Summary:

- Tesla, Inc.’s Q1 delivery report fell short of expectations, causing shares to drop.

- The dip in deliveries is likely temporary and does not change Tesla’s long term delivery trajectory.

- EPS estimates have reset to the downside as investors expect continual margin pressure.

- Despite risks and concerns, Tesla’s valuation and risk profile have become more attractive, making it a bargain for EV investors ahead of Q1.

Slaven Vlasic/Getty Images Entertainment

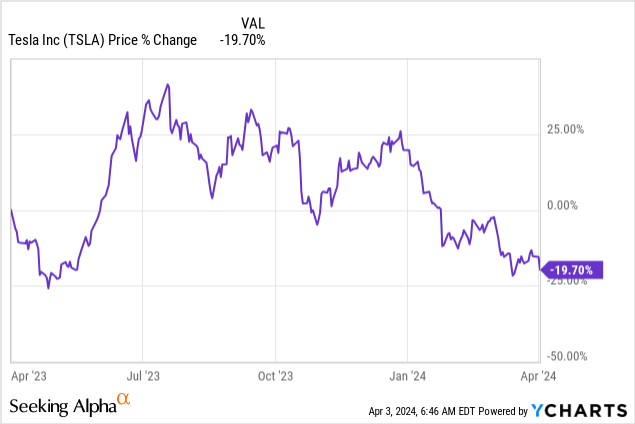

Shares of Tesla, Inc. (NASDAQ:TSLA) came under new selling pressure this week after the electric vehicle (“EV”) maker disappointed with its latest delivery report. Tesla delivered “only” 386,810 cars in Q1 ’24, which drastically underperformed delivery expectations. However, Tesla saw a boost in deliveries in China, which is facing challenges of its own, including growing competition and pricing pressure.

I believe the slowdown in the global EV market is causing more fear than warranted given Tesla’s long term upward trajectory in deliveries. Thus, I see Tesla stock as a strong rebound candidate in 2024!

Previous rating

I rated shares of Tesla a hold after the electric vehicle company disclosed considerable margin pressure in the third quarter that showed that the EV market was becoming more competitive: “Overreaction To Cybertruck Comments Creates Long-Term Opportunity.” The Q1 ’24 delivery report was not great, but it likely triggered an overreaction that long term-minded investors can exploit. With fears over a prolonged EV market slowdown, EPS estimates for Q1 ’24 trending down and investor sentiment taking a drastic turn compared to last year, I believe there is a contrarian investment opportunity here. For those reasons, I am upgrading my rating of Tesla from hold to buy.

Making sense of the latest delivery report and reasons for rating change

Tesla’s delivery report showed that the EV maker produced 433,371 electric vehicles in Q1’24 and delivered 386,810 cars in Q1’24. In the year-earlier period, Tesla produced 440,808 electric vehicles (-1.7% Y/Y) and delivered 422,875 electric vehicles (-8.5% Y/Y). The delivery accomplishment also fell way short of analyst expectations, which called for 449,080 deliveries (-13.8%), resulting in the biggest sales-miss for Tesla ever. It was Tesla’s first drop in deliveries, on a year over year basis, since Q2 ’20. The EV maker named its production ramp for the Model 3 as a reason for the drop in deliveries in the first-quarter.

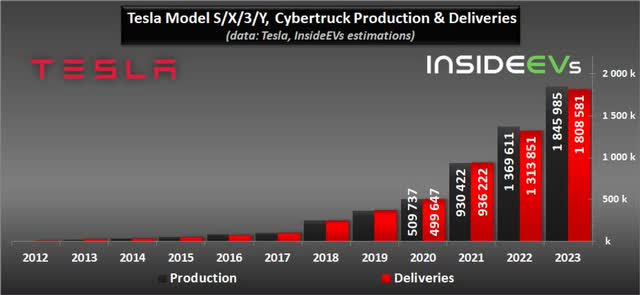

While it is easy to jump on the bandwagon and criticize Tesla for its delivery shortcomings, the bigger picture is still overwhelmingly in favor of the EV company. While Tesla was overtaken by BYD Company (OTCPK:BYDDF) in the fourth-quarter as the world’s largest EV maker by output, the U.S. company has grown its deliveries over a long period of time and consistently reached new delivery records, including last year, which is when Tesla delivered 38% Y/Y delivery growth. Tesla’s FY 2023 delivery records were driven chiefly by the continual popularity of the Model 3. A catalyst for incremental delivery growth in FY 2024 could come from the recent start of deliveries for the Cybertruck as well as the revamped Model 3, which became available in the U.S. in January.

