Summary:

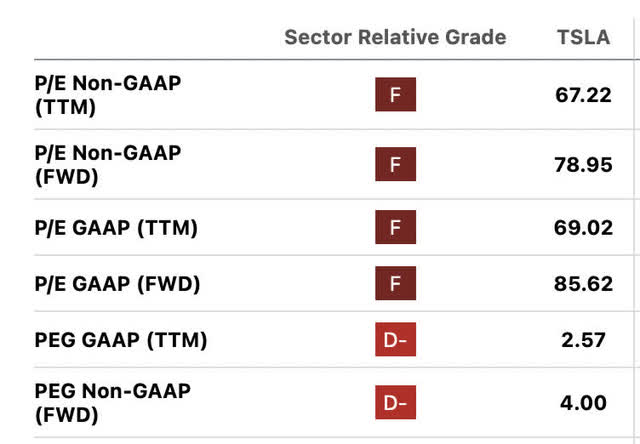

- Tesla, Inc.’s forward earnings ratios have increased, reversing the previous trend of lower ratio estimates.

- Earnings yields for both GAAP and non-GAAP earnings have fallen, which is concerning in a rising interest rate environment. Growth is stalling in the face of a weakening consumer.

- We consider whether adjusting for R&D can provide a more positive outlook for Tesla’s earnings.

jetcityimage

Will Genius Fail?

This is not a knock on Tesla, Inc. (NASDAQ:TSLA) CEO Elon Musk for not being a “genius.” He’s the closest thing to one in the automotive CEO world. Rather, it refers to the world regulators and think tanks. They believed that through subsidies, tax credits, and attacks on the oil industry that they would be able to pivot successfully and profitably into a new world widely comprised of electric vehicles (“EVs”). They forced competition that wasn’t ready to compete.

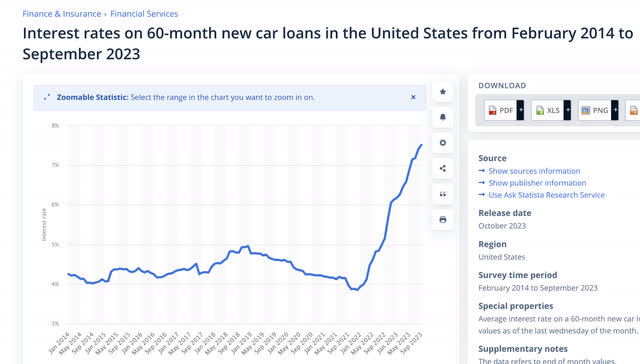

The same regulators pushing forward the transitional goals are also raising rates at the fastest pace in decades. This is crushing consumer buying power and at least temporarily destroying the macro credit environment. As fate would have it, there are a lot more cogs in the wheel of an economy than just a ship and a rudder. Let’s see how things are going for the “genius” economists pushing ahead the EV revolution.

A Black Swan?

Black Swans are interesting. Data and numerous writers would tell you that if everyone is talking about an event, the risk is baked in because everyone is expecting it, hedging it, and finding ways to mitigate it. Black Swans pop up overnight, without warning. As for baked-in Swan events that people are expecting, here’s what I’m hearing in my sphere of influence:

- Housing bubble trading at too large a multiple of annual income.

- The housing bubble due to interest rates making home buying unaffordable.

- CRE bubble due to interest rates and vacancies.

- A worsening of the consumer balance sheet.

- Banks with low-yielding HTM securities.

- War

- Too high of a Schiller forward P/E ratio of the market.

- Student debt repayments ensue.

- Non-mortgage debt balances topping $4.7 Trillion.

Very few FUD factories mention the automotive sector and the issues that currently surround it. This segment of negative catalysts is very overlooked at the moment in my opinion. With the ongoing strikes of the UAW threatening Ford (F), General Motors (GM), and Stellantis (STLA), combined with the pressure of these companies to meet global emissions standards, they also must do the following:

- Produce EVs on a massive scale.

- Procure battery agreements.

- Reconfigure or build new plants to EV production specifications.

- Shore up lithium and battery metals supply chains.

- Do all of this in the face of a strike that is eliminating the cash resources from the large ICE high-margin vehicles that could be used to reinvest in the currently un-profitable EV business.

What a task

What a task indeed. The world governments in their overestimation of control may have pushed this agenda too far, too fast. Tesla does not have the same issue that their competition is going through. They’ve already procured the battery agreements, secured the lithium supply chain, and built ground-up EV factories that the big automotive names may never have a chance at achieving. That being said, Tesla is now very expensive, with the growth story petering out.

I last covered Tesla in December of 2022, when it was trading in the $130s.

