Summary:

- Tesla, Inc. stock has rallied 60% since a disappointing Q1 FY2023, driven by a tech rally and market sentiment toward a “soft landing” scenario.

- Recent positive catalysts include growing adoption of Tesla’s North American Charging Standard and China’s tax breaks for electric vehicles.

- However, the rally may not be sustainable due to weak fundamentals and earnings revisions, leading to my downgrade of Tesla stock to sell.

Dimitrios Kambouris

A 60% Rally After a Disappointing Quarter

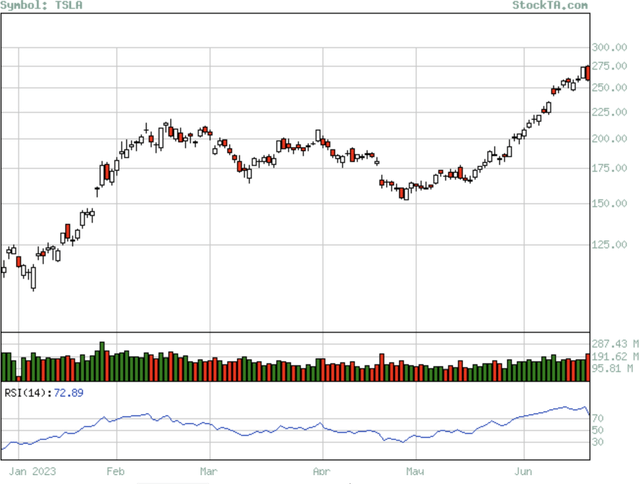

Tesla, Inc. (NASDAQ:TSLA) has reignited its rocket engine in the wake of an AI-driven thematic rally, pushing its stock price to the moon after a disappointing Q1 2023. Since then, the stock has surged by 60%, with its momentum reaching an extreme level. The Relative Strength Index (RSI) has consistently remained above 70 in the past few days, indicating an overbought signal.

While there have been recent positive catalysts that could potentially bolster the stock’s momentum, such as charging standards and China EV subsidies, I believe the recent rally is primarily attributed to the broader tech rally and market sentiment surrounding a “soft landing” scenario. The lack of solid support from its fundamentals and estimates revisions leads me to believe that the recent price action is not sustainable. Consequently, considering the warning signs from both technical and fundamental perspectives, I’m downgrading TSLA to a sell rating. In the following discussion, I’ll explain why these recent developments are unlikely to significantly improve the company’s fundamentals, particularly in the near term.

Growing Adoptions on TESLA’s NACS

Recently, several of Tesla’s EV competitors, including Rivian (RIVN), General Motors (GM), and Ford (F), have announced their partnership with Tesla’s North American Charging Standard (NACS). These partnerships allow them to use their adapters to connect to Tesla’s charger network. I believe it represents a major step toward a wider acceptance of the Tesla standard, which has attracted a lot of attention from the public.

However, these announcements unlikely to improve TSLA’s vehicle delivery targets and auto revenue growth. As I mentioned earlier, concerns persist regarding Tesla’s auto growth deceleration and margin contraction in the face of a demand slowdown and ongoing price reductions in Q1 2023. Therefore, it’s necessary to adjust its valuation accordingly.

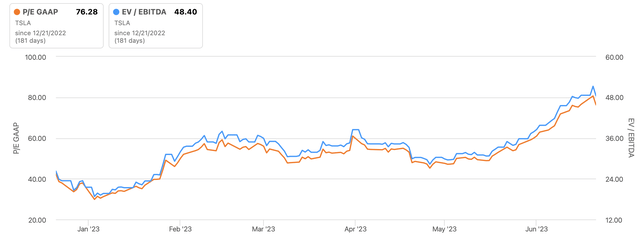

Interestingly, I’ve observed that every time a competitor adopted TSLA’s charging network, the stock price rallies by 4%-5%. I believe this reaction may be exaggerated. TSLA’s P/E TTM has expanded from 49x since my initiation coverage date to 76x, indicating that the recent surge in stock price is primarily driven by multiple expansion rather than fundamental factors.

China’s Tax Break for EVs

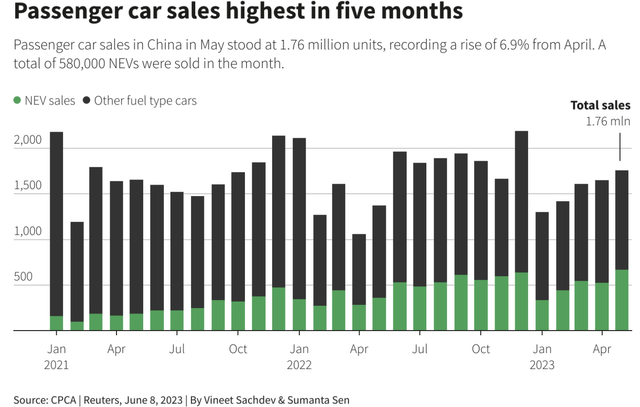

This week, China introduced a substantial tax break package worth 520 billion yuan over a four-year period. This package is primarily aimed at EV and other environmentally friendly cars. This is the most aggressive tax incentive so far in the automotive industry. The purpose is to stimulate growth in the face of slower auto sales. I believe it’s possible that the tax break can potentially boost demand for Tesla. However, we should keep in mind that this new policy will also benefit other domestic EV automakers as well. Most importantly, we haven’t seen a significant economic recovery in China.

