Summary:

- Tesla and BYD are leading the global transition to sustainable energy, with Tesla’s stock price up by 159% YTD compared to BYD’s 31%.

- In Q2-23, Tesla delivered 466,140 cars worldwide, including 155,000 in China, while BYD sold 700,244 mostly in China, marking their best-ever quarter.

- Despite BYD’s revenue growing at twice the rate of Tesla’s in FY22, Tesla’s net income is over five times that of BYD’s, indicating superior pricing power and cost management.

Justin Sullivan

My previous article Thoughts Post Tesla 2023 Investor Day focused on the vision of Tesla, Inc. (NASDAQ:TSLA), and why I am a big believer for Tesla continuing to lead the path to sustainable energy. In this article, I want to do a side-by-side comparison between TSLA and BYD (Warren Buffett’s Berkshire Hathaway holds an approximately 6% stake in BYD (OTCPK:BYDDF)). I believe this is a meaningful topic because 1) it helps investors understand TLSA’s future growth in China market, where TSLA currently generates one-third of its EV sales; and 2) it allows investors to quantitatively compare the performance between the two EV leaders.

Stock Price

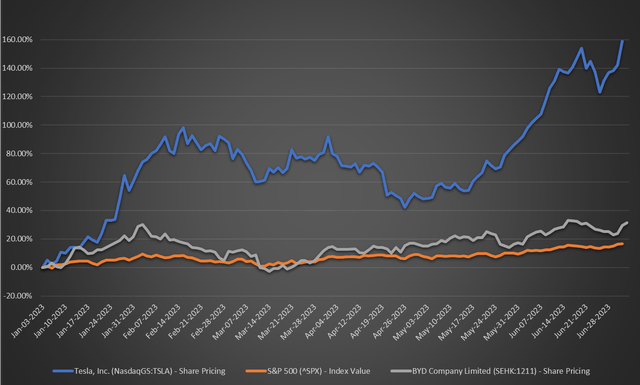

Tesla, Inc. stock is currently traded at $279.82, up by +159% YTD, as compared to BYD Company Ltd. (1211.HK)’s movement of +31% YTD, and S&P 500’s movement of +17% YTD.

Relative to BYD, TSLA had a spectacular jump since the beginning of 2023, driven by its stronger-than-expected second-quarter deliveries and production numbers, as well as improvements in Macros (Inflation decrease and Feds pausing interest-rate hikes).

Sales Records

In FY11, Elon Musk denied BYD as Tesla’s competitor. In May-23,he acknowledged that BYD’s EVs are very competitive. In this section I will focus on the sales performance comparison of TSLA and BYD. They are two distant leaders in the global EV market, and the sales records in Q2-23 also reinforced their positions.

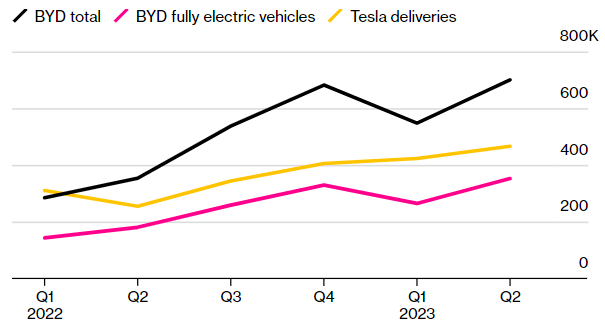

In Q2-23, TSLA delivered 466,140 cars (+70% YoY) worldwide, beating Wall Street estimates. This included 155,000 cars sold in China. BYD sold 700,244 fully electric and plug-in hybrid vehicle mostly in China, and this was the best-ever quarter for BYD.

Tesla and BYD Q2-23 Sales

If we zoom out to the Worldwide, according to the IEA’s annual Global Electric Vehicle Outlook, “over 10 million electric cars were sold worldwide in 2022; EV cars share of the overall car market has risen from around 4% in 2020 to 14% in 2022 and is set to increase further to 18% in 2023; most of the EV car sales are concentrated in three markets – China (60%), Europe and the United States, and by 2030 the average share of electric cars in total sales across China, the EU and the United States is set to rise to around 60%.”

