Summary:

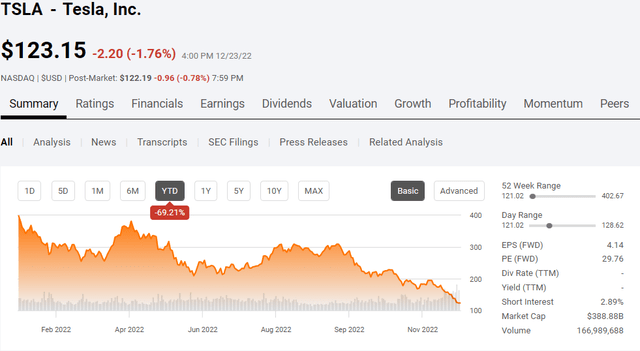

- Shares of TSLA have declined -69.21% in 2022 and -57.32% from May 6 when I wrote an article saying shares were overvalued by 85.26%.

- I looked through the expected case from ARK Invest and Ron Baron’s bull case numbers, and I don’t see a path to a multi-trillion market cap any time soon.

- I wouldn’t be surprised if the market rebounds and TSLA acts like a coiled spring in the back half of 2023.

- In the short term, I think there’s a good chance shares of TSLA continue to decline and approach the $100 level going into earnings.

Xiaolu Chu

Tesla (NASDAQ:TSLA) has been the ultimate battleground stock as the bears could never wrap their brains around the valuation while the bulls incorporated all of the future possibilities into their investment thesis. Shares of TSLA have declined -69.21% in 2022, and shares have declined -$185.92 (-60.15%) from their 9/19/22 price of $309.07. Earlier in the year, I wrote two articles that created a huge debate in the comment section. The first article was, Tesla: After Declining By -30.94% From Peak (can be read here), The Stock Could Fall By Another -30%, and the second was Tesla: Overvalued By 85.26% Not A Technology Company (can be read here). Since the first article, TSLA has declined by -59.95%, and since the second article TSLA has declined by -58.35%. I didn’t respond to a single comment in the second article; more than 3,100 comments were written. Since those articles I had written two others, I changed my stance from bearish to neutral because TSLA’s numbers were getting significantly better, and their businesses outside of automotive finally contributed to its gross profits.

It seems like you can’t turn on a financial news network or head to a financial news site without seeing something about Elon Musk, TSLA, or Twitter within five minutes. I wish I was incorrect in my predictions because a lot of investors have seen nothing but capital destruction from shares of TSLA in 2022. I tend to take a numbers-driven approach to investing and look at scenarios based on how a company is currently valued compared to its profits and growth rates, rather than what the unpredictable possibilities could be. Musk deserves the utmost respect, and one thing I don’t like to see is investors bash him because of the erosion of TSLA’s share price. Mr. Musk doesn’t control the stock market, and if TSLA reached an unrealistic share price, that also isn’t his fault. Mr. Musk has a relentless work ethic and defied all odds when he went head-to-head with the traditional automakers and changed the industry forever. Under his stewardship, TSLA’s revenue grew 18,013.48% over the past decade from $413 million to $74.45 billion while losing -$396.2 million of net income in 2012 to generating $11.22 billion of net income in the trailing twelve months. TSLA the stock, and TSLA the company, are two separate things and many investors make the critical mistake of viewing them as one and the same. TSLA is a great company, and the entire team at TSLA deserves a tremendous amount of credit as they defied all odds to get to this point. I tip my hat to Mr. Musk because his relentless work ethic should be celebrated because it truly illustrates that anything is possible if your willing to make the hard sacrifices and believe in yourself when others don’t.

My criticism of TSLA has always been the valuation, not the company. I have read through some bull cases that don’t make mathematical sense to me. I’m a shareholder of TSLA by proxy, as my wife had previously invested in TSLA and indirectly through several ETFs and mutual funds. I have never shorted TSLA, and when TSLA declines in value, it directly impacts me. TSLA’s declining value has been immense, as roughly $800 billion of its market cap has been erased from its peak. As my first scenario about shares declining by at least another -30% from its 2/15/22 level occurred, and my second scenario about shares being overvalued by 85.26% on 5/6/22 is 26.91% away from coming true, I wanted to revisit the numbers and see if a numbers-driven approach indicates more downside in TSLA’s future. I’m also going to look at two specific bull cases, one from ARK Invest (can be found here) and another from Ron Baron (can be found here), and see if I can get anywhere near these valuations.

