Summary:

- Tesla faces challenges including declining profit margins, increased competition in the EV industry, and a decline in market share.

- The company’s profit margins have been negatively impacted by price cuts, and its market share has been lost to legacy automakers and EV startups.

- Tesla is also facing problems in China, with a decline in sales and market share, and is at risk of losing further ground in the Chinese EV market.

Xiaolu Chu

Thesis

Tesla, Inc. (NASDAQ:TSLA) is an American multinational automotive and clean energy company headquartered in Austin, Texas, which designs and manufactures electric vehicles (cars and trucks), stationary battery energy storage devices from home to grid-scale, solar panels, and related products and services. The stock is part of a high-performing group of stocks called the ‘Magnificent 7’, which have led the market higher this year. However, the company faces several challenges such as lower than expected growth rate, declining profit margins, and increased competition in the Electric Vehicle industry.

Catalysts

Declining Profit Margins

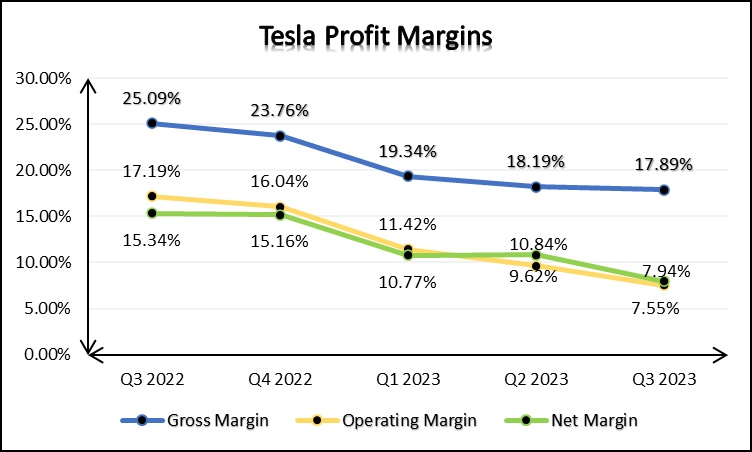

Tesla has announced multiple price cuts since the end of 2022 in order to drive demand for its electric vehicles as competition heats up in the industry. To no one’s surprise, this has had a negative impact on the company’s profit margins. The below chart shows the decline in key profit margins for the company over the last five quarters. We can see the effect of price cuts reflected in the margins, which have declined sharply (by over 400 basis points) since Q4 2022.

Tesla Quarterly Income Statement

Compared to Q3 2022, all profit margin measures have declined by roughly 700 basis points. People may claim that these price reduction measures are temporary and are being done only to prevent competitors from gaining early ground, but I feel these price cuts are here to stay because that is how Musk always intended it to be if we are to believe what he said in interviews during Tesla’s IPO. Elon mentions that Tesla’s goal was to mass-produce electric vehicles while reducing the price as the company moved from the Roadster (high price, low volume) to the Model S (mid-price, mid-volume) to a mass-market vehicle. It is clear that his goal is to reduce the price so he can reach as many customers as possible, which is what a mass-market seller does.

Judging by Q3 2023 numbers, Tesla has reached a stage where its operating margins (7.55%) are at the same level as ‘traditional/conventional’ auto manufacturers. The above graph includes all revenue streams for Tesla, namely within Automobiles – Vehicle sales, regulatory credits which are credits for building environment-friendly vehicles as per 10-K, known as carbon credits in common parlance, and automobile leasing. Apart from this revenue also includes energy generation and storage, and other services. If we were to look at purely the automobile segment, specifically revenue from the sale of EVs, then margins would be much lower. As per the Q3 2023 10-Q, Gross Margins for Automotive Sales, Automotive Leasing, Energy Generation and Storage, and Services were 15.74%, 38.45%, 24.44%, and 5.96% respectively.

