Summary:

- When I last covered Tesla, Inc., I gave it slightly positive coverage, saying that shorts were taking a bigger risk than longs.

- After my article was published, Tesla ran up in price considerably, and its earnings missed estimates.

- To be worth its current valuation, Tesla needs FSD to become fully autonomous and the Robotaxi fleet to launch.

- In this article, I explain why, had I bought Tesla around the time my last article on it published, I’d be taking profits now.

- I still discourage shorting the stock because Elon Musk’s star power could keep the stock price higher than a DCF model would value it.

Electric cars sarawuth702

Tesla, Inc. (NASDAQ:TSLA) stock recently crashed 12% in a single day after the company’s second quarter earnings release missed estimates. Although the earnings figures were only off by a little, the earnings call revealed that the company’s Robotaxi project was delayed. The Robotaxi is considered a key differentiator for Tesla, as none of its competitors are attempting anything as ambitious (a few AI-powered taxi services exist, but they are local to specific cities).

If Tesla could launch a truly autonomous Robotaxi fleet with worldwide operations, it would be a differentiator, and a major revenue driver for the company. When the August rollout of the first Robotaxi was announced in the Q1 earnings call, it ignited a major rally in Tesla shares. The markets saw value in the idea, and they had good reason to: nobody else had done anything this ambitious in driverless taxis. It was therefore understandable that TSLA stock crashed after Tuesday’s earnings call: the expected catalyst got called off.

Personally, I was skeptical of the Robotaxi being able to turn Tesla’s fortunes around after the Q1 earnings release when optimism was running high. The reason I felt that way was that the concept of a Robotaxi faces more hurdles than mere technical feasibility. I have no doubt in my mind that Tesla can build full self-driving, or FSD, to the point where it can outperform the average human driver.

My skepticism mainly revolves around getting the Robotaxi approved in all the cities it will need to be approved in, to move the needle for Tesla on the revenue front. Getting all these regulatory approvals is far from a given, even if FSD can be statistically shown to be safer than a human driver. In its Robotaxi rollout, Tesla will likely face pushback from taxi drivers, safety advocates, and possibly even people who oppose Elon Musk’s politics. The process of getting the “Robotaxi Fleet” into numerous service areas could therefore take a very long time.

The fact that the Robotaxi’s big reveal was delayed to October was a bigger contributor to Tesla’s post-earnings selloff than the earnings miss itself. As mentioned previously, EPS missed by a fairly narrow margin, and revenue actually beat expectations. That argues that the Robotaxi news was the dominant factor in the Tuesday after-hours selloff. Additionally, Tesla’s first quarter earnings missed estimates, yet the stock rallied on the Robotaxi announcement, which would seem to imply that Robotaxi hype has been influencing the trading in Tesla more than fundamentals have.

When I last covered Tesla stock, I rated it a hold. This particular “hold” was not perfectly neutral, as I said the risk to shorts was greater than the risk to longs (in other words, I thought that upside was more probable than downside on balance). Since then, Tesla stock has appreciated 26% in price, vindicating what I wrote.

While I still discourage shorting Tesla stock, I now think that the risks to longs are greater than the risks to shorts. For this reason, I am downgrading my rating to a (fairly low conviction) sell. While I don’t possess proof that the Robotaxi won’t go live and make Tesla a lot of money, TSLA longs lack hard evidence that it will. I do think I can prove that, if the Robotaxi launches, scaling it will be a very long, drawn out affair marked by bureaucracy in local jurisdictions, and much legal wrangling on Tesla’s part. TSLA stock is very much trading on one idea; bad news as to that idea’s viability could easily trigger a selloff as severe as that seen on Tuesday. So people going long Tesla here are taking fairly major risks.

