Summary:

- Tesla’s share price rally in recent months is not supported by fundamentals.

- Its operating trends have not improved much in recent months, while its recent agreements to open its Supercharger network to other carmakers don’t justify its valuation gain.

- Its shares are currently overvalued and investors should use the opportunity to take profits.

Xiaolu Chu

Tesla (NASDAQ:TSLA) stock is currently overvalued following a great share price rally in recent months. Investors should, therefore, take profits, as current valuation is not supported by its fundamentals.

As I’ve covered in previous articles, I have not been particularly bullish on Tesla’s stock due to lower margins and relatively weak demand in recent months. Despite that, Tesla’s share price has performed quite well since the beginning of the year, which was a surprise to me.

In this article, I’ll analyze the most recent developments to see if they justify Tesla’s current valuation, or if its shares are overvalued following its rally in recent months.

Recent Developments

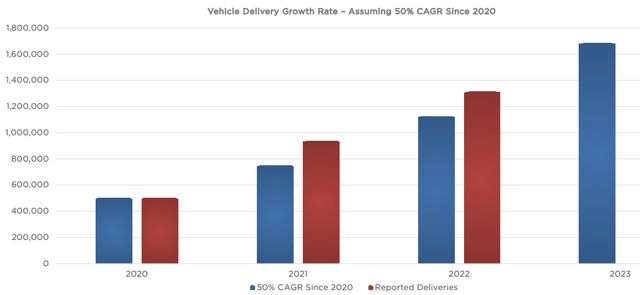

Tesla has a strong track record regarding vehicle deliveries, which have been growing at around 54% YoY over the past three years. In 2022, the company delivered more than 1.3 million units, representing annual growth of 45% YoY. This was slightly below its annual target of 50% growth, even though at the end of the year the company started a pricing war, first in China and then in other markets as well.

This was important to support demand, even though Tesla’s growth in the past two quarters has not been impressive, delivering some 422,875 vehicles in Q1 and 466,140 units in Q2. At this pace, Tesla is on track to deliver around 1.8 million units in 2023, which would represent an annual growth rate of about 40% YoY.

While this is still a strong growth rate, it represents some growth slowdown, which is justified by the company’s aging model lineup, given that the Model 3 is now six years old and the Model Y is three years old, while the Model S/X are niche models.

Therefore, for Tesla to maintain annual deliveries growth of around 50% YoY, it’s critical to launch new models and update its current ones, especially the Model 3 which is expected to be updated in the coming months. However, Tesla’s Cybertruck deliveries have been pushed back several times over the past few years, and is now only expected to start deliveries to customers during 2024.

This will be an important model to sustain growth during the next year, while following that the expected Model 2 will be critical for Tesla to significantly increase its annual deliveries. However, despite the fact there were some expectations that this model would be presented by this point in the year, so far Tesla has not presented this model like it has done for others in the past, such as the Cybertruck or the Roadster that were presented many years ago.

On the supply side, Tesla’s capabilities have been more impressive, especially at its Shanghai factory that is currently producing at a pace above 1 million cars per year, far above its initial target of 750,000 units per year. This is explained by the factory expansions during 2022, and very good levels of efficiency, which have been key for Tesla to be very competitive in the electric vehicles (“EV”) space. This has allowed it to lower prices and maintain superior levels of profitability.

Indeed, as I’ve covered recently on XPeng (XPEV) and NIO (NIO), Tesla’s gross margin was naturally impacted in recent quarters by the price war, but is still way above its closest peers. In Q1, Tesla’s gross margin was 19.3% and is expected to be 18.7%, but after that its gross margin should recover to levels between 19-21%. On the other hand, XPeng and NIO’s gross margins have collapsed in recent quarters due to the price war, with XPeng reporting negative gross margins, which aren’t clearly sustainable over the medium to long term.

Acknowledging this situation and that Tesla has a cost advantage over its Chinese peers, there were reports that the Chinese auto industry has pushed for an agreement between Chinese EV companies and Tesla to end price cuts, which should be theoretically positive for all players, as it will protect margins going forward.

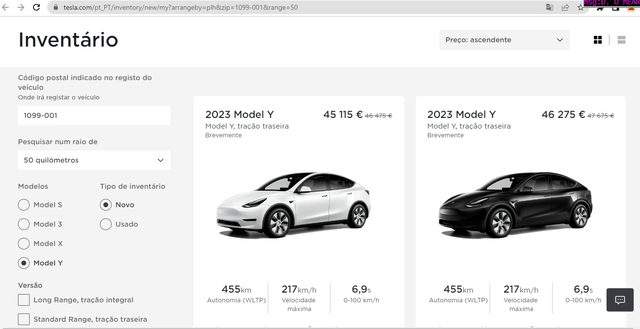

This means further price cuts aren’t likely, even though the company can use other means to lower prices. Indeed, I’ve been following Tesla’s Portuguese site over the past few months because I’m personally considering to buy a Model Y, and while its reported price has not changed since mid-April, Tesla has constantly reduced prices for cars in inventory.

