Summary:

- Tesla, Inc.’s Q3 2024 results showed mixed revenue growth, with the core Automotive unit lagging at 2% YOY, indicating strong competition in the EV sector.

- Despite an 8% overall revenue growth, the increase is driven mainly by non-core businesses, raising concerns about the sustainability of Tesla’s financial performance.

- Tesla’s valuation is significantly higher than peers, with P/E and EV/EBITDA multiples far exceeding sector medians, suggesting the stock is overpriced.

- Despite Tesla’s high cash reserves and new projects, the current stock price reflects irrational exuberance, making it a strong sell at this level.

Michael Vi/iStock Editorial via Getty Images

During the last few weeks, there have been many events that had an impact on Tesla, Inc. (NASDAQ:TSLA) stock price: from the Q3 earnings released on October 24th, 2024, to the US elections won by Former President Donald Trump on November 5th 2024. Since the US election, TSLA stock has appreciated by 35% reaching $328/share as of November 12th, 2024.

In this article, I will provide an overview of Tesla’s Q3 financial earnings and operational performance, and I will explain why I believe that the stock is currently trading at a well overpriced level. This is not my first article on Tesla, I previously wrote about it about three months ago, and my view has changed from sell to strong sell. Indeed, in my previous article I expressed my concerns about the strong competition that Tesla was facing, and I think that the Q3-2024 results confirm that. Moreover, as I will explain below, some new projects announced by Tesla are not ready to provide additional revenue streams yet.

Definitely, many investors have earned strong gains from the recent stock price soaring. However, I believe that – when deciding whether to invest or not in a company – an investor should take a deeper look at the company’s financial and fundamentals to understand the real value of a company.

Q3 2024 results and the truth behind revenues

Tesla’s Q3 2024 revenues were a bit mixed. Total revenues increased by 7.8% year-on-year to $25.1 billion (from $23.3 billion in the same period of one year ago). However, the story gets more interesting if we look at sales generated from the different business units: indeed, the Automotive unit – that accounts for almost 80% of total revenues – only increased by 2% year-on-year, a modest growth that is more in line with a mature automotive company rather than a fast-growing one. From my perspective, the small growth is also a clear sign of the strong competition that Tesla is facing in the EV sector.

On the other hand, the other two non-core business units showed strong yearly growth rates, with the Energy Generation and Storage that grew by 52% to $2.4 billion sales and the Service unit that increased by 29% to $2.8 billion revenues. However, Energy Generation and Storage accounts for 9% of total sales and Service accounts for 11% of total revenues. Therefore, whether the growth impact of these two business units was the main driver of Tesla’s revenue growth inQ3-2024, the impact in absolute terms is almost marginal.

Taking a look at the quarter-on-quarter revenues growth provides other relevant information: the Automotive unit, from Q2-2024 to Q3-2024 only increased by 1%, even less than on an annual basis. The same is valid for the two other units, with Service growing by 7% and Energy Generation and Storage declining by 21% q-o-q.

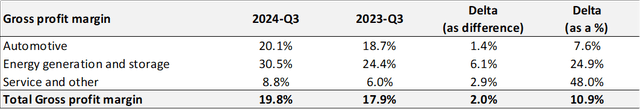

Focusing on the cost side, the total cost of revenues increased by 5.3% to $20.1 billion with almost $16 billion represented by costs for the Automotive unit, $1.6 billion for the Energy Generation and Storage unit and $2.5 for the Service unit.

Due to cost of revenues increasing less proportionally than revenues, the gross profit increased by 19.6% to $5 billion with the gross profit margin reaching 19.8%, 200 basis points more if compared with the 17.9% of Q3-2023.

As a result of the increasing gross profit, also EBIT and net income showed a positive trend, with EBIT at $2.7 billion (+54% y-o-y) and net income at $2.1 billion (+16.2% y-o-y). However, it should be pointed out once again that the increase in EBIT and net income is mostly driven by the two non-core Tesla businesses.

Overall, looking at the income statement, one could see an 8% revenue growth and think that Tesla is doing fine. However, going one level deeper, it is possible to see that the Automotive business is not doing very well. This is despite the number of both Model 3/Y production and Model 3/Y deliveries increased year-on-year (+6% and +5%, respectively), sales from the Automotive unit only increased by 2% due to Tesla constantly reducing the average selling price to face the competition from Chinese competitors. To give an idea, in Q3-2024, BYD Company Limited (OTCPK:BYDDF) sales increased by 20% year-on-year.

Few words on the Cybercab, Tesla’s robotaxi

Some investors are more optimistic about Tesla’s future since they believe that, besides auto, Tesla could develop other groundbreaking innovations able to generate strong value. For example, in October, Tesla presented its robotaxi, called Cybercab: however, the financial market did not appreciate the Cybercab concept and the stock declined by 7%. Despite Tesla announcing that the Cybercab will be launched in 2026, I am skeptical about the real potentiality behind this idea. First, from the images that were released, one can see that the Cybercab only has two seats. This goes a bit against the concept of a taxi that — for example — could be used to drive a family with luggage to the airport. In addition, the Cybercab will not have the steering wheel since it will be self-driving: however, Tesla’s full self-drive technology (“FSD”) still has some safety issues to solve and – to be honest – I cannot see how the FSD could be ready to be used on a fully self-driving car in 2026.

Valuation

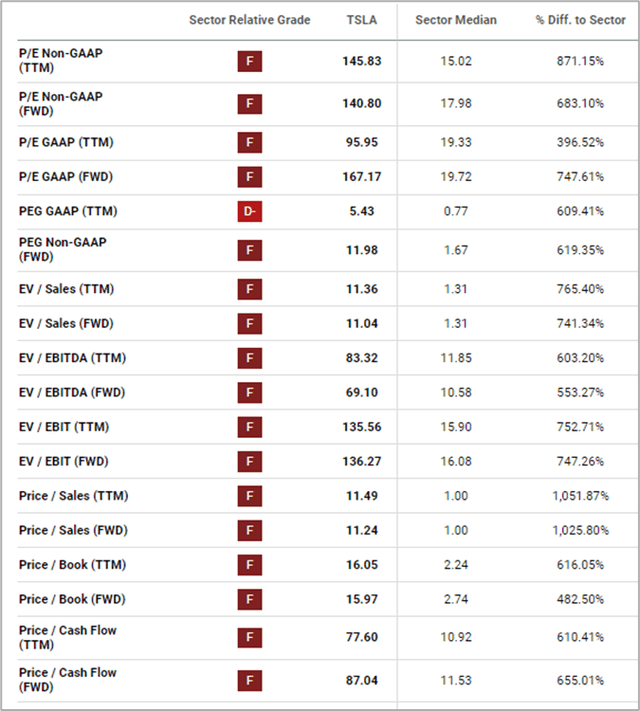

Focusing on the valuation of Tesla’s stock, I believe that the image below is self-explanatory.

Considering all the possible multiples, one can see that Tesla is trading at multiples that are incredibly higher than peers. Even if we could consider that Tesla could benefit from the US election outcome, I believe it is almost impossible to justify a P/E at almost 10 times the sector median or an EV/EBITDA trading at almost 7 times the peers’ median.

Conclusion

In conclusion, while Tesla has undeniably reshaped the automotive industry in the past years, its current stock price may not reflect a fair valuation based on fundamental financial metrics. From my standpoint, the incredibly high premium attached to Tesla’s stock represents an example of irrational exuberance. Definitely, Tesla is sitting on plenty of cash (almost $34 billion) and has many new projects in its pipeline. However, one has to be realistic and, at this price, I believe that Tesla is a strong sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.