Summary:

- Tesla, Inc. stock dropped as much as 10% on the trading day after the EV maker opened its books for Q1 2023.

- Investors are arguably worried that CEO Elon Musk’s willingness to sacrifice margins in favor of volume might lower the potential for value accumulation.

- However, the volume strategy could be value-accreditive in the long run, taking into consideration the push for higher post-purchase revenue.

- I now think that Tesla’s fair implied target price is anchored somewhere around $248.56/ share, which makes Tesla stock a Buy for me.

jetcityimage

Tesla, Inc. (NASDAQ:TSLA) shares dropped as much as 10% the day after the company reported Q1 2023 results and CEO Elon Musk indicated in the post-earnings analyst conference call that the leading electric vehicle (“EV”) maker might be willing to sacrifice margins in favor of volume. However, the volume strategy could be value-accreditive in the long run, taking into consideration the push for higher post-purchase revenue in the form of charging, energy and software services. Moreover, I do not necessarily see Tesla’s volume push as worrying. In fact, investors should consider that Tesla still defends industry-leading operating-margins, and, in my opinion, there is no reason to argue that continued production efficiency gains should not be passed on to the consumer in form of lower MSRP prices.

As compared to my previous article, I now think that Tesla’s structural profit margin for cars will trend towards about 10% (vs. 12.5% estimated prior), which provokes a target price downgrade to $248.56/ share). Tesla is still a “Buy” though.

For reference, Tesla stock continues to underperform. For the trailing twelve months, TSLA shares are down about 47%, as compared to a loss of only about 7% for the S&P 500 (SP500).

Tesla’s Q1 2023 Results

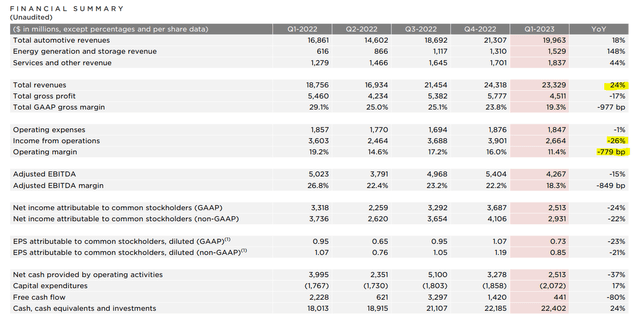

Tesla reported a solid performance for the 2023 Q1 quarter: during the period from September to end of December, the world’s leading EV company generated about $23.3 billion of revenue, a YoY increase of about 24% as compared to the same period one year earlier.

While a 24% YoY revenue expansion is certainly notable, especially given the stressed macroeconomic environment, analyst expected that Tesla’s Q1 revenues could have been even higher (~$23.4 billion) — and thus bullish estimates opened room for a $100 million consensus miss.

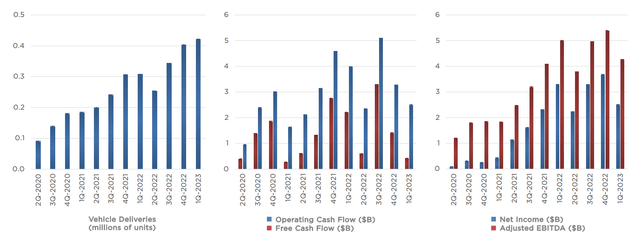

Tesla’s operating profit for Q1 2023 came in at $2.66 billion, a YoY contraction of about 26% versus Q1 in 2022. Similarly, net income attributable to shareholders was $2.5 billion ($0.73/ share), a 24% YoY plunge versus Q1 2022. According to company disclosures, Tesla’s profitability (779 basis point drop in operating margin vs Q1 2023) was pressured by several factors, including: (i) underutilization of new factories, (ii) reduced average selling price, (iii) higher raw material and logistics costs, and (iv) lower credit revenue.

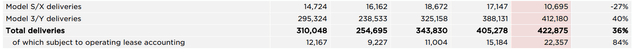

Tesla’s vehicle deliveries numbers continue to trend favorably: as compared to Q1 a year ago, Tesla’s total deliveries surged 36%, with strong deliveries for Model 3/Y (40% deliveries YoY jump) offsetting a weaker deliveries base for premium models S/X (negative 27% YoY growth).

Tesla’s Volume Strategy Could Be Value-Accreditive In The Long Run

Post-Q1, the market has reacted negatively on Tesla’s push for volume, likely perceiving that the volume strategy will result in reduced potential for shareholder value accumulation. I, however, see the strategy as somewhat differentiated. In my opinion, there is no reason to assume that the volume strategy will not be value-accreditive in the long run, taking into consideration the potential lifetime value generated from features like autonomy, supercharging, connectivity, and service. Musk said in the Q1 conference call with analysts:

We’ve taken a view that pushing for higher volumes and a larger fleet is the right choice here versus a lower volume and higher margin…

… We’re the only ones making cars that technically could sell for zero profits now and yield tremendous profits in future through autonomy

In the first quarter, Tesla implemented price reductions on several vehicle models across various regions, slashing the starting price of its Model 3 in the US by roughly $7,000 to prices below $40,000. Despite this, I would like to point out that Tesla’s profitability (11.4% operating margin) remains materially above the industry average and median. For example, for the trailing twelve months, General Motors (GM), Ford Motor Company (F) and Germany-based Volkswagen (OTCPK:VWAGY) captured an operating margin of 7.5%, 5%, and approximately 8%, respectively.

