Summary:

- Teva’s stock has risen 32% since December, outperforming the SPY, buoyed by FDA approval of Simlandi, a biosimilar to Humira.

- Simlandi, developed with Alvotech, stands out for its “interchangeable” status, potentially becoming a preferred generic despite market competition.

- Teva’s Q4 earnings show significant growth; the 2024 outlook is optimistic with revenue projections of $15.7-$16.3 billion, focusing on key products.

- Investment recommendation: Buy Teva for its operational and financial improvements, despite risks from high leverage and market competition for Simlandi.

Johnce/E+ via Getty Images

Teva’s Prescription for Profit: Simlandi’s Market Shake-Up

Since my December call for a “revival” in Teva Pharmaceutical Industries Limited’s (NYSE:TEVA) stock for the new year, shares are up 32%, beating the market’s performance (SPY) of 11% in the same time period.

Seeking Alpha

Over the weekend, Teva made a regulatory announcement that generated some interest. Simlandi, an arthritis injectable developed in partnership with Alvotech (ALVO), an Iceland-based company that specializes in biosimilars, has been approved by the FDA. Simlandi is an “interchangeable biosimilar” to AbbVie Inc.’s (ABBV) popular arthritis treatment, Humira. The news propelled Alvotech’s stock up more than 10%, while Teva’s stock rose only 2%.

Interestingly, the company notes that “as the only interchangeable adalimumab biosimilar with the high-concentration formulation, Simlandi can be substituted for Humira at the pharmacy level, subject to state pharmacy laws.”

Generic entry is not new to AbbVie’s Humira. The popular medication is expected to see another ~30% decline in sales in 2024, going from $12.1 billion to $9.6 billion. Simlandi will stand out among a generic crowd since switching is made easier for patients thanks to its “interchangeable” status. For example, pharmacists are now able to substitute without the prescriber’s express consent. Assuming the biosimilar is adequately available and less expensive than Humira, the switch (patients with scripts originally written for the brand name “Humira”) is likely to gain popularity. So, Simlandi could reasonably become the preferred generic.

Predicting peak annual revenue for Simlandi is challenging due to the number of generics available on the market already. Moreover, going off of Humira’s past and current revenues is misleading because generic entry has lowered its cost and margins. It is, however, reasonable to believe that Simlandi will have an impact on Alvotech’s and Teva’s bottom lines. Simlandi could feasibly generate at least hundreds of millions of dollars per year in my view.

Teva has exclusive U.S. commercialization rights and will share profits with Alvotech. For Alvotech, which also markets a Stelara biosimilar, U.S. approval serves as an additional market opportunity for Simlandi, as it is already on the EU market.

Similandi is expected to make a significant difference in the generic market, so all things considered, this is a very good outcome for both companies.

Q4 Earnings & 2024 Outlook

Looking at Teva’s latest earnings for the quarter ending December 31, 2023, net revenues rose to $4.46 billion year over year from $3.88 billion, marking significant growth. Gross profit jumped to $2.42 billion from $1.77 billion year over year, showing enhanced operational efficiency despite a modest rise in R&D costs. Share dilution was negligible, with only a slight increase in the weighted average number of shares. A notable decline in goodwill and other asset impairments led to a net income of $461 million, a dramatic turnaround from a net loss of $1.30 billion last year.

For 2024, Teva’s outlook is cautiously optimistic, with revenue projections ranging from $15.7 to $16.3 billion. This outlook is supported by key products like Austedo, Ajovy, Uzedy, and Copaxone, which are major contributors to revenue. Expected operating income and adjusted EBITDA of $4.0-$4.5 billion and $4.5-$5.0 billion, respectively, signify strong operational performance. Finance costs are anticipated to be around $1 billion, with a tax rate of 14%–17%. The projected diluted EPS of $2.20–$2.50, along with a free cash flow of $1.7–$2.0 billion and controlled CAPEX of about $0.5 billion, highlight a strategy focused on profitability and cash generation. This outlook underscores Teva’s commitment to growth, operational efficiency, and financial discipline.

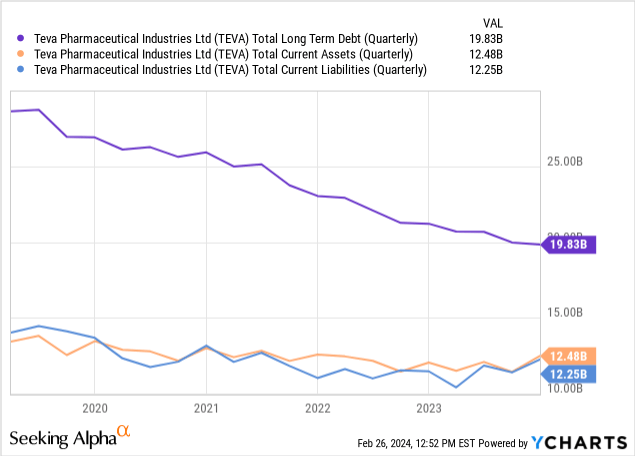

Financial Health

Turning to Teva’s balance sheet, ‘cash and cash equivalents’ totals $3.226 billion, with no other categories listed. In comparison, the company’s debts span various categories, including ‘Short-term debt’ ($1.672 billion), ‘Long-term liabilities’ including ‘Senior notes and loans’ ($18.161 billion), among others, leading to significant leverage. However, the company continues to make progress in debt reduction, as evidenced in the chart below.

