Summary:

- Teva gets a buy rating as it trades well below 10-year highs and shows growth potential as the leading global generic drugmaker.

- Their drug pipeline is robust and diverse, as well as existing drugs on the market across multiple clinical segments, including cancer drugs.

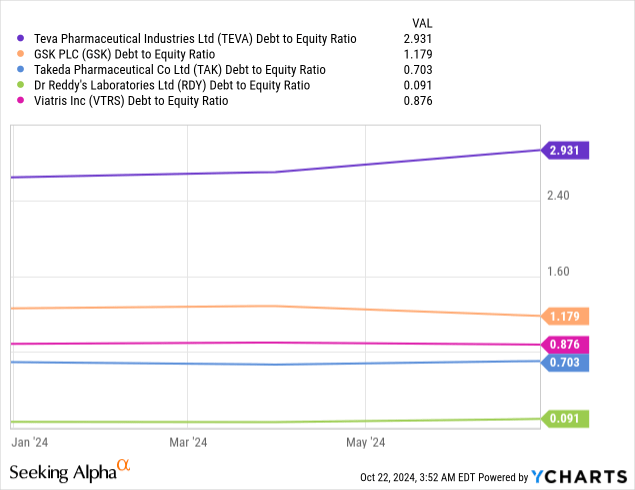

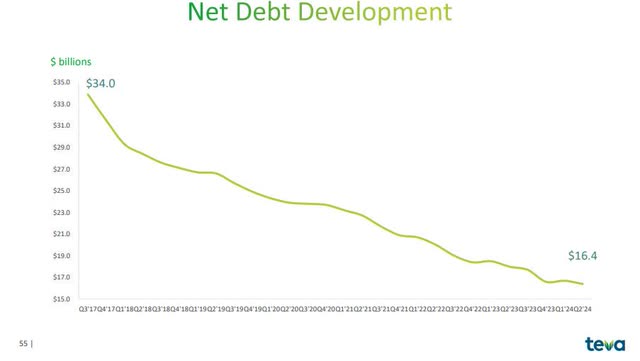

- Debt to equity is high vs peers; however, debt is on a declining trend.

- A key risk in pharma space, both financial and reputational, is facing costly legal/regulatory cases.

JHVEPhoto

Thesis: Opportunity to Buy Major Pharma Stock at Under $20, with Growth Indicators

As we gear up for Teva Pharmaceutical Industries (NYSE:TEVA) announcing their Q3 earnings results in just a few weeks on Nov. 6th, my thesis today argues that this stock presents a buy opportunity with high confidence that future share price gains could be driven by its leading market position in the continually growing generic drugs market which points to demand growth across multiple clinical segments as well as a market need to lower drug costs, a robust drug pipeline and diversified global drug portfolio, and indications of an improving debt picture, while its valuation currently is mixed and the share price remains far below 10-year highs at under $20/share.

At the same time, investors should consider that Teva is not a dividend-income stock, and the biggest risk factor it could be impacted by in the future is legal/regulatory settlements it may face, as any pharma company, which also can hurt brand reputation as well as the bottom line.

Here is a snapshot of the supporting points of my thesis today.

Positive supporting points:

- Despite recent bullishness, the share price well below 10-year high.

- FY24 financial guidance raised by company after strong Q2.

- Teva is #1 generics maker globally, as generics forecasted to grow further.

- Robust development pipeline, and diversified portfolio of existing drugs.

- Generic drugs market forecast to grow further from 2024-2033.

- Mixed valuation picture, undervalued on forward EV/EBITDA ratio.

Negative supporting points:

- Not a dividend payer yet 4 of its key peers are.

- Despite declining debt, debt/equity ratio very high vs peers.

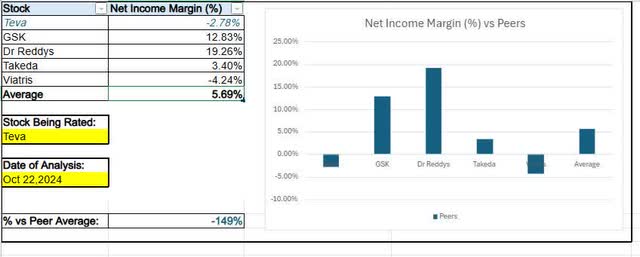

- Negative profit margin vs key peers, as OpEx costs grow.

- Recent legal settlement with US govt point to legal/regulatory risk of the pharma sector.

