Summary:

- Tesla, Inc. CEO Elon Musk has re-advertised the FSD story again, at a time of peak recessionary fears and rising auto loans.

- To counter the potential deceleration in EV sales and maintain market share, Tesla seems to have embraced the path of margin compression as well.

- Historically, the magic of Tesla lies in part with Elon Musk and its market-leading EV sales/ margins.

- With Musk distracted with Twitter and ChatGPT, sales potentially impacted by legacy EV models, and margins compressed, it remains to be seen how the Tesla stock may perform ahead.

- Investors may need to calibrate their expectations accordingly, since it is uncertain that Tesla may regain its hyper-pandemic stock prices and margins in the intermediate term.

alexsl

The FSD Investment Thesis Depends On Regulatory Approval

Tesla, Inc. (NASDAQ:TSLA) has once again gone on the offensive and re-advertised the availability of its full self-driving (“FSD”) technology by 2023, as highlighted by Elon Musk in the recent FQ1 ’23 earnings call:

But the trend is very clearly towards full self-driving, towards full autonomy. And I hesitate to say this, but I think we’ll do it this year. So that’s what it looks like.

As realized by most investors, TSLA’s CEO has long touted the supposed availability of its FSD technology multiple times since 2018, 2019, Robotaxis by 2020, and 2021. The optics unfortunately do not favor the automaker, given the reportedly fake 2016 promotional video, with Ashok Elluswamy, the director of TSLA’s Autopilot software, saying:

The intent of the video was not to accurately portray what was available for customers in 2016. It was to portray what was possible to build into the system. (Tech Crunch.)

On the one hand, TSLA’s FSD technology has had much room for improvement over the past seven years, with the beta program already hitting 150M miles driven since October 2020.

The automaker’s FSD update 11.4 has been rather promising as well, bringing forth faster response time and improved turn performance, on top of better predicting pedestrian movements and weather-adaptive speed control. Recent videos also indicate zero disengagement/ takeovers from the drivers, suggesting the improved readiness of its FSD technology on both suburban roads and highways.

As a result, TSLA’s latest update in April 2023 may propel its FSD technology nearer to the top spot of Consumer Reports’ (currently outdated) “Top-Rated Active Driving Assistance System” released on January 25, 2023.

On the other hand, while General Motors Company’s (NYSE:GM) Cruise may only record 1M miles driven, it has already obtained the authority approval for paid robotaxi operations in Austin and San Francisco. The automaker may also test its Origin shuttle with no steering wheel from 2023 onwards, pending authority approval.

Even TSLA’s fellow autonomous competitor in China, Baidu, Inc. (NASDAQ:BIDU), has already obtained the relevant robotaxi permits in Beijing, Wuhan, and Chongqing. The company also claims to have accumulated over 50M KM or the equivalent of 31M miles driven on Level 4 autonomous driving, while providing over 20 daily rides per vehicle by FQ4’22.

Therefore, while we are optimistic about the eventual roll-out of TSLA’s FSD and robotaxis in the future, it remains to be seen if it may actually obtain full regulatory approval by 2023. This is especially since the automaker is still under investigation by the National Highway Traffic Safety Administration, significantly worsened by the recent crash in North Carolina.

Margin Compression Is TSLA’s Answer To Growing Market Share

TSLA recently reported decimated gross margins of 19.3% (-4.5 points QoQ/ -9.8 YoY) and operating margins of 11.4% (-4.6 points QoQ/ -7.8 YoY) in FQ1’23, naturally impacting its Free Cash Flow margins to 1.9% (-3.9 points QoQ/ -10 YoY).

These numbers were worse than our prudent projections in the previous article here, with the latest quarter’s revenues lower by -$0.58B/ -2.4%, operating margins by -2.1 points, and EPS by -$0.17/ -18.8%.

In addition, TSLA’s global inventory had dramatically risen by the latest quarter to 15 days (+15.3% QoQ/ +400% YoY) of supply or $14.37B in value (+12% QoQ/ +114.7% YoY). Given the ongoing underutilization of its Gigafactories in Texas/ Berlin and the potential deceleration of demand due to the uncertain macroeconomic outlook through 2024, it was likely that TSLA might either cut production output or further slash its Average Selling Prices ahead.

While the automaker had been wanting “to accelerate the world’s transition to sustainable energy,” we reckoned the margin compression might be quite damaging in the long term, despite the potential expansion in volume and market share.