My price target for Tesla was right at $130 based on a model that I often reserve for Tech giants. They can grow their earnings almost in perpetuity by spending greatly on Research and Development combined with a large mix of non-physical, non-tangible products that they sell and improve upon ongoing. They avoid taxes through R&D and keep the top line marching upwards either organically or inorganically through strategic acquisitions. That story appears to be fading in the face of lower margins, lower sales volumes, and the difficult-to-produce Cybertruck.

The lower Tesla margins are largely their creation through impatient price cuts to increase volume. In full disclosure, I jettisoned my Tesla after the run-up far above my intrinsic value which I considered unrealistic. In the face of the UAW issues, I still consider both Tesla and Toyota Motors (TM) the leaders of the automotive race, and the lead is getting greater by the day. Both are non-unionized and still pumping out vehicles to their consumers.

Earnings yield turn

The forward predictions for both Tesla’s forward GAAP and non-GAAP earnings numbers have reversed course. For the longest, the forward ratios were continuously lower, ratio estimates are now penciling higher. From an earnings yield perspective, let’s see where that leaves us:

- TTM Non-GAAP earnings yield 1.48%

- Forward Non-GAAP earnings yield 1.27%

- TTM GAAP earnings yield 1.4%

- Forward GAAP earnings yield 1.17%.

Falling earnings yields in a rising interest rate environment are not what we want to see in any growth story.

Is there a better story when adjusting for R&D?

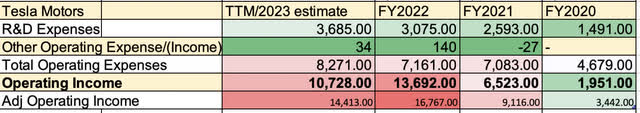

Tesla is a solid R&D spender. Let’s see an updated model based on backing out R&D and comparing it to the current trailing growth rate:

My own excel , data courtesy Seeking Alpha

For this R&D back-out model, see the following trailing data:

- YOY adjusted operating income backing out R&D growth at 43% per annum during this period of profitability.

- $14.413 Billion in estimated 2023 Adj operating income.

- Market Cap of $698 Billion/14.413 Billion = 48 X, adjusted PEG of 1.11

- 3.176 Billion shares outstanding

- 14.413 Billion/ Shares outstanding= $4.53 a share in Adj. operating income

- $4.53 X PEG one multiplier of 43 = $195 fair share price.

The stock doesn’t look terribly overvalued on this metric, but this only works when you expect the stock to “grow into” the multiple. Peter Lynch pointed out that he never exceeds an assumption of 25% per annum growth rates, as any growth rate above 25% is unrealistic in perpetuity. Therefore, I never go over 25 X as my multiple in these situations when designing a PEG ratio model. We can already see the growth rate hitting a wall. With this in mind, my fair value following Peter Lynch would be:

- $4.53 a share in Adj. operating income.

- X 25 assuming a return to growth able to achieve 25% per annum.

- $113 a share fair value.

Balance sheet management

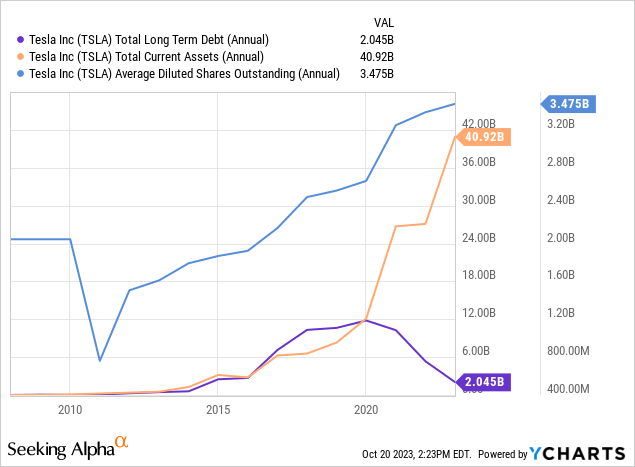

The above is really where Tesla has an advantage over its competition. Because they have a leader in CEO Elon Musk that has a fan base of his own, they’ve been able to finance a lot of this growth at minimal cost. Just look at the shares outstanding line. They’ve been able to raise equity and pay employees partially with equity while borrowing at low rates with convertibility. No other auto companies can do this. If Ford or GM diluted its shareholders the way Tesla does, they’d both be turned into penny stocks.