Seeking Alpha

Looking at ARK Invest and Ron Baron’s base and bull cases for Tesla

ARK Invest focuses on disruptive innovation and takes a long-term approach toward investing so a full investment cycle can be reached which could be seven-plus years. ARKK owns 4,101,387 shares of TSLA, which is a current value of $505.09 million across the ARK Innovation ETF (ARKK), ARK Autonomous Tech & Robotics ETF (ARKQ), and ARK Next Generation Internet ETF (ARKW). Ron Baron is the Chairman, CEO, and Portfolio Manager at Baron Funds. On 11/4/22, Mr. Baron had roughly $4 billion worth of TSLA shares across his funds which would correlate to roughly 19,279,896 shares at an 11/4/22 price of $207.47 per share. ARK Invests expected case for TSLA is that it’s market cap reaches $5.3 trillion in 2026, and Mr. Barons bull case is that shares of TSLA reach between $500 – $600 in 2025 and TSLA has a $4.5 trillion market cap in 8-10 years.

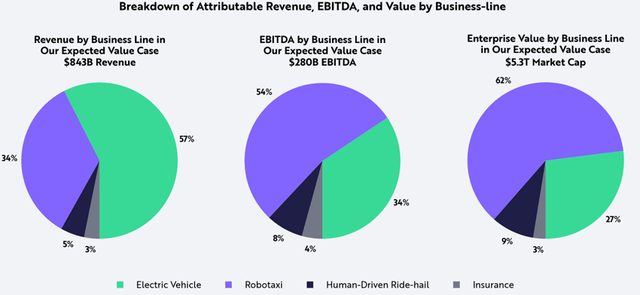

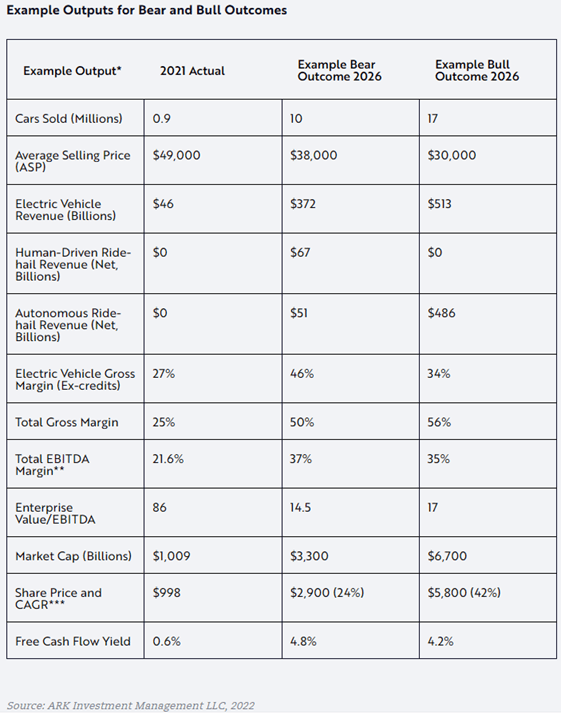

Within ARK’s research, they published a breakdown of revenue, EBITDA, and Enterprise Value by business line. These figures are based on their expected case of a $5.3 trillion market cap. ARK Invest also provided further details about the numbers behind their projections. In a bear scenario, ARK Invest projects that TSLA’s market cap in 2026 would be $3.3 trillion in a bear scenario in 2026 and $6.7 trillion in their bull case. In these scenarios, ARK Invest sees the average price of a TSLA vehicle at $38,000 in a bear case and $30,000 in their bull case. The only number I will speculate on is the average sale price of a TSLA vehicle in their base case, as it wasn’t published. I simply split the difference between the bear and bull case and pegged the average sale price at $34,000. The two tables below are from ARK Invest research.

