Summary:

- Tesla stock has underperformed the S&P 500 by 45% since our initial bearish article in November.

- As shares have sold off and the company’s financials have remained stable, the valuation is beginning to look much more attractive.

- The potential success of Tesla’s self-driving technology could unlock a new vertical for the company, powering higher growth and a more robust multiple.

- We’re upgrading Tesla to a “Buy.”

Justin Paget/DigitalVision via Getty Images

There are a number of sayings in finance, but one of our favorites is the following: “When the time comes to buy, you won’t want to.”

Essentially, at its core, it means that the best time to buy a given asset is when everyone else is maximally bearish on it. When this happens, fears are usually overblown, and it might be possible to secure a great price for a great asset over the long term.

It’s similar to Baron Rothschild’s advice – “Buy when there is blood in the streets, even if the blood is your own.”

Today, when it comes to Tesla, Inc. (NASDAQ:TSLA), it appears as though there is blood in the streets.

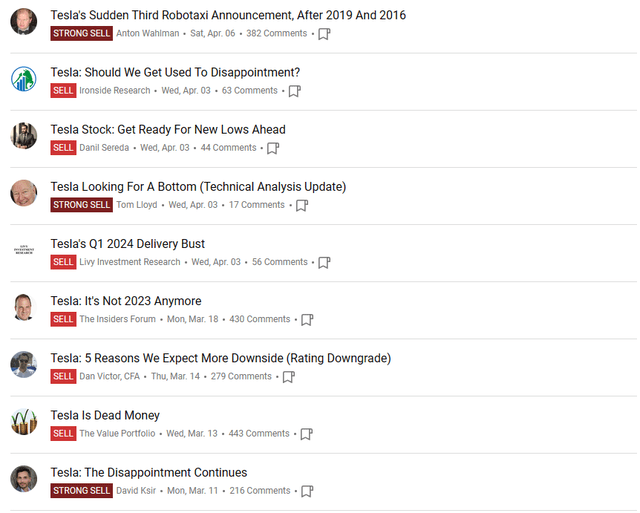

Here on Seeking Alpha, there has been a slew of negative analysis on the company recently, which has coincided with a particularly weak period for the stock:

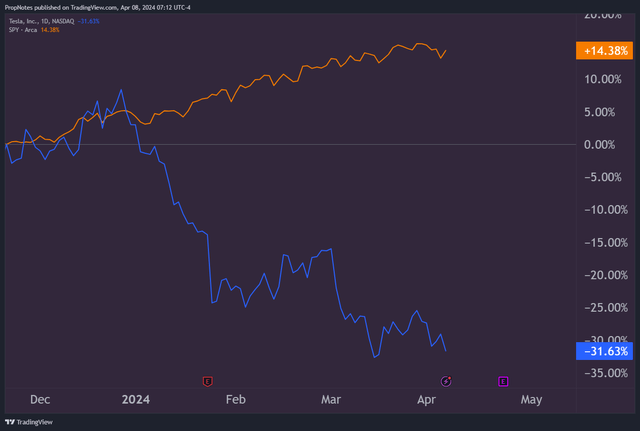

In fact, since our initial bearish coverage on Tesla last November, the stock has underperformed the S&P 500 (SP500) by a massive 45%:

This is partially due to a number of factors that we discussed in our first article, including potential margin compression, slowing growth, and a particularly expensive valuation that was completely out of line with the rest of the industry.

However, fast-forward to the present, and Tesla has continued to execute. Sure, growth has slowed, but as the stock has come in and nominal profits have continued to rise, the stock now appears more reasonably valued, and positive developments in the self-driving space could potentially unlock a wholly new, valuable vertical for the company, especially as the conventional auto business becomes more and more competitive.

Today, we’ll explore a couple of the reasons as to why we find ourselves more bullish on Tesla, as well as why we view this as a potential ‘close-your-eyes-and-buy’-type moment.

Sound good?

Let’s dive in.

Tesla’s Financials

No conversation about Tesla would be complete without a mention of the company’s financials.

In short, the company is doing well. Results have been relatively strong, liquidity is robust, and the company has a number of growth avenues available to it.

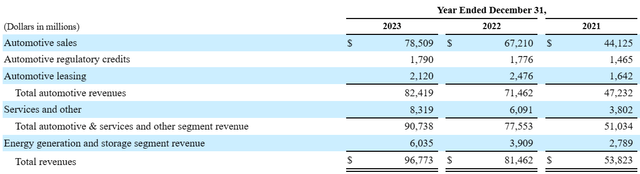

On the profitability front, TSLA recently reported all-time highs in both TTM revenue and TTM net income, bolstered by strong vehicle sales which grew more than $11 billion YoY, from $67 billion to $78 billion, and big growth in the Energy segment, which was up from $3.9 billion to $6 billion:

Gross margins were down in 2023 due to higher input costs, both in terms of labor and commodities, as well as lower sales prices across the board, but net income has remained strong due to a non-cash tax release that has kept on-paper profitability high:

Our 2023 GAAP net income was impacted by the recognition of one-time non-cash benefit of $5.9 billion from the release of valuation allowance on certain deferred tax assets. This was due to our recent history of sustained profitability and is similar to several other companies who have recently gone through a similar change in their account.

