Summary:

- Elon Musk’s previous bonus award vested early due to Tesla’s rising share price, leaving him with no currently active incentive plan.

- Musk is seeking to increase his voting control of Tesla to 25%.

- He has indicated that he would like to move the AI and Robotics development outside of Tesla if he does not have 25% control.

- Granting Musk another incentive bonus to increase his voting control would have significant financial implications for Tesla shareholders and could negatively impact the company’s share price.

SimonSkafar

A new incentive plan for Elon Musk

For the past week or so, Tesla (NASDAQ:TSLA) bulls have been active on social media, suggesting that Elon Musk needs a new bonus plan to get him to focus his attention on the management of Tesla. Musk’s last bonus award was supposed to cover the term from 2018 to 2028 and had a series of milestones that needed to be achieved during that period, several of which were tied to Tesla’s market cap.

Tesla’s shares rose sharply during the period, resulting in Musk’s bonus award vesting early. There is no clawback if the company performance and share price should fall back to below the targets, once the award is vested it remains vested, so Musk has no currently active incentive plan.

The 2018 award consisted of 303,960,630 share options with a strike price of $23.34 and an expiry date of January 19th, 2028. Once exercised there is a five-year hold period preventing the sale of the shares, except that sufficient shares can be sold on exercise to pay the strike price and the associated taxes.

In addition to the bonus award stock options, Musk owns 411,062,076 shares in Tesla. If all his stock options were exercised, his shareholding would be 715,022,706, approximately 20.6% of the company.

Any claim that Elon Musk is somehow not incentivized to manage Tesla is questionable because a $1 change in Tesla’s share price results in a $715 million change in his pre-tax net worth. I think most reasonable shareholders would consider that to be a sufficient incentive.

Musk trying to maintain control

It seems that Musk may not be as concerned about the financial aspects of a new plan, as he is about maintaining control of Tesla.

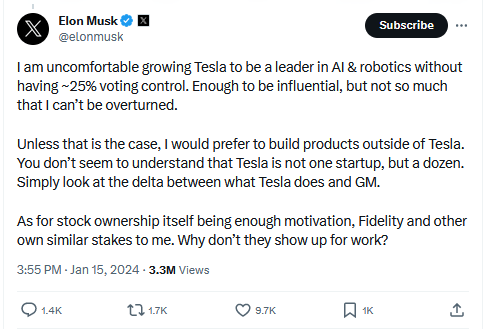

In a tweet this week, he put forward a case for additional incentive to increase his voting control to 25% of the company. As usual, the presentation of that case was not made public as an 8-K filing, it came instead in the form of a tweet, below:

Elon Musk’s tweet Jan 15th (X, formerly known as Twitter)

It looks very much like he is proposing to continue the AI and Robotics business outside of Tesla if he cannot get his control of Tesla up to 25%. In December of 2023, Musk filed with the SEC to raise $1 billion for an artificial intelligence company called X.AI. Presumably, that company would continue the AI and Robotics business if it was discontinued at Tesla. He did not say which parts of the business he would like to move into the AI company or what if anything, he would expect to pay for the part of the business that has, until now, been developed and financed by Tesla.

Raising Musk’s voting control to 25%

What I am looking at is the implications for Tesla shareholders of giving Elon Musk another incentive bonus that would increase his voting control to 25% of the company.

His existing shareholding gives him a 12.9% vote, based on 3.18 billion shares outstanding.

If he were to exercise all his options, without selling any shares he would have a 20.5% share of the vote, based on 3.49 billion diluted shares outstanding.

The 2018 bonus award is the subject of a court case (Tornetta vs Tesla) that is waiting for a verdict, the whole 2018 bonus award may be annulled, this article assumes that Musk wins that case and keeps the vested options.

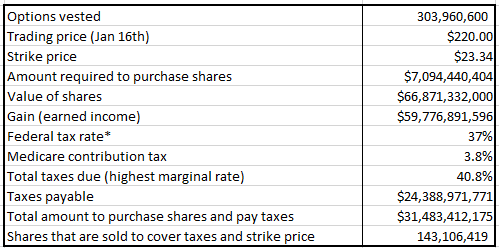

Tesla is Musk’s only monetizable asset of any note and more than half his Tesla shares are already encumbered by loans, so it is unlikely that he would exercise the shares without selling the portion that he is allowed to sell to pay the strike price and the taxes. Below is a calculation of what that would involve:

Calculation of the net effect of Musk’s option exercise (Calculated)

As a resident of Texas, he would pay $24.4 billion federal tax on exercise of the options, the gain on which is treated as earned income. Adding the $7.1 billion paid to Tesla for the strike price, his total outlay would be $31.5 billion, and the net effect after selling 143 million shares, would be to raise his holding by 161 million shares.

That would increase his voting control to 16.4%, still a long way short of the 25% he would like to have.

Exercise of the options and sale of the shares would require the sale of 143 million shares, and it would add $7.1 billion to Tesla’s cash position, some of which could be used for a buyback to counter the effect of Elon Musk’s sale.

I am discounting the possibility that he may have to pay state taxes to California where he was a resident when the bonus award was granted and when a portion of the options vested. His share sale may be higher and his final holding lower than I have calculated, but for this article, it is not material.

The $7.1 billion would go into “cash from financing” on Tesla’s balance sheet, it would not affect net income. However, the option exercise would trigger the payment of payroll taxes. In Q4 2021, the exercise of 66 million options required a payment of $340 million in payroll taxes.

The payroll tax will depend on the price at the time of exercise, but shareholders should expect a hit of about $500 million in earnings when Musk exercises his 2018 bonus options.

