Summary:

- Tesla is currently showing immense strength in its energy segment; however, I believe this will not be management’s focus in five to 10 years.

- Instead, I believe the energy segment will act as support and allow management to show growth amid moments of contraction in its EV sales amid the redirection of resources to AI.

- The long-term thesis related to autonomous taxis and Optimus remains intact, and analysts are underestimating the market potential here.

- In an optimistic outcome, I estimate that Tesla could achieve 30%+ revenue CAGRs, and have its P/S ratio expand, over the next 10 years.

cokada/E+ via Getty Images

In my last broad coverage of Tesla (NASDAQ:TSLA) (NEOE:TSLA:CA), I focused on the long-term thesis related to autonomous taxis. In addition, I touched on the long-term thesis related to Optimus in my Q2 analysis. However, one element that came up recently in my coverage of Enphase was Tesla’s position in energy storage, which is a much smaller element right now in the company’s long-term direction but is the focus of this analysis. It is an area of its operations I have not given significant attention so far, but I believe that it does deserve it.

I believe Tesla’s energy business is going to shine in the next few years and could be instrumental in supporting the company’s valuation amid its strategic pivot to autonomy and robotics. The long-term thesis for Tesla needs short-term financial support from segments that are not vulnerable to changes in its automotive segment, and the energy storage business is arguably the most stable provider of growth, which could later be a segment that is much less prominent once the Optimus and autonomous taxi initiative is showing financial returns.

Tesla’s Energy Business

The company’s position in energy generation and storage is underpinned by three core elements at this time, namely the Solar Roof, Powerwall for residential use, and Megapack for utility-scale storage.

Of these, the Megapack is particularly strong, and its integration with Powerhub and Autobidder allows for real-time monitoring and control of energy assets and real-time trading, autonomously participating in energy markets.

Secondly, the Powerwall 3 is market-leading, offering a usable storage capacity of 13.5 kWh. The Powerwall 3 has a continuous power output of 11.5 kW, which allows it to handle significant energy loads and serve as an uninterruptible power supply during outages. By storing solar energy, the Powerwall allows homeowners to reduce their reliance on the grid, providing greater energy independence and security.

The Solar Roof, which is less of a medium-term revenue opportunity, is a solar power generation tool that directly replaces roof tiles. They are also made of tempered glass, which makes them more durable than standard roofing tiles. With photovoltaic cells embedded in the tiles, the system pairs especially well with a Tesla Powerwall. Notably, this has not yet gained widespread adoption. I believe this could be one of the first parts of the Tesla business that gets sold as the company more aggressively focuses on autonomous driving and Optimus. That is not to say that the technology is not important, but I believe it will be harder for the company to develop a medium-term moat in this area than with the Megapack and Powerwall.

Focusing on the market for both the Powerwall and the Megapack, the field is saturated. In terms of the Powerwall, LG Chem RESU offers a slightly higher capacity option (up to 16 kWh). The Generac (GNRC) PWRcell has usable energy capacities ranging from 9 kWh to 18 kWh. The Enphase (ENPH) IQ Battery 10 has a usable energy capacity of 10 kWh, which makes it a far weaker competitor. Surprisingly, therefore, there are stronger competitors to the Powerwall at the moment from a purely technical standpoint.

Tesla is also ramping up production at the moment with an upcoming plant in Shanghai, China. These factories aim to produce 40 GWh annually, giving Tesla a leading position to meet the growing demand for renewable energy. Key competitors in the field include Fluence (FLNC), CATL, and BYD (OTCPK:BYDDF) (OTCPK:BYDDY), which has become famous as a key competitor to Tesla across the board. The Megapack can store up to 3.9 MWh of electricity, but Fluence’s Gridstack Pro offers a capacity of 5-6 MWh per enclosure, and the CATL Tianheng system offers a capacity of 6.25 MWh per unit (claimed to be the highest in the world). BYD’s MC Cube-T offers a capacity of 6.43 MWh per unit.

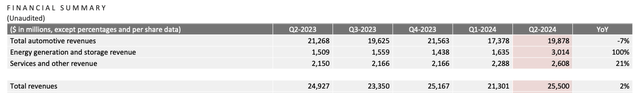

Based on this analysis, Tesla has some catching up to do. However, the question remains whether Musk will choose to invest so much of Tesla’s resources into energy storage now or whether he is likely to straightforwardly redirect capital toward autonomous vehicles and Optimus, which could cause stock price volatility if current growth segments are disregarded. That being said, Tesla is achieving record deployments. In 2023, the company deployed 14.7 GWh of energy storage, more than doubling the 6.5 GWh deployed in 2022 and nearly ten times the 1.65 GWh deployed in 2019. In Q2 2024, Tesla set a company record by deploying 9.4 GWh of energy storage, more than doubling its previous quarterly record. In Q2, the energy generation and storage business contributed nearly 12% of Tesla’s total revenue, which is up from 6% in the same period in the previous year. Furthermore, its energy generation and storage revenue jumped 100% YoY as of Q2. These all indicate reasons to be bullish amid a decline in automotive revenues. However, this is a short-term observation, and the long-term thesis looks a lot different to me.

