Summary:

- Tesla, Inc. surged 44% following Donald Trump’s re-election, supported by anticipated business-friendly policies and CEO Elon Musk’s strong administrative ties.

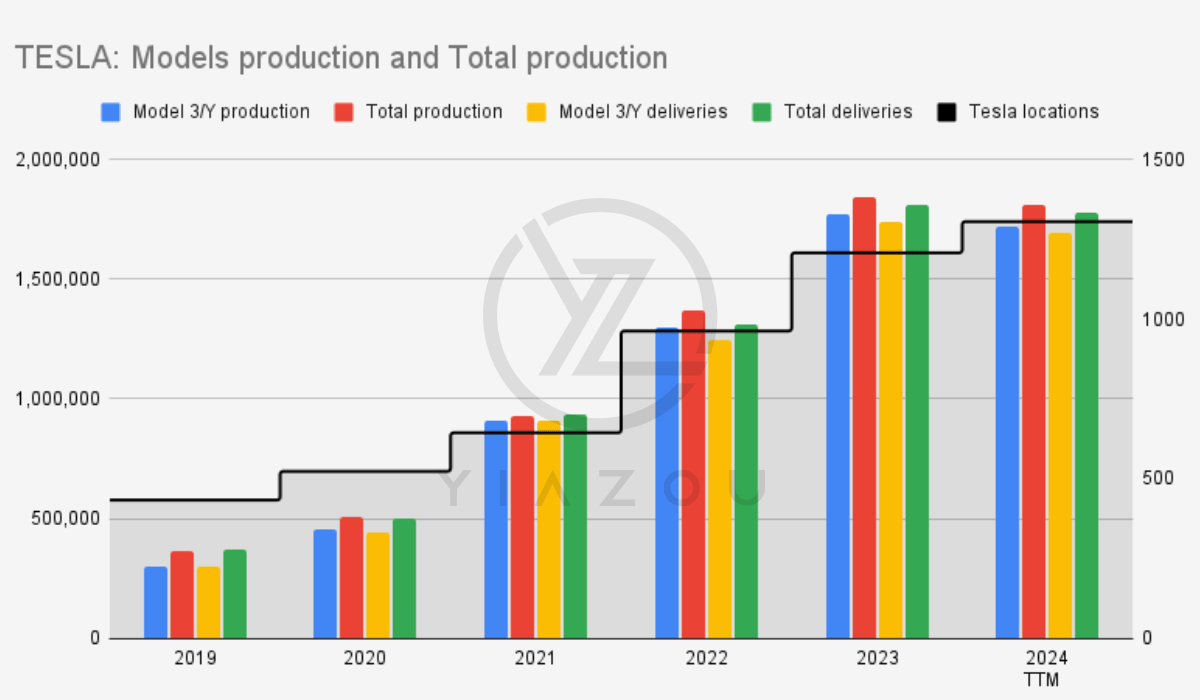

- Model 3/Y production increased sixfold from 2019 to 2023, with a 98% delivery-to-production ratio demonstrating strong demand.