It is more usual towards the end of the quarter to push for deliveries at quarter end, but surprisingly Tesla is currently doing higher discounts for inventory cars in Portugal than it was doing at the end of Q2. This may mean that demand is quite weak following the quarter end, or Tesla has more inventory than desired, both negative signs for deliveries growth in Q3.

As shown in the next graph, while a new Model Y starts at around €46,500 in Portugal, Tesla is doing a discount to inventory units starting at around €45,100 (3% discount). Usually, the discount is only about 1% at quarter-end, thus Tesla seems to be pushing harder for deliveries much sooner than usual, not a positive sign regarding demand.

Tesla Portuguese website (Tesla)

On the other hand, there were other recent developments that are positive for Tesla’s revenue growth ahead, namely its decision to open its Supercharger network in the U.S. to other automakers. This was not particularly surprising, given that I considered that possibility two years ago when the company decided to open some supercharging stations to competitors in Norway.

Tesla has recently made agreements with Ford (F), General Motors (GM), Rivian (RIVN), Polestar (PSNY), and Mercedes (OTCPK:MBGYY), for these automakers to adapt Tesla’s North American Charging Standard (NACS). This is a great milestone for Tesla in my opinion, clearly showing that it has a competitive advantage with its supercharging network, which he can now monetize even further by having higher utilization rates in the future, compared to if this network was only available for Tesla’s drivers.

Therefore, Tesla’s long-term revenue stream coming from supercharging has increased with these deals, even though it’s difficult to quantify how much revenue Tesla will add from this. Nevertheless, as additional costs from higher utilization should be minimal, higher utilization rates of its network should be an important boost for its profitability over the next few years.

Valuation

In my previous article on Tesla, my valuation was around $138 per share, which was only slightly ahead of its share price at the time. Given that Tesla is currently trading at near $280 per share, this means Tesla is currently way overvalued, or that new revenue streams and higher expectations regarding its business over the coming years may justify a higher valuation.

Considering that Tesla’s annual growth is expected to remain quite robust, in my earnings model I assume it will increase annual deliveries at about 37% per year over the next three years, supported by new models, such as the Cybertruck and the Model 2. This means that I expect annual deliveries to reach nearly 3.4 million units by 2025 (vs. 1.3 million units in 2022). Beyond that, I expect annual growth to moderately decline. As the company’s size becomes bigger, it will be much harder to maintain annual growth rates in the 30-40%.

Therefore, I assume that annual deliveries will grow at around 10-20% after 2026, to about 7.5 million units by 2031. On the other hand, average revenue per car is expected to fall, mainly because the Model 2 will be a cheaper car and should represent a good part of Tesla’s deliveries by the end of this decade.

Regarding gross margins, I’m assuming that most of Tesla’s price reductions have ended, which means its gross margin should have reached a bottom in Q2 2023. Indeed, according to analysts’ estimates, Tesla’s gross margin is expected to be about 18.7% in Q2, recovering to 19.2% in Q3 and 20.6% in Q4. Thus, I’m assuming that gross margin will recover in the coming years, being between 20-25% over the medium to long term as the company becomes more efficient due to a larger size and higher utilization rates of its factories. This will make it one of the most profitable auto companies worldwide by this measure over the coming years.

Investors should note that these estimates are much lower than in my previous analysis, when I was assuming gross margin to be around 25% in 2023 and 2024. However, Tesla’s aggressive price cuts were far beyond what I was expecting, and its decline in gross margin was much steeper than predicted a few months ago.

On the other hand, I was previously forecasting that “other revenues,” which is basically all revenue that is not generated from car sales and includes connectivity, service, self-driving, and the Supercharger network, would decrease its weight on total revenues. These other revenues accounted for 12.3% of Tesla’s revenues in 2022, amounting to $10 billion, and I was forecasting a gradual decline to less than 5% by 2029. However, due to Tesla’s recent agreement to open its Supercharger network in the U.S., and potentially in foreign markets in the future, I think it’s reasonable to assume that “other revenues” will have a higher weight on total revenue in the coming years.

Assuming that its weight gradually declines to around 10% of total revenues over the long term, these revenues can increase to more than $30 billion by 2031, or three times higher than reported in 2022. In my opinion, in these “other revenues” is where Tesla’s valuation can have a wider range of assumptions between investors and analysts, given that they are hard to quantify presently and Tesla may add new revenue streams in the future, such as robotaxis, that currently are only a wild estimate.

