Summary:

- Categorizing Tesla, Inc.’s business based on actual data has been difficult since it went public.

- For many years, Tesla was unprofitable, and when it finally become profitable a few years ago and was included in the S&P 500 index, it became more interesting.

- In this article, I explain how I define cyclical businesses, and why I think investors should treat Tesla as a deep cyclical stock.

- The categorization became easier when CEO Elon Musk explained that Tesla is subject to cyclical forces.

RomoloTavani/iStock via Getty Images

Introduction

Even though I’ve been writing about stock investing for over 7 years now, I’ve avoided writing an article on Tesla, Inc. (NASDAQ:TSLA) for Seeking Alpha until now. There are several reasons for this. The first, is that Tesla has always been a hot button topic that polarized investors (and continues to be). I’ve found that when investors get tribal or ideological about a stock or businesses, there isn’t much that I can do as a writer to change many minds. The second, is that I have a handful of strategies that I use to analyze stocks of different types, and Tesla, until recently, didn’t really fit into any of those categories. For that reason, like many stocks in the market, I declined to have a strong opinion about it. I simply didn’t see any clear data pointing in one direction or another. Tesla always looked risky as a stock investment to me, but it was possible that the reward might indeed be worth the risk, at least for a small position, so it seemed it was feasible and investor might do well with the stock if they got lucky.

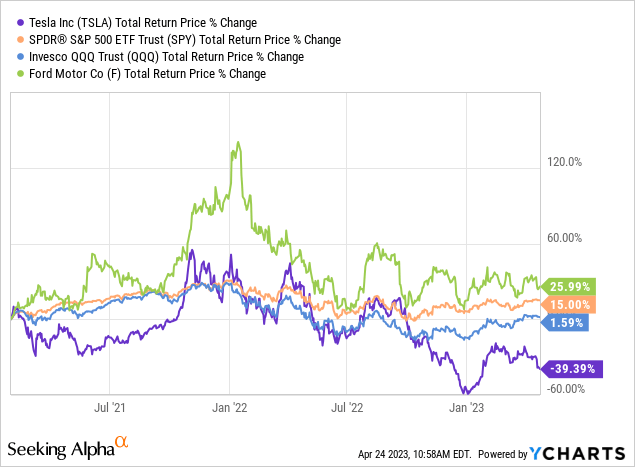

This was my position for several years until around early 2021, when it appeared to me that the stock was at such a high valuation, even the most optimistic projections probably wouldn’t produce great returns. So, on January 31st, 2021, I published a video on my YouTube channel titled “Why I’m Avoiding Tesla Stock,” where I made the case it was overvalued because to justify the price at that time it would have needed to grow earnings 50% per year for well over a decade. Below are the returns of Tesla since the video was published compared to the SPDR® S&P 500 ETF Trust (SPY), Invesco QQQ Trust ETF (QQQ), and Ford Motor Company (F).

Tesla stock is down nearly -40%, while Ford is up +26%, the SPY up +15%, and QQQ is flat. By basically any measure, avoiding or selling Tesla stock was a good call at that point. (Ironically, but not entirely unexpectedly, 70% of viewers of that video disliked it and thumbed it down.)

In that analysis, I mostly gave Tesla the benefit of the doubt when it came to assuming it was part of a straight-up, secular growth business. And even with those assumptions, it hadn’t looked attractive. Recent develops and more data have led me to believe that Tesla should be treated as a deeply cyclical business, just like most other auto companies. If this turns out to be the case, and the U.S. is indeed going into a recession, Tesla stock could have much more downside during the next few years.

Defining Cyclicality & Why It Matters

Understanding business cyclicality is important, especially if we are to distinguish between a less-cyclical secular growth business and a deeply cyclical one. Tesla’s biggest bulls have argued essentially that Tesla isn’t really a car company, and is instead a secular growth technology company, so it should not be valued as an automaker (which would imply cyclical earnings risk). I’ll start by sharing three examples of what pure secular growth earnings patterns look like.