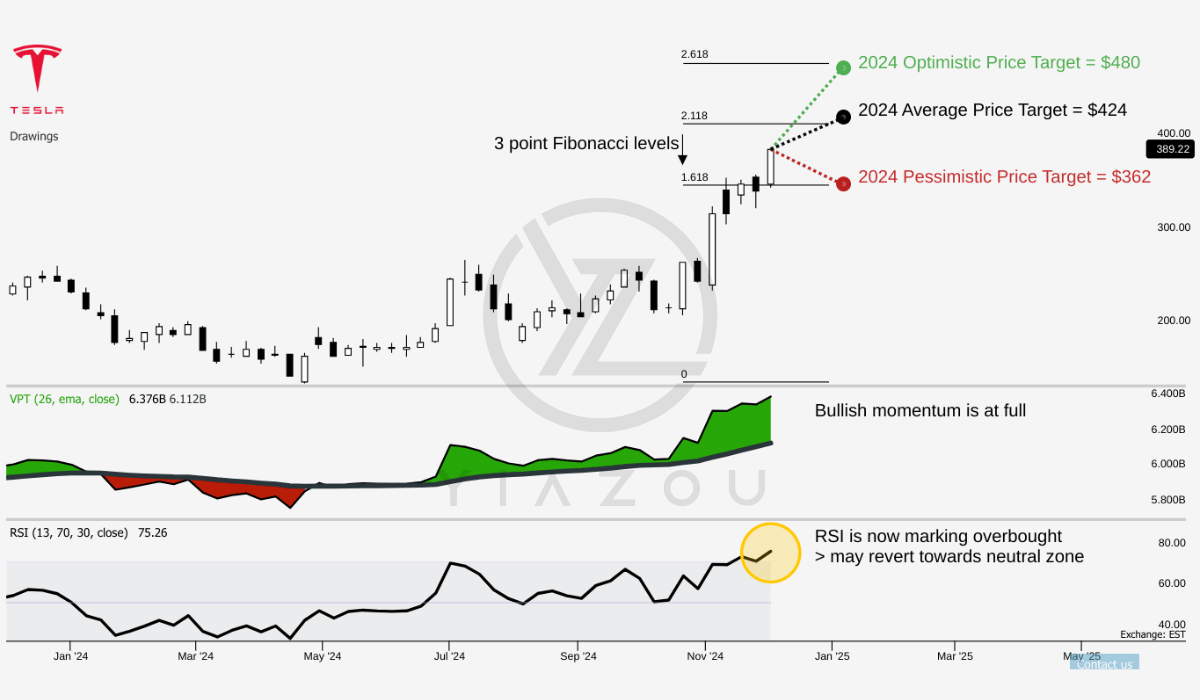

- We project Tesla’s stock to hit $424 by year-end, with a bullish case target of $480 on full self-driving, or FSD, advancements.

- Tesla faces risks from pro-oil policies and potential China-related conflicts, threatening supply chain stability and operational growth.

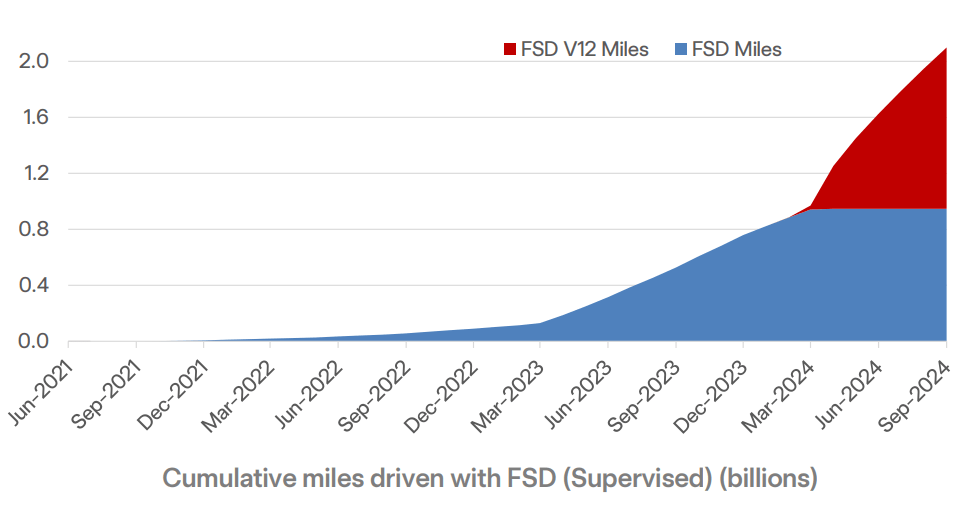

- FSD technology remains a critical growth driver, expected to surpass human safety standards and boost Tesla’s EV dominance.