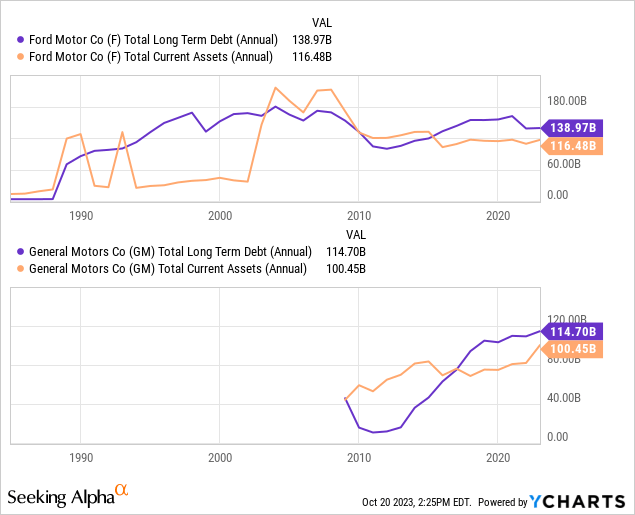

Compared to Ford and GM

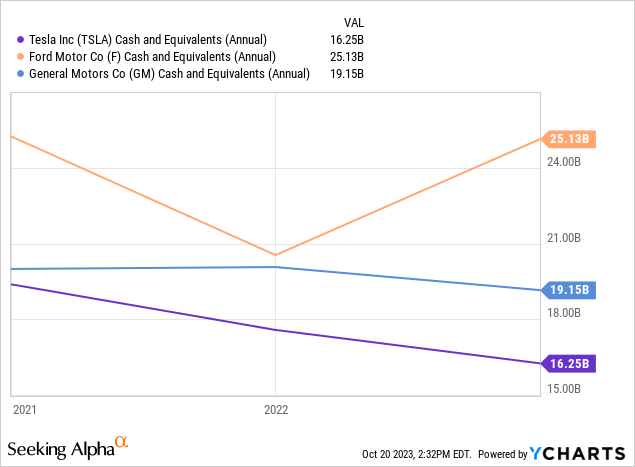

With Tesla only having about $3 Billion in LT debt, ample cash, and achieving much of what they have achieved with equity financing, there’s no comparison. Rates keep rising, but both Ford and General Motors sit under a mountain of debt with ongoing strikes. While some borrowing rates can be offset with cash equivalents yielding their own income, let’s see where Ford and GM’s cash pile sits as compared to Tesla:

While both are running ahead of Tesla on an average annual basis, the percentage of cash equivalents to debt looks like the following:

- Ford: 18% cash as a percentage of debt

- GM: 16% cash as a percentage of debt

- Tesla: cash 8 X debt.

Getting a 5% yield on cash can only offset a small portion of Ford and GM’s interest payments, while Tesla can achieve a positive net interest income to the tune of 762 million dollars on a TTM basis and sure to increase. Some long-term securities decrease net interest expense for Ford and GM over just the cash equivalents, but they still have a negative value for interest expense and proportionality more maturities upcoming.

Earnings call doesn’t encourage a return to growth anytime soon

From the Q3 transcript with commentary by Elon Musk and Vaibhav Teneja (emphasis added):

EPS of $0.66 misses by $0.07 | Revenue of $23.35B (8.84% Y/Y) misses by $794.43M.

Regarding energy storage, we deployed 4 gigawatt hours of energy of storage products in Q3. And as this business grows, the energy division is becoming our highest margin business. Energy and service now contribute over $0.5 billion to quarterly profit.

In Mexico, we’re laying the groundwork to begin construction and doing all the long lead items. But I think we want to just get a sense for what the global economy is like before we go full tilt on the Mexico factory. I’m worried about the high interest rate environment that we’re in. I just can’t emphasize this enough that the vast majority of people buying a car is about the monthly payment. And as interest rates rise, the proportion of that monthly payment that is interest increases naturally.

[regarding cybertruck] it’s difficult to going from a prototype to volume production, it’s like 10,000% harder to get to volume production than to make a prototype in the first place, and then it is even harder than that to reach positive cash flow.

On the operating expenses front, R&D expenses continued to rise due to Cybertruck prototype builds and pilot production testing combined with spend on AI technologies like full self-driving, Optimus and Dojo. We have and will continue to make investments in these areas, and hence our capital expenditure and R&D will continue to grow in the near term.

Elon Musk sees the consumer weakening in this macro environment. This would indicate a pullback in building out the Mexico plant that was ultimately another route to improve margins. However, he seems to have underestimated how expensive it would be to bring Cybertruck to market and all the R&D expenses that would go along with it. Several fund managers are fighting to get Tesla to spend more on advertising, but it seems doubtful with Musk’s current focus on preserving cash for R&D.

Furthermore, if the share price sees more downward pressure, share dilution may need to be curbed to preserve EPS estimates and not create a self-perpetuating series of earnings misses. The EPS denominator needs to be smaller if the numerator continues to decrease.

