Summary:

- Gary Black and Ross Gerber, top fund managers in the Tesla, Inc. community, both cut their Tesla, Inc. fund holdings after earnings.

- Both of their ETFs previously had Tesla as their top position.

- Analyst estimates continue down after Tesla vehicle price cuts.

Justin Sullivan

Last week, shares of electric vehicle giant Tesla, Inc. (NASDAQ:TSLA) slumped after the company’s lackluster Q1 earnings report. While overall results were mostly in-line with expectations, management didn’t provide a rosy gross margin forecast and failed to hike its yearly production guidance. In the days since, a couple of very vocal Tesla bulls have significantly cut their positions in the name in their respective exchange-traded funds (“ETFs”).

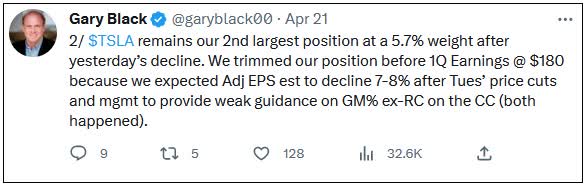

The first big Tesla position cut I saw make the rounds last week was from Gary Black, who runs The Future Fund Active ETF (FFND). This ETF, which unfortunately was launched back in August 2021 around the time many growth names were peaking, has had Tesla as its top holding for most of its history. As of Monday, The Future Fund has lost almost 35% since inception, compared to a roughly 6% loss for the SPDR® S&P 500 ETF Trust (SPY). Gary provided this update on Twitter last week.

FFND Tesla Update (Gary Black Twitter)

Gary has been one of the more notable Tesla bulls on Twitter, publishing a Tesla catalyst list every few weeks regarding upcoming important items. Interestingly here, Gary cut the position before earnings, despite being so positive on the name in the long term. The Future Fund ETF holding went from 3,880 shares last week to 2,660, which is a decline of more than 31%. The holding was also trimmed by 100 shares in early March, and this doesn’t include another small holding decline due to fund redemptions.

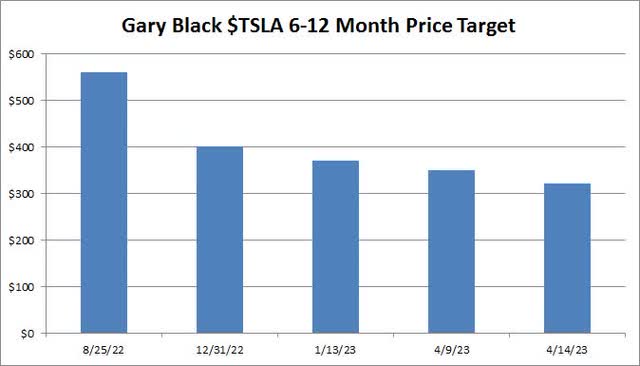

Beyond Twitter, you’ll find Gary Black making appearances on various traditional media, primarily CNBC. His overall firm is an SEC-Registered Advisor, of which Tesla has been a holding that’s a majority of the firm’s reported net assets. Gary may be known most for his Tesla price target that he updates periodically, which he recently cut to $320 as the electric vehicle (“EV”) maker has further cut prices. As the chart below shows, that’s off almost 42% from where it was just after last year’s stock split.

$TSLA Price Target History (Gary Black Twitter)

The second vocal bull I’d like to discuss today is Ross Gerber. Ross primarily runs a Wealth and Investment Management firm, but he launched the AdvisorShares Gerber Kawasaki ETF (GK) about two months before Gary Black’s ETF launched. Like FFND, the GK ETF has also been crushed since inception, losing more than a third of its value while the SPY is down less than three percent over that same time. Ross is also very vocal on Twitter but appears frequently on various TV and online media spots around the globe.

Earlier this year, Ross was interested in running for a board seat at Tesla, but he eventually decided against it. He has called for Tesla to “grow up,” primarily in regards to CEO Elon Musk’s various actions surrounding Twitter. Ross has wanted Tesla to start spending money on advertising instead of massively cutting prices and also wanted a succession plan developed for the post-Musk future. Ross was very critical of Elon Musk’s share sales, which he believes were a major reason the stock fell considerably from its all-time high.

When a Monday night holdings update came out for GK, it was revealed that Ross had decided to slash his Tesla position in the ETF during the day. The fund sold 1,900 shares of the company to under 5,000 in total, which represented a drop of more than 27.5% of Friday’s position. This was just one of a few position cuts that have happened in the ETF recently, as the above-linked tweet details a holding that topped 8,000 shares in late February. Like FFND, a very small portion of the decline in recent months was due to fund redemptions.

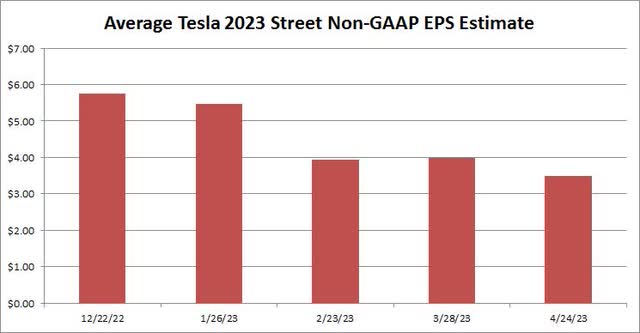

Both ETF managers have consistently worried so far this year about falling earnings per share for Tesla, as they were each hoping for $6 or more originally. Gary Black models estimate out to 2030 and then works back to the present to get his price target, but his model last week was down to $3.60 for 2023. Ross Gerber has talked about a 50X P/E for Tesla, saying that it was worth $300 if it could do $6 this year, but only $200 if it could do $4. As the chart below shows, the average Wall Street estimate for this year has come down by nearly 40% since just before Christmas 2022.

TSLA 2023 EPS Estimate Average (Seeking Alpha)

These falling Street estimates have also led to falling price targets, as you might expect. Just since last week’s report, the average street valuation has gone from over $208 to under $192. The current figure still represents about an 18% upside from Monday’s close, but don’t forget that just about a year ago, the Street thought Tesla was worth more than $335. As I mentioned in my article after earnings, Tesla stock has again fallen below its 50-day moving average. That key technical level has just rolled over again and is now below $190 and declining by the day.

In the end, Tesla’s recent price cut bonanza and less-than-impressive Q1 earnings report have dented the faith of some very vocal bulls. While Gary Black’s and Ross Gerber’s ETFs don’t have massive positions in regards to the number of shares they hold, both are very respected money managers in the Tesla community. They have each removed Tesla from the top spot in their respective funds, with Ross’ Monday cut dropping Tesla to just the 5th largest holding in GK. Tesla shares dipped below $160 for the first time since late January on Monday, with sentiment in the name not looking good right now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.