Summary:

- Tesla, Inc.’s valuation heavily relies on its self-driving technology, which remains far from achieving safe Level 4 or 5 autonomy.

- Tesla’s vision-based approach faces significant challenges, struggling with real-world complexities and showing diminishing returns compared to sensor-rich systems employed by competitors like Waymo.

- Waymo’s methodical deployment and superior safety metrics highlight its lead in the self-driving race, posing a major threat to Tesla’s market dominance.

- Tesla’s failure to deliver on FSD promises could drastically impact its valuation, potentially cutting it by more than half, aligning it with traditional automotive stocks.

Hiroshi Watanabe

Tesla, Inc.’s (NASDAQ:TSLA) promise to lead the full self-driving (“FSD”) revolution has increasingly been the focal point of Tesla bulls. In fact, CEO Elon Musk has even stated that Tesla’s stock is near worthless if the company is unable to achieve its self-driving ambitions. With FSD being pitched as the cornerstone of the automotive future, Tesla has positioned itself as more than just a car company-it’s a tech titan poised to disrupt transportation and reap the unprecedented profits from full self-driving.

However, beneath this grand narrative relentlessly pitched by Elon Musk and Tesla bulls like fund manager Cathie Wood, a far more uncertain reality lay. Despite Tesla’s head start and tens of billions of dollars invested into FSD, the company remains far from delivering safe Level 5 or even Level 4 autonomy. Meanwhile, competitors like Waymo are leaping ahead, deploying driverless robotaxis exponentially and rapidly refining their systems with real-world data.

Much of Tesla’s valuation hinges on the belief that its FSD technology will revolutionize transportation and unlock massive revenue streams, most of which will be directed towards Tesla. In the increasingly likely scenario that Tesla cannot deliver on this promise, and Waymo continues to solidify its rapidly growing lead, the very foundation of Tesla’s bull thesis risks crumbling along with the company’s high valuation.

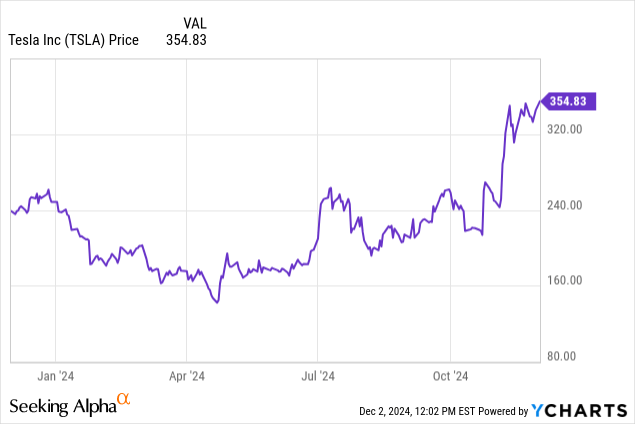

Tesla’s stock rise can largely be attributed to the promise of Tesla’s self-driving technology.

Tesla’s Vision-Based Approach is Clearly Flawed

The core of Tesla’s self-driving technology is its vision-based system powered by neural nets. Tesla insists that its end-to-end neural networks and camera-only approach is the future autonomy. However, this contrasts sharply with most of its major competitors, who are employing sensor-rich systems that incorporate LiDAR, radar, and high-definition maps. While Tesla’s approach is theoretically more scalable and Waymo’s approach is far more costly, this scalability advantage will be irrelevant if Tesla cannot even get its technology to work in the first place.

Neural networks thrive on data and improve as they are fed larger quantities of complex, diverse, and high-quality inputs. Unfortunately for Tesla, the scaling laws that have governed AI advancements are showing signs of diminishing returns. Tesla faces this bottleneck acutely, as it must interpret real-world complexities in real-time without the aid of additional sensor data or the aid of pre-mapped environments.

The monumental challenge of accounting for nearly every possible edge case, which is largely a requirement for achieving an autonomy solution that will appease regulators, has placed Tesla at a standstill. This is evident in the fact that Tesla has barely improved at a linear pace over the past few years, even though it needs to improve at a far greater exponential rate to be viable.

Tesla’s pure vision approach struggles to match truly multi-modal systems like that of Waymo’s. LiDAR, radar, and pre-mapping offer critical advantages in complex environments, including adverse weather conditions, construction zones, etc. Tesla’s systems rely solely on visual inputs, and have shown major limitations in handling edge cases, such as hidden objects or dynamic traffic situations. These shortcomings have barely been addressed and continue to raise major questions on whether Tesla’s approach is fundamentally flawed.

Competitors are Leaping Ahead

Tesla’s competitors, mainly Google’s (GOOG) Waymo, have developed methodical development strategies that have proven to be incredibly effective thus far. In fact, Waymo is now unquestionably far ahead of Tesla in terms of actually rolling out a viable robotaxi service, something that CEO Elon Musk has talked about for years. Waymo’s reliance on a sensor-rich, multi-modal system has proven to be the superior approach by far.

Waymo’s reported critical intervention rates in the tens of thousands of miles are orders of magnitude better than those of Tesla. Waymo reported a critical intervention rate of 1 per 17,000 miles, which stands in sharp contrast to the critical intervention rates of Tesla, which often occur once every hundred and even tens of miles according to crowdsourced data. Waymo’s superior safety metrics underscore the increasing reliability of its technology.

Per Waymo’s September post:

“The most recent data shows that over 22 million rider-only miles driven through the end of June, the Waymo Driver has been involved in 84% fewer crashes with airbag deployment, 73% fewer injury-causing crashes, and 48% fewer police-reported crashes compared to human drivers**. Notably, this is the first time the airbag deployment metric has been introduced in our crash rate analysis, providing valuable context regarding the severity of crashes with other vehicles.”

