more than 7 points y/y driven by price reductions, which flowed directly into an 8 point reduction in operating margins and 6 point reduction in adjusted EBITDA margins, Tesla’s overall adjusted EBITDA still fell “only” -13% y/y to $16.6 billion, its second-highest year on record.

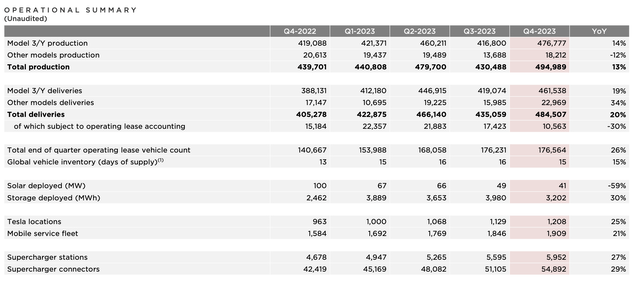

Increased production volumes and greater efficiency continue to be the greatest catalyst for further margin accretion. Tesla’s Model 3/Y production increased 14% y/y in its most recent quarter:

Tesla production trends (Tesla Q4 shareholder deck)

This is a great indicator ahead of the company’s next-gen vehicle. Here’s what CEO Elon Musk said on the Q4 earnings call in regards to this new car:

And we’re very far along on our next-generation low-cost vehicle. This is an earnings call, not a product announcement. So there’ll no doubt be many questions that try to ask us about new product, new products coming. But we reserve product announcements for product announcements not earning calls. So — but we’re very excited about this, and this is really going to be profound, not just in its design of the vehicle itself, but in the design of the manufacturing system. This is a revolutionary manufacturing system significantly, far more advanced than any other automotive manufacturing system in the world, by a significant margin.

Several years ago, I said, perhaps the most important competitive characteristic of Tesla in the future will be manufacturing technology and you will really see that come to bear with our next-gen vehicle. The first manufacturing location for this will be at our Gigafactory and headquarters in Austin, Texas, and then we’ll follow that up with other locations around the world. Probably the factory we’ll build in Mexico will be second, and then we’ll be looking to identify a third location, perhaps by the end of this year or early next outside of North America.”

Higher software attach is the other key driver to higher margins. The company recently released a major new version of its full self-driving (“FSD”) package that incorporates AI/neural net technology to guide autonomous driving. As a reminder, the FSD package can be added at a cost of $12k, while a lower-feature Enhanced Autopilot option can be added at $6k. Both software options are available after purchase as well, so as features are added and encourage more Tesla owners off the bench, the company has access to a high-margin source of revenue growth.

Key takeaways

Though there is a “sky is falling” attitude toward Tesla in the current stock market, it’s worthwhile to call out all the opportunities that the company enjoys in 2024 (and more relevantly, beyond 2024) – including higher starting prices for competing vehicles, potential pull-forward of demand from buyers wanting to take advantage of generous federal tax rebates (which are available at point of purchase starting in 2024), and both hardware/software improvements to existing Tesla models despite no increase in price for either.

Stay long here and wait patiently for the Tesla, Inc. rebound.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.