Moreover, investor should also consider that Tesla is continuously pushing for efficiency gains, having communicated an approximate 40% cost reduction upside during the company’s annual investor conference in February. Needless to say, if such an efficiency gain would be materialized, Tesla’s most recent price cuts of between 7-10% shouldn’t be to concerning for the company’s margin profile — in fact, more price cuts could be warranted.

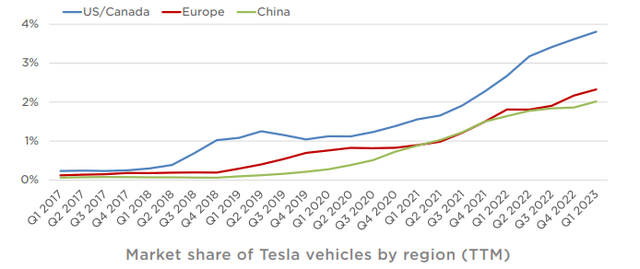

With that frame of reference, Tesla’s market share is already trending towards about 4% in the United States, and towards approximately 2.5% and 2% in Europe and China respectively.

The Cybertruck Is Coming – Finally

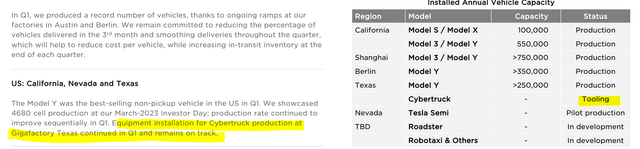

According to Tesla’s Q1 reporting, Tesla is on track to (finally) begin production of its highly anticipated Cybertruck electric pickup later this year, with tooling and equipment installation in progress at EV makers Texas plant. The company plans to hold a delivery event for the Cybertruck as early as the third quarter.

Lower TP To $248.56 Per Share

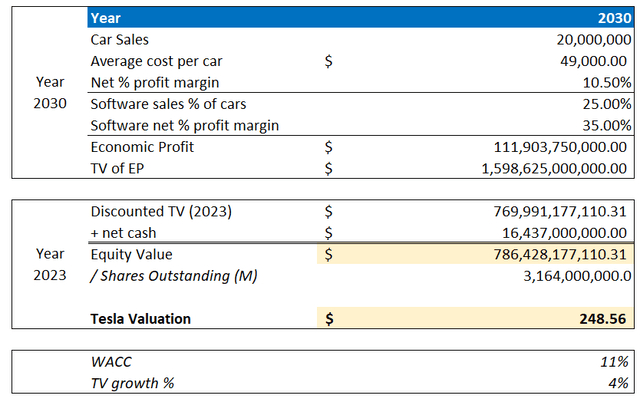

I continue to see Tesla’s ambition to sell 20 million cars per year by 2030 as reasonable. However, reflecting on Tesla’s Q1 2023 results and management commentary, I lower my average sales price per Tesla car to $49,000 and my net-profit margin assumption to 10.5% (pricing headwinds partially offset by economies of scale).

Furthermore, I now assume that for every dollar of hardware sales, Tesla will be able to sell 25 cents of post-purchase revenue, including energy services, software solutions and insurance (for reference, Apple (AAPL) generates about 30 cents worth of services for every dollar of hardware sales). For Tesla’s software business, I continue to view a 35% net-profit margin as reasonable.

Based on this, I now calculate a $111.9 billion annual economic profit, with a 2030 present value equal to $1,599 trillion. This number discounted back to early 2023, assuming a 11% WACC, and adding a $16.432 billion of net-cash, gives an equity value of $786.4 billion, or $248.56/share.

Author’s Estimates & Calculation

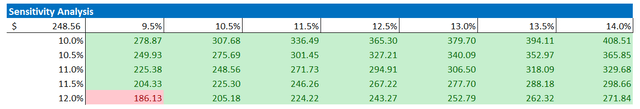

Below the updated sensitivity table — varying discount rate (row) and net % profit margin (column).

Author’s Estimates & Calculation

Conclusion

Following Tesla’s Q1 2023 earnings report, the company’s stock dropped as much as 10%, mostly due to Elon Musk’s indication during the post-earnings analyst conference call that the EV maker might prioritize volume over margins. However, I believe that the focus on volume could be a long-term value accretive strategy, particularly when considering the potential for post-purchase revenue streams from charging, energy, and software services. Furthermore, while some investors may be concerned about Tesla’s shift towards a volume-focused approach, it’s worth noting that the company still maintains industry-leading operating margins. Additionally, there’s no reason to suggest that any continued gains in production efficiency shouldn’t be passed on to the consumer in the form of lower MSRP prices.

In the broader context, it’s essential to recognize that the EV market is rapidly evolving and increasingly competitive, with new entrants seeking to challenge Tesla’s dominance. As such, the company’s willingness to adjust its strategy and potentially sacrifice short-term margins to capture a larger share of the market long term could be a smart competitive move.

Tesla remains the leader in the EV race; and accordingly, I continue to assign a “Buy” rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice; market commentary and author's opinion only

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.