Summary:

- Tesla, Inc. is facing challenges with recent financial results due to EV demand, but the company is working on new models and expanding capacity.

- The robotaxi business presents a significant potential major catalyst for Tesla, with the prospect of vastly expanding the revenues and profits from EVs manufactured.

- Analysts are overly negative on the stock, with only 17 of 48 having Buy ratings.

- Tesla stock isn’t cheap based on current financials, but a successful robotaxi business would lead to a far higher stock price.

JHVEPhoto/iStock Editorial via Getty Images

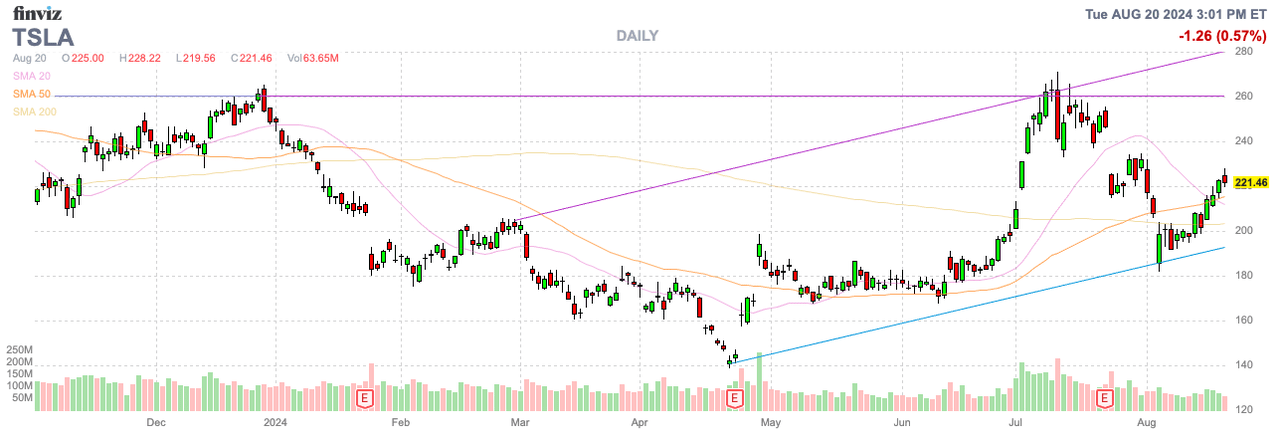

Tesla, Inc. (NASDAQ:TSLA) has hit some roadblocks lately, but the market has gotten very negative on the stock. Even with some major concerns, the robotaxi business has a huge upside potential, providing a major catalyst for Tesla. My investment thesis remains Bullish on the stock, though the EV company has already risen 25% since the last article on Musk becoming re-engaged.

Pause On The Timeline

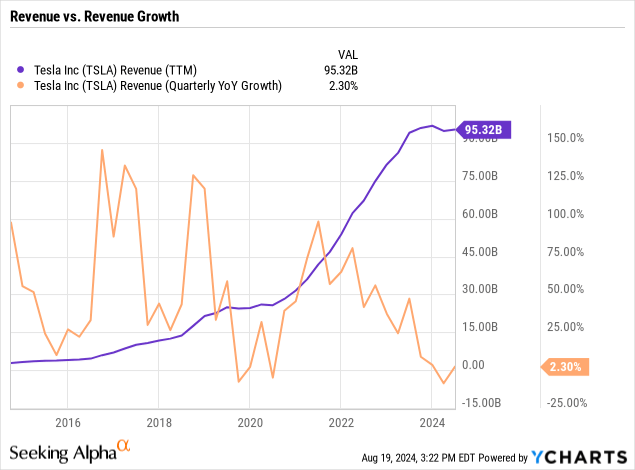

Tesla hasn’t reported impressive quarterly results for a few quarters now. For Q2 ’24, total revenues only grew 2.3% with vehicle revenues actually down 7% YoY.

The EV manufacturer went through a similar growth issue back in 2019 before more explosive growth. The issue with Tesla is that vehicle models and manufacturing capacity timing can lead to lumpy quarterly and annual results.

Tesla went from $20 billion in annual revenue heading into COVID-19 and has reached $95 billion in TTM sales now. During this period, the company has reported several quarters with declining sales from the prior year.

The company produced just over 410K units in Q2 while delivering 444K units. Tesla is building for EV capacity reaching 3 million vehicles for over 50% more production in 2025.

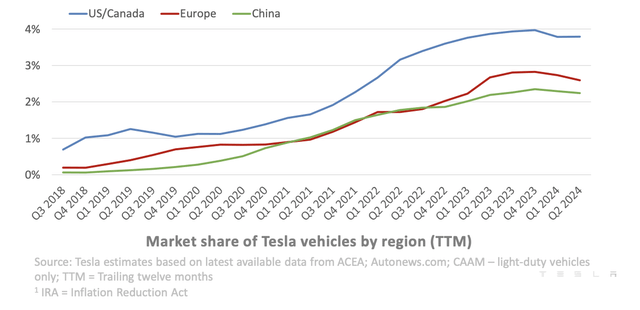

As usual, CEO Elon Musk is building for the future and not stuck on the current results. Despite the massive growth, Tesla has very limited market share in key U.S. and China auto-markets.