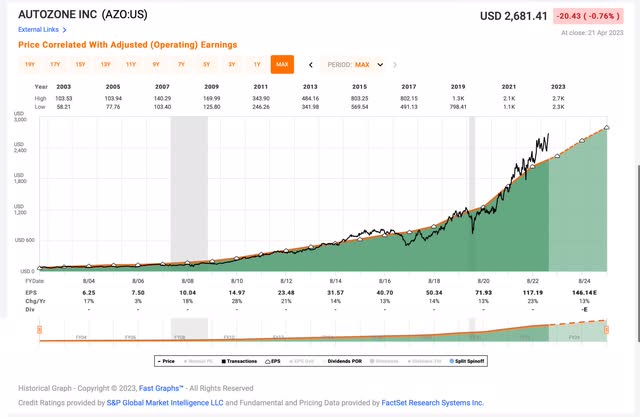

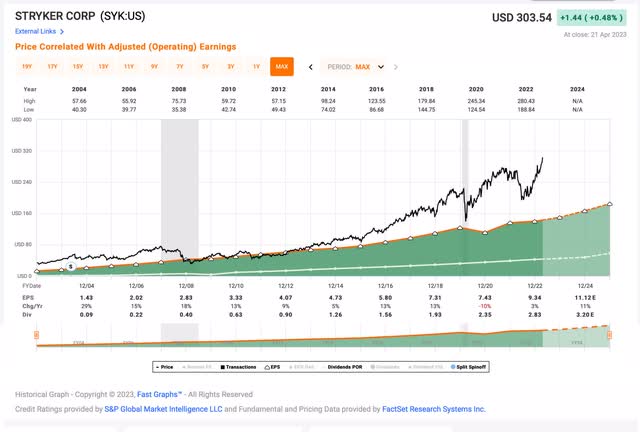

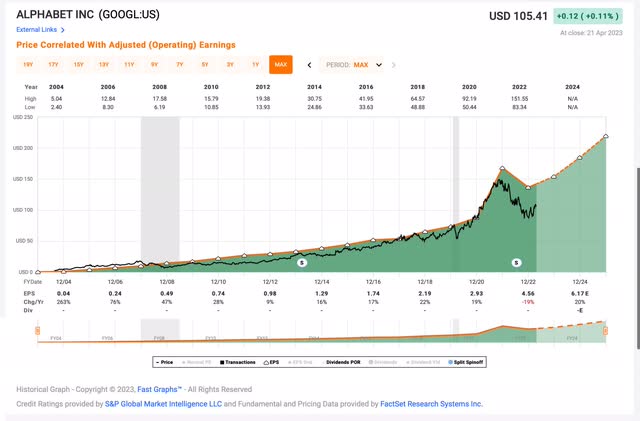

In the FAST Graphs below, I would like you to focus on the dark green shaded area and how much it falls year-over-year during the past 20 years for three stocks: AutoZone Inc. (AZO), Stryker Corporation (SYK), and Alphabet Inc. (GOOGL). These are all slight variations on what I consider less-cyclical, secular growth, earnings histories.

We can see with AutoZone, that there isn’t a single down year of EPS growth during the past 20 years. This is what a pure secular growth, less-cyclical business looks like.

With Stryker, we see a similar pattern, with the only exception being one year in 2020, when due to the pandemic, their business was interrupted, but quickly recovered. I would still consider this a secular growth business because of the unusual situation we had during the pandemic that is unlikely to repeat any time soon.

And lastly, for stocks in this category, we have Google, which had a perfect secular growth earnings pattern, even through the Great Recession, until last year when earnings declined. But, on a two-year basis, earnings still grew a lot from 2020-2022. The decline they experienced in 2022 in earnings growth had more to do with the unusually large growth year in 2021 caused by massive economic stimulus. So, I would mostly view this as a pulling forward of 2022’s and probably 2023’s earnings into 2021, and, just based on the data we have now, I would still consider this a secular growth business (although, I suspect that a recession will show that much of Google’s secular growth is probably behind it now and we should expect it to become at least moderately cyclical going forward given that advertising in general has been cyclical historically).

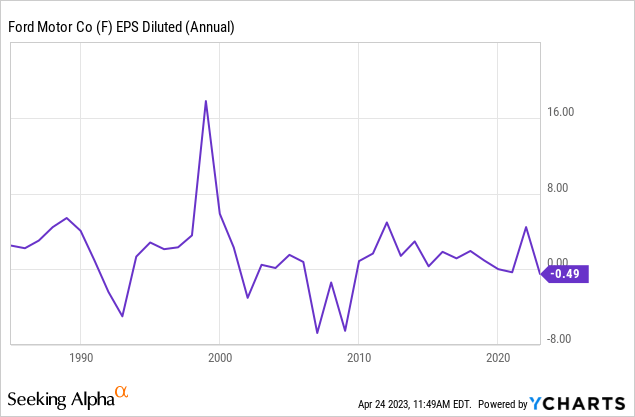

Next, I would like to share the history of a deep cyclical auto maker, Ford.