Why the Robotaxi is So Important

The reason Tesla’s AI-related projects like Optimus, FSD and the Robotaxi are so important, is because EV manufacturing is getting extremely competitive. Volkswagen (OTCPK:VWAGY) is a major player in Europe. BYD (OTCPK:BYDDY) is selling more electric cars than Tesla – in China and now internationally. There are also several smaller Chinese players like Li Auto (LI), NIO (NIO) and Xpeng (XPEV). The U.S.’s recent 100% tariff on Chinese EVs probably kept the Chinese manufacturers out of the U.S. market, but Volkswagen, Korean companies, and domestic companies are free to sell as much as they want in the United States.

The above makes it seem increasingly unlikely that Tesla will ever get its previous growth rates and margins back based on vehicle sales alone.

This is where FSD and the Robotaxi come into the picture. Tesla cars are not just hardware, they are linked to self-driving software. The self-driving software that Tesla is developing is uniquely ambitious in scope. Tesla is trying to make its cars autonomous anywhere, while competitors like Waymo train their AI on individual cities and launch very localized Robotaxi services. It’s much the same story with the Chinese EV companies: their AI is trained rigorously on specific cities where Robotaxis are eventually launched.

Tesla is trying to create full self-driving software that can operate basically anywhere. If the company nails this, then the financial benefits will be massive: it will be able to launch the “Robotaxi fleet” it promises, and its competitors will be nowhere near ready to scale to the same degree.

The problem is that FSD, and even more so the Robotaxi, keep getting delayed. FSD itself was in beta testing for years; the company recently dropped the word “beta” from the program name, which it now calls “FSD supervised.” “Supervised” means that you may have to take control of the steering wheel occasionally, which isn’t exactly what FSD was pitched as. For something to be “full” self-driving, it would need to complete the “full” task of driving all on its own. It therefore appears that Tesla merely renamed its FSD beta program, rather than achieving a “full” release.

This all has implications for the Robotaxi. The goal of that project is to have a fully autonomous fleet of taxis that can operate without drivers. That can’t happen as long as the software the Robotaxi runs on needs human supervision: an AI-aided taxi with a human driver (or “supervisor”) would likely cost just as much as an Uber (UBER), as there would be a human being to pay. So the Robotaxi sales pitch doesn’t really work until the “full” in “full self-driving” becomes a literal statement.

Furthermore, there will likely be regulatory hurdles in getting Tesla Robotaxis widely adopted even after FSD surpasses human driving skills. In a recent Reuters article, several car experts were quoted as saying that regulatory approvals would be a major hurdle for Tesla’s taxi project. This makes intuitive sense, as such issues have often cropped up for Uber, simply due to opposition from the taxi lobby. Tesla’s hypothetical Robotaxi fleet will face that same opposition, plus other forms of opposition from safety lobbyists and possibly Musk’s political enemies. It won’t be easy.