ARK Invest

ARK Invest

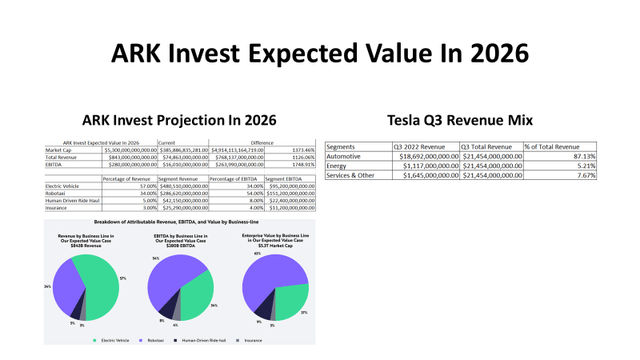

This is where I get lost on ARK Invests expected value projection of $5.3 trillion in 2026. In Q3 2022, TSLA generated $21.45 billion in revenue. This was made up of $18.69 billion from Automotive (87.13%), $1.12 billion from Energy (5.21%), and $1.65 billion (7.67%) in Services & Other. In the expected revenue case, ARK Invest has TSLA generating $843 billion. Electric Vehicles will account for 57% ($480.51 billion), Robotaxi 34% ($286.62 billion), Human Driven Ride Hail 5% ($42.15 billion), and 3% from Insurance ($25.29 billion). Interestingly, Energy isn’t part of ARK Invests analysis, and it represented 5.21% of Q3’s revenue mix.

Sticking with the charts from ARK Invest, they believe in 2026, 10 million cars will be sold at an average price of $38,000 in the bear case, and 17 million cars will be sold at an average price of $30,000 in the bull case. The expected case is $480.51 billion of revenue from vehicles, which would equal 57% of $843 billion. I’m going to speculate that since the expected case is the middle between a bear and bull case, the average price per vehicle would be $34,000. To reverse engineer $480.51 billion of revenue in 2026 from an average sale price of $34,000, TSLA would need to sell 14,132,647 vehicles.

In 2021 there were 58,180,800 total vehicles sold. To reach ARK Invest’s expected value case, TSLA would need to capture 24.29% of the global market just to meet the revenue projection from automotives. In ARK’s bull case of selling 17 million vehicles, TSLA would account for 29.22% of the 2021 global market, and in the bear scenario of selling 10 million vehicles, TSLA would account for 17.19% of the 2021 global market. The United States is TSLA’s most popular market, and in the first nine months of 2022, TSLA has sold 396,069 vehicles in the U.S out of 10.11 million vehicles, capturing 3.9% of the 2022 U.S auto market. I have trouble seeing how TSLA will get to selling 10 million vehicles annually in a bear case scenario over the next four years, let alone 17 million in a bull case.

Steven Fiorillo, Ark Invest, TSLA

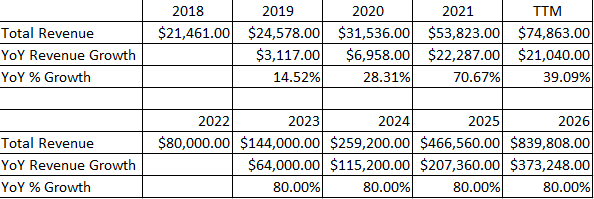

In the TTM, TSLA has generated $74.86 billion of revenue. To meet ARK Invests expected base case, TSLA’s annual revenue would need to increase by $768.14 billion or 1,126.06% from the current TTM level over the next four fiscal years. Over the previous four years, TSLA’s largest YoY growth rate was 70.67% in 2021, which seems to be an anomaly. If I assume that TSLA ends 2022 with $80 billion of total revenue, TSLA would need to grow at an 80% YoY rate for the next 4 years to come within striking distance of Ark Invests base case for revenue in 2026.

