Summary:

- Five months ago, I wrote the article, “Tesla: The Last Bubble Standing.” Now, as Tesla melts down, I believe there are few bubbles left.

- The AAII Sentiment survey and Tesla’s collapse could signal that a new bull market is just around the corner. But, which corner?

- I’ll dig into what to expect from Tesla, as well as the broader market.

Joshua Lott/Getty Images News

The Last Bubble Burst

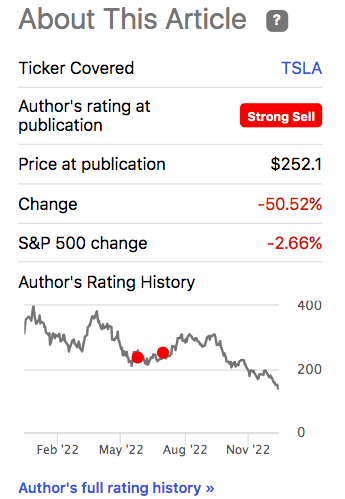

Rating History From Prior Article (Seeking Alpha)

Yes, the bubble burst. My buy and sell ratings here on Seeking Alpha haven’t always been well timed, and, I believe the short-term is often unpredictable. But this time around, my warnings on Tesla (NASDAQ:TSLA) came to fruition quite quickly.

As the market transitions to more sensible valuations, there are less and less reasons to be bearish. The beginning of a recession often signals the beginning of a new bull market. I’m still not bullish on Tesla, nor the S&P 500. But I wouldn’t be short, and I wouldn’t be sitting on a pile of cash at a time like this. Jim Cramer often exclaims on CNBC, “There’s always a bull market somewhere.” This is by no means an endorsement to take advice from Jim Cramer, but I believe there are plenty of contrarian values to be bullish about as the market shifts from what was to what will be.

As for Tesla, I’m not a buyer yet. In my base-case scenario, I’m seeing long-term returns of 5% per annum.

Tesla’s Outlook

Legendary investor Sir John Templeton once told Bill Miller the following:

“There are only two types of investors, those who are outlook and trend investors and those who are price and value investors. 90% of people are outlook and trend investors.”

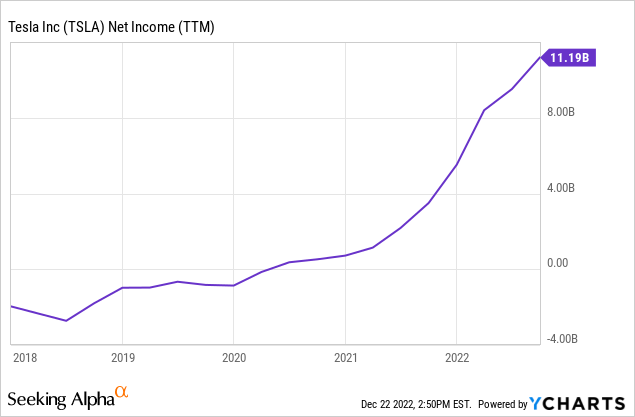

A year ago, the outlook for Tesla was phenomenal. The company was demonstrating explosive growth, and that growth was expected to continue. So far, it has. Tesla’s net income has soared:

Despite this terrific financial performance, Tesla’s stock has plummeted. So, what’s going on here? Well, like Sir John Templeton said, 90% of investors are “outlook and trend investors.” What happened was, the outlook changed. Elon’s diverting his attention to Twitter, a recession looms, and Tesla’s market share is shrinking. These are all things I warned about five months ago. They’re coming to light.

As for the market share, Forbes said it best:

“Tesla continues to dominate EV sales, with 65.4% of the EV market. However, that is down from 68.2% in 2021 and 79.4% in 2020. With the market growing, Tesla is still rapidly growing its vehicle sales despite its loss of market share.”

That’s U.S. market share, by the way. Globally, Tesla has an EV market share of roughly 14%.

Another issue for Tesla is that every automaker globally now wants in on EVs. And of course they do, EV stocks have soared and traditional automaker’s stocks haven’t. In addition, Tesla’s displayed remarkable profitability selling EVs. This is simply how capitalism works; when an industry gets hot, everyone rushes in. Once everyone’s rushed in, the profits get squeezed because there’s more competition.

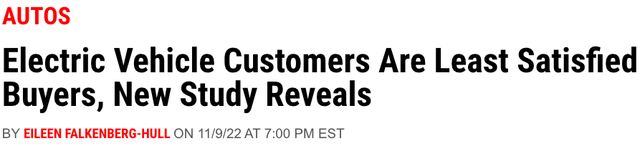

Now, looking at Tesla. The company maintains the premium product. Tesla’s customer satisfaction scores are industry leading. Tesla had a first-mover advantage, and its technology is just better at this point. Elon did a terrific job of building Tesla’s brand in a brutally competitive auto market.

One thing to note on the customer satisfaction scores: that’s just for EVs. Newsweek recently found that buyers of internal-combustion vehicles are more satisfied than EV buyers:

Article Headline (Newsweek)

The world is still developing the infrastructure necessary to make EV road-trips a seamless experience. That process will take time. Despite this, the EV industry will continue to grow.

