Summary:

- Tesla, Inc.’s EV production forecast has been adjusted due to the launch of a new crossover model, Redwood.

- The Redwood model is expected to be popular due to its low cost and practical design, potentially impacting sales of the 3/Y models.

- Concerns arise from competition in the Chinese market and a slowdown in supply growth for Tesla.

Investment thesis

We have covered Tesla, Inc. (NASDAQ:TSLA) before, and in this report, we present the adjustments we have made to our forecast, in particular taking into account the downward revision of the electric vehicle (EV) production forecast due to the intention to launch a new crossover model codenamed Redwood. This move requires a reallocation of Tesla’s energies to the detriment of ramping up deliveries of its flagship 3/Y models. However, we expect Tesla’s EV deliveries CAGR to be above the expected market average of 21% YoY (at 23% YoY), but below our previous forecast.

We expect the Redwood model to become a highly sought-after product due to its low cost (not only within Tesla’s EV lineup, but also among internal combustion engine vehicles) and practical crossover model, giving the company an incentive to increase production of the model. We assume that after the official announcement of the new crossover we will increase our forecast for its deliveries, but for now we will wait for the news. The rating is HOLD.

The slowdown in supply growth is worrisome for Tesla investors

Tesla delivered over 484k EVs in Q4 2023, which was in line with our expectations of 482k units sold. Thus, the company delivered 1.81 million vehicles in 2023 (+35% YoY), meeting its ambitious annual delivery target, which would seem to inspire confidence that the company’s EV sales will continue to grow, if not for the company’s expectation of lower delivery growth in 2024.

During its conference call on Q4 2023 financial results, the company announced that it intends to release a new crossover model, codenamed Redwood, in the second half of 2025 and is already preparing for its launch. The new model will likely cost $25k (as Tesla has previously promised to create an EV at this price point), and demand for it is expected to be significant, which generally gives the news of the Redwood’s release a positive tone. However, due to the workload to prepare for the start of production of this model on the next-generation platform (which among other things is still in development), the company has to reallocate its energies to the detriment of ramping up deliveries of its flagship 3/Y models, whose sales in 2023 accounted for 96% of all EVs sold by the company.

The company preferred to keep the details on Redwood confidential until the official announcement of the model, and at the moment it is known that the production capacity may reach 10 thousand units/week, which is equivalent to 480 thousand units/year.

We expect the Redwood model to become a highly sought-after product due to its low cost (not only within Tesla’s EV lineup, but also among internal combustion engine, or ICE, vehicles) and practical crossover model, giving the company incentive to increase production of the model. Among other things, expect that after launching such a low-cost EV, Tesla may find itself in a cannibalization situation, with sales of the 3/Y models being affected as a result.

The arrival of a serious competitor in the Chinese market, namely BYD Company (OTCPK:BYDDF), which has surpassed Tesla in EV sales in Q4 2023, but is still lagging behind in cumulative 2023 sales, is also a concern whether the company will be able to keep up with demand: 1.81 million units for Tesla vs. 1.58 million EVs for BYD. Most of BYD’s cars are more traditionally designed and sold in a lower price range than Tesla’s, and come in hybrid versions in addition to battery-only vehicles, or BEVs. The price war, which continued throughout 2023, failed to bring Model 3/Y prices below those of BYD’s sales leaders in China.

We acknowledge that in the Chinese market, Tesla will lose its leadership in 2024 due to BYD’s more affordable EVs, but expect that Tesla will continue to grow the volume of electric vehicles sold in China and elsewhere.

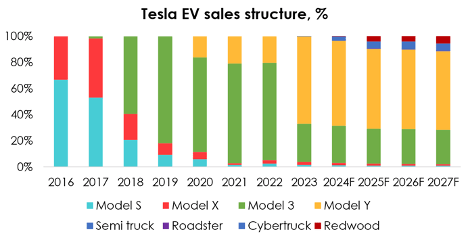

Tesla EV sales structure

Let’s take a look at Tesla EV deliveries breakdown by models:

- S/X model accounted for less than 4% of the company’s deliveries through 2023, and we expect its share to drop to 2% by 2027, both due to fairly low sales and faster sales gains for the rest of Tesla’s EVs.

- 3/Y model will continue to be the company’s sales leader, but its share of sales will decline from a record 96% as Cybertruck and Redwood sales ramp up. Thus, in 2024, we expect the combined share of Model 3/Y deliveries to be 93%, falling to 86% by 2027.

- Over the next two years, we expect 3/Y model shipments growth to keep pace with global EV market growth at 21% YoY, before being displaced by Redwood shipments in 2026-2027, with the growth rate slowing to 16% YoY.

- No news from the company on Semi, pilot production continues at the plant in Nevada, USA. We maintain the assumption of official sales start in Q4 2024, we estimate the deliveries of this model at the level of no more than 0.5% of all the company’s supplies.

- As for the Roadster, the company is also not giving any updates, due to which we have shifted the production launch of this model to H2 2025.

- Cybertruck deliveries were not disclosed by the company when it published its results in early January, and Tesla does not comment on production volumes, which is alarming. We have therefore revised downwards our forecast for Cybertruck deliveries in 2024 from 117.5k units to 70.5k units and in 2025 from 218.7k units to 153k units, equivalent to 3% and 5% of Tesla’s total deliveries.

- We expect Redwood deliveries for H2 2025 to total 19.3k units and 143.3k units in 2026 (4% of Tesla deliveries).