Steven Fiorillo

The only numbers that I can create an accurate picture of is vehicles and total revenue since we data correlated to each aspect. Robotaxis are projected to be 34% of revenue, and Human Driven Ride Hail is projected to be 5% for a combined revenue of $328.77 billion in 2026. If the numbers didn’t make sense for the vehicle aspect, they defiantly don’t make sense to me when this is brought into the mix. This assumes that over the next four years, TSLA will build new businesses that generate more revenue than Alphabet (GOOG) (GOOGL) does today ($282.11 billion) and almost as much as Apple (AAPL) generates ($394.33 billion). We have no idea what the U.S government will put in place as regulations or what the mandates of each individual state will be. This also assumes a large amount of buy-in from TSLA customers that opt into these programs. I’m not sure that anyone can quantify how many people would allow their vehicles to be put into a Robotaxi program while they are not using the vehicle. Personally, I wouldn’t opt into a Robotaxi program unless I was purchasing vehicles specifically for that use, and that would assume that the numbers behind the business make sense.

It’s hard for me to take ARK Invest’s projections seriously as TSLA’s market cap would need to increase by $4.91 trillion or 1,373.46% over the next 4 years for its base case to be met. This is more than adding 2 AAPLs to TSLA’s current valuation. Even bringing TSLA’s market cap down to $4.5 trillion and expanding the time horizon to 2030 – 2032, as Ron Baron believes, doesn’t seem realistic. I can’t back my way into these valuations in a way that makes sense to me. I’m not bearish on TSLA the company because I believe they still have a long runway of growth ahead of them, but I’m bearish on the valuations. These types of projections assume that TSLA is going to obliterate the competition in addition to adding complete hypothetical situations to the analysis. TSLA is one of the rare success stories that has truly shaped an industry, and the barriers of entry that were overcome are astonishing. TSLA didn’t have the capital, manufacturing, credibility, or the infrastructure that its competitors did, yet it found a way to succeed. If the odds weren’t enough, which TSLA faced, they accomplished their goals without a combustible engine and pioneered an entirely new sector within the automotive industry. I’m not saying that it’s impossible for TSLA to achieve these market caps that Ark Invest or Ron Baron believe, but I think it’s highly improbable.

Dissecting Tesla’s current valuation and determining if I am going to stay neutral, become bearish again, or if I think shares have fallen enough to actually become a Tesla bull

As shares of TSLA have declined -69.21% in 2022 and the valuation has become constricted, this doesn’t mean that TSLA trades at an attractive valuation. I would argue that TSLA hasn’t traded at a realistic valuation for a long time, but investors continued to pile in at market caps that exceeded $600 billion, $800 billion, and even $1 trillion. At the end of the day, the objective of every business is to generate a profit, and everything comes down to dollars and cents. It doesn’t matter the sector, $1 dollar of revenue and FCF is equal to $1 of revenue and FCF regardless if it’s an auto manufacturer or an industrial. How the market perceives these metrics is a different story, but the value of $1 billion of revenue and FCF doesn’t change.

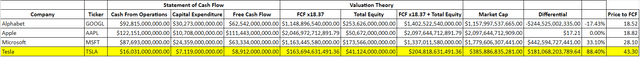

My benchmark is AAPL because it’s the largest and most profitable company in the market. AAPL has a market cap that exceeds $2 trillion, and in its fiscal year of 2022, AAPL generated $394.33 billion in revenue, $99.8 billion of net income, and $111.44 billion of FCF. Over the previous five years AAPL has generated $1.56 trillion in revenue, $366.687 billion in net income, and $400.78 billion in FCF. Over this period, AAPLs revenue has increased by $165.09 billion (72.02%), net income by $51.45 billion (106.41%), and FCF by $59.67 billion (115.25%). AAPL is the largest company of the S&P 500, and the Nasdaq 100, and is the most profitable company in the market. It’s hard to debate why any company deserves a larger valuation or multiple than AAPL considering its growth and profitability.

I have reverse-engineered AAPL’s market cap using FCF as the measure of profitability and the total equity on the balance sheet. I have discussed FCF for years because I feel one of the most important valuation metrics is the FCF to Market Cap multiple a company trades at. Coincidently this hasn’t been a widely discussed valuation metric. FCF represents a company’s cash after accounting for cash outflows to support operations. I like to use this metric rather than net income because FCF is a measure of profitability that excludes the non-cash expenses and includes spending on equipment and assets. It’s also a harder number to distort or manipulate due to how companies account for taxes, and other interest expenses. This also is the pool of capital companies utilize to pay back debt, reinvest in the business, pay dividends, buy back shares, and make acquisitions. If TSLA is going to dethrone AAPL in the future as the largest company in the market or give AAPL a run for its money, we should look at these companies from the same valuation metrics. Since Ark Invest thinks that TSLA will trade well above AAPL’s all-time high of around $3 trillion in 2026, and Ron Barron believes it will occur between 2030 and 2032, it’s fair to value them on the same methodology, especially considering the growth AAPL has generated over the past five years.