The longer-term trend in Tesla’s production/deliveries numbers should be more important than a temporary setback. Tesla’s delivery ramp still looks pretty impressive to me…

A look at Tesla’s Q1 China numbers shows a more mixed picture. Tesla did reasonably well in China in March, with total deliveries of 89,064 vehicles, showing 48% month-over-month growth. China is also suffering from a slowdown in demand, which has caused companies like Li Auto (LI) to warn about its delivery potential in the first-quarter. The rebound in Tesla’s March sales in China also strongly suggests that the delivery picture is not as bleak as some media reports would want investors to believe.

Bloomberg

Implications for Tesla’s Q1 ’24 earnings report

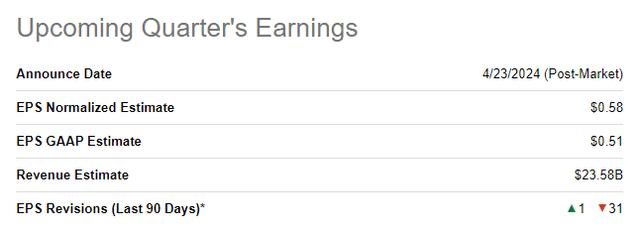

Tesla Q1 ’24 earnings expectations are likely to continue to drop after the EV company submitted its delivery report for the first-quarter on April 2, 2024. With slowing EV growth and pressure on Tesla’s deliveries, investors are likely to lower their expectations ahead of the earnings release as well which may weigh on the company’s valuation in the short term. Analysts currently model $0.58 per-share in Q1 ’24 earnings for Tesla, and analysts have revised their earnings estimates down a massive 31 times in the last 90 days.

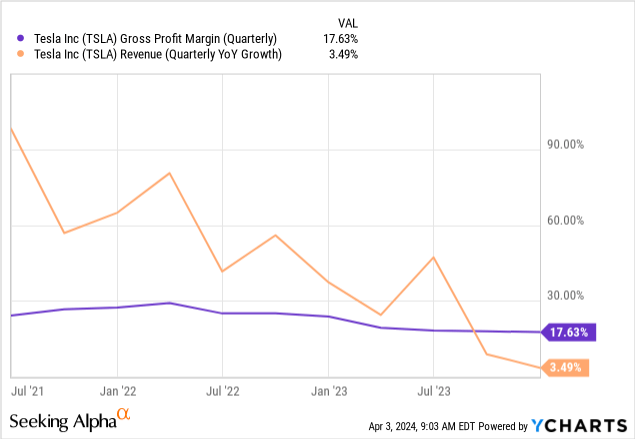

The delivery report also indicates that Tesla is likely going to see slower top line growth as well more pressure on its gross margins… which has become a point of concern for many investors lately. Tesla’s revenue growth slowed to 3% in the last quarter while its gross margins fell to 17.6%, showing a 6.1 PP contraction year over year. In the short term, these pressures will likely continue, and I expect a sequential drop-off in both operating and gross profit margins when the company releases Q1 earnings on April 23, 2024. However, Tesla’s valuation is now so attractive relative to the company’s historical valuation, that a contrarian purchase can make a lot of sense for long-term investors at this point in time, in my opinion.

Tesla’s valuation sends a contrarian buy signal

Despite some points of weakness being revealed in Tesla’s Q1 ’24 delivery report, I believe that Tesla is now an exceptional bargain for EV investors from a valuation point of view. The market segment has seen its fair share of negative press lately, with electric vehicle maker Fisker (OTC:FSRN) struggling for its survival and other China-based EV manufacturers also carefully managing delivery expectations. The changing market perceptions have weighed heavily on Tesla’s valuation, and shares are trading just 10% above the 1-year low of $152.37.