Tesla’s Future Growth

The number of electric vehicles sold globally is projected to grow at 17% per annum through to 2027. Tesla has an opportunity to grow its autonomous drive, EV semis, and energy generation businesses at rates exceeding 17%. But, because 95% of Tesla’s revenue comes from the automotive arm, where Tesla is losing share, I expect the company to grow its earnings at a slower pace.

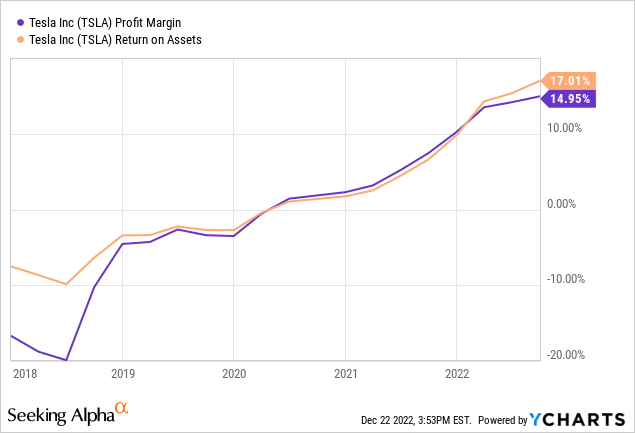

The other issue I’m seeing is the cyclicality of the auto market. Nearing the peak of the cycle, Tesla’s never before been this profitable:

These kinds of profit margins and return on assets numbers are far beyond industry averages and will be difficult to maintain over the next 10 years as competitors catch up on a technological basis.

All things considered, I’m projecting earnings to grow at a pace of 15% per annum from here.

Long-term Returns

My 2033 price target for Tesla is $208 per share, implying a return of 5% per annum.

- Tesla has earnings per share of $3.23. If it can grow that at 15% per annum, it will earn $13 per share in 2033. I’ve applied a terminal multiple of 16x.

Does Tesla’s Collapse Signal A New Bull Market?

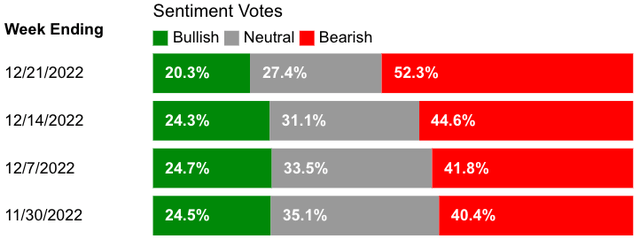

A recession in 2023 is now baked into the consensus. Globally, the world is already beginning to experience rolling recessions. At the same time, investors are exceptionally pessimistic:

AAII Sentiment Survey (AAII)

This usually means it’s time to be contrarian and go long. All of the billions of dollars that have flowed out of Tesla stock have to go somewhere after all.

I explained in my article “QQQ: An Excessive Bust Is Coming” why I expect the pessimism in the technology sector to be more prolonged. The reason: George Soros has explained in the past that excessive margin, speculation, and exuberance on the upside creates excessive insolvency, fear, and selling on the downside. After the dot com bubble burst, it took 15 years for tech stocks to gain popularity again. Fifteen years is often the amount of time it takes for investors to forget about the pain inflicted when a bubble pops. After a fifteen-year stretch, earnings tend to catch up to valuations, and industries have time to fully consolidate.

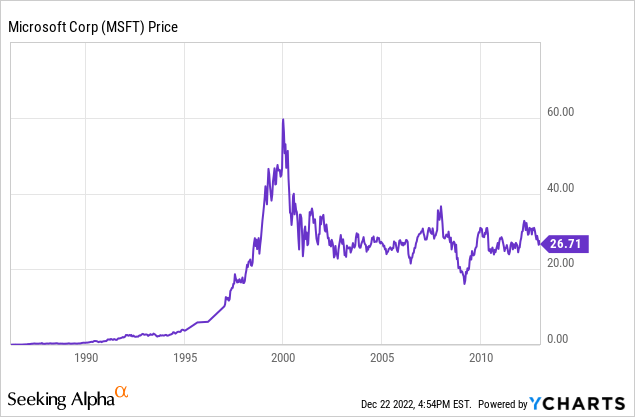

Rather than looking at stocks that have “gone to the moon,” I’m finding opportunities in stocks that have gone nowhere for 15 years. This was the case for Microsoft (MSFT) in 2013:

I believe flat indexes and stocks are now great hunting grounds for the next bull market. The key is that the fundamentals are in good shape (You don’t want to buy a company that’s about to go bankrupt or become obsolete). As for the market as a whole, I’m seeing returns in the range of 5% per annum for the Vanguard S&P 500 ETF (VOO) and Spider S&P 500 Trust ETF (SPY).

In Conclusion

I’ve upgraded Tesla to a “sell” from a “strong-sell.” Following its collapse, Tesla may be offering a market matching return of 5% per annum. A 5% annual return is right between a “sell” and “hold” rating for me. But, because of the opportunity cost and George Soros’ boom-bust model, I think it’s best to sell and move on. After tech stocks toppled in 2000, value stocks really took off. As Jim Cramer often exclaims, “There’s always a bull market somewhere.” Until next time, happy investing.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article includes base-case scenario estimates, using known facts and economic projections. The future is uncertain, and investors must draw their own conclusions.