Summary:

- Tesla, Inc. is facing a persistent slowdown in demand and increased competition in the EV market, impacting its pricing strategy.

- The company has experienced significant declines in all key metrics, including negative revenue growth and FCF deterioration.

- Despite price cuts, Tesla has seen a decline in total deliveries, particularly in China, where competition and geopolitical tensions pose risks.

- Many rounds of job cuts have also been implemented, implying a cautious growth outlook in the mid and long term.

- The stock is still trading at a premium valuation of 74x P/E FTM after almost 30% selloff YTD.

makasana

Investment Thesis

Tesla, Inc. (NASDAQ:TSLA) is facing a significant slowdown in demand despite a series of price cuts, partially due to cyclical headwinds in the U.S. electric vehicle (EV) market. The EV market has become increasingly competitive, with more players introducing their own electric vehicles, which is impacting Tesla’s pricing strategy. I think a structural demand slowdown for Tesla vehicles cannot be ruled out unless they can differentiate themselves among competitors.

In my previous article, I maintained a sell rating due to deteriorating gross margins and sluggish demand following those price cuts. Since then, the stock has declined by over 30% as TSLA’s fundamentals show no signs of improvement. Meanwhile, the stock continues to trade at a lofty valuation. Therefore, I reiterate my sell rating. Particularly, Tesla’s revenue growth turned negative for the first time since 2Q FY2020.

Significant Slowdown in All Key Metrics

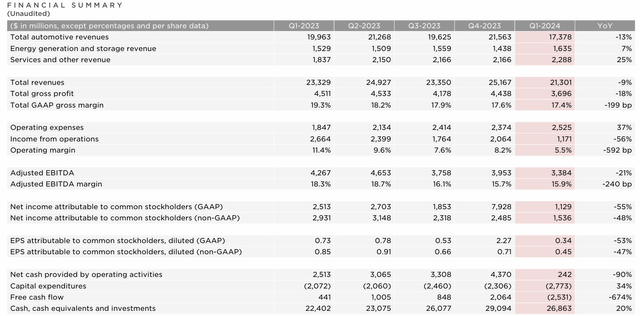

For TSLA bulls, no doubt, they are betting on a turnaround story. Looking at the table, we observe that the carmaker is suffering from a double-digit decline across all metrics except for a high single digit decline in revenue. Not only has the company experienced negative revenue growth, but its gross margin continues to deteriorate since my previous analysis. Weak top-line growth and margin deterioration resulted in a 47% YoY decline in non-GAAP EPS in the last quarter, putting significant upward pressure on the stock’s P/E multiple. Notably, the company has lost $2.5 billion in FCF due to a 90% YoY decline in cash flow from operating activities.

As for the previous quarters, if we exclude stock-based compensation from the cost of revenues, TSLA has maintained a YoY decline in operating income over the last five consecutive quarters since Q1 FY2023. The gross margin has been deteriorating over the last six consecutive quarters since Q3 FY2022, with the current gross margin of 17.4% being the lowest since Q3 FY2019. I believe the significant deterioration in the company’s fundamentals is largely driven by cyclical weakness in demand and increased competition in the EV industry, particularly in China.

Slowdown in Demand

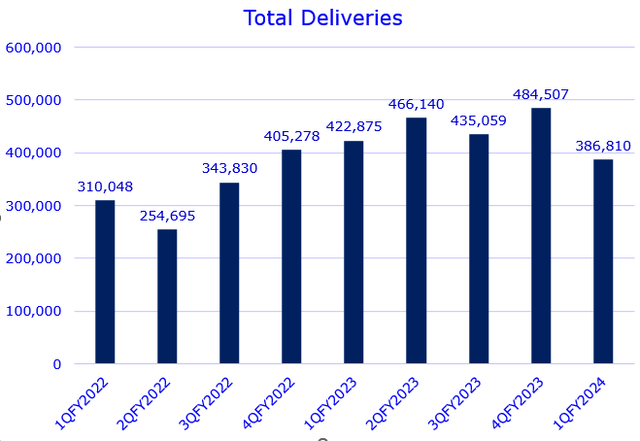

Despite TSLA’s price cuts since last year, we recently observed a 20% YoY drop in total deliveries in 1Q FY2024. This suggests that the price reductions have not succeeded in stimulating the weakening EV demand. The press release attributed the slowdown largely to the early phase of the production ramp of the updated Model 3 at Fremont factory and factory shutdowns resulting from shipping diversions caused by the Red Sea conflict and an arson attack at Gigafactory Berlin.