Source: Tesla Q2’24 shareholder letter

Ford (F) and General Motors (GM) only have roughly double the revenue totals of Tesla, but the key is that Tesla generally only sales higher end vehicles. The company plans to enter the lower end market via a new under $25K vehicle or a robotaxi model.

All of this is setting up Tesla for a bigger 2025 depending partially on the robotaxi event delayed to October. The company did make it clear the robotaxi deployment depends on both technological advancement and regulatory approval.

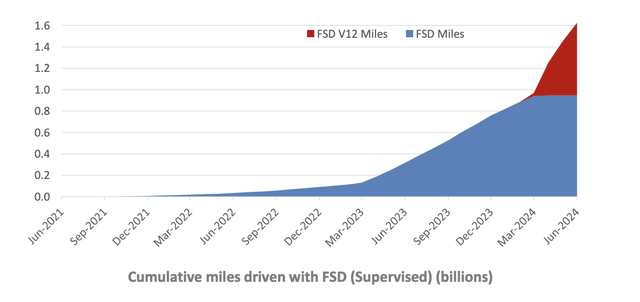

While Tesla has a seen a dramatic boost in cumulative miles driven with FSD due to software improvements and costs, the company still hasn’t done regulatory testing.

Source: Tesla Q2’24 shareholder letter

On the Q2 ’24 earnings call, CEO Elon Musk hinted at a new robotaxi vehicle for the October 10 event as follows:

We postponed the sort of Robotaxi the sort of product unveil by a couple of months where it were — it shifted to 10/10 to the 10th October -end because I wanted to make some important changes that I think would improve the vehicle — sort of Robotaxi, the thing that we are — the main thing that we are going to show and we are also going to show off a couple of other things. So moving it back a few months allowed us to improve the Robotaxi as well as add in a couple other things for the product unveil.

And I should say that the Cybertaxi or Robotaxi will be produced here at our headquarters at Giga Texas.

In essence, Tesla has a lot to work out to officially launch robotaxi services. The company needs a new, lower-cost vehicle, FSD improvements and regulatory approval with no apparent process towards approvals.

The California DMV hasn’t listed Tesla as having a permit for AV driverless testing or having logged any miles. In addition, the FSD miles are based on different vehicle models than a purpose-built robotaxi vehicle.

Uber Technologies (UBER) CEO Dara Khosrowshahi isn’t very positive on Tesla launching a robotaxi service using customer vehicles. Of course, Tesla would effectively become a competitor for Uber, so the CEO has a bias towards this path.

Dara has a point that the existing 7 million Teslas on the road might not be viable partners in the robotaxi venture. He made the following remark on a podcast:

The times you’re going to want your Tesla are probably going to be the same times that ridership is going to be at a peak.

Besides, the timing issue, a Tesla owner might prefer leaving travel items in a car, which might not be feasible with random passengers using the EV all day. The more likely solution will be either Tesla launching a service with their vehicles, or possibly forming a partnership with Uber, though has suggested Tesla AVs can only be used in the Tesla network.

On the Q2 ’24 earnings call, CEO Elon Musk discussed a plan towards millions of Tesla robotaxis on the road with a goal of up to 7 to 10 million EVs as follows:

This would just be the Tesla network. You just literally open the Tesla app and summon a car and resend a car to pick you up and take you somewhere. And you can — our — we’ll have a fleet that’s I don’t know, on order of 7 million dedicated global autonomy soon. In the years come it’ll be over 10 million, then over 20 million. This is immense scale. And the car is able to operate 24/7, unlike the human driver. So, the capability to — like, if there’s this basically instant scale with a software update.

And now this is for a customer on fleet. So you can think of that as being a bit like Airbnb, like you can choose to allow your car to be used by the fleet, or cancel that and bring it back. It can be used by the fleet all the time. It can be used by the fleet some of the time, and then Tesla would take — would share on the revenue with the customer. But you can think of the giant fleet of Tesla vehicles as like a giant sort of Airbnb equivalent fleet, Airbnb on wheels.

The — I mean, then in addition we would make some number of cars for Tesla that would just be owned by Tesla and be added to the fleet. I guess that would be a bit more like Uber. But this would all be a Tesla network. And there’s an important clause we’ve put in, in every Tesla purchase, which is that the Tesla vehicles can only be used in the Tesla fleet. They cannot be used by a third-party for autonomy.

Tesla only has spare capacity in 2025 for up to 1 million vehicles beyond current EV demand. Even if the company makes an affordable $25K robotaxi version, the company would still have to tie up $25 billion in capital to build 1 million cars and launch them on the robotaxi service.

