Summary:

- Tesla, Inc.’s growth in China faces stiff competition from homegrown companies like BYD Company Limited and new entrants like Xiaomi Corporation.

- Margin compression has become a consistent issue for Tesla as the company has had to slash prices.

- Despite missing 4 of its last 5 revenue estimates, Tesla stock has rallied 90% year-to-date, but bears argue that its valuation is still immensely high.

Xiaolu Chu

Background

It doesn’t take much from Tesla, Inc. (NASDAQ:TSLA) for the company to make headline news – each day, readers are algorithmically blasted with new tidbits about the company and its mercurial CEO, Elon Musk. Check out a few headlines from the last few weeks alone:

- Tesla added in its terms and conditions that buyers of the Cybertruck could be sued if they sold the vehicle in the first year of ownership (the company later removed this from the terms and conditions).

- A side-by-side video of the Cybertruck and the Rivian (RIVN) R1T off-roading appeared to show that the Cybertruck had a… more difficult time with things.

- The company sold the limited edition “CyberBeer” in a “CyberStein” for $150. The drink does not get good reviews.

- General Motors (GM) quietly purchased the only North American gigacasting manufacturing specialist.

Whether bull or bear, there is a dizzying array of information each day pumped out on the company, and it can be difficult to distinguish noise from signal.

There have been, however, a few developments that we think should be on investor’s radar.

Let’s dive in.

The China Connection

It’s no secret that China is arguably the largest growth market in the world for Tesla. The company has invested countless time and money into making Tesla a hallmark brand within the country, and with good reason: Chinese consumers have been among the most rapid responders of EV adoption in the world (so much so that traditional ICE companies have been caught flatfooted at the pace of the transition).

China has become a material part of Tesla’s financial picture as well. In the latest quarter, sales in China for Tesla clocked in at $5.02 billion, or roughly 21% of overall sales. These figures were a disappointment – in the same quarter of the prior year, the company posted $5.13 billion in Chinese sales.

Flat-to-down sales in the country are perhaps not surprising when one considers that Tesla has encountered stiff competition in the country, none more so than homegrown BYD Company Limited (OTCPK:BYDDF). The company only just announced its Sea Lion mid-size EV SUV lineup, which is poised to take a stab at the market share for Tesla’s Model Y.

BYD and its founder have found massive support, including from the Oracle of Omaha himself, Warren Buffett (the legendary investor who has been selling shares recently but still holds a large position in the company).

Readers should also not forget the fact that there are a number of other startups, including NIO Inc. (NIO), vying for a slice of the vast market share, and Tesla’s supremacy in the country is far from assured. Factor in the ever-shifting attitudes of the Chinese government towards American business in the country, and the calculus changes yet again.

It was notable, then, that just a few days ago a new entrant into the Chinese EV market made a splash: smartphone maker Xiaomi (OTCPK:XIACF)(OTCPK:XIACY) received roadworthiness approval from the Chinese government for its SU7 EV. Deliveries are targeted for February 2024.

Readers unfamiliar with Xiaomi should know that this is no ordinary smartphone maker – it recently overtook Apple (AAPL) as the second-largest smartphone manufacturer in the world, and the robustness of its ecosystem has led some to dub the company “the Apple of China.”

Some background on those unfamiliar – Xiaomi has a history of accomplishing what it sets out to do. In 2017 the company made an enormous investment into India with the aim of gaining a strategic foothold. By 2022, the company was one of the top smartphone brands in the country, for a time holding the top spot. The company is also in the midst of making a switch from being a value-based brand to making more premium offerings, with a priority

According to Bloomberg:

The Xiaomi-branded EV is a critical link in the company’s plan to create “an all-around ecosystem” for its customers. It’s already revamped the operating system for smartphones and other home appliances to include EVs in the future so users will able to control all types of Xiaomi products on a unified platform.

The competitive threat posed to Tesla by the dual introduction of Xiaomi’s offering and the BYD Sea Lion are tough to overstate. While Tesla recently made price cuts to the Model X and Model S in China, the Model Y was, for most iterations of the vehicle, spared. The introduction of new competition is not likely to make the market any easier to navigate.

The Numbers

The story of margin compression at Tesla is not new, but it is true.