Xiaolu Chu Invest Heroes

Tesla’s sales and revenue forecast

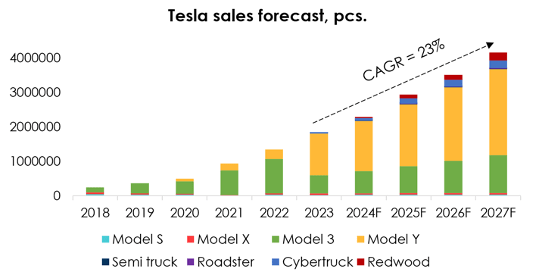

Due to growth in new model deliveries, we expect Tesla’s compound annual growth rate for electric vehicle deliveries to be at 23% YoY, above the expected market average of 21% YoY but below our previous guidance.

As such, we have revised our forecast for aggregate Tesla deliveries downwards from 2.4 million units (+34% YoY) to 2.2 million units (+24% YoY) for 2024, and from 3.4 million units (+42% YoY) to 2.8 million units (+26% YoY) for 2025.

Invest Heroes

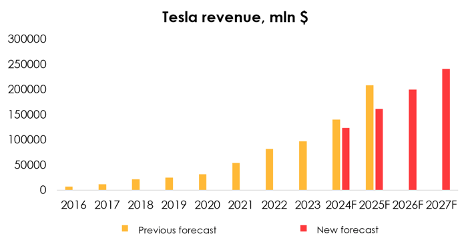

Due to lower expected EV deliveries, we have revised Tesla’s 2024 revenue forecast downwards from $139.9 bn (+45% YoY) to $123.5 bn (+28% YoY) and 2025 revenue forecast downwards from $208 bn (+49% YoY) to $160.9 bn (+30% YoY).

The financial results of the company’s other segments – Energy generation and storage, Services were broadly in line with our expectations and subject to minor upward revisions.

Invest Heroes

Tesla’s financial results

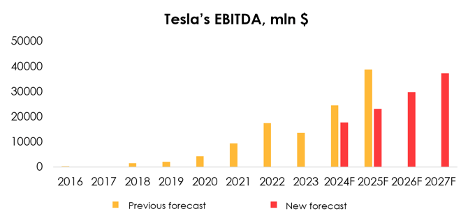

We have revised downwards Tesla’s 2024 EBITDA forecast from $24.5 bln (+81% YoY) to $17.6 bln (+30% YoY) and 2025 EBITDA forecast from $38.7 bln (+58% YoY) to $23.2 bln (+31% YoY) due to:

- Downward revision of revenue guidance from $139.9 bn (+45% YoY) to $123.5 bn (+28% YoY) for 2024, and from $208 bn (+49% YoY) to $160.9 bn (+30% YoY) for 2025;

- Downward revision of the company’s gross margin outlook for 2024 from 23.4% to 18.8% and for 2025 from 25.5% to 19.4% due to our lowered expectations for EV sales margins. Despite continued cost per electric vehicle reductions, the company faces another tough year ahead, during which it will have to deal with the impact of the price war, ramp up Cybertruck deliveries and prepare for the launch of the Redwood model in H2 2025.

Invest Heroes

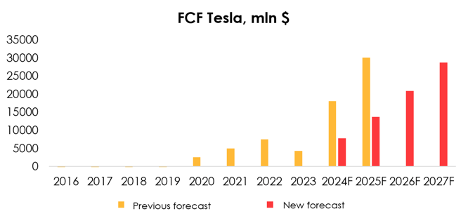

The cash flow forecast was revised downwards from $18.1 bn (+315% YoY) to $7.8 bn (+80% YoY) for 2024 and from $30.1 bn (+66% YoY) to $13.8 bn (+76% YoY) for 2025 due to an increase in expected capex in 2024-2025 from $8 bn to $11 bn, as well as a reduction in the company’s operating profit outlook.

Invest Heroes (Invest Heroes)

Valuation

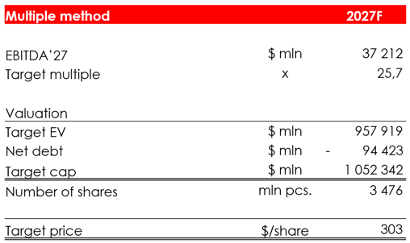

We have revised our target price on Tesla stock from $246 to $210 due to:

- Decrease in the EV/EBITDA multiple from 26.6x to 25.7x;

- Shift of the forecast period to 2027;

- Shift in FTM estimate to Q1, hence the proximity of future financial results.

The rating is HOLD

The $210 valuation was obtained by discounting using the multiple method at 13% per annum. Previously, our valuation of the company was based not only on the multiples method, but also on FCF (FCF Yield). We decided to abandon the latter method, as due to the strong shift in sales of the previously announced models, the FCF Yield method significantly undervalues TSLA and differs by times from the multiple method valuation.

Invest Heroes

Conclusion

Due to lower expected EV deliveries, the impact of the price war, the ramp-up of the costly Cybertruck, and preparations for the launch of “Redwood,” we have lowered our Tesla, Inc. price target and maintained a HOLD rating.

Speaking of other company news, Tesla is hatching plans to launch a humanoid robot called Optimus to do mechanical work in factories. There have been no official announcements yet, and we currently equate Optimus as a venture bet and do not include it in our forecast due to the high uncertainty.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.