Summary:

- Teva’s stock has risen 105% in two years, outperforming the S&P 500, but it is no longer a bargain at $17.50 per share.

- The company’s focus on debt reduction has been successful, with net debt falling to $15.70 billion, but high interest expenses remain a concern.

- Key drugs like AUSTEDO®, AJOVY®, and UZEDY® are driving revenue growth, with AUSTEDO® showing the most promise due to long patent life and rising demand.

- Despite strong performance and growth in generics and biosimilars, I recommend holding Teva stock, valuing it at $15 per share.

JHVEPhoto

My last article on Teva (NYSE:TEVA) was about two years ago and I had expressed an overall positive view. Net debt was coming down a lot and generics were performing quite well, which is why I considered Teva as a buy.

I believed in the company’s comeback and since then the stock has risen 105%, which is twice the return of the S&P 500. Two years later, Teva has become a stronger company with a brighter future, but after such an increase in price per share, I no longer think it is a bargain.

Debt sustainability

The aspect of Teva that most concerns investors is its huge debt accumulated following the $40 billion acquisition of the generic arm of Allergan. The aim was to become one of the world’s leading drugmakers, and indeed it did, but the market did not rate the deal positively. This situation, combined with legal problems and high interest rates, generated strong negative sentiment toward the company.

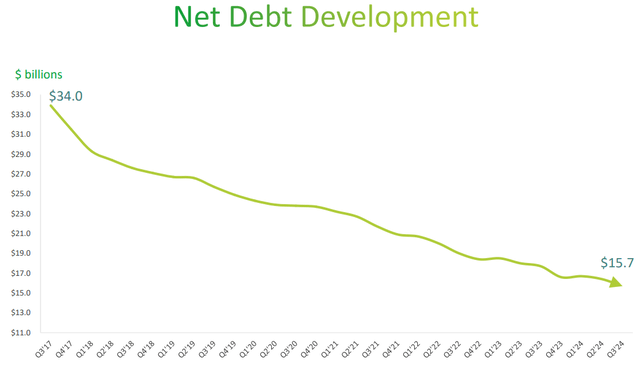

The goal was to bring net debt below $20 billion by the end of 2023, and it was largely achieved.

Teva Q3 2024

Last quarter it stood at $15.70 billion and the pace at which it is falling does not seem to be stopping. As a reminder, Teva does not pay dividends, so it can use much of its free cash flow to reduce net debt.

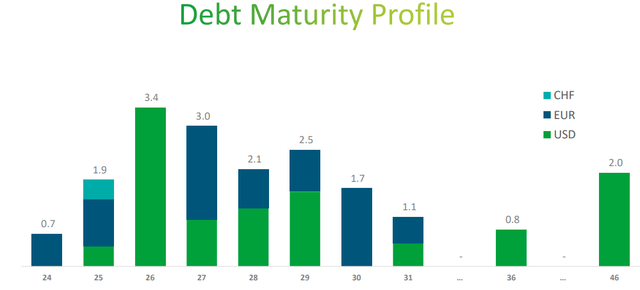

Teva Q3 2024

The maturity profile highlights an interesting aspect, namely that much of the debt is concentrated in the next five years. By 2029 the debt to be repaid is $13.60 billion (71.57% of total debt) at a weighted average cost of 4.50%, so not too high. This is why management is focusing primarily on debt reduction rather than shareholder remuneration, because refinancing this debt at current rates would mean greatly increasing interest expenses.

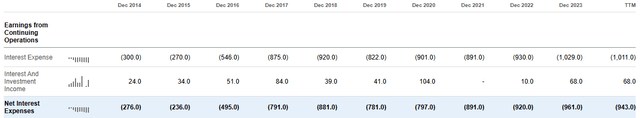

Seeking Alpha

The latter are already too high ($943 million) and reducing them would bring significant economic benefit to the company. Just think, in the last 12 months, 25% of operating income was used to pay interest. If the company gives continuity to its performance, starting in 2027 there could be a first major improvement in this respect.

AUSTEDO®, AJOVY® and UZEDY®

Teva is best known for its generic/biosimilar drugs, but it also has some rather interesting innovative products.

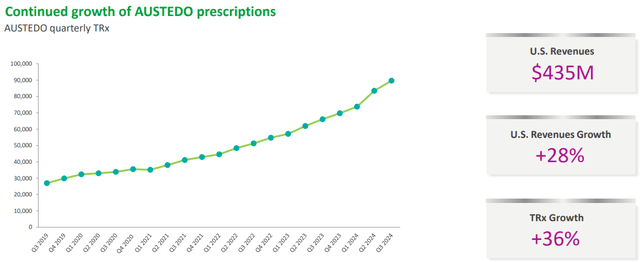

AUSTEDO is the most important of them all, in fact it is responsible for 10% of total revenues. This drug helps reduce involuntary movements caused by tardive dyskinesia or Huntington’s disease.