Not only is Waymo increasing its miles driven at an exponential rate, with rides per week growing approximately 10x from a year prior, but it is doing so in an incredibly safe manner, evident in its safety statistics. To make matters worse for Tesla, many Chinese competitors like Baidu (BIDU) are also launching robotaxi services similar to that of Waymo. Even if Tesla manages to improve its FSD technology dramatically down the road, there will be a good chance that all the major markets will already be saturated by competing robotaxi services by then.

The company’s cautious and methodical deployment strategy has allowed it to refine its systems in controlled environments before scaling. This disciplined approach has allowed the company to launch robotaxi services that are not only fully operational, but also revenue generating. In fact, the company has started to increase its operations at an exponential pace in recent quarters, further solidifying its lead.

In addition, Waymo’s methodical and transparent approach has built trust among regulators, and more importantly, the public. In sharp contrast, competitors like Tesla and even General Motors’ (GM) Cruise have actually damaged their reputations recently as a result of reckless rollouts and high-profile accidents. What’s more, some of these companies like Cruise have even attempted to cover up accidents, which has led to enormous public and regulatory backlash, of which Cruise has still not recovered from.

The Financial Implications: Cracks in Tesla’s Valuation

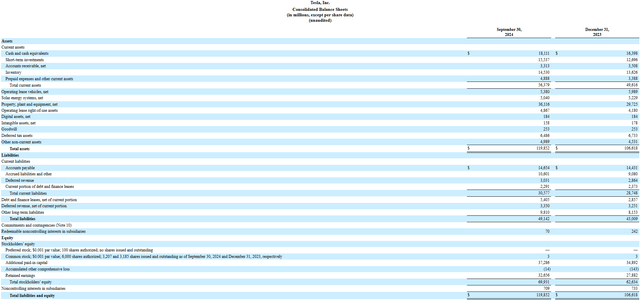

Tesla’s Q3 reveals both positives and negatives for the state of the company’s current business. Tesla continues to perform well in its electric vehicle business, with revenues of ~$25 billion and a net income of $2.1 billion during the quarter. Even the onslaught of Chinese competition has not negatively impacted the company in the way that many bears thought it would have.

Unfortunately for bulls, Tesla’s self-driving financials tell an entirely different story. Tesla’s FSD revenue remains mostly deferred, with over $3.6 billion in unrecognized income that is tied to promises the company has yet to fulfill. This unrecognized income is becoming an indication of Tesla’s failure on the self-driving front. This financial strain is only worsened by the fact that Tesla has already made massive investments in building out its AI infrastructure. The company has poured billions into developing its Dojo supercomputer and other AI projects to gain an edge in self-driving (among other things). However, these investments have yet to truly make an impact on accelerating the company’s technological development.

The scaling limits of neural networks, along with the growing complexity of edge cases, have slowed down progress dramatically. This slowdown will make it increasingly hard for Tesla to justify its massive valuations, much of which is built on the promise of an AI-led, self-driving future. Meanwhile, Waymo’s revenue-generating robotaxi is already starting to make a noticeable impact with 150,000 self-driving rides per week, a figure that is only growing exponentially. Alphabet (GOOGL) has even started to regularly mention Waymo in its earnings calls, which it has never done before. As Waymo continues to hit major milestones and Tesla fails to achieve its own lofty promises, Tesla could see its valuation plummet.

Major Risks to Tesla’s Self-Driving Narrative

Tesla faces several risks as it struggles to make a dent in the self-driving race. The most immediate issue appears to be the scaling wall that is impacting the AI industry as a whole. Reports indicate that advancements in neural nets are slowing down, with rumors from all the top frontier labs that their latest models have significantly underperformed.

For Tesla, which relies heavily on scaling its neural network architecture, this plateau could be a significant roadblock. In fact, the only major noticeable improvements that have occurred for FSD was when Tesla increased the size of its FSD neural net parameter count by approximately 5x. Without further breakthroughs in AI research, Tesla’s vision-only approach may never achieve the reliability required for full autonomy.

Regulatory challenges also remain, as Tesla’s aggressive marketing strategy has drawn a great deal of scrutiny from safety regulators. These regulators have increasingly raised concerns about Tesla FSD’s reliability and the potential of misuse by drivers. High-profile incidents involving FSD-equipped vehicles have only further heightened the growing distrust around the technology. On the flip side, Elon Musk’s cozy relationship with incoming President Donald Trump may help Tesla overcome many of these regulatory challenges.

In addition, Tesla faces growing competition not just from Waymo but from a plethora of highly funded companies like Zoox, which is backed by Amazon (AMZN). To make matters worse, Chinese self-driving technology is also starting to make a major dent, with Baidu rapidly catching up to even the industry-standard Waymo in terms of self-driving miles recorded.

Conclusion

Tesla’s failure to deliver on its self-driving promises undermine the very foundation of its narrative as a technology company and, ultimately, its valuation. The company’s vision-based approach, while theoretically scalable, has proven to be inadequate in practice. Meanwhile, competitors like Waymo have started to accelerate their robotaxi service deployment while at the same time maintaining superior levels of safety and reliability.

For Tesla, the stakes could not be higher. The company’s current market capitalization of ~$1.1 trillion and P/E ratio of 140 suggests that the market is pricing in a large probability that Tesla will be able to fulfill its FSD promises. If Tesla fails to do so within a reasonable time frame, its P/E ratio could easily see a large compression and fall more in line with traditional automotive stocks. This could see Tesla’s valuation easily cut by more than half of its current levels.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.