3alexd

Investment Thesis

Since our last coverage, Tesla, Inc. (NASDAQ:TSLA) has appreciated approximately 44%, propelled by optimism over Donald Trump’s re-election. Anticipation of business-friendly policies, probable rollbacks on EV tax credit caps, and strong links with the administration by CEO Elon Musk are considered positive factors for Tesla’s growth. On the negative side, Trump’s pro-oil stance and the prospect of international conflicts, particularly with China, threaten to impact Tesla’s global operations and supply chain.

Regardless, Tesla’s fundamentals remain solid: Model 3/Y production increased sixfold from 2019 to 2023, and the deliveries are not that far off, a testament to superior operational execution. Inventory days remain at just 19 days, underlining strong demand and lean logistics. Meanwhile, Tesla’s progress toward Full Self-Driving (FSD) coupled with cost-efficient manufacturing strategies supports long-term growth.

Progressive Production and Delivery Trends

Tesla’s consolidated production and deliveries have had a constant upward trend over mid-to-long-term based on the Model 3/Y lineup. Model 3/Y production surged from 302,301 units in 2019 to 1,775,159 in 2023 with a sixfold increase. Deliveries followed a similar upward path climbing from 300,885 to 1,739,707 over these five years. Based on that, Tesla can continue to scale up manufacturing and logistics operations. For 2024 TTM (as of Q3), 1,719,397 Model 3/Y units were produced and 1,693,701 delivered, suggesting a potential slowdown in 2024 against 2023 due to macro conditions (mostly inflation). Nevertheless, the other models (while niche in contribution) had stable production at around 70K units annually from 2022.

What’s vital here is Tesla’s edge in in-line production with deliveries, which led to global vehicle inventory days of supply of 19. For all vehicles, the delivery/production ratio remains high >96%. In 2023, Tesla produced 1,845,985 units and delivered 1,808,581 units (98%) based on solid demand and minimal inventory overhang that may optimize cash flow. Moreover, Tesla’s physical footprint has also expanded, with locations growing from 433 in 2019 to 1,306 in 2024 YTD. This footprint expansion is in line with the global rollout of its Model 3/Y platform.

Yiazou

From 2022 to 2023, the company had a considerable jump from 963 to 1,208 in locations head-to-head with the company’s production scaling efforts. The relationship between production growth and retail expansion is clear in 2024 TTM, Tesla has delivered 3.84 times more vehicles than in 2019 and its retail network grew by 2.02 times during the same span. Therefore, Tesla has maintained a progressive balance between manufacturing capabilities and distribution infrastructure.

As per the Street, Tesla’s 2024 revenue may hit ~$99.82 billion based on the scaling of vehicle production and deliveries. Analyst estimates for Q4 2024 suggest quarterly revenue of $27.40 billion and an EPS normalized estimate of $0.75. Following the trends, the company has shown mixed performance in earnings surprises over the last two years. Tesla exceeded EPS expectations in only 3 out of 8 quarters and revenue expectations in 2 out of 8 quarters. This may hint at overestimation by analysts. But the upward revisions for EPS and revenue estimates in the past three months point to growing optimism about Tesla’s Q4 performance.

Looking forward, Tesla’s advancements in autonomous driving represent a massive growth driver. The company expects Version 13 of its FSD software to hit a fivefold improvement in miles between interventions (against Version 12.5). This progress has already yielded a 100x improvement since the start of 2024. Internally, Tesla projects that its FSD will surpass human safety levels by Q2-Q3 2025. So, the integration of neural networks and improvements in AI capabilities may boost Tesla’s autonomous driving and differentiate its EVs. At the macro level, as adoption rates for FSD increase, the loyalty for the company’s software-based intelligence may accelerate too.

Q3 Quarterly Update Deck

Overall, Tesla continues to focus on cost reduction and operational sharpness in manufacturing. The 4680 battery cell design is approaching cost competitiveness that can sharply reduce vehicle production costs. Additionally, Tesla’s “unboxed” manufacturing strategy for its upcoming Robotaxi product can push CapEx-efficient growth. The next generation of Tesla vehicles that are slated for production in 2025 will leverage existing platforms and manufacturing lines. The approach may optimize resource utilization and enable Tesla to hit a maximum production capacity of~3 million vehicles annually without additional CapEx.