Teva Q3 2024

Over the quarters, prescriptions have increased greatly, +36% over last year, and consequently so have revenues, +28% over last year. Revenue guidance for FY2024 is $1.60 billion and the future of this drug looks very promising for Teva for two reasons:

The patent expiration is a long way off, 2038, so it will be a long time before there is a generic.

The prevalence of Huntington’s Disease in the West has increased over the past 50 years. In addition, the use of antipsychotics is expected to increase, and as a result there are likely to be more cases of tardive dyskinesia (being caused by the use of antipsychotics).

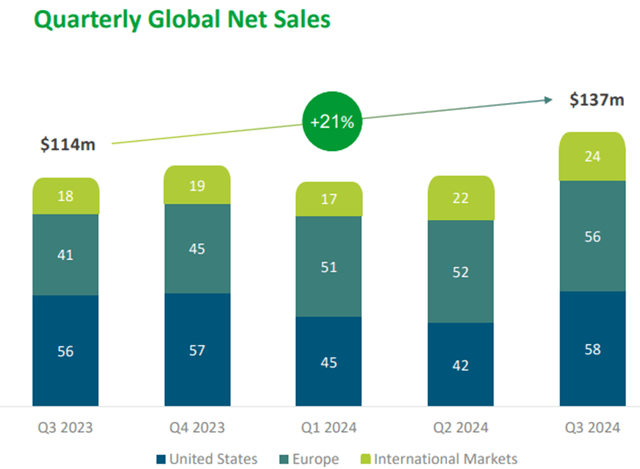

AJOVY is Teva’s other major drug, and its sales increased 21% over last year, driven mainly by increased demand in Europe.

Teva Q3 2024

AJOVY is used for the preventive treatment of migraine in adults, particularly those who suffer from migraine at least four times a month. Migraine is increasingly common, but this drug will not grow much longer as the patent in Europe expires in 2026 and in the US in 2027. To date, AJOVY generates 3% of total revenues.

Teva Q3 2024

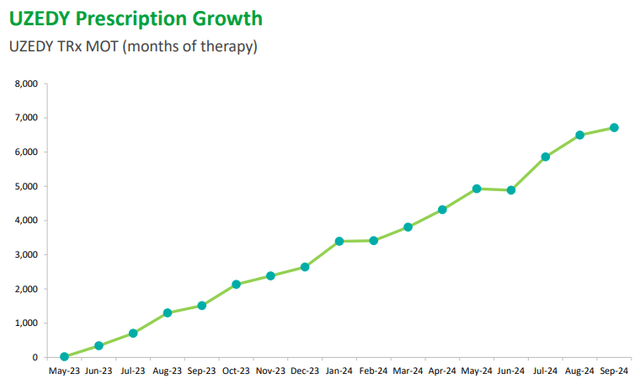

Finally, let’s take a look at UZEDY, the new entry in Teva’s portfolio used by those suffering from schizophrenia. Its prescriptions have increased significantly, as have its revenues: $35 million in Q3 2024 versus $2 million last year.

When it comes to UZEDY and its product profile, and I’ve been very encouraged by the uptake of UZEDY, because when we developed it, we are always proud of the product profile. It’s a pre-filled syringe. It’s subcutaneous. The PK – the drug levels get up to active levels within 24 hours. There’s no PO supplementation. We’re already presenting data showing how people can switch onto this very convenient product. When you’re a bit in the psychiatrist office, it’s very busy. You want to be able to have something ready and easily administered to your patients. So that’s what I’ve been proud of.

Its results were so positive that the revenue guidance for FY2024 was revised way up: $100 million vs. $80 million.

Biosimilar portfolio and generic products

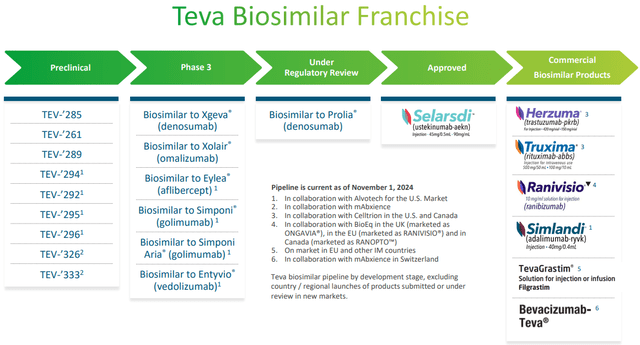

Teva Q3 2024

The biosimilars portfolio is a major component for Teva’s revenues, and the biosimilar of Prolia® is almost ready for commercialization. Prolia is a drug developed by Amgen to combat osteoporosis; about 7.50 million patients use it and it generated record revenues of $1.10 billion in one quarter earlier this year. This biosimilar only needs approval.