Tesla Q2 Quarterly Update Deck

My Long-Term Outlook

In my opinion, while the growth in its energy storage segment is currently very strong, this acts as a medium-term diversification and is potentially a good segment of the business for management to focus on growing while it transitions its core operational focus toward autonomous taxis and Optimus. As the path to scale for both of these elements is likely to take over a decade, energy storage is certainly not an element of the business I think management will be looking at tapering soon, as it bolsters the stock price and improves sentiment amid what will potentially be declining medium-term automotive sales for periods during the pivot. At this stage, we also do not have a clear market for Optimus, and so there are still elements of speculation in the long-term thesis for Tesla that is likely to cause negative reactions in the stock price and affect internal order. That being said, I reiterate that I think management might double down on the energy segment in the medium term and focus on competitiveness in technical capabilities of the Powerwall and Megapack, and potentially significantly reduce this segment later once the pivot to robotics and automation becomes more financially asserted.

As far as the long-term thesis goes, I do not see the energy business as playing a significant role. I believe that the scale of Optimus and robotaxis 20 to 30 years out, if successfully executed, is going to dwarf the revenue potential of its energy generation and storage operations. Statista forecasts that the yearly revenue generated from autonomous taxis will grow to $9 trillion by 2030. Musk has mentioned in various interviews that I have watched that he believes Optimus will be the biggest long-term opportunity for Tesla. If Musk were to sell 8 billion $20,000 Optimus robots over the next 30 years, this would equate to $160 trillion in revenue. That outcome is still speculative and based on some conjecture, but the target is achievable. The question is if there will be inhibitions in production, increasing the cost of manufacturing and lowering margins, and also whether the market is as tenable as Musk currently envisages. Even on financing, the target market of the whole global population wanting or being able to afford an Optimus bot seems unlikely to me, especially considering the competition that could arise.

Is Tesla a Buy, Sell or Hold Amid Its Strategic Pivot?

Tesla is richly valued at the moment, and in my previous analysis, I outlined a 2029 price target of $1,050. While there are rational concerns at the moment about a medium-term collapse in Tesla’s share price as a result of lower medium-term growth rates and currently very high valuation multiples, I believe it is the long-term narrative surrounding Optimus and autonomous taxis that will be able to sustain sentiment for the duration of contractions in growth rates related to a decline in its moat in EVs and its pivot toward its new distinct operating model in AI.

There is a lot of skepticism surrounding Tesla’s market position at the moment, but I believe that many of the Tesla bears have failed to recognize the validity of Tesla’s unique position to achieve full autonomy and to bring Optimus to market at scale. Some investors consider this long-term vision to not be grounded in reality, but we must remember that despite timelines that might not coincide with Musk’s initial predictions, he has managed to make Tesla the most successful EV manufacturer and retailer in the world. From my research and analysis, it is clear that the Tesla bears have failed to recognize the long-term direction of Tesla and are instead focusing on the specifics, which might not align with management’s initial intentions but are subject to change as it relates to Tesla’s extremely high level of agility.

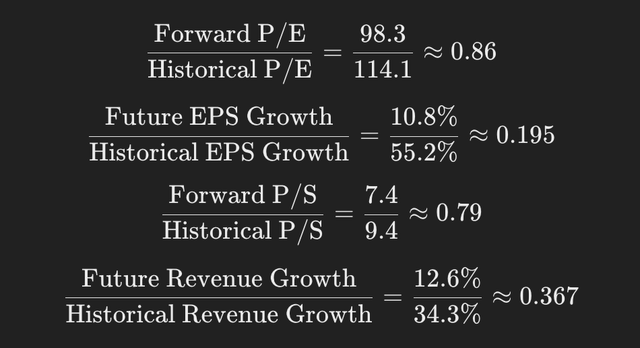

| Forward P/E non-GAAP ratio | 98.30 |

| Historical five-year average forward P/E non-GAAP ratio | 114.10 |

| Future forward EPS long-term growth (three-to-five-year CAGR) | 10.80% |

| Historical five-year average forward EPS long-term growth (three-to-five-year CAGR) | 55.20% |

| Forward P/S ratio | 7.40 |

| Forward P/S ratio five-year average | 9.40 |

| Future forward revenue growth | 12.60% |

| Historical five-year average forward revenue growth | 34.30% |

We can place the above chart into context by outlining certain ratios from the table:

Author’s Analysis

The above ratios show that the P/S ratios and P/E ratios have only contracted a minor amount in comparison to their respective growth rates. Therefore, there is still a lot of sentiment in the market that is being sustained, which I believe is hinged on the company’s direction toward autonomous taxis and Optimus. This is why I consider it so important for Musk and Tesla’s management team to continue to focus on strengthening the long-term thesis and begin to outline for investors the market opportunities and statistical revenue and profit potentials of the autonomous taxi and Optimus operations. I believe that this will significantly help to support the company’s valuation in the medium term during moments of contraction related to the pivot. There is undoubtedly a significant amount of risk here right now, but the potential reward is very high if the pivot is successfully executed. I have mentioned many times in my previous theses that Tesla’s gross margin is likely to scale significantly as a result of its operating model becoming more focused on software than manufacturing, but in addition to this, its revenue growth rates could be much higher than initially anticipated by most analysts with a successful autonomous taxi and Optimus market.