A Note on Valuation

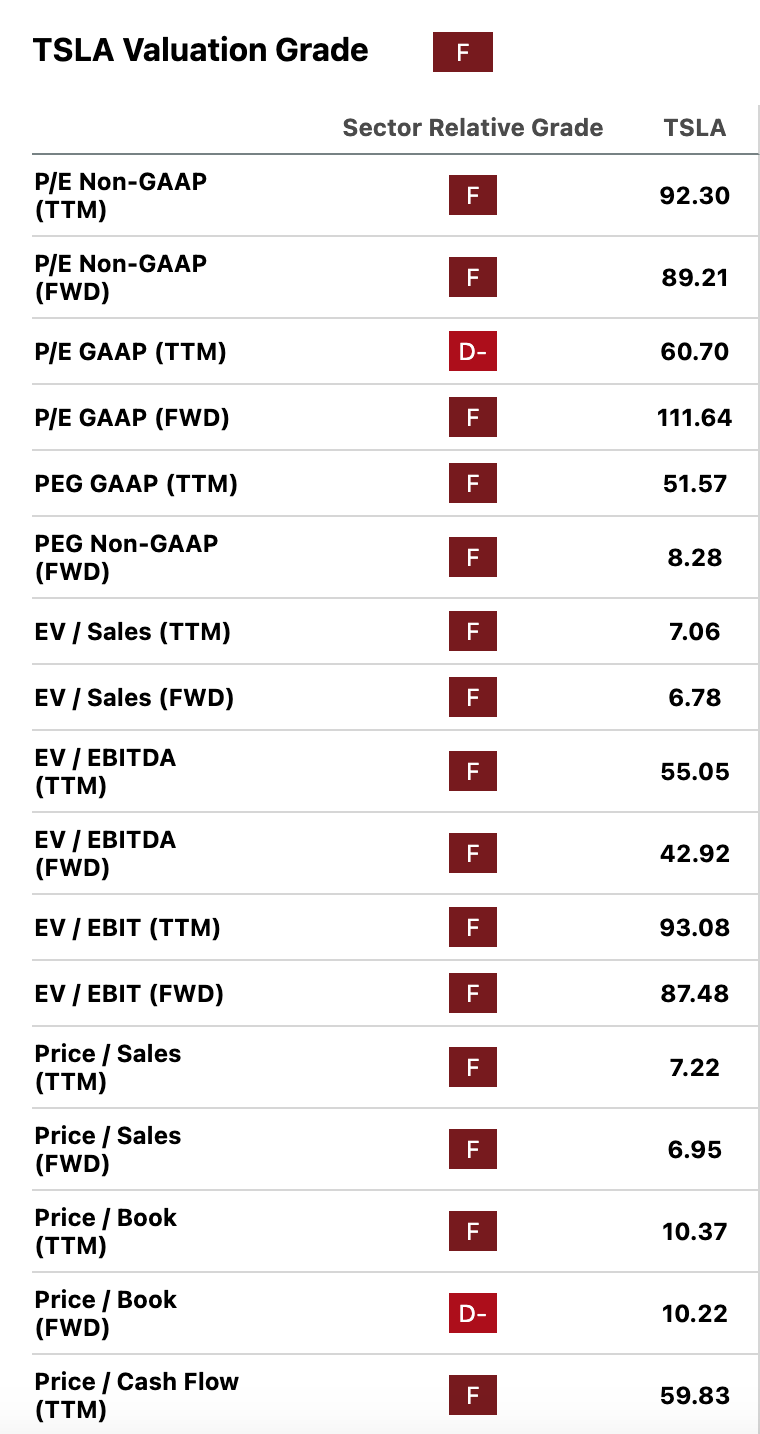

Going by multiples, Tesla is a very pricey stock. According to Seeking Alpha Quant, it trades at the multiples shown below:

Tesla multiples (Seeking Alpha Quant)

TSLA’s P/E, price/sales and price/book ratios are far above average for its sector, yet the company did hardly any earnings growth in the trailing 12-month period. Worse still, based on car sales alone, we wouldn’t expect much future growth. The EV industry has gotten extremely competitive, with dozens of competitors across the world selling very similar products. This isn’t the kind of industry that you expect to deliver high growth or high margins.

On the flip side, if Tesla does achieve a wide Robotaxi deployment, then it could easily be worth the price of admission. We all witnessed Nvidia (NVDA) rise hundreds of percentage points over a few years because it cornered the market on AI chips. If Tesla succeeds in launching a fully autonomous, global robotaxi fleet, it will be the only company on earth doing such a thing. Since it will not have taxi driver fees to worry about, it will probably be able to price out taxis and even Uber. In this scenario, Tesla gets its previous high growth rates back. However, FSD seems perpetually stuck in “beta”/“supervised” mode, and even if the software became good enough for prime-time, there would still be many years of regulatory and political wrangling before the Robotaxi service could achieve a large scale.

It’s for this reason that I consider Tesla a sell at today’s prices. Buying TSLA right now is a bet on an extremely rapid Robotaxi deployment, and there is little evidence to suggest that such a thing will materialize. The software itself still has kinks to work out, and the regulatory challenges are immense.

This doesn’t mean that you should short Tesla by any means. CEO Elon Musk’s star power can keep the stock high through surprisingly challenging times. But if you bought TSLA stock around the time I last covered it, now might be a good time to take profits. It takes a lot of “faith” to think this one is going higher.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.