Different story for the biosimilars of Eylea® and Entyvio®, in fact they are both in collaboration with Alvotech for the U.S. market and are still stuck at phase 3. Eylea in 2023 generated global sales of as much as $9.71 billion, while Entyvio $5.54 billion. The latter continues to grow in double digits as it treats ulcerative colitis and Crohn’s disease, two diseases whose prevalence is on the rise.

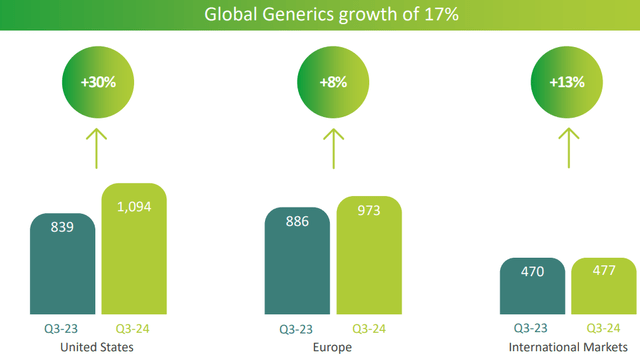

Finally, let us briefly take a look at the main source of revenue, generic products.

Teva Q3 2024

In the United States the improvement was sharp, but overall revenue performance was also great, up 17% from last year.

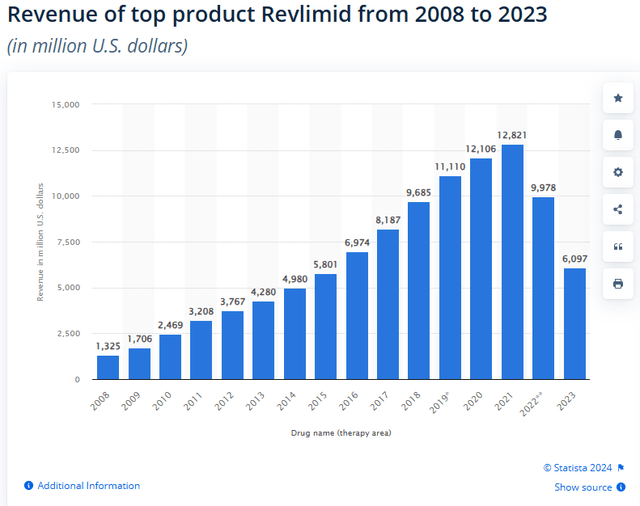

A large part of this improvement can be attributed to Teva being the first to release generic Revlimid® in 2022.

Statista

Revlimid is used to fight blood cancer and performed exceptionally well until the patent expired. Since then, its revenues have halved, favoring generic drugs including Teva’s. Teva’s focus on complex generics has also led it to enter the type 2 diabetes market; in fact, this year it launched a generic of Victoza®. That drug generated annual revenues of $1.65 billion.

Conclusion

Since my last article, Teva has grown 105% as it has been able to deleverage and increase its revenues by double digits. Its competitive advantage lies in developing advanced generic drugs, and the generic potential of Revlimid is vast. In addition, AUSTEDO is rising rapidly and its patents have a very long expiration date.

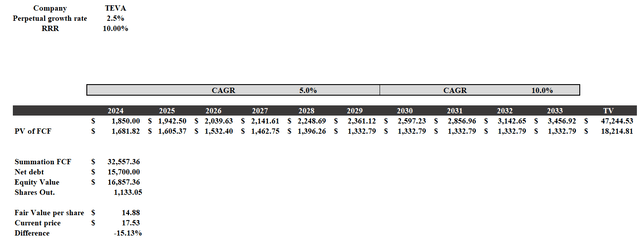

Teva deserved a strong price-per-share increase, but maybe 105% was too much. I created a DCF model to figure out what its fair value is, and personally I would not buy it above $15 per share.

DCF model

This model was created as follows:

- The company estimates a FY2024 free cash flow between $1.7 billion and $2 billion, I entered the average. From that point on, I assumed a 5% growth rate until 2029, which is when most of the debt will have been repaid. Interest expense relief will generate more cash flow, so from 2030 to 2033 I entered a 10% growth rate.

- The perpetual growth rate is 2.50%, while the RRR is 10%. The latter is an arbitrary value; I wanted to consider a return at least in line with the long-term annual average of the S&P 500.

As mentioned the result is about $15 per share, below the current $17.50 per share. I currently believe that Teva is a hold and that the opportunity to outperform the S&P 500 is now gone, unless there are unexpected twists and turns. Some drivers could be the approval and marketing of a generic of Prolia in both the U.S. and Europe, as well as a more positive than expected performance of AUSTEDO.

Teva is proving to be a solid company and is gradually regaining lost ground, but is no longer a bargain in my opinion.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.