Summary:

- The upcoming Robotaxi event on October 10, 2024, may introduce new autonomous technologies and may unveil the next generation of the Tesla AI-enabled ecosystem.

- Tesla’s Optimus robot and AI5 chip could revolutionize labor-intensive industries and enhance operational efficiency, offering long-term upside potential beyond the current price target.

- Despite potential headwinds in vehicle sales, Tesla’s energy storage segment shows substantial growth, providing a compelling investment case amid rising demand for baseload capacity.

imaginima

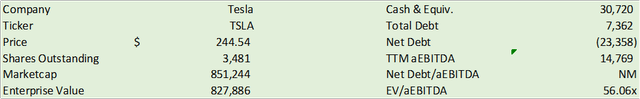

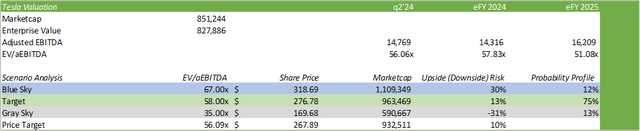

Tesla’s (NASDAQ:TSLA) robotaxi event on October 10, 2024, is said to be one of the most anticipated events of the year for the automaker-turned-AI/robotics firm as Elon Musk is expected to unveil a swath of new technologies. This event may lay out the groundwork for the next generation of the company as it transforms itself beyond just being an electric vehicle manufacturer. Given TSLA’s current valuation of 56x TTM EV/aEBITDA, I believe the robotaxi event is priced into shares and any movement post-event will be the result of tactical & momentum trading. I rate TSLA shares with a HOLD rating with a price target of $267/share at 56x eFY25 EV/aEBITDA.

Robotaxi Day & Operations

Robotaxi Day is coming up on October 10, 2024, with mixed expectations for the stock coming out of the event. CFRA analyst Garrett Nelson is skeptical of the event as Mr. Musk has a long history of overpromising and underdelivering on timelines. Mr. Nelson anticipates investors will sell the news post-event.

Elon Musk has a long history of exaggerating the timeline that various Tesla products will be brought to market. We think the Robotaxi will be no different.

Garrett Nelson, Analyst CFRA

Dan Ives of Wedbush is a bit more upbeat on the upcoming event as it may roll in a new era of autonomous technology.

Tesla is the most undervalued AI name in the market and we expect Musk & Co. to unveil some game-changing autonomous technology at this event

Dan Ives, Analyst Wedbush

I’m expecting Mr. Musk to present the broader umbrella of autonomy across the portfolio, including his plans for the existing fleet of Tesla vehicles on the road, Optimus, and how he plans on integrating xAI across the ecosystem.

Mr. Musk voiced gaudy expectations for the growth trajectory of these projects in Tesla’s q2’24 earnings call, suggesting that Optimus may have a demand trajectory in the billions to cater to every human and manufacturing-type job. Though the personal robot companion trajectory may not be as grandiose as suggested, placing an Optimus humanoid robot in every manufacturing position, – let alone physical labor-type of job – has a strong economic outlay and may not be as farfetched as one may think.

At $20,000 per humanoid robot, Optimus may be the labor force of the future. I believe that Optimus will be capable of executing repetitive tasks across distribution centers and manufacturing jobs, and if the robot is designed to be connected to the broader ecosystem with incorporated deep learning and neural networks, the humanoid will likely have the ability to adapt to its surroundings as a human. Though a rudimentary comparison from a person’s perspective, the 2021 Ryan Reynolds movie Free Guy [film] presented a program executing a complex task like learning how to make a cappuccino through trial and error on its own accord. As simple as this sounds, a program creating something out of nothing is incomprehensible. Translating this to other human-like features, Optimus very well could be developed with xAI’s AGI model when commercially available, which may make Optimus as close to replicating human behavior as possible.

With the advanced features in mind, Optimus may be the answer to improved operations in historically labor-intensive industries, such as the automotive industry. Companies like Amazon (AMZN) may bolster their use of robotics in warehouse functions and create a completely autonomous facility. Having an automated facility can allow for improved operations through 24/7, lower operating expenses, and elimination of unionization as well as other productivity risks. I just hope that when the deal goes through, Amazon calls its fleet Optimus Prime.

Though the robotaxi event is geared towards unveiling the robotaxi, I do not believe that there will be an impactful detail unveiled at the event that investors aren’t already aware of. The premise of the robotaxi is to both manage a fleet as well as allow for Tesla vehicle owners to allow for their vehicles to be utilized as robotaxis around the clock. This means that if a Tesla owner wishes to partake in the program, they may opt in to allow for their vehicle to transport customers while the owner is at home or at work and not utilizing their vehicle. Tesla’s plan for monetization is to split the earnings between the vehicle owner and Tesla.

Perhaps Mr. Musk will reveal more information relating to the broader xAI ecosystem and how the vehicles and robotics will integrate with the AI factory being built out at the Texas gigafactory. A compelling argument for this broad technology integration may drive the share price upward as the story is physically presented.

Perhaps Mr. Musk will reveal more details on the Tesla AI5 chip, which he suggested will provide capabilities comparable to the Nvidia (NVDA) B200. Management anticipates the chip to begin production in 2025 with scaled production coming into play in 2026. Despite the easing of the supply chain for the H100s, Tesla will be moving to adopt the AI5 chip across its ecosystem, including vehicles and humanoid robots. Developing an in-house chip poses significant advantages that cannot be met with 3rd party hardware. Similar to the hyperscalers’ use of custom silicon, I believe AI5 will be purpose-built and offer significant performance improvements across the Tesla ecosystem as the chip will not necessarily need to be developed to cater to the broader market. Mr. Musk suggested that this chip will be leveraged in their AI factory at the Texas gigafactory as Tesla builds its own in-house data center.