Regardless, Tesla is working out problems on how to launch a robotaxi service into the millions of vehicles. Top competitor Waymo, owned by Alphabet (GOOG, GOOGL) only has up to 778 robotaxis under permit in California.

Waymo has made big news by announcing the milestone of reaching 100,000 paid rides per week. The company has doubled the weekly rides on Waymo One only since June.

Tesla even has issues with edge cases due to the lack of using Lidar sensors common in other AV pursuits, such as the 4 used by Waymo. Cameras and radars are fine with perfect lighting, but these sensors struggle in edge cases of limited light during storms and night driving. A Lidar sensor provides the ability for the vehicle system to see a 3D image with limited visibility, but Elon Musk has refused to use the sensors, apart from for verification, due to high costs.

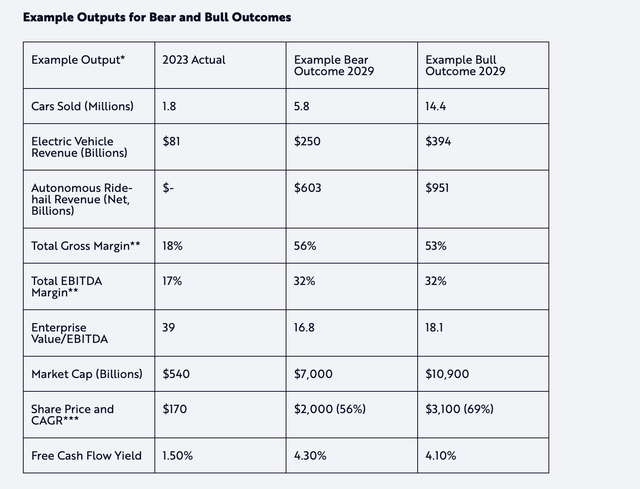

Cathie Wood assigned the $2,600 valuation to the stock on being able to hit this target in 2029. Tesla would produce nearly $1 trillion in robotaxi revenues under this scenario with 53% gross margins, up from just 18% in the last quarter.

The key to the story is turning the business to higher margin sales from autos, while also further growing production capacity by rolling out vehicles directly into the Tesla fleet. The company isn’t reliant on customers buying EVs.

Instead of Tesla selling an EV for $45K, the company would generate $0.50 per AV mile and generate 90K miles of robotaxi driving annually. In essence, the company would produce a similar amount of revenues in Year 1 of a robotaxi business as selling the vehicle and the profit margins would be far higher at over 50% of revenues. Not to mention, the AV would have an estimated useful life with proper maintenance of another 10 years.

Unusually High Negativity

While many questions exist on the timing and volumes of a Tesla robotaxi service, Elon Musk has a history of pushing for big plans and eventually succeeding. Tesla has a market cap of $700 billion for this reason.

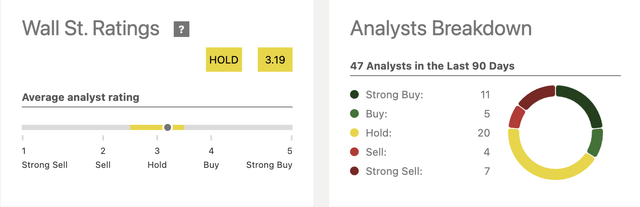

The mind-boggling part is that Tesla analysts are generally negative on the stock. The current consensus estimates are for a Hold rating, with 31 analysts either having a Hold or Sell rating.

Tesla only has 16 Buy or Strong Buy ratings, even after the stock has fallen dramatically over the last couple of years. As a comparison, Microsoft (MSFT) has 55 Buy or Strong Buy ratings, with only 2 Holds and 0 Sells.

The Wall St. community typically trends towards Buy ratings on covered stocks, yet Tesla comes with nearly equal Buy and Sell ratings. On top of this, the average analyst price target is only $204, actually $18 below the current prices, suggesting the real analyst views are bearish on the current stock price.

The odd part here is that consensus estimates have revenues rising nearly 17% each of the next 2 years. Tesla would be set up for a nice rally with stronger growth along with the ongoing opportunities in autonomous vehicles and humanoid robots.

The market appears too busy trying to solve the plethora of issues for Tesla to move forward with a large robotaxi service. With Elon Musk, the key is iterating until he gets the vision correct. Too many other companies are trying to get a robotaxi business perfect before fully launching, hence Cruise Automation, owned by GM, pausing service after a fatal accident not even caused by the service.

Takeaway

The key investor takeaway is that Tesla has hit a turbulent period in 2024, but our view is that the company is on the verge of the next level higher. The company has the capacity for higher EV production, along with new models, to boost production. Ultimately, though, the next revenue breakthrough likely comes from the eventual launch of robotaxis. Sure, Tesla and Musk still have a ton of issues to work out, but the company has a strong history of working through these issues, while competitors sputter.

Tesla isn’t cheap here based on current financials, but the company has a real plan to 5x to 10x revenues over the next 5+ years before even factoring in the Optimus robots.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start Q3, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.