Concerns Over Shareholder Transparency and Governance

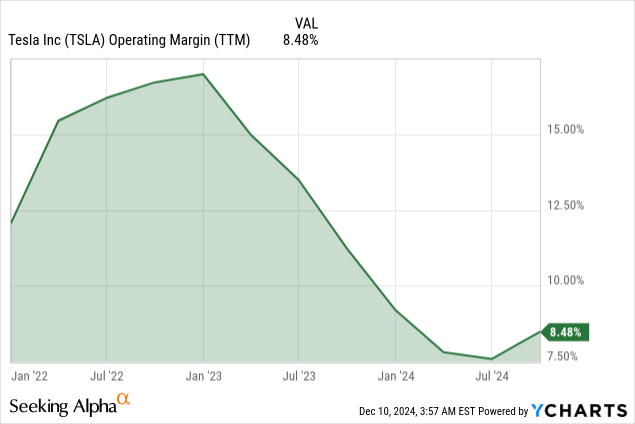

Tesla stock’s value growth is largely based on its automotive business scalability. However, there are serious cracks in the company’s TTM operating income margin. The margin has been on a downward trend over the midterm. From March 2022, when Tesla’s operating margin stood at 15.5%, the company increased its margin through mid-2022, hitting 16.76% by December 2022. However, 2023 was an inflection tale, with the margin starting to fall. Most of the drop happened between March 2023 (14.78%) and September 2023 (11.15%).

Further, this constant TTM margin erosion indicates that Tesla is facing cost pressures and reduced pricing power. In September 2024, the operating margin ended up at 8.5% with a 7%-point contraction since March 2022. No doubt, Tesla is struggling with increased production costs. If this trend continues, Tesla will face funding and liquidity issues on the ongoing expansion initiatives, hurting TSLA stock badly in upcoming quarters.

Moreover, Tesla’s governance structure is under criticism due to the ongoing legal drama on Elon Musk’s $56 billion compensation package (now worth $101.5 billion). While the company’s stockholders had initially approved the pay package, the Delaware court ruled that the package was too excessive. The court’s stance is that Musk’s grip over the board during the negotiation process was improper. Despite holding ~22% of Tesla’s stock, Musk’s influence was deemed to be high enough to tilt decisions in his favor. A ruling that nullified the compensation package reflects high governance issues within Tesla’s management. The second rejection decision pointed to the fact that Tesla shareholders were not fully informed about the terms of Musk’s pay deal, citing concerns over Musk’s influence on the board during negotiations and transparency provided to shareholders.

What’s vital here is that the package is >8.1% of the company’s current market cap, and it has already spent considerable resources fighting this legal battle, including a $345 million fee award to the shareholders’ lawyers. The governance challenges and associated financial costs may impact Tesla’s reputation. Furthermore, the ruling against Musk’s pay package opens up a Pandora’s box of financial and legal issues. The package itself had triggered a $2.6 billion charge for Tesla when it was originally implemented. Any attempt to reinstate the deal (or structure a new one) could lead to more liabilities (financial costs and taxes). The uncertainty surrounding the resolution of the case means that Tesla may face months or even years of legal conflict.

Logically, it may drain both time and resources that could otherwise be used to address operational and fund strategic initiatives. If the company continues to be forced to pay large sums in legal fees and compensation with the continued influence of Musk on Tesla’s board, it could harm the company’s reputation with institutional stockholders.

