Summary:

- Tesla, Inc.’s recent Q2 financial report showed a 47% YoY increase in revenue, but the stock dropped by 10% on the announcement.

- Tesla currently accounts for 16% of the electric vehicle market share and aims to increase its market share further.

- The decline in Tesla’s gross margin and increased competition pose risks to the company’s profitability and stock price.

sarawuth702

In this article, I would like to summarize the Q2 2023 results of the well-known automotive company Tesla, Inc. (NASDAQ:TSLA). No investor could miss out on this year’s rally fueled mainly by news about the development of artificial intelligence (“AI”). Tesla is one of the reasons, why the most watched index S&P 500 Index (SP500) is performing so well. Beyond Tesla, only a handful of companies, the so called MAMAA stocks – Meta (META), Apple (AAPL), Microsoft (MSFT), Amazon (AMZN) and Alphabet (GOOGL) – have fueled the index’s growth of over 16 % in 2023.

The recent financial report would have usually cheered up investors, as revenue grew by 47% YoY to $24.9 billion, an outsized increase compared to other companies in the sector. But despite this information, the stock dropped by 10% on the announcement. What is behind this decline? And is there any room for another drop? Let’s dive deep into the Q2 report.

Sector Overview

The electric vehicles (“EV”) market is one of the fastest-growing markets. The number of cars sold was 10.3 million in 2022 and is still rising fast. It is expected to go up at a fast CAGR of 14% to 17.1 million units delivered each year by 2028, driven by the availability of new models as well as various initiatives of governments.

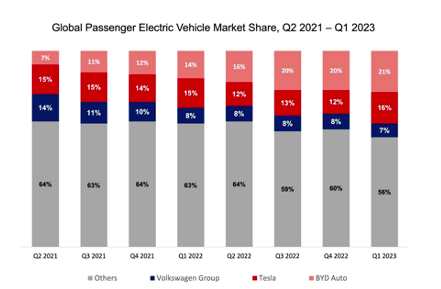

In terms of market share, Tesla currently accounts for 16% of the EV market. Since the market itself is expected to grow by 14% annually and Tesla targets growth well in excess of that, in order to deliver, they will have increase their market share further.

TSLA Presentation

Recent results and insights

Tesla is currently trading at a P/E ratio of almost 70x, which is by no means cheap. As said above, revenue and also EPS have risen lately. Earnings per share (EPS), in particular, beat analyst’s estimates (with the $0.91 actual vs. $0.82 estimate consensus).

The not-so-great news was the gross margin decline, which fell for the fourth time in a row to 18.2%. This was caused by numerous price cuts of its Model 3, Y, S, and X in an attempt to boost sales in the face of increased competition and weakening consumer behavior. Moreover, Tesla’s CEO Elon Musk also implied that the automotive company will likely keep cutting prices to shield against economic uncertainty, which likely will lead to further margin compression over the medium term.

Data from TSLA compiled by Author

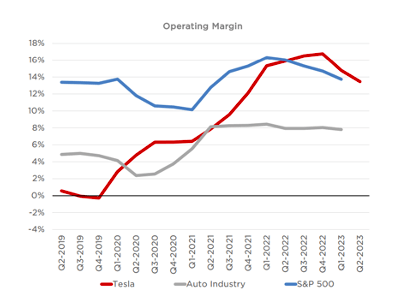

The operating margin is still double the industry average, but the spread compared to Tesla’s competition seems to be narrowing. This is particularly true relative to the Chinese manufacturer BYD Company Limited (OTCPK:BYDDF), which is also trading at a more pleasant P/E ratio of about 37, even though the company continually expands the share of vehicles sold (i.e., increases its market share). Yes, you can suppose that BYD has additional risks that compensate for the price. But still, it looks like the price of Tesla is led by overhype of investors.

A further risk for Tesla is a reaction from the other manufacturers who are actively trying to join the trend of electric vehicles. For example BMW (OTCPK:BMWYY) and Mercedes (OTCPK:MBGAF) have recently more than doubled their EV vehicles sold.

A decrease in vehicles sold in Q3 from Q2, according to Musk, combined with current huge investments in Project Dojo (well over $1 billion by the end of 2024), may eventually reduce net income in the short term.

On the other hand, when the investment succeeds, it can create a virtual monopoly with full self-driving (“FSD”) systems, which would boost revenues in the long term. Operating expenses also continue to be driven by the Cybertruck. This model is set to be released by the end of Q3 2023.

If you read the last quarterly report carefully, you will have noticed how the company is taking advantage of the current interest in artificial intelligence. Tesla even put it as the first thing in their “core technology” section. It looks more like investor appeasement than a Dojo project training computer breakthrough. The same thing goes for Cybertruck vehicles. The company promotes them as the most unique vehicle so far, which may be true, but can also be a problem, if the Cybertruck does not match customer expectations.

Conclusion

To sum it up, I don’t share the same optimism as other investors pumping up the price of Tesla stock. I know that Tesla is currently leading in the sector of EVs and that electronic vehicles are the future of transportation, but we mustn’t forget some of the red flags connected with this company. Don’t get me wrong, I know Tesla’s position in this segment and its technological lead over competitors, but the current price looks pretty high. It’s a classic case of a great company, but at an extremely pricy valuation.

The market capitalization of Tesla ($769 billion) is higher than of its 5 biggest competitors combined, which is not justified based on the fundamentals, in my opinion. This is why, I think it’s only a matter of time before some bad news or quarterly result for the car manufacturer starts the chain reaction. A further risk to consider is that Elon has been heavily focused on Twitter, now “X,” which takes away from his capacity to manage Tesla. If Twitter needs funding, he may be forced to sell additional share as he did last fall.

|

Stock |

P/E |

Market cap. (in billions) |

|

Tesla |

76.28 |

$744.629 |

|

BYD |

31.67 |

$90.353 |

|

BMW |

5.77 |

€65.732 |

|

Volkswagen |

4.68 |

€65.521 |

|

Mercedes-Benz |

5.08 |

€73.584 |

Overall, I rate Tesla stock a SELL as I do not see not much space to outperform the S&P 500 from here. I believe that investors who want to buy some stocks of this company will get the opportunity (discount) in the near term at a lower level.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.