Assuming a sustained cadence ahead, TSLA may eventually report similar margins as other legacy automakers, such as Ford Motor Company’s (NYSE:F) EBIT margin target of ~8% for the Ford Model e segment by FY2026. Otherwise, the former may still trump General Motors’ EV EBIT margin target of up to mid-single-digits by FY2025 and BYD Company Limited’s (OTCPK:BYDDY) current EBIT margin of 4.6% over the last twelve months [LTM].

However, the gap between TSLA’s production volume and its competitors may also narrow over the next few years, based on the former’s supposed 2M annual design capacity in 2023, F’s 600K run-rate in 2023/ 2M in 2026, and GM’s 400K run-rate in H1’24/ 1M in 2025. Notably, the potential winner of the race may be BYDDF, with a projected 3M run-rate in 2025 and up to 10M in 2030.

TSLA’s situation is made more precarious, with the raised FY2023 capital expenditure to the upper limit of $9B (+25.6% YoY), compared to the previously guided range of $6B to $8B. Based on its annualized cash from operations of $2.51B (-37% YoY) in FQ1’23, we may see its FY2023 Free Cash Flow generation potentially impacted to only $1.04B (-86.2% YoY).

Therefore, while chasing market share may be a great idea in the short term, we are not certain about the sustainability of the strategy through the uncertain macroeconomic outlook. This may also trigger the eventual decline of its balance sheet, from $22.4B (+24.3%) of cash/ equivalents and -$21.1B (+33.8% YoY) of net debts reported in the latest quarter.

Only time may tell how things develop for TSLA from here:

Overall, we expect our ability to be self-funding to continue as long as macroeconomic factors support current trends in our sales. (Seeking Alpha.)

So, Is TSLA Stock A Buy, Sell, or Hold?

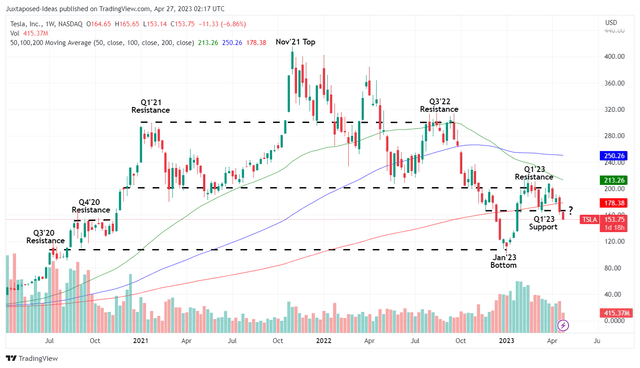

TSLA 1Y Stock Price

For now, Tesla has breached the Q1’23 support levels of $170s, already retesting the Q4’20 level of $150s, if not the January 2023 level of $110s.

While this dip may appear attractive, relative to the November 2021 heights, we do not recommend anyone to add here. The uncertainty of the likely recession has made its forward execution more precarious, attributed to the margin compression thus far.

We remain unconvinced that Tesla, Inc.’s support levels may hold over the next few quarters, especially given that Elon Musk is growingly distracted with Twitter and ChatGPT, with AI similarly contributing to the increased capital expenditure in FY2023, though likely attributed to the FSD ambition.

In our opinion, the automaker’s investment story may not hold in the near term, attributed to the end of its dominance in the EV market as well. Its market share in the U.S. has declined to 58% YTD, compared to 72% in 2022, with Tom Libby, associate director of industry analysis at S&P Global Mobility projecting a further decline to below 50% by mid-2023.

Tesla’s global market share has also eroded to 13% in 2022, compared to 14% in 2021, with BYDDF gaining +9 points YoY to 18.4% at the same time. This cadence may have been the result of other electric vehicle makers’ strategies, with the latter being more than willing to operate at widening losses and/or minimal profit margins while chasing volume growth, one that we are starting to see with the former.

Therefore, we prefer to cautiously rate Tesla, Inc. stock as a Hold (Neutral) here, while iterating a safer entry point at its previous January 2023 levels for an improved margin of safety.

Even then, assuming that Tesla, Inc. stock loses its Elon Musk hype, it is not overly bearish to project a slow but sure decline in its NTM/PE valuations of 41.87x nearing its automotive peers at a mean of 8.28x, one that market analysts already project may happen by FY2031. Those levels may point to a painful price target of $50s, based on market analysts’ projection of FY2024 EPS of $5.04.

Only time may tell.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.