As we can see from the chart, I admit that the passenger car sales in China have been improved recently, but overall consumption remains weak due to a lack of significant stimulus policies. According to Bloomberg article, EVs and plug-in hybrids deliveries increased by approximately 36% between January and April in CY2023, which is considerably lower compared to the 128% growth during the same period last year.

Considering the extensive price cuts and the slower recovery in China, I believe that the tax break is unlikely to immediately translate into a substantial revenue boost for TSLA. Therefore, it would be prudent to see several positive earnings results before confirming any significant growth inflection point in the near term.

Technically Bearish

From a technical perspective, when a stock’s RSI exceeds 70, it indicates that the stock is in an overbought condition, which is generally seen as a bearish signal. Despite having a recent 6% pullback, TSLA’s RSI currently stands at 73, suggesting that the stock still remains in overbought territory. Additionally, we notice that TSLA’s 50-day, 100-day, and 200-day moving averages are in the range of $190 to $200, indicating that the stock has experienced rapid and significant upward movement.

However, it’s worth noting that these moving averages could potentially act as technical support levels if the downtrend continues, suggesting a potential drawdown of approximately 33%.

Significant Multiple Expansion

As of now, TSLA’s P/E GAAP TTM stands at 76x, which represents a significant increase from the 48x observed after the 1Q FY2024 earnings release. This implies a substantial multiple expansion of 58%. When factoring in the earnings consensus for the next twelve months, the stock is trading even higher at 90x P/E. This can be attributed to the market’s expectation of a YoY decline in TSLA’s earnings for the current fiscal year.

Furthermore, we have seen a 60% expansion in TSLA’s EV/EBITDA GAAP since the last earnings release. This expansion can be justified by examining the unchanged earnings and revenue revisions made by the street’s outlook on TSLA.

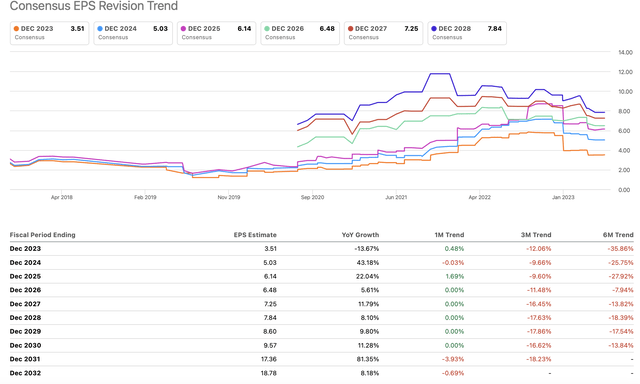

When examining the table, it’s evident that analysts have not made any earnings revisions based on a flat 1M trend, despite the positive headline news. However, over the past 6 months, analysts have made substantial downward revisions to the company’s EPS estimates, with reductions of 36% and 26% for CY2023 and CY2024, respectively.

This indicates that the recent rally in TSLA’s stock price is not driven by positive underlying fundamentals, as there have been no significant upward revisions to earnings estimates that would justify the substantial multiple expansion. As a result, TSLA would face a significant downside risk if the Fed continues being hawkish and signals further rate hikes later this year. High valuation stocks are particularly vulnerable to high long-term real interest rates. If headline inflation decreases while nominal interest rates remain elevated for an extended period, the real interest rate would rise, posing a challenge for stocks like TSLA with lofty valuations.

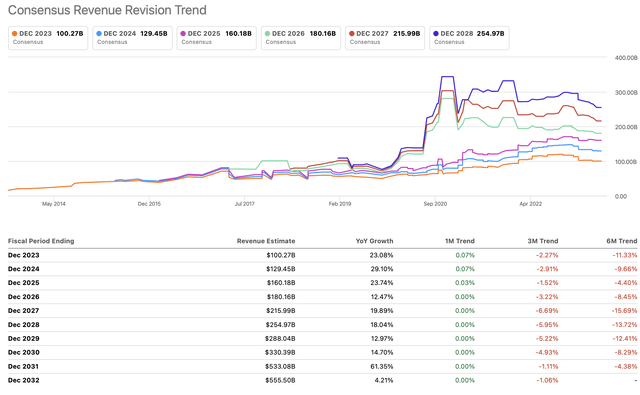

Furthermore, it’s worth mentioning that the street has not made any significant changes to TSLA’s revenue revision either, as indicated by the relatively flat 1M trend. This lack of upward revision suggests that there has been no significant improvement in revenue expectations over the past month. Notably, analysts have actually reduced the revenue consensus by 11.3% and 9.7% for CY2023 and CY2024, respectively, over the last 6 months.

Conclusion

In sum, from a technical standpoint, Tesla stock remains in an overbought territory with a high RSI, and its moving averages indicate a potential maximum drawdown before reaching a strong resistance level. On the valuation front, TSLA’s P/E ratio has significantly expanded, and its EV/EBITDA multiple has also seen a notable increase. However, despite these multiples expanding, there has been a lack of positive revenue and earnings revisions from analysts.

This suggests that the recent rally in TSLA’s stock price may not be driven by improved fundamentals or upward revisions in earnings and revenue expectations. Investors may be running ahead of the street consensus, potentially pricing in future tailwinds, or the rally may be fueled primarily by short-term momentum.

Looking ahead, TSLA faces downside risks if the Federal Reserve maintains a hawkish stance and indicates further rate hikes, as high valuation stocks like TSLA are vulnerable to higher real interest rates. Additionally, the lack of significant positive earnings and revenue revisions raises concerns about the sustainability of the recent price action. Therefore, I’m bearish on Tesla, Inc. stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.