We can see from Ford’s historical earnings what a deep cyclical business can look like. During bad downturns, earnings can go completely negative and they can even fall deeply during moderate downturns like 2020, but they usually recover after the downturn is over.

Below, we can see this pattern goes back decades.

Peter Lynch used Ford as an example of a cyclical stock even back in the 1980s and 1990s.

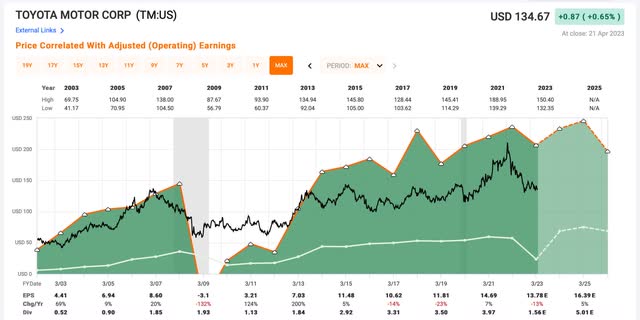

Toyota (TM) has a similar pattern you can see in the graph below:

Okay, I’ve hopefully shared enough here that readers can see the difference between a secular growth business and a deep cyclical business. My basic definition is that deep cyclical businesses have a history of earnings growth that falls -50% or more during a downturn and then eventually recovers. Pure secular growth businesses continue to grow earnings every year, no matter what.

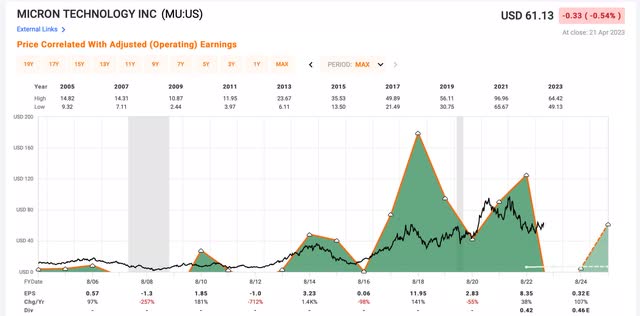

With all that said, there are sometimes business that can be both deeply cyclical and secular growth (though they are rare). One such example is Micron Technology, Inc. (MU).

Above we can see Micron’s earnings are deeply cyclical, always falling more than -50% during down cycles. However, we also see a general pattern during the past 20 years where the down cycles have tended to fall less deep, and the upcycles tend to be higher. This is an example of a deeply cyclical business that has also been in a long secular growth uptrend for about two decades. (though it appears that the current down cycle might be a deeper one).

I’ve shared these three different categories because determining what a a good price at which to buy Tesla stock will be influenced heavily by what sort of business we think Tesla will be over the next 5-10 years. When I made my warning video on Tesla, it was priced so high that even the most optimistic pure secular growth story wasn’t enough to justify the valuation the market was paying. But, now Tesla stock is about -40% cheaper, and we have 2.5 additional years worth of earnings data to examine. In the next section, I’ll share what category into which I think Tesla’s business will ultimately fall.

How Cyclical Will Tesla Be?

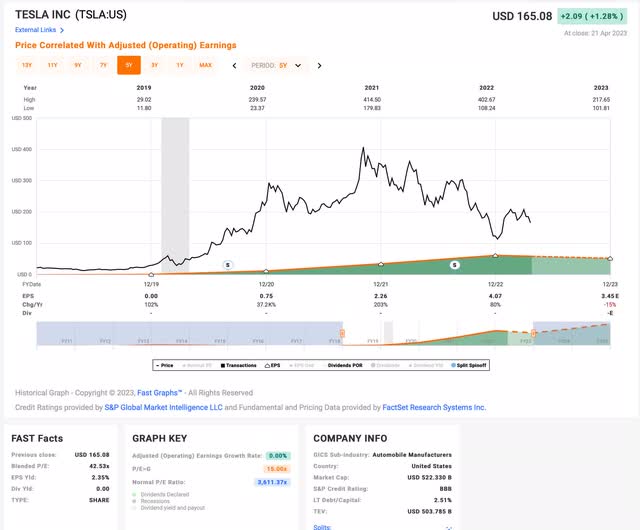

Leading up to 2020, Tesla was not a profitable business. As they became profitable, they followed a similar pattern of newly profitable businesses, where after initial really fast growth, we see some additional fast growth years in 2021, with 200% earnings growth, and 2022 with 80% earnings, but the trend is decelerating earnings growth. Back in early 2021, I calculated that in order for Tesla stock to be a “buy” at the time, starting in 2023, they would need to grow earnings at about 50% per year for 10 years for earnings to grow into the valuation. Importantly, this was assuming Tesla would be a pure secular growth business with zero earnings cyclicality.