Stock Overview: A Global Pharma Brand

With roots in Israel going back to 1901 and currently trading on the NYSE, according to its SA profile, the firm “develops, manufactures, markets, and distributes generic medicines, specialty medicines, and biopharmaceutical products in North America, Europe, Israel, and internationally.”

It is also the parent company of one of Croatia’s leading pharma giants, Pliva, which was the original inventor of antibiotic azithromycin in 1980, and often gets into strategic collaborations with various firms such as Teva’s recently announced partnership with mAbxience to develop “biosimilars” in the oncology space, or medicines “highly similar to another already approved biological medicine.”

For some of my comparable peer data today I selected the following 4 peers since they have significant global businesses in the pharma space across multiple clinical segments but also trade on the 2 major US exchanges: GSK (GSK), Takeda (TAK), Dr. Reddy’s (RDY), Viatris (VTRS).

Strong Market Share in a Growing Market

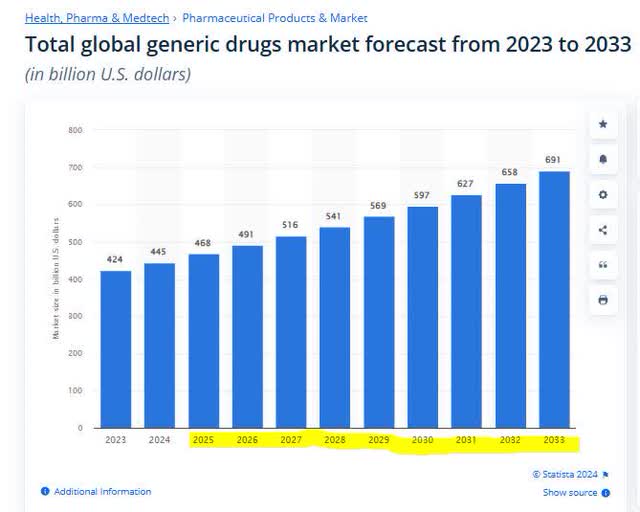

According to Statista, the global market for generic drugs is forecasted to continue growing steadily and reach nearly $700B by 2033, which I think spells good news for firms like Teva from a forward-looking view.

Statista – generic drugs market forecast (Statista)

In terms of market share of the generics market, both Wikipedia and The Jerusalem Post reported that Teva is the largest generics maker in the world and the 18th largest pharma company overall.

I think this data, coupled together, should add confidence to the future growth prospects of this firm who has a leading market position in an already growing market.

Price Still Far Below 10-Year High, with Mixed Valuation Picture

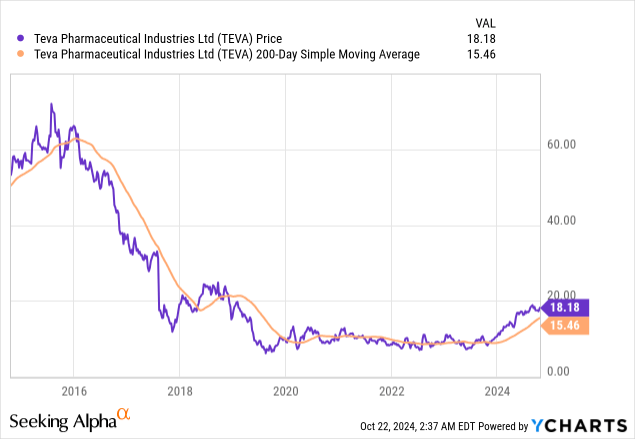

Yes, it seems you can get a major pharma stock for under $20 a share. As of the writing of this research article, the stock has been trading about 17% above its 200-day simple moving average, in the $18 range, however as the chart below shows, it is still well below its 10-year high, which peaked well above $60/share back in 2016.

I think its more recent bullishness also correlates with strong market momentum, as it easily beats the S&P500 index on 1-year total return.

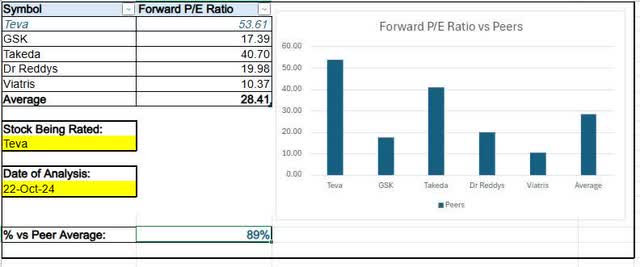

Going beyond just the short-term price bullishness, let’s talk about valuation by comparing the forward price-to-earnings ratio (GAAP-based) to its peer average, which I did in the following sheet using peer data from Seeking Alpha.