China: Tesla EV’s market share in China is ~10%, vs BYD’s 40%. That said, considering the low penetration of EV, there are massive opportunities for both leaders to capture in the next few years.

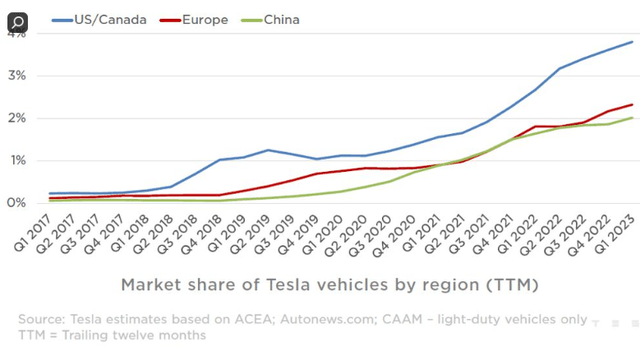

EU: As shown in the following chart, Tesla’s EV share of the total cars market in EU had a steady increase YoY and QoQ. For BYD, although the company confirmed that it was in “full expansion” phase, its market share is likely still nascent.

US: Tesla EV’s market share in US is over 60%. Although we know that Tesla’s market share may drop in future years (Bank of America analysts estimated Tesla’s share of the U.S. electric vehicles market will drop to 18% by 2026). BYD confirmed that it had no intention to enter the US market.

The main takeaways are:

1. The China market has had a very strong recovery; EV demand is trending up.

2. The two EV leaders should continue to capture rapidly-growing EV market for many years to come, mainly benefiting from a secular market shift.

3. Competition is not a burning concern, especially when BYD confirmed no intention to enter the US market.

Financials

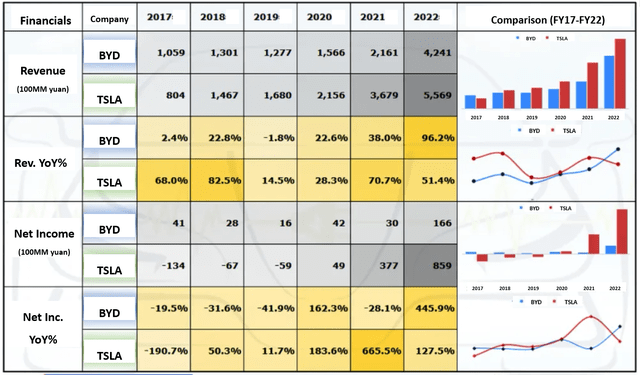

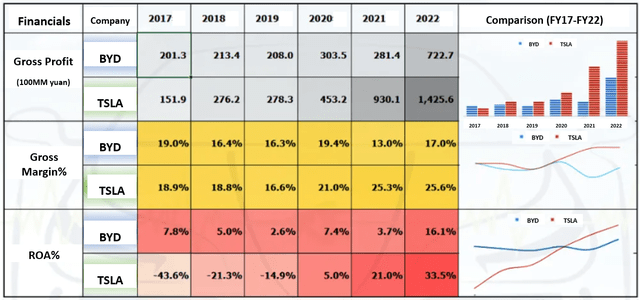

In this section we focused mainly on financials, and all financials are in RMB (Tesla financials are converted to RMB using 12/31/22 FX rate).

Main observations are:

1. BYD’s revenue grows at ~2x of TSLA’s revenue growth rate in FY22, which means BYD might be able to catch up if its growth momentum continues. Note that EV sales accounted for 77% of BYD’s total revenue.

2. Although revenues are tracking relatively close, BYD’s net income is less than 20% of TSLA’s net income. This means TSLA’s pricing power and cost management are best in class. TSLA’s strong earning power should support its continued investment in innovation and retain flexibility in increasing consumer surplus.

