Summary:

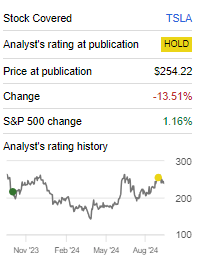

- Tesla is down ~14% since our downgrade, pre-Q3 deliveries report, and We, Robot event, and we maintain our hold in the aftermath of both.

- We, Robot, while impressive, offered no real tangible near-term catalyst, and no detailed execution plan, accounting for regulatory hurdles.

- The stock price has corrected since our downgrade, but we don’t see any near-term catalyst to boost sales, particularly as Chinese competition persists.

- We think Tesla remains overvalued, and investors would be better positioned on the sidelines for the near term.

Hiroshi Watanabe

Tesla (NASDAQ:TSLA) held its long-awaited ‘We, Robot’ event Thursday centered around Robotaxi and, more broadly, the future of autonomy. Our last note on Tesla was a downgrade to hold titled “Tesla: Robotaxi Is A Make-It Or Break-It Kind Of Thing,” and since the stock is down 14%, as shown below, and that pullback is the result of two things we forecasted in our downgrade: a tougher time beating deliveries expectations after upward revisions for Tesla’s delivery estimates into the quarter, and investor hype around Robotaxi despite uncertainty and overdue promises which put a lot of pressure on the event to deliver something new and exceptional.

Seeking Alpha

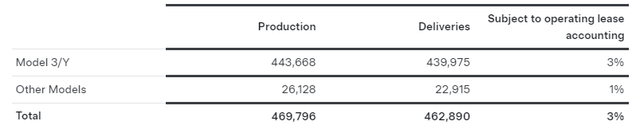

Our expectations on both played out. Tesla deliveries and production numbers came out earlier this month at 469,796 in production and 462,890 in deliveries, which is up sequentially but missed analysts’ high expectations, with some estimates as high as ~470,000. The following chart outlines Tesla’s deliveries for the quarter. And, the Robotaxi event seems to have not sparked that “ah-ha” moment that investors were hoping for and that the market priced in heading into the quarter. The stock is down as much as 8% on Friday, and we expect some of those losses to stick.

Tesla Q3

We, Robot in Review

We specify “in review” because we believe the event was more like a movie than a company event, nothing short of what one would expect from Tesla billionaire CEO Elon Musk. Held in the Warner Bros movie studio set, the We, Robot event unveiled the “Cybercab” prototype, which had no steering wheel and no pedals. Musk’s new promise is that driver-supervision-less operating Model 3 and Model Y vehicles will hit California and Texas in 2025, and fully autonomous Cybercab will be in the works for 2026. We think it’ll be difficult for Musk to meet these deadlines without considerable delays, considering the unaddressed risk of regulatory hurdles, which we saw with Google’s Waymo, and a lack of real detailed discussion about the technological capabilities of Cybercab. Some even remarked, ‘It looks like the Model 2 prototype re-packaged.’ There are now 20 available EV units, including the one Musk drove on stage. This, coupled with the lack of commentary on Tesla’s near-term position, makes us more skeptical about Tesla’s near-term performance.

The price tags on the Cybercab were interesting at less than $30,000, with a variety of models to cater to different customers, including the Robovan (which can transport up to 20 individuals). The price tag and variety of vehicles are telling, in our opinion; they show us that Musk is sticking to this re-branding of Tesla as an affordable everyday kind of car rather than a more high-end luxury one. This seems like a strategic shift as Tesla tries to maneuver an extending field of competition, particularly from Chinese players, which we detail more in our last note on the company. Our belief is that Tesla’s more recent ‘bringing affordable high-tech to the average-Joe’ persona will take time to reflect positively on financial performance, particularly on margins that have been pressured since the price wars began in 2022, but we do think it has significant longer-term potential, eyeing 2H25. This outlook feeds into our hold-rating post-event.

The event was also about much more than cars and transportation; Musk did justice to his inspiration for the event name from Isaac Asimov, author of the I, Robot series, because he also showcased humanoid robots that would serve as the future’s bartenders for sale at $20,000 to $30,000 per robot. The event was shiny, to say the least, but void of a concrete roadmap and the details behind it. We’d say investors left the event with a wider imagination of the future of autonomy, but not a more informed understanding of Tesla’s plan and how it’ll impact financials. That’s the pain point: a lot of fluff and little tangible data in our opinion, i.e., rate-of-change on the Full Self-Driving tech or go-to-market strategy with Cybercab. Additionally, as Barclays’ analyst Dan Levy points out, it “did not show its low-cost model planned for production in the first half of 2025 production.” We think it’s fair to say there remain more question marks than answers around Tesla’s near-term, and hence, maintain our hold-rating. We don’t see any near-term catalyst to reaccelerate end demand, and we think the better interest rate environment will take time to play out until well into 1H25.

