Summary:

- Adaptation of new technologies has largely followed a 10-10 rule (10 years to build and another 10 for mass deployment).

- And YouTube is a rare exception. A very rare exception.

- Tesla, Inc. CEO Elon Musk recently shared a more detailed Master Plan for energy sustainability and the role that Tesla can play.

- This article focuses on the part of the plan that is directly relevant to EVs.

- By drawing similarities from YouTube, the core argument is to analyze Tesla’s potential of breaking the 10-10 rule (and my conclusion is quite optimistic).

carloscastilla

Thesis

In early March this year, Tesla, Inc. (NASDAQ:TSLA) CEO Elon Musk announced Tesla’s Master Plan, stating that he hopes to achieve a completely sustainable energy economy through transformative changes in five areas. These five areas included the expanded usage of heat pumps, high-temperature heat delivery, use of hydrogen fuel, and, of course, the replacement of gasoline vehicles with electric vehicles (“EVs”). However, at that time, this plan was criticized for “lack of details.” Then, in earlier April, Tesla released a 41-page PDF providing much more details about the Master Plan on the specifics of Musk’s vision to break away from reliance on fossil fuels and transition to renewable energy.

If you are interested in TSLA and/or the general area of future transportation and energy sustainability, I highly encourage you to read the whole report. For this article, to limit the scope and length, I will only focus on the part of the plan that is directly relevant to EVs. In particular, this report also revealed more information about three new vehicles that TSLA is working on:

- The entry-level model will use a 53kWh lithium iron phosphate battery pack.

- A small van will use a 100kWh high-nickel cathode battery pack.

- Another large bus will use a 300kWh lithium iron phosphate battery pack.

In addition, the report also announced that the existing Model 3/Y will be equipped with a 75kWh lithium iron phosphate battery across the entire lineup, while the upcoming Cybertruck will have a 100kWh high-nickel battery.

And the thesis of this article is to project the future impact of the above developments in the EV space. I will argue that thanks to these developments, TSLA’s EVs have a good chance of breaking the so-called 10-10 rule and entering an accelerated phase of deployment.

The 10-10 rule

Tech investors are always looking for the next Alphabet/Google (GOOG, GOOGL) and Amazon.com (AMZN). However, throughout my career in high-tech research and development, I’ve witnessed first-hand the force of the so-called “10-10 rule.” The rule is very simple – most technologies took 10 years to develop and another 10 years to achieve mass adoption. So, a 20-year life cycle is a rule, and exceptions are rare – very rare. Even Google and Amazon are no exceptions.

We are often impressed (or misled) by the explosive growth of high-tech companies such as Google and Amazon. That is mainly because we’ve only started paying attention to them AFTER they have entered the rapid-growth phase. If you consider the entire history of Google and Amazon starting from their very inception, you will see that it actually took more than 20 years for their products to take off and dominate.

Actually, even more earth-shaking technologies than the search engine and e-commerce have obeyed the 10-10 rule. Examples included cell phones, PCs, the Internet itself, GPS, and so on.

What does this 10-10 rule have to do with TSLA?

I have a good reason for the above introduction of the 10-10 rule and a review of its history. Because I am about to argue that TSLA might have a good chance of breaking the rule going forward. Note that when I speak of TSLA in this article, I am referring to “the TSLA” since 2013 or so, when the company switched gears to focus on the Model S sedan, which is the beginning of the TSLA that we know today. Before that, the “former TSLA” was concentrated on the EV sports cars (the Roadster) for more than a decade and pretty much went nowhere.

So, the year 2023 happens to mark the 10th year of the TSLA we know today. And arguably, TSLA has successfully completed the first phase of the 10-10 rule. That is, it has matured EV technology and manufacturing in scale in the past 10 years, as evidenced by the sizable TSLA EV fleet (see the chart below) and its leading position in this space.

Although compared to the 1.4B vehicles in operation globally, the EV fleet is only a tiny fraction. And this is the key part of my thesis – TSLA may not need 10 years to expand its user base for the second phase of the 10-10 rule.

What can we learn from YouTube?

A good way to make my case is to analyze an example that has actually broken the 10-10 rule and see if there are similarities to be drawn. As aforementioned, most technologies, no matter how groundbreaking they are from hindsight, have obeyed the 10-10 rule and exceptions are VERY rare. YouTube happens to be one of the very few exceptions.

In a nutshell, YouTube completed product development and mass market penetration in only about 2 years: it was founded (by 3 individuals) in 2005 and became one of the top ten most visited websites on the Internet in 2007.

So, what’s special about YouTube? and does TSLA share these special traits? Indeed, I will argue next that: A) there are a few traits that make YouTube special; and B) TSLA does share these traits – even though video sharing and EVs seem to be completely different industry sectors.

- Infrastructure. In 2005, all the necessary infrastructure was already in place for YouTube to take off – high bandwidth internet, video editing tools, video transmission protocols, et al. Others have tried similar ideas before but failed largely because no one has the resources to prepare infrastructure at such a scale.