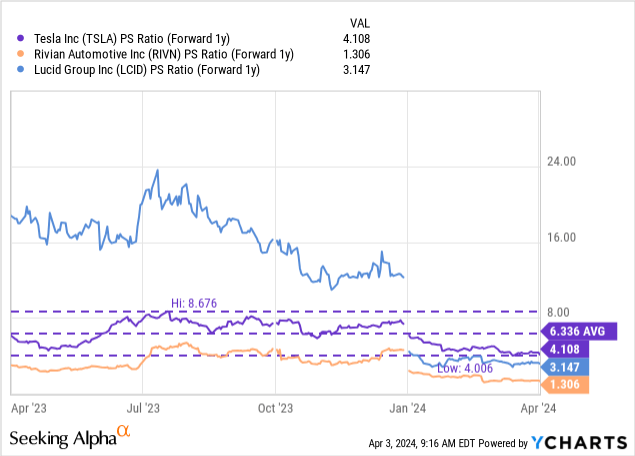

Tesla is currently valued at a P/S ratio of 4.1X. This is quite low for Tesla, which has historically traded at much higher price-to-revenue ratios. I am using a revenue-based multiplier for the EV maker since most other large-cap electric vehicle companies are not yet profitable (with the exception of BYD). Tesla’s 4.1X P/S ratio implies a massive 35% discount to Tesla’s 1-year average price-to-revenue ratio.

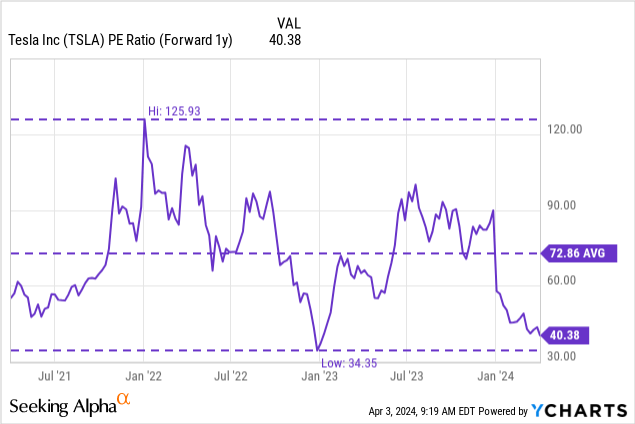

Tesla’s is now also valued at less than half the P/E ratio the company’s shares traded at the beginning of the year. The FY 2025 P/E ratio for Tesla has fallen to only 40.4X, while the average P/E ratio in the last three years was 72.9X.

If Tesla revalued merely to its 3-year average earnings-based valuation ratio, shares of Tesla could have a fair value of $300. Readers should also note in the chart below that Tesla’s P/E ratio has been highly volatile over time as well, with the P/E ratio bottoming out at 34X in January 2023 (which is when Tesla first started to announce price cuts) and topping out at 126X in early 2022 (when the economy recovered from COVID-19).

Given the P/E valuation history of Tesla, I believe investors are overly bearish about the company’s delivery update, and Tesla has routinely recovered from rapid sentiment changes. If history repeats itself, which I believe it will, this may be just another contrarian investment opportunity for long term investors.

Risks with Tesla

There are number of risks for Tesla… which is still by far the largest EV manufacturer by output and market cap in the U.S. With a global slowdown in EV sales, the immediate risk is continual gross margin pressure, which is likely what investors are going to see when Tesla releases first-quarter earnings on April 23, 2024. Weaker margins and free cash flow, in the short term, should therefore be expected. What would change my mind about Tesla in terms of rating would be if the EV maker were to see a consistent decline in delivery rates and weak demand for the revamped Model 3/Cybertruck.

Final thoughts

Tesla’s Q1 ’24 delivery report caused shares of Tesla to slide 5%, and they are now trading near 1-year lows. Investor sentiment ahead of Tesla’s Q1 ’24 earnings release has taken a serious hit, and analysts are likely to lower their EPS expectations further ahead of the earnings report on April 23, 2024… creating a low bar for Tesla to step over. While there are legitimate concerns about a slowdown in the EV market, Tesla’s March deliveries in China were solid, but got surprisingly little attention. Tesla’s factories still churned out more than 400k electric vehicles in Q1, and the long-term growth trajectory is still pretty much intact.

Given that Tesla’s valuation as well as risk profile have become significantly more attractive lately, I believe that negative news are sufficiently priced into Tesla’s valuation at this point. Therefore, I see the current consolidation as another unique moment in time to buy Tesla, Inc. shares aggressively and to capitalize on weak investor sentiment!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, BYD, LI, NIO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.