The issue Tesla has now is that earnings growth is expected to be negative this year, falling -15%, and in my opinion this expectation is not pricing in a U.S. recession. This means it’s now time to seriously consider whether Tesla should be treated as a deep cyclical business, or not. As I showed with Micron’s 20 year history, a business can still be in a bigger secular growth trend, and also be deeply cyclical. So, it is fine if one thinks that electric vehicles (“EVs”) are a secular growth story and Tesla will continue to be one of the major players in that long-term growth story. That can be true even if Tesla experiences deep earnings down cycles within the larger secular growth trend.

But, if this is the case, investors should be prepared for extremely deep stock price volatility. This is especially true in Tesla’s case because the valuation the past two years has not reflected negative earnings growth at all.

Tesla Is Behaving As A Deep Cyclical Business

Recent developments and massive price cuts in order to move inventory show signs that Tesla is prepared to overproduce in order take and retain market share. Additionally, whereas a few years ago, commentary from Tesla and Tesla bulls was all about technology and how Tesla wasn’t really a car company, the past two months Tesla has gone out of its way to compare itself to other car companies. And CEO Elon Musk has clearly stated Tesla’s business is tricky and cyclical. Here is Musk on the Q1 conference call:

Yeah. I mean there’s really two macro factors that are tricky. The biggest being the interest rate. So if there’s a very high Fed rate or interest rates are very high, that is — every time the Fed raise the interest rates that’s equivalent to increasing the price of a car. It makes the cars less affordable because people are able to buy cars as a function of what they can afford on a monthly basis. So that’s — so it’s just almost directly equivalent to a price increase, is there any kind of interest rate increase.

Then the other factor is whenever there is uncertainty in the economy, people will generally postpone new — big, new capital purchases like a new car. This is a natural human reaction. So if people are reading about layoffs and whatnot in the press, they’re like, well, they might be worried about — they might be laid off. So then there’ll be naturally a little more hesitant than they would otherwise be to buy a new car. Now this is just the nature of the auto industry. But there is — there will be a trans amount of pent-up demand for new cars. So it goes through cycles.

I don’t follow Musk closely, but this is the first time I can recall him ever referring to cycles with Tesla. This, combined with the recent price cuts and continuous reference to other vehicle makers and how Tesla compares to them, tells me Musk views Tesla’s primary competition as other auto-makers. If your competition is other automakers, then that means you are primarily in the auto business. And autos, as I have shown, are deep cyclical businesses, which Musk states himself above. Deep cyclical businesses don’t grow earnings at 50% per year for 10 years. They simply don’t. Because earnings growth has some years where they are deeply negative.

Exacerbating the cyclicality problem, is also a pandemic and stimulus boom/bust problem for Tesla. As I explained when I warned investors about Alphabet (GOOG) and Apple’s (AAPL) boom/bust issue in February of 2022 in my article “Apple & Alphabet Will Not Side-Step A Deep Bear Market,” stimulus money created a one-time boom in these company’s businesses. We already saw negative earnings growth from Alphabet last year, as I predicted. I think we will see that same trend spread to Apple and Tesla over the next 12-18 months as stimulus money dwindles and credit tightens. This creates a double problem for Tesla because it will be affected both by the “boom/bust” of stimulus and by a normal credit down cycle in autos caused by higher interest rates and tighter credit across the board.

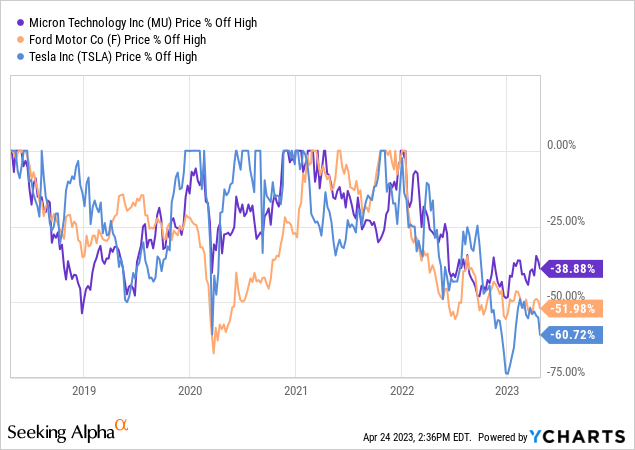

I think investors should think of Tesla stock as a combination of a stock like Ford and a stock like Micron. Both of those types of stocks are subject to very big price drawdowns.