The current ratio, calculated as current assets divided by current liabilities, is approximately 1.02, indicating a barely adequate liquidity position.

The net cash provided by operating activities for the year 2023 was $1.368 billion, translating to an average monthly cash inflow of about $114 million. The company’s cash flow activities reveal a strategic focus on managing operational efficiency and debt obligations while moderately investing in assets, as seen in the net cash used for financing activities and investments.

Given the positive operating cash flow and existing liquid assets, the odds of requiring additional financing within the next twelve months seem low, assuming operational performance remains constant. However, the reliance on substantial long-term debt raises considerations about long-term financial sustainability.

Market Sentiment

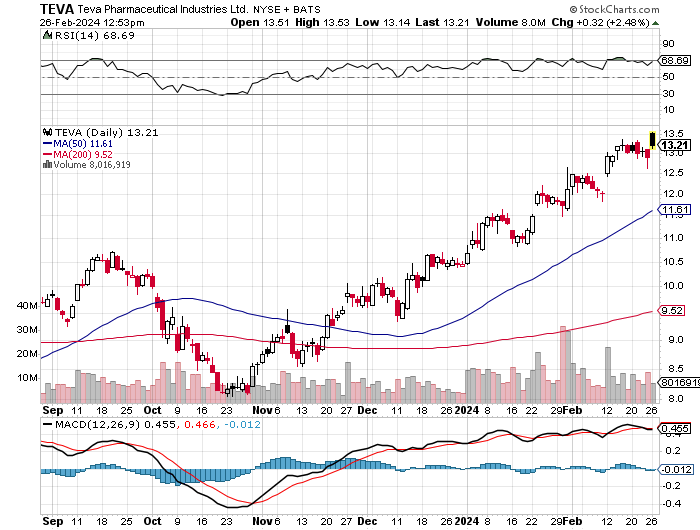

According to Seeking Alpha data, Teva has a market capitalization of $14.45 billion. Analysts’ revenue projections indicate marginal growth, with an expected increase to $16.72 billion by 2026, reflecting cautious optimism. TEVA’s stock momentum outperforms the SPY across various timeframes, notably a 67.62% increase over 9 months versus the SPY’s 22.75%, highlighting strong market performance.

StockCharts.com

Per Fintel, short interest stands at 18,316,679 shares (1.64%), underscoring a relatively low market bet against the stock. Institutional ownership changes reveal a dynamic, with 64 new positions amounting to 16,152,239 shares and 53 sold out positions totaling 17,812,295 shares, indicating active institutional engagement. Prominent institutions, such as Ion Asset Management and Lingotto Investment Management, appear to demonstrate confidence in TEVA. Insider trades over the past three and twelve months show a net negative activity of 279,557 and 792,041 shares, respectively, suggesting some caution among insiders.

Given these factors, TEVA’s market sentiment can be qualified as “adequate.”

My Analysis & Recommendation

Simlandi presents another promising revenue driver for Teva. The company continues to make strides in reducing its debt and novel drugs like Austedo point towards its R&D advancements outside of the generics realm. Although the stock has appreciated some already, it’s reasonable to believe there is further upside remaining in 2024 as Teva makes good on their goals. As such, Teva remains a “Buy” here.

Still, there is considerable risk. The two most obvious are covered in the article. Teva remains highly leveraged and any negative developments could have major impacts on its financial viability. Simlandi, specifically, could underwhelm the market due to significant competition. Beyond this, typical sector-specific risks (e.g., regulatory changes, prospects of drug pricing legislation, macroeconomics) could also break down Teva’s stock.

As always, investors should maintain a diversified portfolio and not have too much exposure to one stock to mitigate risk. Also, stay abreast of Teva’s ongoing quarterly performances and financial health. Critically, remain objective and adjust outlooks as new information becomes available.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article aims to offer informational content and is not meant to be a comprehensive analysis of the company. It should not be interpreted as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. The predictions and opinions expressed herein about clinical, regulatory, and market outcomes are those of the author and are rooted in probabilities rather than certainties. While efforts are made to ensure the accuracy of the information, there might be inadvertent errors. Therefore, readers are encouraged to independently verify the information. Investing in biotech comes with inherent volatility, risk, and speculation. Before making any investment decisions, readers should undertake their own research and evaluate their financial position. The author disclaims any liability for financial losses stemming from the use or reliance on the content of this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.