Teva – fwd PE ratio vs peers (author worksheet)

From this data, we can see that Teva which has a nearly 54x forward earnings multiple, is severely overvalued to its peer average, by 89%, actually.

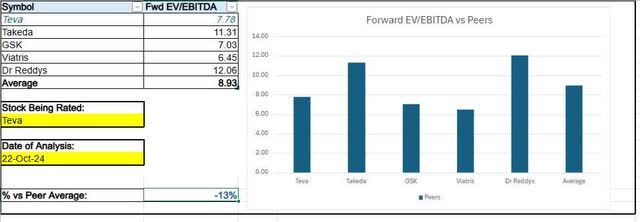

However, also from peer data we can see the following which shows that Teva with a forward EV/EBITDA multiple of 7.7x is actually undervalued to its peer average by 13%.

Teva – fwd EV/EBITDA ratio vs peers (author worksheet)

This presents a mixed valuation picture, therefore.

Since the first metric, forward P/E ratio, shows the market is very optimistic about this firm’s future earnings potential, next we will have a look at what some drivers of that forward-looking optimism may be.

Future Growth Indicators From Robust Pipeline and Diverse Drug Portfolio

Indicators of continued forward-looking confidence are supported by key data and commentary from the firm’s Q2 results.

In his Q2 results commentary, CEO Richard Francis said the firm was “delivering strong growth driven mainly by our generics and innovative business” and “showing significant progress in on our late-stage innovative pipeline, underscored by the acceleration of the development timeline of duvakitug (Anti-TL1A). With these robust results, we are raising our financial guidance for 2024.”

In the pharma space, what I am looking for is a robust and diversified pipeline of drugs/therapies, particularly ones in late-phase development, as well as a portfolio of drugs already on the market globally.

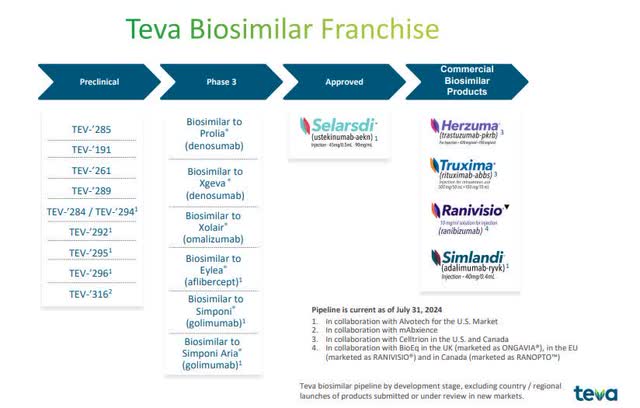

From company data, what, I think, can help future revenue growth is that the fact that Teva has 5 products either on the market or approved, 6 in late phase, and at least 9 in preclinical stage, as the graphic below shows.

Teva – drugs pipeline (company Q2 presentation)

The nature of this type of business is that it is highly regulated, as I mentioned in my recent article covering pharma giant Novo Nordisk (NVO), and with that said it could take years in some cases to get a drug through the process and actually earning money from it, while in the meantime requiring huge research budgets.

In fact, info about the US FDA (Food & Drug Administration) drug approval process indicates extensive discovery and preclinical research before late-stage FDA review even starts, and the preclinical phase requires personnel, equipment, facilities, and systems of quality assurance. All of this points to high upfront capital expenses for a major pharmaceutical company.

Further, a 2024 article in medical journal The Lancet did a study on 81 drug development projects and “found that the median development time from first-in-human study initiation to obtaining marketing authorisation was 7.3 years.”

I think the competitive edge, however, that Teva has is that it can help drive lower drug costs by bringing generics to the market, and lower drug costs are good for both patient and payers (insurers), while competitive edge is good for Teva shareholders.

For example, in collaboration with Celltrion, Teva made available Truxima, a biosimilar version of the original drug Rituxan (rituximab) used in lymphoma and leukemia patients, and which has been authorized for use in the EU as well.

The unfortunate fact, as data from the National Institutes of Health has pointed to, is that “globally, the incidence of NHL(non-Hodgkins lymphoma) has increased rapidly in the past decades. NHL ranked as the 11th most commonly diagnosed cancer, with nearly 545,000 new cases.”

I think this will continue to drive the need for innovative, cost-efficient and potentially life-saving therapies in this space. As the article from NIH goes on to say, “with the advent of novel targeted therapies, prognosis in NHL has significantly improved over the past few decades, with survival rates exceeding 80% in high-income countries.”