Growth will return when Tesla stops being a “car” company

The energy storage business being the “highest margin” as per the earnings call is encouraging. That is one segment with mega packs and the Tesla power walls that I see being the biggest opportunity from a profit perspective. Additionally, more negative economic sentiment could lead to greater consumption of power walls as more consumers want to get off the grid and become more energy-independent in case of a disaster. I feel that the thought process is unrealistic, but I know many who are considering solar and generators for that very reason.

Revenue sources:

From Fact Set:

| Source | Percentage |

| Consumer Vehicle Manufacturing | 84.68% |

| Automotive Services | 7.48% |

| Power Generation and Support Products | 4.14% |

| Commercial Finance | 3.69% |

Seeing some progress in the revenue spread between vehicles and others. Services and power generation now up to 11% is good progress. Financing and leasing programs should get lumped in with vehicle sales putting direct vehicle sale revenue at about 88%. I can see the growth story getting back to the frontline once higher-margin businesses like the power storage, charging and software upgrades/FSD (full self-driving) become closer to 25% of the overall revenue mix.

Could Autos be the coal mine?

Looking at the balance sheets of Ford and GM, I can see the entire industry being under threat of collapse. Tesla and Toyota are the strongest automakers. When looking for a possible black swan, which everyone seems to be trying to find these days, an automaker bailout similar to what happened in the 2008 GM bankruptcy could be on the table again. Not enough attention is given to this aspect of the economy so the fewest numbers of hedges must be in place by proxy of this logic. Hopefully more eyeballs on the situation will create better dialogue.

- GM has 160K + employees

- Ford has 170K + employees.

I’m not even mentioning Stellantis here, but this number of employees is not small. I am also not saying that the Government would not bail out both companies should they face extinction. They probably will. But the next thing that would ensue would probably be a further tightening of the credit market. That can spurn all sorts of other issues.

Auto loan defaults

From Chief Economist Mark Zandi at Moody’s (emphasis added):

Low- and middle-income earners have been especially hit hard by soaring prices on everything from rent, groceries, and new and used cars despite the Federal Reserve’s attempts to tamp down stubbornly-high inflation.

This year, credit card delinquencies have hit 3.8%, while 3.6% have defaulted on their car loans, according to credit agency Equifax.

Both figures are the highest in more than 10 years.

“The increase in delinquencies and defaults is symptomatic of the tough decisions that these households are having to make right now — whether to pay their credit card bills, their rent or buy groceries,” Mark Zandi.

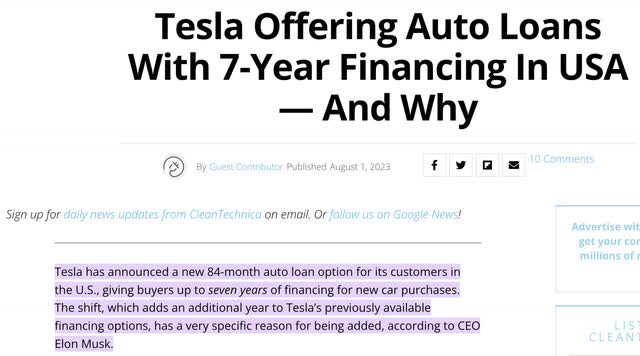

Length of auto loans

I’m sure Tesla isn’t the only one doing 84-month loans, but it should be an indicator of how affordable vehicles have now become. Not very. Soon, auto loans will be akin to home mortgages.

Yes, auto loan rates look as bad or worse than what home mortgage rates have gone through. If buying used, expect this rate to be much worse.

Conclusion

Tesla, Inc. stock is expensive. The growth story is receding, and I am sticking to Peter Lynch’s advice of never assuming more than 25% growth rates in perpetuity. That being said, Tesla has a very popular product, an industry-leading balance sheet by a mile, and more future growth catalysts than any other auto company.

It’s not possible that every auto company has a “genius” at the helm, and world governments should have let this transition play out in a more gradual fashion after all of these complicated supply chains have been figured out. The expediting may now prove to be elongating, and ultimately the first catalyst in a recession.

The main hindrances are rates, inflation, and a weakening consumer. However, Tesla is being set up to be stronger than their U.S. competition in future years for all the reasons I mentioned. Although I’ve jettisoned it, Tesla stock is worth a hold rating and accumulate it in the mid to low $100s. They’ll be back to growth eventually. But the macro picture needs vast improvement.

The “genius” regulators have ruined the growth story, both through subsidizing and forcing EVs that should have never been built by Ford and GM, and trying to raise rates to fight the inflation they created. Ultimately, I can see auto manufacturer failures as the black swan nobody expected.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information provided in this article is for general informational purposes only and should not be considered as financial advice. The author is not a licensed financial advisor, Certified Public Accountant (CPA), or any other financial professional. The content presented in this article is based on the author's personal opinions, research, and experiences, and it may not be suitable for your specific financial situation or needs.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.