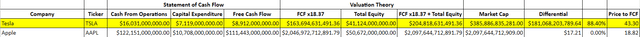

Today, I can get within $17.21 of AAPL’s market cap with the valuation methodology of combining the total equity on the balance sheet and multiplying the FCF by 18.67. This is as close to reverse engineering AAPL’s market cap as you can get. AAPL is generating $111.44 billion in FCF, which is $102.53 billion more than what TSLA has produced in the TTM, yet TSLA trades at a much larger valuation. Based on total equity plus 18.37x FCF, TSLA would have a market cap of $204.82 billion, compared to its current market cap of $385.89 billion. At one point, TSLA exceeded $1 trillion in market cap without even generating $10 billion in FCF. Today, TSLA trades at a multiple of 43.30x on its FCF compared to AAPL, which trades at 18.82x its FCF. Regardless of what TSLA has accomplished, there’s no reason why it should trade at a multiple that exceeds AAPLs. The worst part is this looks conservative compared to earlier in the year when TSLA traded at over 100x its FCF.

Steven Fiorillo, Seeking Alpha

Steven Fiorillo

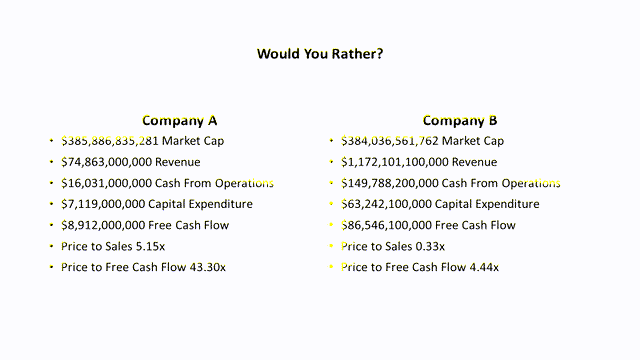

If I asked you which company should be valued more, which would you pick? Company A has a $385.89 billion market cap, and generated $74.86 billion in revenue, $16.03 billion in cash from operations, $8.91 billion of FCF, and trades at a price to sales of 5.15x and a price to FCF of 43.30x. Company B has a $384.04 billion market cap, generated $1.17 trillion in revenue, $149.79 billion in cash from operations, and $86.55 billion in FCF over the TTM and trades at a price to sales of 0.33x and a price to FCF multiple of 4.44x. Looking at the stats, there is no way that I would think Company A would have a larger market cap than company B, but it does.

Steven Fiorillo

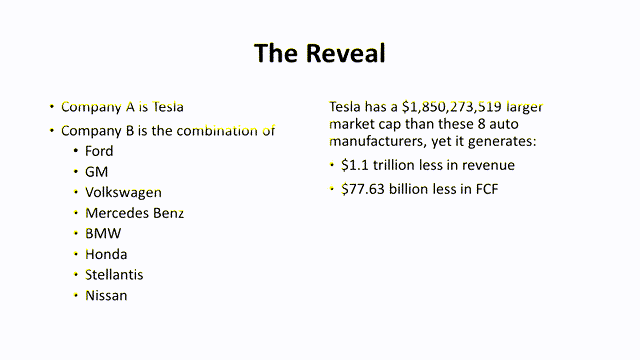

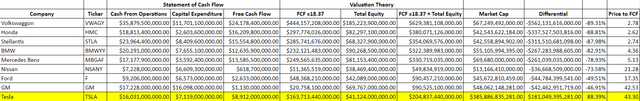

Company B wasn’t just one company, it was the combination of Ford (F), GM (GM), Volkswagen (OTCPK:VWAGY), Mercedes Benz (OTCPK:MBGAF), BMW (BMWVY), Honda (HMC), Stellantis (STLA), and Nissan (OTCPK:NSANY). After declining by almost -70% in 2022, TSLA still has a market cap that is $1.85 billion larger while generating $1.1 trillion less in revenue and $77.63 billion less in FCF compared to these 8 auto companies.