Tesla Stock May Hit $424 By Year End

Tesla stock is currently priced ~$389 sits below its average 2024 price target of $424. This is in-line with the 2.118 3-point Fibonacci extension level. The optimistic target of $480 corresponds to the 2.618 level and suggests considerable upward momentum. Meanwhile, the pessimistic target of $362 is at the 1.618 level, It provides a floor under bearish moves. Moreover, the RSI stands at 75, which indicates an overbought condition. However, the absence of bullish or bearish divergence suggests that this overbought state is based on solid momentum rather than impending reversal signals. The upward RSI trend further confirms this strength and signals caution for potential short-term corrections as the RSI nears saturation levels.

Whereas, the Volume Price Trend (VPT) line is at 6.39 billion, which exceeds its annual moving average of 6.11 billion. This reflects buying pressure with increasing volume driving price moves. This aligns with the ongoing price strength and supports the possibility of upward continuation due to the volume-backed nature of the current rally.

Yiazou (trendspider.com)

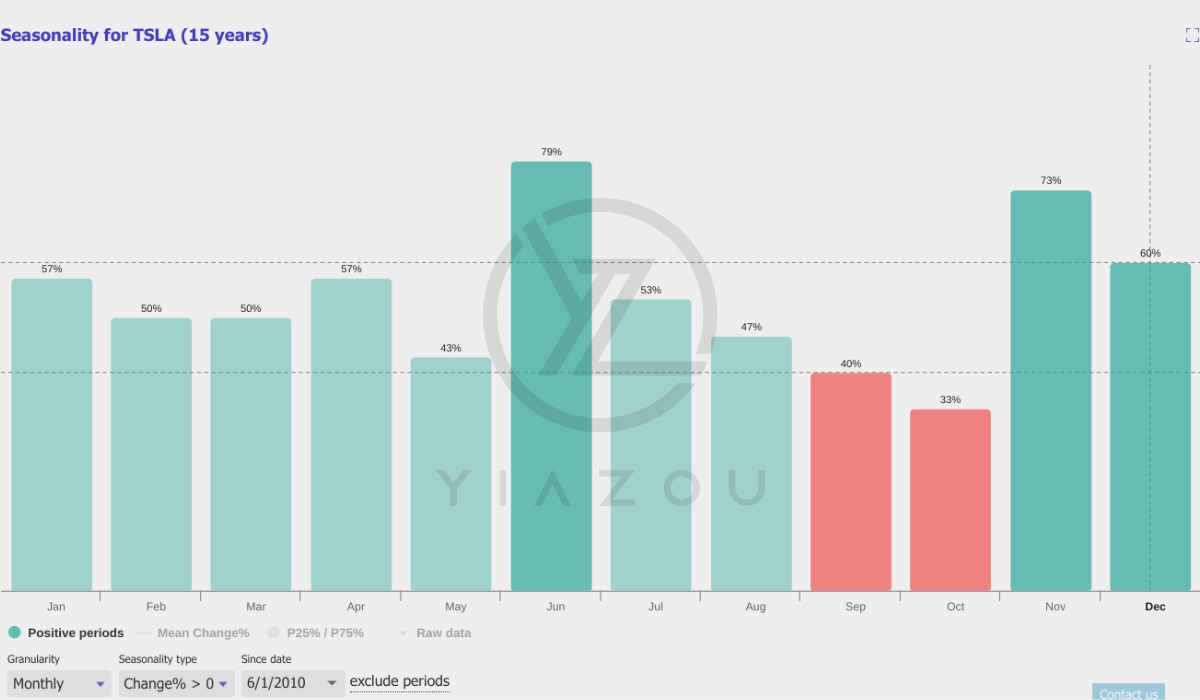

Finally, December’s monthly seasonality indicates a 60% chance of positive returns based on a 15-year trend, adding a probabilistic edge for short-term investments.

Yiazou (trendspider.com)

Takeaway

Tesla is up 44% over the last period, powered by optimism over growth prospects and regulatory benefits that could arise in the aftermath of Trump’s re-election. Despite geopolitical and macro risks, the strong fundamentals of Tesla put it on the right operational efficiency track. We forecast that Tesla will reach $424 by year-end, while an upside target of $480 can be considered if there is strong production momentum on improvements in FSD technology.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.