Taking these assumptions into consideration, my revenue estimate for 2025 is about $190 billion, while current consensus is only $155 billion, and to grow to more than $360 billion by 2031.

Regarding operating expenses, Tesla has done a very good job in recent years, as the weight of operating expenses in total revenues has consistently declined as the company’s top line has become larger and cost growth has been much lower. Indeed, in 2022, its operating expenses amounted to $7.2 billion, or 8.9% of total revenue, while in the previous year its operating expenses represented 13.2% of total revenue.

As the company continues to increase production and grows its top-line over the next few years, I expect its efficiency to improve even further, given that the auto industry is known for its economies of scale and high weight of fixed costs. Therefore, even though Tesla is expected to construct new factories and operating expenses will naturally increase, efficiency gains in its current facilities and higher production levels should lead to improved efficiency.

This means its operating profit should grow quite strong over the next few years, from $13.6 billion in 2022, to more than $28 billion by 2025 in my estimates. This is also above consensus, which is expecting operating profit of $$23.8 billion by 2025, which seems to be quite conservative. On the bottom line, I expect Tesla to report a net profit of $25 billion by 2025, leading to a net profit margin of 13% vs. 15.4% in 2022.

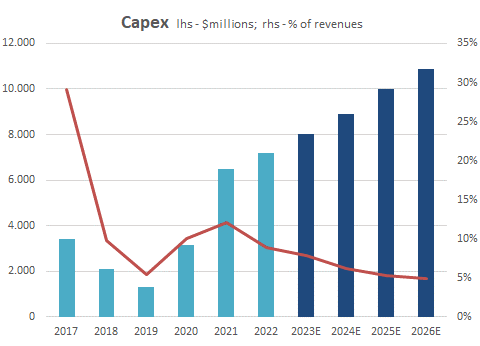

Based on my earnings model, I use the Discounted Cash Flow (DCF) valuation model to value Tesla’s company value, which requires some more assumptions regarding working capital and capital expenditures (capex).

I assume that working capital will not be much significant on an annual basis because Tesla has shown in the past that it has good logistics, as the number of units produced and delivered each year is quite similar, thus I’m not expecting inventory levels to be significant in the future.

Regarding capex, Tesla invested about $7.1 billion in 2022 and more than $2 billion in Q1 2023, thus I expect capex for 2023 to be above $8 billion. This represents less than 8% of annual revenues expected in 2023, a weight that should gradually decline over the next few years, even though Tesla is likely to increase capex in absolute terms during this period to more than $11 billion by 2026.

Capex (Tesla & author calculations)

Taking all these estimates into consideration, I expect free cash flow to be flat in 2023 compared to 2022 (about $7.5 billion), but to recover after that and reach about $23 billion by 2025. Considering these estimates, Tesla’s intrinsic value is about $150 per share, way below its current share price. Other important variables for the DCF model are the beta, which I use the historical beta for the past five years (1.50) based on Bloomberg data, an equity risk premium of 5.5%, and a risk-free rate of 5%. This leads to a cost of equity of 13.3%. For the terminal value, I assume a growth rate of 4%, which is higher than usual.

While there are some revenue streams that may be potentially important in the future that are hard to quantify right now, such as robotaxis or revenue coming from opening its supercharging network, Tesla’s current market value doesn’t seem to be supported by fundamentals.

Moreover, I’m more bullish on my medium-term estimates than the Street is. Thus, I find it quite difficult to accept Tesla’s current valuation, and, therefore, its shares seem to be overvalued. Based on its free cash flow yield, Tesla also seems to be overvalued, given that its current free cash flow yield is below 1%, based on my $7.4 billion free cash flow estimation related to 2023, which is also above current consensus (it expects free cash flow to be $6.4 billion).

Conclusion

Tesla’s share price has had a great rally this year, which doesn’t seem to be supported by fundamentals, given that its operating trends regarding deliveries and margins have been on a downtrend due to the price war in the EV space.

While its recent agreements with other carmakers to share its Supercharger network is a positive step and should add significant revenues in the coming years, this doesn’t seem enough to justify Tesla’s valuation gain over the past few months. Thus, Tesla seems to be overvalued right now. Investors should consider selling their TSLA stock and take some profits, as recent gains seem to be highly speculative and not supported by its underlying business prospects.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XPEV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you are a long-term investor and want to be exposed to several secular growth trends, check out my marketplace service focused on different secular growth themes, namely: Digital Payments / FinTech, Semiconductors, 5G / IoT / Big Data, Electric Vehicles, and the Metaverse. If this is something that you may be interested in sign up today.