In its other clinical segments, key revenue growth drivers this year so far have come from its existing drugs Austedo, used in patients with Huntington’s Disease, and Ajovy, for patients with migraines. I think how this benefits Teva going forward is that it can penetrate multiple clinical segments through a diversified drug portfolio rather than relying solely on a single product, thereby lowering risk for investors too.

Teva – rev growth (Teva Q2 presentation)

High Debt/Equity but Debt on Declining Trend

Some business fundamentals I would consider as an investor are the debt picture of this firm, and so first let’s look at the following chart which shows Teva’s debt-to-equity ratio of 2.93 being well above its key peers, indicating to me that this firm is very dependent on debt financing, which I think also poses a higher risk factor as well to an investor.

On a positive note, however, according to their Q2 presentation debt levels at this firm have seen a trend of steady declines, now hovering around $16.4B, which is also confirmed in their balance sheet data.

Teva – declining debt (company q2 presentation)

From a future-view, since it is firm so dependent on debt financing I think that a lower interest-rate environment could be of benefit to it when it needs to take on new debt later on or refinance old, so the indicators I care about are whether the central banks such as the Fed and ECB (European Central Bank) are on a rate-cutting trajectory.

After the Fed’s rate cut in September, we can see from CME Fedwatch data that there is a +90% probability of a further rate cut in November, and a +60% likelihood of another cut in December.

In addition, the ECB “lowered three key ECB interest rates by 25 basis points” on Oct. 17th, based on updated assessments of the inflation outlook.

I think this could point to some relief going forward in the cost of financing for firms that are very dependent on debt financing, such as Teva, and lower interest expense can have a positive impact on future net income results, which could be another upside for the share price, after we have gone through the last few years at elevated interest rates and higher cost of debt.

Profit Margin Behind Key Peers, as Costs Mount

Considering that from its income statement it is evident that Teva has posted net losses in the first two quarters of the year, let’s compare its profit margin to peers using my chart below, and peer data.

Teva – net income margin (author worksheet)

What the data tells us is that Teva with a negative profit margin of -2.78% is actually 149% below this peer group average, but also that it is one of only two pharma companies in this group with a negative profit margin, while peers like GSK can boast a profit margin of nearly 13%.

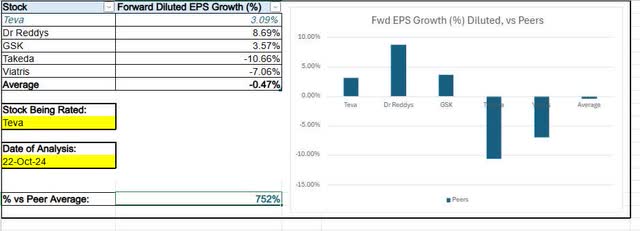

In terms of forward EPS growth, what my sheet below tells us is that Teva with a fwd EPS (diluted) growth expected of 3.09% is over 700% above this peer group average which actually shows a negative EPS growth.

Teva – fwd EPS growth vs peers (author worksheet)

Although this may at first appear like great news for future share prices, I think it is essentially a “recovery” from unprofitability in the first half of this year and right now the analyst consensus is split 5/5 in terms of upward and downward earnings revisions.

My concern looking ahead is whether this company will reign in its high costs, to continue improving the bottom line.

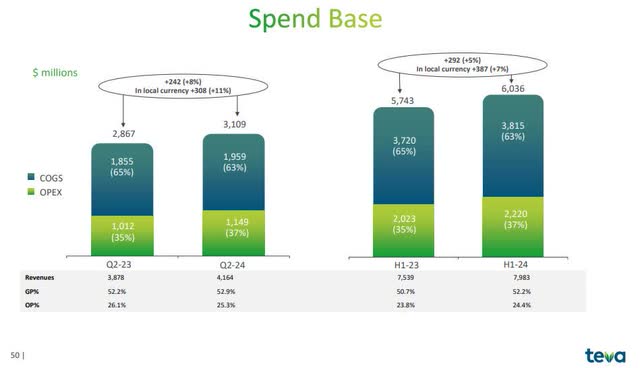

The company referred to high operational costs as impacting their operating margin, according to their Q2 earnings release:

The decrease in non-GAAP operating margin in the second quarter of 2024 was mainly due to higher operational expenses as a percentage of revenues, partially offset by higher gross profit margin.

For example, we can see in the graphic below that both the cost of goods sold and operating expenses have climbed by at least a few percentage points on a YoY basis.