Not a single one of these auto manufacturers trades at a premium trades at a premium from the total equity plus 18.37x the company’s FCF, yet TSLA trades at an 88.39% premium. VWAGY has generated $24.18 billion of FCF in the TTM and has $185.22 billion of total equity on the books, and its current market cap is $67.25 billion, which is a -89.31% discount to this valuation methodology. Comparing all of these auto manufacturers the same way, they trade between a -89.31% discount to a -46.91% discount vs. TSLA trading at an 88.39% premium.

Steven Fiorillo, Seeking Alpha

Many have argued that TSLA shouldn’t trade as a car company, even though 87.13% of its revenue in Q3 came from automotives. Let’s look at TSLA as a tech company and through a different lens. If TSLA was to disappear tomorrow, there are other auto manufacturers, and the impact on society would be minimal. If AAPL, GOOGL, or Microsoft (MSFT) disappeared tomorrow, it would drastically impact society. AAPL and GOOGL control most of the smartphones and tablets in the world, while MSFT has the second-largest cloud service platform, and the most critical business platforms as most computers run on Windows, and most people utilize Office. There isn’t a perfect way to quantify this, but it’s logical that the impacts from AAPL, GOOGL, or MSFT disappearing tomorrow would have larger ramifications than TSLA disappearing.

Steven Fiorillo, Seeking Alpha

Based on my previous methodology, GOOGL is trading at a -17.43% discount, while MSFT trades at a 33.10% premium. MSFT has produced $87.69 billion of cash from operations and $63.33 billion of FCF compared to TSLA, generating $16.03 billion of cash from operations and $8.91 billion of FCF in the TTM, yet TSLA trades at a significantly larger valuation. On a price-to-FCF methodology, GOOGL trades at 18.52x, AAPL trades at 18.82x, MSFT trades at 28.10x, and TSLA trades at 43.30x. It’s very hard to justify why TSLA still trades at a larger premium than the three largest companies in the market, which generate much larger revenues, and profits.

My take on what will happen to TSLA’s share price in 2023

What happens to TSLA in 2023 depends on many different variables, and nobody knows what’s going to occur. TSLA looks like a falling knife, but from a valuation perspective, there’s no reason for TSLA to trade anywhere near the levels it does today. I know this is going to rub a lot of people the wrong way, but you can’t incorporate Robotaxis or Human Drive Ride Hail into the market cap when these aren’t businesses yet, and there’s no direction as to what laws will be put into place. TSLA has always traded well above what many considered a reasonable valuation, but the current downtrend is making TSLA look much more reasonable. If the market rebounds in 2023 and TSLA strings together some good quarters, I could see TSLA rebounding to over $200.

In the short term, I think TSLA will continue to fall, and we could see its market cap decline to under $300 billion. If shares don’t establish a bottom in the coming weeks and Q1 numbers don’t impress the street, I think we could see the market cap fall under $250 billion. I also don’t see how the bear case that ARK Invest presented is possible, let alone their expected or bull cases. The other auto manufacturers are gunning for TSLA, and there is going to be tremendous competition in the EV space in 2023 and 2024. I think the days of discussing TSLA being a multi-trillion dollar company will come to an end, and TSLA is going to need to significantly increase its profits to get back over a $500 billion market cap. I think there is a very good chance that shares of TSLA will continue to decline to the $100 level going into Q1 earnings.

Disclosure: I/we have a beneficial long position in the shares of AAPL, TSLA, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Barbell Capital provides investors with a comprehensive approach that utilizes growth, value, dividends, and options for income, to generate alpha in your portfolio while mitigating downside risk. Within Barbell Capital you will find exclusive research, model portfolios, investment tools, Q&A sessions, watchlists, and additional features for its members. There is also a live portfolio dedicated to generating capital from trading, selling puts, and selling covered calls. The profits will be allocated to future capital appreciating investments and investing in dividend investments to generate income while we sleep. Join today with a two week free trial!