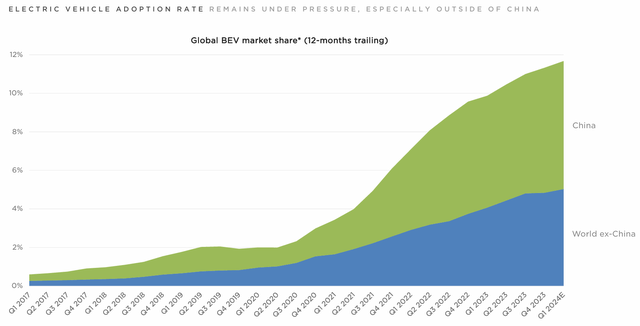

Let’s look at the chart above, we see that China holds the largest EV market share globally. Although Chinese consumers reduce overall spendings in a post-pandemic economy, China’s EV market has been resilient. According to Counterpoint, China’s EV sales increased by 28% YoY, whereas the US saw a modest 2% YoY growth. TSLA should have a growth tailwind in China. According to Reuters, Tesla’s China-made EV sales declined by 18% YoY in April this year. I believe that intensified competition in China has compelled domestic EV makers to aggressively reduce prices to compete for a limited share of the growing market.

Additionally, geopolitical tensions between the U.S. and China pose another risk to the company. Over the past decade, the Chinese government has provided generous subsidies, tax incentives, and favorable license-plate policies for buyers. Therefore, there’s uncertainty regarding whether the government may prioritize domestic EV makers over foreign companies like TSLA in the current geopolitical environment.

Multiple Rounds of Job Cuts

TSLA employed more than 140,000 people globally before initiating its unprecedented job cuts. In April, the company announced that it was laying off over 10% of its workforce, including the departure of two senior executives. According to Bloomberg, CEO Elon Musk had previously advocated for a 20% reduction in the workforce. Additionally, during the 1Q FY2024 earnings call, he mentioned that new models would be produced on the same manufacturing lines as the current vehicle lineup to enhance production efficiency. I believe these decisions indicate the company’s need to reset its growth outlook in the mid-to-long term.

What Could Go Wrong

We know that TSLA stock is highly volatile and is frequently impacted by headline news. For example, the stock jumped 15% in April following the approval from government officials to deploy its driver-assistance system in China. However, it has since declined by 8% whereas the S&P 500 was up 3%, as investors remain concerned about the company’s gloomy growth outlook.

In my view, the stock could see significant upside potential if TSLA can successfully navigate a rebound in demand and revenue, particularly if the overall EV market shows signs of early recovery in the U.S. In addition, the street consensus has been largely reset, presenting a low basis for beating expectations going forward, especially given the negative growth in revenue in the last quarter.

Furthermore, a 10-20% reduction in the workforce will likely lower operating costs, potentially boosting the company’s margins and bottom line. This is particularly important as its operating margin has suffered from negative year-over-year declines in multiple quarters.

Valuation

Not surprisingly, TSLA is currently trading at a premium valuation, as it has consistently done over the past years. With the company expected to show negative YoY EPS growth in FY2024, its non-GAAP P/E FTM stands at 74x, significantly higher than the TTM basis of 57x. This premium valuation largely reflects expectations regarding the company’s AI training capacity, more advanced FSD system, and potential demand rebound in the future. I believe that this valuation is also influenced by Elon Musk’s past executions and outstanding track record, as investors believe in his ability to navigate the company through its growth turnaround story.

Conclusion

In sum, TSLA faces significant hurdles amid a demand slowdown, margin compression, and increased competition, particularly in key markets like China. Despite initiatives such as price cuts to boost demand and workforce reductions to improve margins, investors have not yet seen the light at the end of the tunnel. While recent positive headline news, like regulatory approvals in China, broader concerns linger over TSLA’s ability to navigate growth rebound like we saw during the pandemic, especially with projected negative EPS growth in FY2024. The company’s premium valuation, hinging on future AI capacity and demand recovery, remains a focal point. Based on these factors above, I reiterate my sell rating on Tesla, Inc. stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.