On a cash basis, FCF did fall this year somewhat, but this has been an industry-wide trend as a number of automakers combat the same macro trends of inflation and higher commodity/input prices.

That said, Tesla’s management has done a good job of being disciplined with variable operating spend, keeping OpEx essentially flat from 2022.

On the liquidity front, Tesla also remains in an incredibly strong position, boasting $29 billion in cash and equivalents, and only $2 billion in long-term debt.

With interest payments being essentially inconsequential, the recent rise in interest rates, which has affected so many other companies, hasn’t had much of an impact on shareholder equity, which should be the case going forward as well.

Finally, on the growth front, prospects appear to be improving.

In our initial article, we made the case that Tesla’s range of opportunities was narrowing, given the company’s astonishingly expensive stock price and lack of progress on producing new initiatives, like full self-drive (“FSD”) and Optimus.

In our view, Tesla was a company resting on the dual pillars of Autos and Energy, with a few interesting side projects to support those two aims.

That could be changing.

In December, Tesla launched FSD v12, which many have touted as a large upgrade over the previous self-driving models. This significant improvement is due to a full technological overhaul, which has converted the program’s decision-making capability from rote memorization of C++ code into a fully automated system powered by neural nets.

Subsequent V12.x upgrades have only improved this service further.

Skeptics have largely dismissed this upgrade as incremental, but anecdotally, we’re hearing from more and more friends about their recent experiences with Tesla EVs, and how good the new FSD model has been.

Recently, we also got a ride through New York in a Tesla Uber, and the Uber driver fully let the new FSD program navigate its way to our destination. As far as threat surfaces, New York streets are quite a difficult challenge – they’re jammed up with pedestrians, bikes, buses, trucks, and a number of other things that the new V12 FSD program handled with ease. Did we mention that it was dark, and raining?

It really felt like you were being driven around by a human driver.

Now, this served as a nice product demo, but we’re also aware that Elon has consistently promised the world when it comes to FSD and robotaxis, and consistently missed the mark. For a summary of these misses, check out fellow SA contributor Anton Wahlman‘s recent article.

That said, it appears as though momentum is building, and Elon recently announced that there would be a robotaxi unveil (presumably) later this year, in August.

In terms of the economics, there’s no question that a fully automated ride hailing service powered by Tesla FSD would boast better economics than current options like Uber (UBER) and Bolt – with lower prices for consumers, and similar margins for Tesla compared to the current ride-hailing giants.

However, the interesting part, to us, is that should this service potentially launch and expand, it could add a third pillar to Tesla’s business.

This could potentially expand financial results, and it could also power faster growth, which could re-inflate the stock’s valuation.

This has been a well-known bullish talking point for a long time, but we’re now finally seeing evidence that it could be closer than Elon’s long track record of missed estimates suggests.

Is Tesla A Good Value?

None of this would mean much if the stock was still wildly expensive, but thankfully, between the improving profitability situation and the falling stock, things now appear far more reasonable for those looking to dip their toes in.

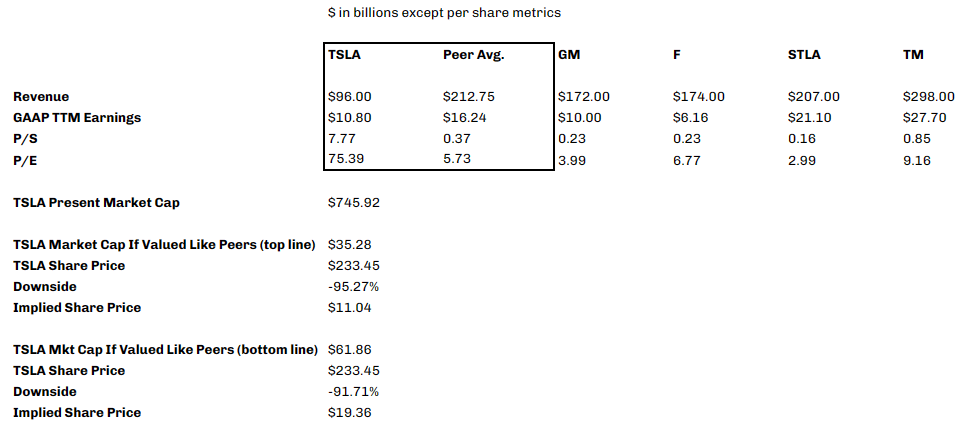

Before, we calculated that if Tesla was valued like other automakers, the stock would probably be worth somewhere between $11 and $19 per share:

PropNotes

Clearly, the market does not believe this to be the case, as Friday’s close was around $164 per share.