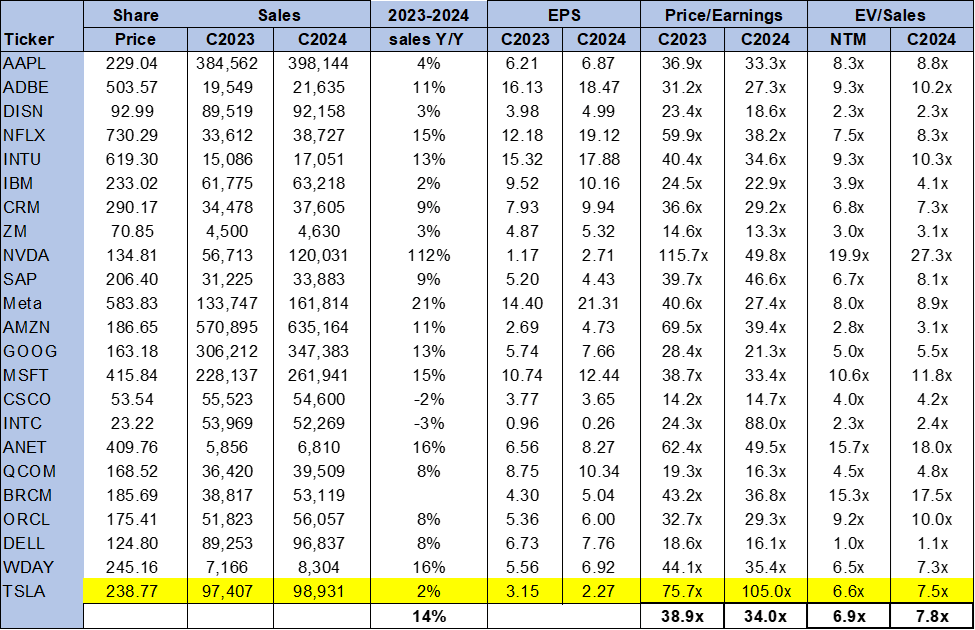

Valuation & Word on Wall Street

We continue to value Tesla relative to the large-cap peer group rather than the auto one, and Thursday’s event, with the future of autonomy and that of Tesla being closely linked, showcases why. On an EV/Sales ratio, Tesla trades at 7.5x, slightly lower than the peer group average of 7.8x and lower than its ratio when we downgraded the stock at the end of September, which was around 8x. When pitched against the Chinese EV peer group on an EV/Sales metric, Tesla comes out on top of BYD, NIO (NIO), and Li Auto. We think a big part of the event’s disappointment had to do with Tesla’s premium valuation heading into October before getting a reality check from the deliveries miss and disappointment of little solid data on the near-term future of FSD and Robotaxi. The valuation remains unjustified at current levels due to a lack of near-term catalyst to support outperformance in the back end of the year, causing us to maintain our hold.

The following chart outlines Tesla’s valuation against the peer group average.

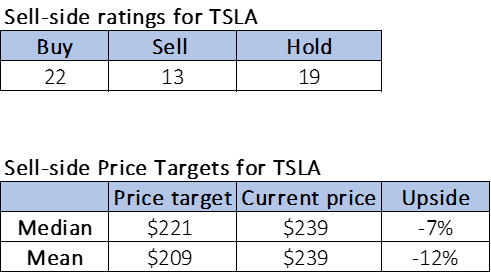

Tech Stock Pros

Wall Street’s sentiment on Tesla hasn’t shifted too much since our last article, around two weeks ago. Of the 54 analysts covering the stock, 22 are buy-rated, 19 are hold-rated, and 13 are sell-rated. The market sentiment continues to be cautious. Tesla stock is currently priced at $239 per share. The median sell-side price target is $221, while the mean is $209, lower than the stock’s current price. This indicates that the market is valuing Tesla higher than analysts believe is justified based on the fundamentals. The stock has peeled back a lot of its late September gains. We’re still not upgrading as we don’t see any near-term catalyst to support outperformance, and we still don’t think the stock has peeled the premium priced in on the deliveries and Robotaxi event hype.

The following charts outline sell-side ratings and price targets for TSLA.

Tech Stock Pros

What to do with the stock?

Heading into October, we stated our opinion that “Tesla is too expensive to have its near-term catalyst amid weak end demand be hopes about Robotaxi,” and with no concrete near-term catalyst provided at the We, Robot event, we think this remains the case. We believe Tesla’s problem once again is pricing too much of the potential positives too early. We would recommend that investors wait for signs of near-term catalysts before jumping into the stock, maybe ones that’ll become more visible after this quarter’s earnings call. We think it’s okay for longer-term investors to keep an eye on it after Friday’s pullback down as much as 8%.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Tired of losing money? Our Tech Contrarians team of Wall Street analysts sifts through the noise in the tech industry and captures outperformers through a coveted research process. We let the work speak for itself here.