One of the major growth factors discussed in the q2’24 earnings call is Tesla’s energy storage business. I believe that this segment holds a compelling investment case given the increased demand for baseload capacity as hyperscalers construct their regional data center footprint. Accordingly, the global data center footprint is expected to grow at a 23% CAGR through 2030 to support the growing demand for AI training and inferencing. I believe that battery storage capacity will be a key component for data centers as an uninterrupted power supply, especially if data centers are connected to the grid. Given that sourcing electricity is one of the largest constraints for the growth rate of new data centers, I suspect that sourcing electricity by any means necessary will be the initial goal before constructing sites with dedicated baseloads, whether it is natural gas, hydrogen, nuclear, wind, or solar.

Tesla Financial Position

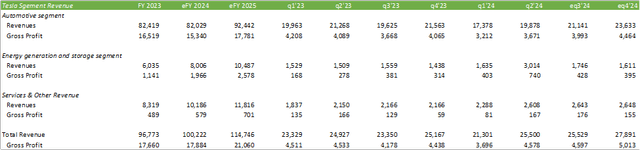

Looking to financial performance, Tesla reported a 9% year-over-year growth rate for vehicle production and 6% year-over-year vehicle deliveries for q3’24. Management suggested that the Cybertruck will be moving into high-capacity production in e2h24, which may result in improved margins as vehicle production scales. Though margins for automotive sales have been in decline as a result of competitive vehicle pricing, Tesla may realize some offset as a result of its growing energy generation & storage segment.

EG&S has experienced substantial growth throughout the last fiscal year, generating $3b in revenue with an expansive gross margin of 24.55% in q2’24. Management believes that this segment may experience significant uplift as a competitive, integrated system for solar power generation and battery storage. As mentioned in the above segment, battery storage may pose a substantial benefit in the coming years as backup baseload capacity for data centers.

Looking ahead, I believe there may be some headwinds to vehicle sales in the coming quarters as electric vehicles are gradually falling out of favor as consumers seek to purchase hybrid models. As discussed in my recent report covering EVgo (EVGO), multiple OEMs have canceled or pushed back EV and battery manufacturing programs as the market for EVs has softened. Though this may not directly impact Tesla, I believe it is worth understanding consumer preferences as these relate to the future sales of electric vehicles.

The macroeconomic environment is making purchasing new vehicles more appealing as a result of the recent Federal Funds rate cut of 50bps. Some economists are forecasting additional cuts in the order of 50bps before the end of 2024. In addition to this, Tesla is offering customers financing options that may alleviate some of the macroeconomic pressures relating to the base rate.

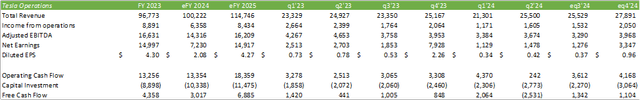

I’m forecasting Tesla to generate $25.5b in total revenue and a diluted EPS of $0.37/share for eq3’24 and $100b in total revenue and a diluted EPS of $2.08/share for eFY24.

Risks Related To Tesla

Bull Case

Tesla is moving into the next generation of the enterprise as the firm further integrates products and services into a larger compute ecosystem. The potential driving factors may include leveraging excess GPU capacity on vehicles and the soon-to-be-released Optimus for broader auxiliary AI needs. In addition to this, the robotaxi system may earn both consumers and Tesla additional income as an autonomous service to leverage vehicle downtime, potentially disrupting the larger ridesharing and taxi industry. This may also result in Tesla licensing its FSD capabilities to other automotive OEMs; however, this will likely be multiple years out before a deal materializes. Tesla’s AI5 chip may also provide added benefits to the firm as a cost-effective, energy-efficient alternative to generally built 3rd -party GPUs to power Tesla’s technology ecosystem.

Bear Case

Elon Musk has historically overpromised and underdelivered on time frames with the Robotaxi event being a prime example. Though the rationale behind pushing the data back was the result of technological improvements, this isn’t an isolated occurrence and may impact future projects. Tesla may also be in a position to push back the commercial launch date of Optimus, a product that management believes will be worth all of Tesla’s current operations combined.

Valuation & Shareholder Value

TSLA shares currently trade near their near-term midpoint at 56x TTM EV/aEBITDA, making me believe that shares have priced in any upside potential relating to the robotaxi event. New information coming out of the event may push shares in any which direction, resulting in a momentum-based trade.

Valuing TSLA shares from a fundamental perspective, I believe shares should be priced at $267/share at 56x eFY25 EV/aEBITDA. Given the limited upside potential, I am rating TSLA shares with a HOLD rating.

Longer term, TSLA shares may reveal significant upside potential as the market for Optimus materializes. Depending on how much of the estimated $20,000 flows down to cash flow, the commercial release of Optimus may provide significant upside potential well beyond my price target. In addition to this, Tesla’s internal use of Optimus across its factory floors will likely improve margins and increase operational efficiency. I believe it is prudent as an investor to keep this in the back of the mind and draw conclusions as the project materializes.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.