Tesla Q3 2023 shareholder presentation

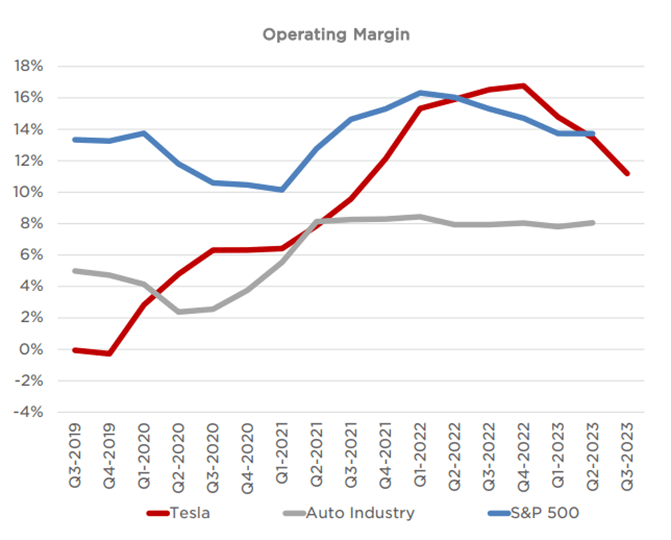

The above image shows the evolution of operating margins for Tesla, the auto industry, and the S&P 500 equity index on a TTM basis, and we can see how Tesla’s margins are trending toward the Auto Industry average margins of close to 8% due to price cuts.

What I want to highlight is that most people see these price cuts as temporary but assuming they are here to stay, the markets have not priced in this decline in profit margins in their valuation of the company which gives me reason to believe that there is a higher downside potential than potential upside.

Increased Competition and Declining Market Share

While there is little denying that Tesla has led the modern EV movement, with a 65% market share in the US in Q3 2022, the company is facing increased competition and has seen its market share decline to 50% in Q3 2023. The United States market accounts for nearly half of Tesla’s total revenue. The market share has been lost to legacy automakers like Hyundai, BMW, and Mercedes and EV Startups such as Rivian. Hyundai, BMW, and Mercedes all saw their sales triple or quadruple compared to the same quarter a year ago.

The reason for Tesla having such a high market share was its first-mover advantage that enabled market leadership. However, as legacy automakers enter the space, they stand to benefit from existing technological advancements as well as their expertise in manufacturing automobiles at scale which will allow them to benefit from economies of scale and price their products competitively, possibly more affordable than Tesla’s products.

For these reasons, I expect Tesla’s market share will keep declining in the coming years.

Problems in China

In FY 2022, China accounted for nearly 22% of Tesla’s sales and remains a major manufacturing and demand node for Tesla. The country is however going through an economic slowdown, and to make things worse, Tesla is losing market share in China too as its sales in the region decline sharply. In September 2023, Tesla’s sales in China declined 11% YoY as per data from the China Passenger Car Association. In October 2023, Tesla sales in the region declined 2.6% compared to the previous month. In November 2023, Made in China (MIC) car sales declined an astonishing 17.8% compared to the same month in the previous year.

Another worrying sign is Tesla losing market share to BYD and other domestic players in China.

Tesla’s market share in China’s EV market has declined from 12.98% in Q2 2023 to 9.89% in Q3 2023. This is because BYD offers electric cars that are far cheaper than Tesla. The former has focused on developing a wide market base with more affordable vehicles and has benefitted due to China’s control of key battery supply chains and the Chinese government’s initiatives to build a vast charging network. BYD saw a 38.4% increase in October 2023 compared to the same month last year.

If Tesla’s history in China, and Sino-US relations are anything to go by then there is also some degree of risk involved in China for Tesla. In 2021, the Chinese government had cracked down on Tesla vehicles citing privacy concerns which meant military and government personnel were not allowed to use Tesla vehicles. Chinese regulators had also summoned Tesla regarding quality issues in early 2021.

Combining the effects of a declining GDP growth rate in the Chinese economy and losing market share is a big blow to Tesla. I expect Tesla to lose further ground in the Chinese EV market owing to the price sensitivity of consumers.

Valuation

After having discussed the catalysts affecting Tesla, let us now look at the valuation.

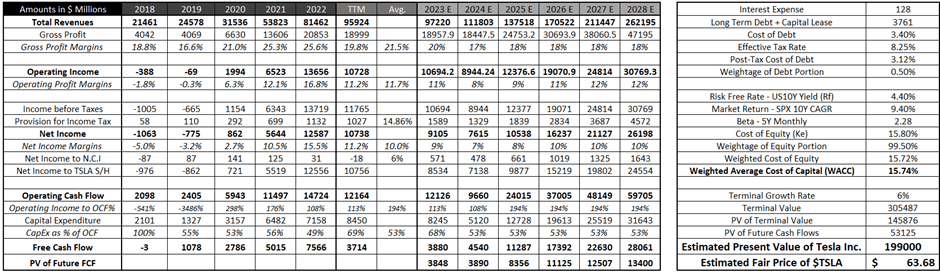

Keeping in mind that the global EV market is expected to grow at 23-24% CAGR over the next 10 years, I have assumed Tesla’s revenues at 22% for the next five years, slightly lower to account for the decline in market share.