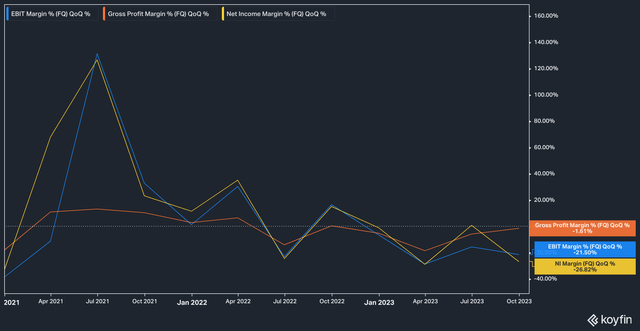

Tesla Margins, QoQ change % (Koyfin)

Instead of moving up and to the right, margins have steadily been compressed on a quarter-over-quarter basis for the last five years. Operating margin most recently fell by 21%, and net income by 26%.

Perhaps most interesting, however, is the fact that gross margin has been able to tread water. This isn’t exactly a success story, however, as Tesla bulls have long contended that the company’s innovative manufacturing techniques would allow it to ever more cheaply produce its vehicles.

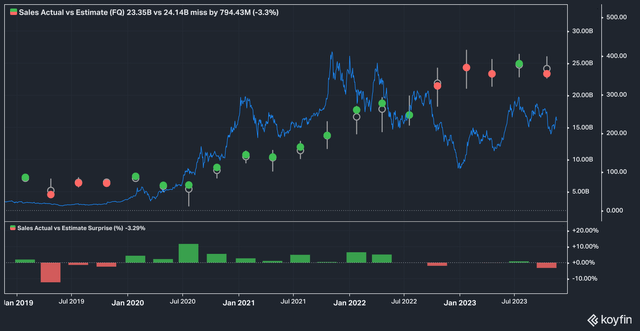

Tesla Earnings Estimates vs Actual (Koyfin)

Things have also not been very rosy on the earnings front. After 11 consecutive quarters of beating estimates, the company has stumbled of late, missing four of the last five top-line consensus estimates. The latest quarter posted Tesla’s worst miss with an almost $800 million gap between analyst expectations and quarterly results.

Despite these misses, the stock has rallied 90% year-to-date. Bulls, naturally, point to this as a victory. Bears see a stock with of lot of excess air left in it.

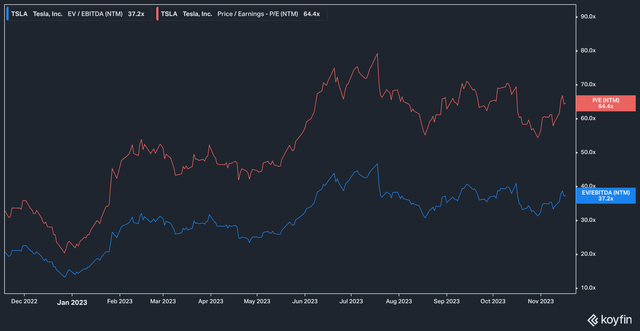

Tesla Forward PE and EV/EBITDA (Koyfin)

To evidence this, bears will point out that Tesla’s valuation on a forward basis is still immensely lofty. On a forward basis the stock trades at a whopping 64x earnings, and 27x EV/EBITDA. For context, the combined forward P/Es of Apple and Microsoft (MSFT) are 61x, and the forward EV/EBITDA of Tesla is only slightly less than those two companies’ combined figure of 43x.

The Bottom Line

Tesla has done a lot to prove its naysayers wrong in the past–when bears expected it to go bankrupt, it thrived. When investors thought it would burn cash forever, it became profitable. However, we think that it has been true for some time that the company no longer enjoys a privileged place in its most important growth market, and new entrants to the field will only make the going tougher. With a lofty valuation, we think the road ahead could be quite bumpy for Tesla, Inc. shareholders.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: The information contained herein is opinion and for informational and entertainment purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist, and while they will be corrected if identified the author is under no obligation to do so. Author Is also under to obligation to update changes of view. The opinion of the author may change at any time and the author is under no obligation to disclose said change. Nothing in this article should be construed as personalized or tailored investment advice. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal, and readers should not utilize anything in our research as a sole decision point for transacting in any security for any reason.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.