3. TSLA’s Gross Margin was 25.6% in FY22, as compared to BYD’s 17% in FY22. This made a difference of ~$7B profit in FY22. TSLA’s better Gross Margin can be attributed to 1) better pricing power, 2) product mix towards high GM products, 3) successful vertical integration.

4. BYD’s 16.1% ROA appeared decent, but TSLA’s 33.5% was much more impressive.

5. Both TSLA and BYD have made massive progress from FY17 to FY22, demonstrating the success of producing and selling EVs at scale.

new.qq.com/rain/a/20230403A09S0Y00 new.qq.com/rain/a/20230403A09S0Y00

Leadership

Elon Musk of Tesla and Wang Chuanfu of BYD are considered two of the top disruptors of our time.

| Description | Elon Musk | Chuanfu Wang |

| Origin |

Born to a family of a Canadian model and a wealthy South African engineer. His parents divorced when he was 10. |

The 8th child of a peasant’s family, was orphaned early and raised by his elder siblings; lived a tough life in China’s Anhui province. |

| Education |

Queen’s University, University of Pennsylvania |

Central South University of Technology, Central South University |

| Entrepreneurial Experiences | Launched his first company, Zip2 Corporation in 1995, followed by PayPal, SpaceX, Tesla, and Twitter. |

Founded Chinese phone battery company BYD (Build Your Dreams) in 1995, and within 10 years captured more than half of the world’s mobile-phone battery market; known as The father of the “blade battery”; entered the automobile business in 2003. |

| Net Worth | Net worth: 237.7 billion USD (2023) Forbes | 19 billion USD (2023) Forbes |

FSD vs Autonomous Manufacturing?

Last but not least, I want to point out a fundamental difference between the philosophies of the two companies. Tesla advocates and tests FSD for years, whereas BYD is very much on the opposite/conservative side.

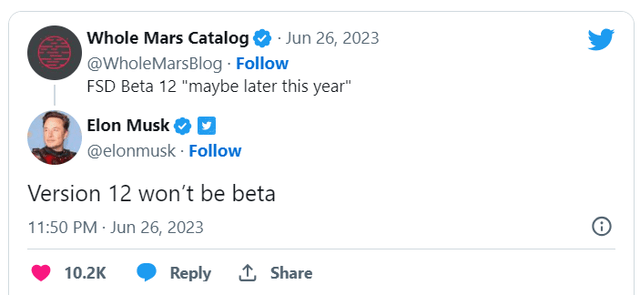

TSLA: Tesla first launched FSD Beta in Oct-20, and this feature allows Tesla vehicles to drive autonomously in most driving scenarios. Elon Musk said in an interview last year that “it’s essential that Tesla solve its full self-driving technology (FSD).” and ” it is the overwhelming focus for the carmaker because it’s really the difference between Tesla being worth a lot of money or worth basically zero.” A recent Twitter post by Whole Mars Catalog said that Musk confirmed “FSD v12 won’t be beta”.

BYD: BYD believes the focus on self-driving cars may be a flawed idea and that the focus should be on autonomous manufacturing instead.

“When we think about [self-driving tech] from all aspects, from human psychological safety needs, from ethics, from regulation, from technology — including application in this industry — we haven’t figured out [the logic] and we think it is probably a false proposition,” BYD spokesperson Li Yunfei said during the Shanghai auto show (via CNBC).

Conclusion and Investment Risks

Both TSLA and BYD are great companies leading the global transition to sustainable energy, and over the course, both stocks should have impressive performance in future years.

For TSLA, its sales performance vs its competitors will likely continue to drive the ups and downs of its stock price. Being able to accelerate its sales in China still remains a key. According to niuche.com, EV sales penetration rate in China’s tier-1 cities and top 15 tier-2 cities exceeded 30%. Tier-3 and Tier-4 cities may soon become the competitive focus, and TSLA’s direct sales channel and EVs with accessible price by relevant customer segments would become critical.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.