Gross Margins and Operating Margins were estimated for 2023 using TTM figures and for the future, I assumed operating margins to worsen next year due to weaker demand as I expect at least a mild recession next year (2024). Thereon, margins are assumed to improve gradually to the average of the last three Financial Years when Tesla has been profitable (2020 to 2022).

For ease of calculation, non-operating incomes and expenses were assumed to be zero for ease of estimations since they have a very limited effect on the final financial estimates. The Income Tax Rate was taken as an average of the tax rate from 2020 to 2022 and the provision for taxes was subtracted to arrive at Net Income. Similarly, I looked at the average share of non-controlling interests in the Net Income and subtracted that to arrive at the Net Income attributable to Tesla shareholders.

My Financial Projections

Operating Cash Flow was estimated using the average of Operating Cash Income to Operating Cash Flow conversion ratio. Capital Expenditure was calculated using the average CapEx (as % of OCF) from 2019 to 2022 since 2018 was an outlier year.

Future Free Cash Flow was then discounted at the company’s Weighted Average Cost of Capital (15.74%), which was calculated using the Capital Asset Pricing Model. The Terminal Growth Rate was taken at a fairly high 6% to reflect the growth prospects of the EV industry. In the end, we received a fair value estimate of Tesla at ~$199 billion or a share price target of nearly $63.68, nearly 74% below the last traded price on the NASDAQ on 8th December 2023.

Risks

Greater than Expected Revenue Growth

As seen in the valuation section above I have assumed Tesla’s revenue to grow at 21-22% CAGR for the next five years. However, there is a risk to my thesis if Tesla’s revenue can grow faster than my assumed growth rate.

This could be due to several factors such as the achievement and approval of Tesla’s Full Self Driving (FSD) technology, and the development of new products enabling growth in market share. However, I do not believe these risks pose much threat to my sell thesis.

Firstly, let’s talk about the FSD technology. A survey from PolicyGenius reveals that nearly three out of four Americans feel less safe when driving or riding in a car that has FSD technology. A majority of survey respondents also said they wouldn’t pay more for a car with autonomous tech. Earlier this year, Tesla had to recall over 360,000 vehicles due to issues with FSD Beta software. Even though Musk has been promising FSD since 2015, achievement and full regulatory approval of FSD Technology seems to be a far-fetched reality, even at the end of 2023.

Secondly, let’s discuss why I see very little chance of Tesla gaining market share. The consumer’s response to Tesla’s Cybertruck has been mixed owing to its higher-than-expected price and disappointing battery range. From Tesla’s existing product mix, the Model S is the best-performing vehicle with a range of close to 400 miles (640km). However, Tesla is set to face a lot of competition from legacy automobile manufacturers such as Toyota which plans to launch an EV with a 1,200 km range, Honda launching an EV with a 300-mile (480km) range, BMW with its i4 EV with a range of 590 km, Kia’s EV6 with a range of 708 km, Mercedes launching a luxury EV with a range of 857 km, and Rivian’s Max having a range of 400 miles (640km).

With increasing investment in the EV space from legacy automakers, I do not expect Tesla to gain market share, rather I expect it to lose market share in both the USA and China as has been explained in the catalysts section.

Declining Input costs – Lithium, Chips, etc

While I mentioned earlier that operating profit margins have declined substantially, some tailwinds could benefit Tesla over the coming quarters. One such significant tailwind comes from declining input costs. The lithium-ion battery makes up between 35-45% of the total cost of an Electric Vehicle. Lithium (Carbonate) prices are down ~80% this year and a supply glut in semiconductor chips should allow Tesla to avail these inputs at cheap prices and boost operating margins in the future.

However, to counter-argue this, one must investigate why prices of Lithium and Cobalt have declined so much and why there is an excess supply of chips. The reason behind both these factors is worsening economic conditions. The recovery in China’s economy was encouraging in Q1 and Q2 2023 but has now been fading away as the annualised GDP growth rate declines which have exerted downward pressure on the prices of many industrial-use commodities. Similarly, semiconductor chips are in excess supply because demand for PCs, etc has decreased compared to last year. When there is economic weakness, Tesla may benefit from falling input prices but it will also negatively impact the topline growth of the company.

Conclusion

To conclude my report, I would like to place a Sell Recommendation on Tesla stock seeing that my fair value estimate is $63.68, nearly a fourth of the closing price on 8th December 2023. I believe that the market is underpricing current headwinds such as the loss of market share, and a decline in operating profit margins. In contrast, future growth prospects such as Fully Self Driving (FSD) have already been priced into the stock’s valuation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.