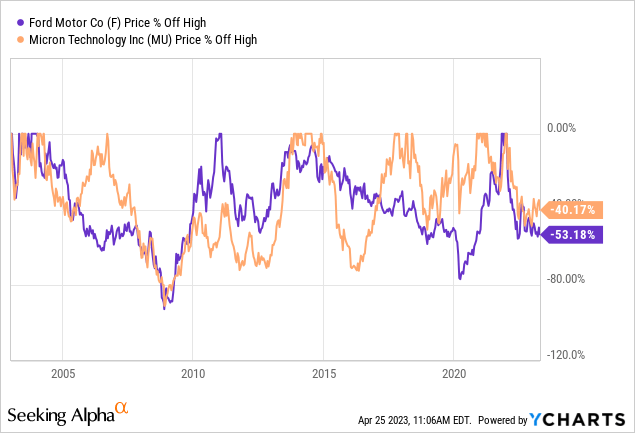

During the Great Recession, both Ford and Micron stock fell more than -90%. And both of those stocks have experienced -75% drawdowns since then as well. Now, I’m sure more than a few readers are rolling their eyes at my comparisons here, so let’s take a more recent time frame and include Tesla stock.

A 5-year drawdown chart actually shows quite a lot of correlation between these stocks and how far they’ve fallen off their highs (which is how I like to measure deep cyclicals). In fact, so far this downcycle, Tesla stock has been even more deeply cyclical than the proxies (because it was so overvalued to begin with near the peak). It’s also worth noting that Tesla stock at one point was already down more than -75% off its highs, and the U.S. hasn’t even had a recession, yet.

What Does This Mean For Tesla Stock?

It’s always hard to know with any precision how deep a cyclical stock might ultimately fall during a recessionary downcycle. But I usually aim to buy at the lowest price I think I might have a reasonable chance of seeing. Aiming to buy low not only improves the returns one can get if the stock eventually recovers but it also diminishes the pain one experiences if the stock continues to fall. Remember, if you buy a stock when it is -60% off its highs and it ultimately falls -80% off its high, you don’t experience a -20% drawdown, you experience a -50% drawdown. (Imagine buying a stock that peaked at $100 per share at $40 (-60% off its highs), if it falls to $20 (-80% off its highs) that’s -50% less than $40).

When I look at how most deep cyclical stocks like Tesla perform during recessions, a drawdown of about -85% off its peak price seems like a very reasonable expectation. That would be a price of about $62.18 per share, and that’s the price I would consider buying the stock. This might sound like a low number, but before the pandemic, the stimulus money, and the supply chain issues that affected Tesla’s competitors, Tesla peaked just over $60 per share. I don’t see any reason during a recession, the stock price couldn’t fall back to that level, particularly when earnings growth is rapidly falling.

Conclusion

Over the years I’ve been one of the few investors to remain neutral with regard to Tesla’s prospects. It wasn’t until Tesla stock got so expensive two years ago I couldn’t see any reasonable way to justify the valuation that I finally warned investors to avoid the stock. It’s down about -40% since then. Now that there is more data regarding Tesla’s cyclicality and it looks like a deep cyclical business (plainly admitted by Musk himself), I think it’s fair to warn investors about the potential downside from here.

If the price does indeed fall near my buy price, Tesla, Inc. stock will have fallen about -60% from todays price. Investors can look at this risk two ways. If they understand this is the price one pays for owning a highly volatile and cyclical stock and they still believe in the secular growth story, then they can hang on. But if they choose to do that, it will be very important they don’t panic and sell near the bottom when things look the gloomiest. The other way to look at it is to see that the medium-term risk is high enough to sell and wait for a lower entry point, even if perhaps it’s not quite as deep as the entry point I’m aiming for. Either way, the medium-term risk-reward doesn’t look good for Tesla, Inc. stock unless we avoid a recession.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AZO, MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you have found my strategies interesting, useful, or profitable, consider supporting my continued research by joining the Cyclical Investor’s Club. It’s only $30/month, and it’s where I share my latest research and exclusive small-and-midcap ideas. Two-week trials are free.