In 2021, Elon Musk exercised 66 million (split adjusted) stock options from his 2012 performance bonus award and sold about 30 million shares to pay the strike price and associated taxes. The sales took place in the final quarter of the year and were a contributing factor in the fall of Tesla’s share price from its all-time high of $414.50 in November to its year-end closing price of $352.

Elon Musk’s Tesla share sales in 2022 also correlate with drops in Tesla’s share price. The major impacts include a 12% drop from sales of 29 million shares in April, a 6% drop after sales of 23 million shares in August, and a 14% drop after sales of 19 million shares in November. All those transactions took place in a period when the Nasdaq index was flat, market moves were not a factor.

It appears that Tesla’s share price is not as liquid as the daily trading volumes might suggest. Much of the volume is probably speculative day trading and option hedging by market makers, and major sales by Elon Musk do have a significant impact on the stock price.

Tesla’s share price would likely take a significant hit if Musk were to exercise all his options at once in an attempt to increase his voting power.

Elon Musk might consider his ownership of share options to be equivalent to ownership of shares and in his mind, he already has 20.5% of Tesla, but he specifically refers in his tweet to 25% voting control, and options don’t get a vote, so taking the literal meaning of his words, he must exercise the options to get control.

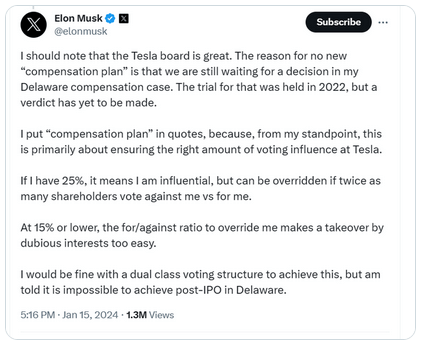

To reinforce his point that control, rather than ownership, is his goal he tweeted again on Jan 16th:

Elon Musk’s tweet Jan 16th (X, formerly known as Twitter)

It seems he is concerned that he can be fired and doesn’t have enough votes to reinstate himself. Perhaps he is feeling pressure from one or more of the institutional shareholders, Blackrock and Vanguard combined own more shares than he does, giving them substantial voting power.

As I mentioned previously, options do not have voting rights and he would have to exercise his options to get the votes. The exercise of the options could trigger a massive share sale which would put serious downward pressure on the share price.

Future bonus plan

Any future bonus plan will likely follow a similar pattern to the existing plan, an award of options at a strike price approximately 10% above the existing market price with a fixed term and a set of vesting conditions.

The amount of tax that Musk would have to pay on the exercise of the options would depend on the price at the time the options are exercised. Presumably, the board would set a target market cap as a condition of vesting.

Let’s take a hypothetical case where the option strike price is $240, and the exercise price is $1,000. Musk would pay $304 in tax (40% of ($1,000 – $240)) plus the $240 strike price, for a total cost of $544. If he sold shares to pay the strike price and taxes, he would end up with 0.456 shares for every option.

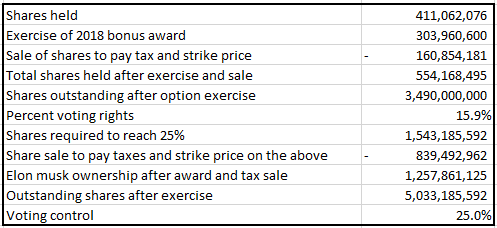

To end up with a 25% voting control after paying the taxes and the strike price, the bonus award would have to be more than 1.5 billion shares (calculations in the table below):

The options required to give Musk 25% control (Calculated)

Option awards are valued at the time of award and are recorded as stock-based compensation based on an assessment of their likelihood of vesting. Musk’s 2018 award resulted in a hit to GAAP earnings of about 2 billion dollars spread over five years, this future award would be much more costly, with 5 times more shares and a ten times higher price.

The Black-Scholes formula gives a value of $156.83 for a $240 strike price based on an existing share price of $220, and a volatility of 50%.

The total hit to GAAP earnings from a stock option award that would ultimately give Elon Musk his 25% voting rights would be in the region of $240 billion spread throughout vesting, which would likely be 10 years, though it could vest earlier or not at all. If it vested, it would probably wipe out all of Tesla’s GAAP earnings over a ten-year vesting period.

The number of outstanding shares would go up by 44%, fully diluted. Surprisingly, an increase in voting shares from 12.9% to 25% requires an increase in shares outstanding of 44% after accounting for taxes.

Stock option awards are not free money

Many shareholders look at non-GAAP earnings as if they were the true earnings of the company and share-based compensation was free money.

It is not free money, it comes out of the shareholder’s pockets in the form of dilution, it reduces earnings per share, and it drives down the share price when the shares are sold.

Tesla shareholders have already felt the effect of Elon Musk’s last exercise of options, they will feel an even bigger effect when he exercises his current crop of options and a massively bigger effect if he is awarded a bonus package that gives him future control of 25% of the company.

In my opinion, there is nothing bullish about Musk wanting another huge bonus award, it eventually comes out of the shareholders’ pockets. He was lucky to catch the front end of a stock price bubble with his last bonus award. That bubble is deflating, he is desperately trying to retain control of the company and keep control of the narrative.

Don’t be fooled, Tesla’s business is facing massive headwinds, growth has stalled, margins have fallen drastically, and Tesla’s auto business is seeing increased competition. It remains a grossly overvalued stock, and one to avoid.

I have a small short position, including some long-term puts. Tesla is a volatile stock with a large following and it often sees price moves based on speculation and emotion rather than financial results, it is not a good idea to risk more than you can afford, either long or short.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.