Summary:

- Battery is a bottleneck issue for EV manufacturers and Tesla is no exception.

- Tesla’s 4680 battery cells aim to improve efficiency and reduce costs, but currently faces both technical and cost issues.

- Elon Musk reportedly issued a deadline to solve these issues by 2024 and is considering halting production if not.

- Failure to solve 4680 battery problems could impact production capacity and pricing competitiveness of Tesla’s models.

Just_Super/iStock via Getty Images

TSLA stock faces a bottleneck problem

My last article on Tesla, Inc. (NASDAQ:TSLA) was an earnings review published at the end of July, shortly after the company released its Q2 earnings report (“ER”). That article was titled “Tesla Q2: Automotive Gross Margin Is The Key.” The article discusses Q2 financials, with a particular focus on its inventory build-up and gross margin excluding regulatory credits. Quotes:

Tesla, Inc.’s stock price plunged about 12% after the Q2 earnings report. The lackluster Q2 results have been dissected by many investment websites. This article focuses on two issues that are less discussed but contain crucial leading information on its profitability going forward. They are the inventory buildup and declining automotive gross profit margin when adjusted for regulatory credits.

In this article, I want to switch the perspective from the quarterly numbers to something that has a more fundamental, longer-term, and also technical impact on the company. I would like to discuss the impact of the development of its 4680 battery cells. To be more precise, I would like to discuss what if the team responsible for these cells could not deliver the results that Elon Musk needs by 2024. This seems like a likely scenario in my view, judging by the current progress.

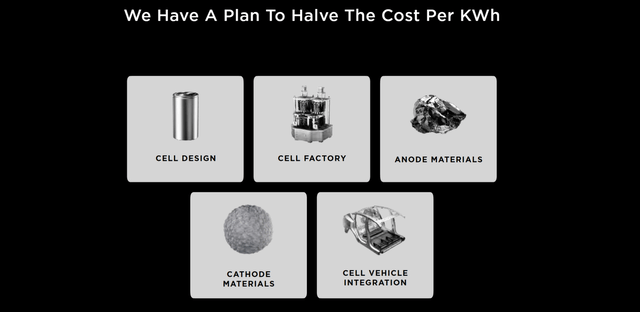

Battery is a – probably THE — bottleneck issue for electric vehicles (EV) in my view. And Musk certainly recognized the issues years ago, as he repeatedly stated the importance of batteries and even named an annual “Battery Day.” He has a long-term vision to break this bottleneck by halving the cost per kWh (see the next chart below) at TSLA through improving the design, manufacturing the cells in-house, and implementing cell-vehicle integration.

The 4680 battery cell is a key piece in this vision. The progress is smooth at all, to say the least, in my view, as detailed next.

TSLA stock and the 4680 battery

Given this is where my professional training lies, I will try as hard to refrain myself from making this a technical paper on batteries. But a few basics are necessary to fully appreciate the importance of the 4680 cells to TSLA. And I have limited the list to only the following 2:

- The 4680 cell is designed to pack 5x more energy than TSLA’s earlier cell (the 2170 cell, see the next chart below). Most readers would wonder the following question at this point: why not just use 5x of the smaller cells, then? Indeed, with/if everything else is the same, each 4680 would be equivalent to 5x smaller cells such as the 2170. However, not everything is the same.

- The first bullet point is only a primer. This is where the real technical details are packed. To start, not all the aspects scale linearly regarding cell size. The example includes the casings, the connectors, the space in between cells, the materials used, etc. Simple geometry can show these things occupy a smaller and smaller fraction of the overall volume as the cell size grows. The 4680 cells also adopted other innovations (such as its module-less design and laser-welding) to improve thermal stability and reduce the parasitic power consumption from thermal-management needs. As a result, larger/fewer cells create substantial efficiency enhancement. In the case of the 4680, it is designed to deliver 16% driving range extension and 6x more power.

Besides these technical advantages, larger and fewer cells would also create economic advantages. They can lead to improved manufacturing efficiency, better logistics, and also reduced assembling difficulties.

TSLA stock: battery cell deadline

It is a good vision and a good plan. It is just that the plan has not materialized yet. On the positive side, TSLA successfully ramped up its 4680-cell production quite rapidly recently. For example, EnergyTrend reported that “the 20 millionth 4680 battery rolled off the production line at Tesla’s Texas factory in 2023” and as of June 6 2024, the factory had produced 50 million 4680 batteries. However, no matter how impressive these numbers may seem, they are far from meeting the need. For example, each of its model Y requires about 1,000 of the cells and its Cybertruck needs even more.

All told, current production still discounts the volume that TSLA needs/wants, and these cells are currently only installed in the Cybertrucks. Even worse, there are reports that the 4680 cells are experiencing performance and cost issues. Musk had reportedly issued a deadline to the team to solve these problems by the end of the year, and is considering halting production if not. Two example reports are quoted below:

EnergyTrend: On June 26, it was reported that Tesla is considering halting the production of 4680 batteries at its GigaTexas factory in Texas due to unsatisfactory energy density, charging performance, and higher costs. If cost reductions do not meet expectations by the end of the year, Tesla will abandon the production of 4680 batteries and instead procure them from external suppliers.

The Information reports that Musk has given Tesla’s 4680 team a deadline for the end of the year to fix the cell. In May, Musk told the team working on the 4680—the nickname for the cylindrical battery, which is 46 millimeters in diameter and 80 millimeters tall—to cut its cost and scale up one of its key innovations by the end of the year, according to three people with knowledge of the matter. And in recent months, Musk has told them he wants to see a solution to a thorny technical problem that can cause the batteries to collapse on themselves while in use, one of those people said.

Other risks and final thoughts

The development of the 4680-battery technology is a key technological step for TSLA in my view, comparable to the integrated casting technology introduced in 2020. Thus, if the above issues are not solved and production is halted/interrupted, I see a material negative impact on the production capacity and also pricing competitiveness of the crucial Model 2. Other models such as the Cybertruck can also be negatively impacted.

In terms of upside risks, any forward-looking analysis always has an element of speculation, and the opposite could happen. If the cost and technical difficulties surrounding 4680 are solved, it would be a pivotal advancement for the mass production of new TSLA models and enable it to increase sales across multiple markets. Meanwhile, lithium prices have been quite low recently. If it stays this way, it could help TSLA to control its production costs. Finally, even if the 4680-cell production is halted, TSLA has long-term battery suppliers (such as Panasonic and LG Energy Solutions) and can also develop new external suppliers (especially those from China).

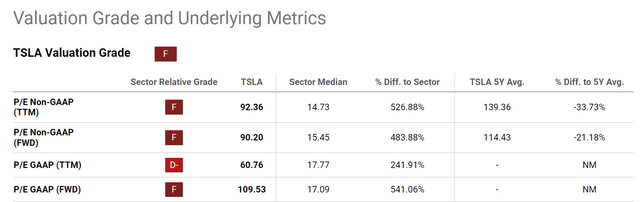

All told, my view is that it is unlikely for TSLA to break the battery bottleneck by 2024 judging by the issues reported thus far. Combined with the elevated valuation of the stock (with an FWD P/E of 90+ as illustrated by the chart below), I do not see a clear skewness in its return/risk profile and thus suggest investors stay on the sideline under current conditions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.