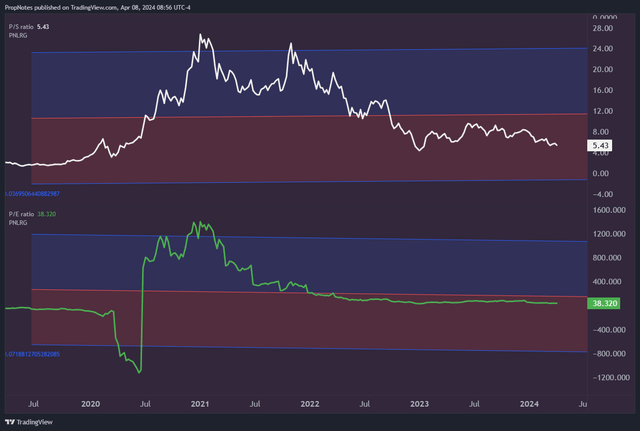

However, if Tesla were to successfully add a robotaxi fleet segment to its business – which, as a software business, would likely be very high margin – then Tesla’s current top and bottom-line multiples, which lie at 5x sales and 38x earnings, suddenly appear much more reasonable:

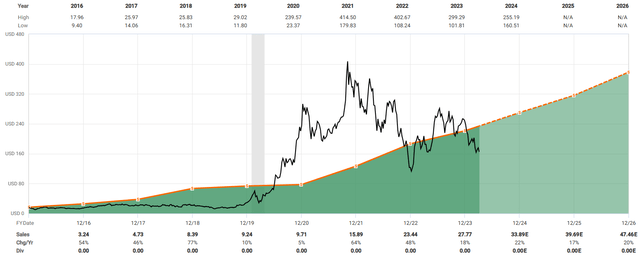

In fact, if you extrapolate out a conservative historical top-line sales multiple at 7x revenue, then, when combined with analyst’s averaged growth estimates over the next few years, TSLA shares actually look relatively cheap – for the first time in a long time:

Zooming out, the last time that Tesla traded at a low 5x handle multiple was in late December 2022, which proved to be a concrete bottom in the stock.

Almost a year and a half on now from that price plunge, things are back at that point, and we’re comfortable saying that the risks are now firmly to the upside, as maximal bearish chatter swells, and the price continues to dip.

Remember – when the time comes to buy, you won’t want to.

Risks

There are a number of risks to our “Buy” thesis.

First, we could be too early to the robotaxi thesis, as so many other analysts before us have been. It could take more months, or even more years, for a fully functional ride hailing service to launch, if one even launches at all.

That said, momentum seems to be building towards this new business driver, which, we think, could send the stock on another leg higher.

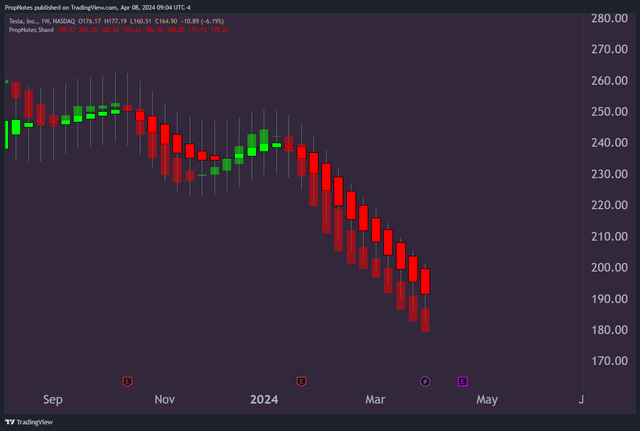

Additionally, negative momentum in the stock has been strong, and catching a falling knife is a great way to get cut:

Our weekly momentum indicator, which is based on a smoothed Heiken Ashi setup, shows that things are still firmly “Red.”

Plus, with a “true” base of value, (as an auto company) at a price WAY lower than where things are currently trading, there’s still plenty of room for negative sentiment around FSD and robotaxis to send the stock lower. With so much speculation built into the valuation, the “floor” of value could take a while to find.

Just because something appears to be a good value doesn’t mean that the market will agree anytime soon.

Summary

That said, if you’re on the sidelines, now appears to be as good a time as any to begin snapping up shares. We think that over the long term, Tesla’s business will likely remain supported by its two key pillars in Auto and Energy.

Analysts are projecting solid top and bottom-line results as the company continues to streamline operations and test out advertising formats, which makes the stock relatively attractive on valuation and growth alone.

Then, if robotaxis end up coming to fruition, the current price really looks like a steal.

While there are some risks around the timing of these developments, as well as how the stock still appears to be trending lower, on balance, we’re upgrading Tesla to “Buy.”

Cheers!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.