Teva – spending (company Q2 presentation)

With that said, for the upcoming Q3 and Q4 results I am looking for commentary from the company on what steps they are taking to improve their cost structure, and I think if they are decisive about that it could be a positive upside for its share price. If they fail to reign in their high cost structure over the next year, it could also present a potential downside to my bullish thesis.

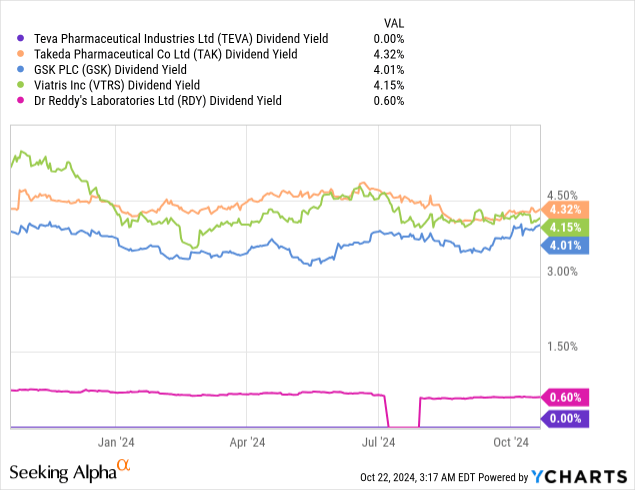

Not A Dividend Income Opportunity

For dividend-income focused investors like myself, the disappointment is that Teva is not a dividend payer, however its 4 peers are.

In fact, here is a look at the dividend yields investors can expect from its peers:

With recent net losses and a push to return to profitability, along with a goal of reducing debt, I don’t expect Teva to start paying a dividend anytime soon, so for investors this stock may not be a dividend play in the short term but perhaps an investment goal of long-term share price gains driven by earnings improvements up ahead.

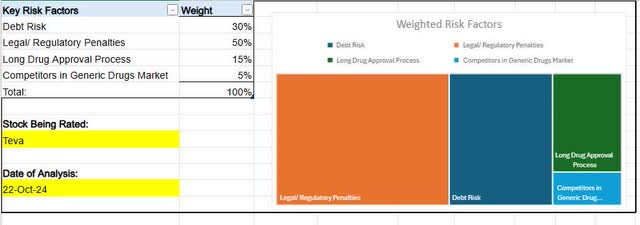

Risk Chart: Legal & Regulatory Risks Surpass Others

We have touched upon some key risks in this article to consider this type of business, which includes the debt risk, time and cost of lengthy drug approval processes where no revenue is generated from those drugs in that time, and competition in the generics market.

In addition, I would add the risk of costly legal and regulatory cases a pharma company could face, which not only has a financial impact but also hurts the brand reputation, and thereby can impact future share prices due to negative headlines in major media.

For example, recently on Oct. 10th Reuters ran a story that Teva agreed to pay $540MM “to resolve allegations it used charities that help cover Medicare patients’ out-of-pocket drug costs as a means to pay kickbacks to boost sales of its multiple sclerosis drug Copaxone and conspired to fix prices for generic drugs.”

I should mention, according to the article, Teva “said it did not admit wrongdoing”, and that other pharmaceutical firms were also part of US Dept of Justice investigations.

With that said, here is a risk chart I created for Teva which shows the types of weighted risks I think investors could consider regarding this stock.

Teva – risk chart (author worksheet)

From this chart, I gave the greatest weight to legal/regulatory penalties as I think they could have the biggest impact to future brand reputation and costs incurred, while the lowest weight was given to the risk of competitors in the generics market, considering that Teva has a leading market position in that space.

In terms of the risk of lengthy drug approval processes, this is a fact for any company in the pharma sector, and not unique to Teva, so more of a sector risk than a company risk.

Conclusion: Bullish Confidence Driven by Long-Term Growth Indicators & Market Position

In summary, I like Teva for its global diversification and role in reducing drug costs for millions of people through much-needed generics/biosimilars, which evidence points to there being a continued need for.

I am confident about upcoming Q3 and Q4 results, expecting continued earnings improvements driven by revenue growth, but think there is more opportunity for the company to speak to what it is doing to reduce costs further.

Going from two quarters of net losses to a potential long-term turnaround and improved profit margins could present a great upside opportunity for investors, along with an improved debt picture and continued leading market position in a space with an already existing demand to fill, as clinicians face the challenge of prescribing “safe and effective” therapies for a growing number of conditions, while payers face the challenge of controlling the high costs of certain drugs, thereby giving generic makers a key role to play.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.