The current consensus is that Tesla will achieve a revenue CAGR of 19.70% over the next five years. However, I believe that if it can successfully begin to implement its autonomous taxi network at scale and take Optimus to an initial market, it could outperform this and reach a CAGR of approximately 22.50%. I estimate this primarily because Tesla has a significant opportunity to compete in the ride-hailing market at a lower cost to consumers, which I believe is underestimated by many analysts. As it may take up to 10 years for its autonomous taxi operations to be implemented as the core revenue generator of its business, with Optimus also beginning to show significant sales, my estimate for a revenue CAGR over the next decade increases to 30%+. This is what I estimate is going to support the company in sustaining current stock market sentiment and then potentially having its P/S ratio expand to 9.50, which is its five-year average achieved when it had forward revenue growth of 34.30% as a five-year average. We are in the very early days of robotics, automation, and AI capabilities. Hence, extrapolating beyond this into higher CAGRs related to an advanced moat in humanoid robots and autonomous taxis is too speculative right now. Still, it is worth considering that the market opportunity for Tesla could be much larger than most analysts currently anticipate. Based on this analysis, Tesla could have a market cap of over $12 trillion in 10 years.

However, this significantly depends on the market for Optimus, and if this market is not as viable as initially assumed, with much lower levels of initial adoption, such a significant market cap increase would be unlikely. I believe the lower-risk market cap growth opportunity at this time, which will be more material to Tesla’s 10-year growth CAGRs anyway, is in autonomous taxis, and I do consider the growth potential here to be more easily viable than Optimus over the long term, without significant shifts in market preferences and a heavier macroeconomic integration of AI in physical applications opening mass-scale desirability for humanoid robots. It seems likely to me that there will be certain businesses or households that own many Optimus bots and many businesses and households that own none, as I currently envisage the future market.

Further Risks to the Thesis

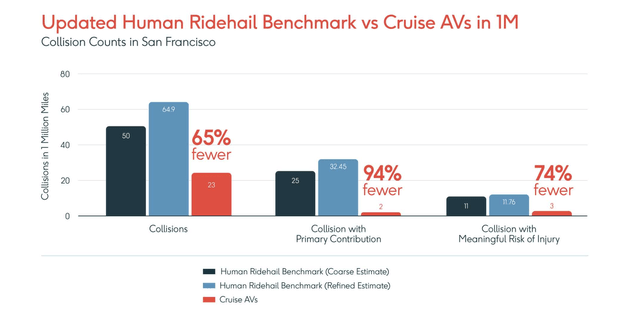

The greatest risk to my long-term investment thesis on Tesla relates to the company’s ability to execute Musk’s vision. As the valuation of the company is already very high, periods of stock price decline during moments of fundamental contraction during the pivot could sow internal disorder, affecting the operational focus of the company. The company’s long-term strategic direction is currently significantly based on success with FSD and regulatory approval regarding its autonomous taxi operations. Tesla currently does not have fully autonomous vehicle regulatory approval, but it is close to this goal in Europe and China. The hurdle in the United States is more significant, and there could be delays related to this. Even though the evidence is mounting that autonomous transport is safer than having a human driver, Tesla’s systems operate a more advanced camera-based approach, which could take more time to pass through regulation. However, this chart from Cruise gives a good outline of the general safety increase from autonomous transport:

Cruise

Furthermore, I believe the greatest threat to Tesla is that much of its success and vision rests on Musk’s ability to lead the company. If, for whatever reason, the CEO can no longer give active service, I believe the company is not one of those organizations that would be able to execute its long-term strategy unabated. Other businesses can withstand changes in CEOs as the nature of their organizations is not hinged on visionary leadership and radical innovation. With Tesla, Musk appears fundamental to the company’s long-term direction and the sustenance of its share price. Therefore, there is immense concentration and personnel risk in the continued leadership presence of Musk himself. Thankfully, to date, Musk has given no sign or intention that he will or will have to step aside.

Conclusion

I believe Tesla is beginning a very significant shift in its operating model, with the long-term potential being significantly underestimated by many analysts. Tesla’s energy business is the strongest element of its operating model at this time in terms of growth rates, but I believe that this segment will take a back seat and potentially have parts divested as the revenue capabilities from Optimus and autonomous taxis become more asserted. As a long-term investor, my rating for Tesla is currently a Buy based on my updated analysis of its operational positioning, including the current strength from its energy business which can inform its long-term growth direction.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, ENPH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.