- Platform. YouTube focused on software and platform development, avoiding the challenges associated with production ramp-up, inventory management, and sales logistics. As a platform, YouTube also benefited from the network effects (aka the snowball effects), where every new user or content creator added value to the platform, creating a strong draw for new users.

I see TSLA’s history and future as amazingly similar in terms of these factors. At this point, the EV infrastructure (such as charging stations, battery manufacturing, mineral mining and processing, and service shops) is taking shape. Again, others have tried the EV ideas before. General Motors (GM) even successfully produced an all-EV car prototype back in the 1990s. But without the infrastructure, it remained a prototype and never reached mass deployment.

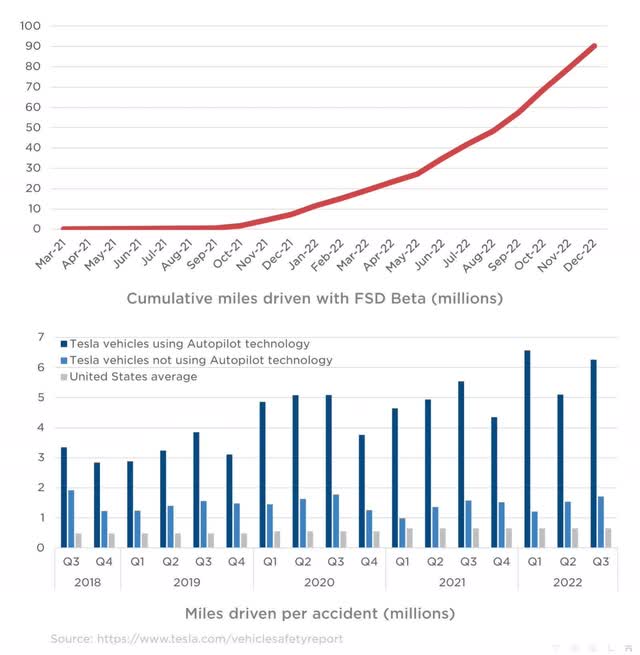

Furthermore, unlike all past vehicles, the future EVs would also be more of a platform rather than a piece of hardware only. And thus, EV companies, especially those with scale like TSLA, could benefit from the snowball effect too, just as YouTube did. As a specific example, autonomous driving technology in the EV space could provide TSLA with the same benefits as YouTube’s platform/network advantages. As its autonomous driving technology matures and scales up rapidly (see the chart below), with over 100,000 Tesla drivers in North America having access to Full Self-Driving (“FSD”) Beta and accumulating millions of miles driven, it could accentuate the potency of network/platform effects. Tesla’s projected cumulative production of 100 million vehicles over the next 10 years, as stated by Musk, further supports the potential for TSLA to complete the mass-expansion phase in less than 10 years.

Risks and final thoughts

My above analysis is obviously tilted towards the long term. And investors need to be aware that the business is facing a few near-term headwinds. The global computer chip shortage keeps plaguing the auto industry. Depending on the pace of the recovery from the pandemic, such shortage could keep throttling TSLA’s production and it may not be able to meet its goal of producing 1.8 million vehicles this year. At the same time, raw material prices continue to increase and the rate of inflation remains at a relatively high level.

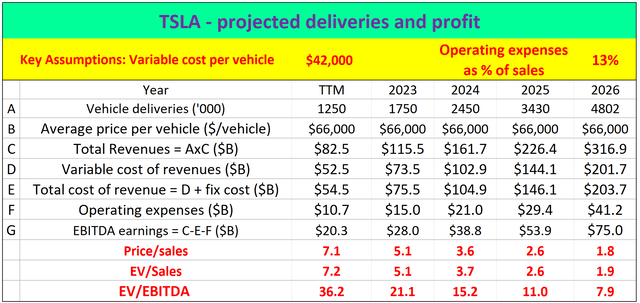

As a byproduct of these issues, rates on auto loans have increased significantly, putting some buyers out of the market. And the potential of a recession could put further pressure on demand, especially for Tesla, whose vehicles are in the higher price tier. In the meantime, TSLA current valuation is certainly not cheap. The chart below shows my projected valuation multiples (key assumptions are detailed in my earlier article). To wit, at its current price of $185, its EV/EBITDA is around 36x. And even assuming a 40% production growth rate, the multiple would still be about 8x in 5 years.

Source: Author based on Seeking Alpha data

However, the essence of investing in tech stocks (or high-growth stocks in general) is to take a longer view and deemphasize the immediate issues and the current valuations. And in Tesla, Inc.’s case, I see significant potential for it to expedite its growth and capture a mass user base in the expansion phase. It may not need another 10 years to achieve mass penetration due to the infrastructural and platform factors analyzed above. Musk shares his vision in 5 areas in the Master Plan, and Tesla is engaged in several of those areas. I feel if Tesla, Inc. ended up achieving any one of those 5 (even partially), its current valuation could be easily justified.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.