Summary:

- Since Richard Francis became CEO in early 2023, his ‘Pivot to Growth’ strategy has continued to bear fruit.

- On April 16, the FDA approved Selarsdi, a biosimilar of Stelara, which earned Johnson & Johnson about $2.45 billion in the first quarter of 2024.

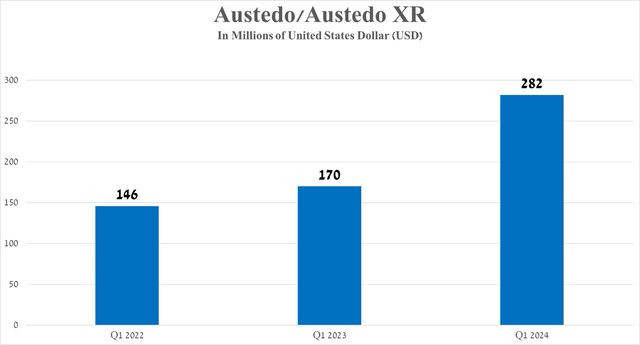

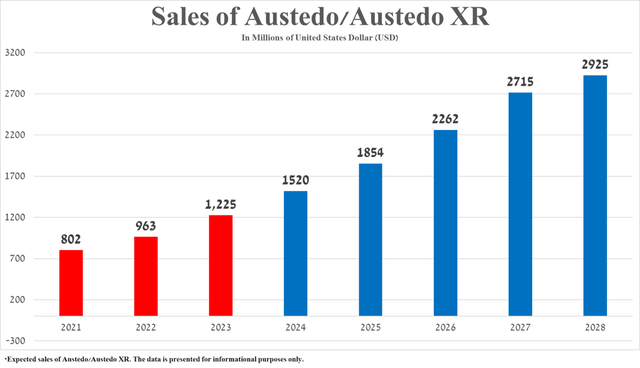

- Austedo/Austedo XR sales totaled $282 million in the first three months of 2024, up 65.9% yearly, thanks to its competitive advantage in the fast-growing tardive dyskinesia therapeutics market.

- The company has an extensive portfolioof experimental medications aimed at treating schizophrenia, Crohn’s disease,multiple system atrophy, Parkinson’s disease, and more.

- Consequently, I’m initiating coverageof TevaPharmaceutical with a”buy” rating.

Guido Mieth

Teva Pharmaceutical Industries Limited (NYSE:TEVA) is Israel’s largest pharmaceutical company and one of the major suppliers of generic drugs in the United States and the European Union.

Investment thesis

Over the past year, the company has made tremendous progress in reshaping its business, and its “Pivot to Growth” strategy is beginning to bear fruit, from accelerating the development of its experimental drugs targeting inflammatory diseases to improving operating income margin and reducing debt.

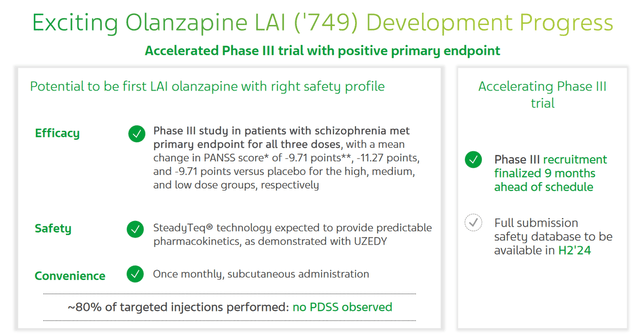

So, on May 8, 2024, Teva published the results of a pivotal clinical study that assessed the efficacy of TEV-‘749 in the treatment of schizophrenia. The data showed that this long-acting injection of the second-generation antipsychotic olanzapine not only met primary and secondary endpoints, but its efficacy in combating this mental disorder that affects approximately 3.5 million Americans was higher than my expectations.

On June 1, the company announced the publication of the results of several studies at Psych Congress Elevate 2024, which demonstrated the usefulness of switching patients from Johnson & Johnson’s (JNJ) Invega Sustenna to Uzedy. This switch provides higher pharmacokinetic parameters, which, in my opinion, will ultimately lead to a decrease in the risk of relapse, as well as improved psychosocial outcomes in patients with schizophrenia.

In my opinion, in addition to the product candidates, the analysis of which will be presented later in the article, additional contributors to the improvement of Teva Pharmaceuticals’s financial position are its expanding portfolio of generics and biosimilars, as well as its innovative medications such as Austedo, Simlandi, Ajovy, and Uzedy.

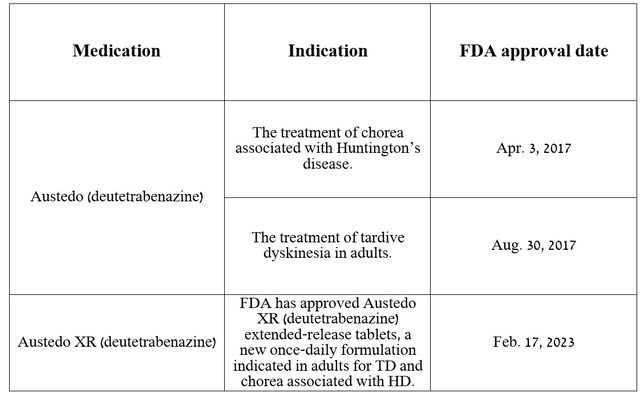

Meanwhile, the company’s flagship products remain Austedo and Austedo XR, which consist of the same active substance called deutetrabenazine, which is a vesicular monoamine transporter 2 inhibitor.

Before moving on to discussing their total sales, patent protection, and indications for use, I want to note that the only significant difference between these two medications is that Austedo XR is an extended-release formulation of deutetrabenazine, which is used once a day, unlike Austedo, which is used twice a day.

Both medicines are approved by the FDA for the following indications.

Source: The table was made by the Author based on Teva Pharmaceutical press releases

Sales of Austedo/Austedo XR were $282 million in the first three months of 2024, an increase of 65.9% year over year, primarily due to continued growing demand in the United States from patients with tardive dyskinesia and additional clinical data published at the Huntington Study Group Annual Meeting, which demonstrated that Austedo remains an effective treatment option for patients with Huntington’s disease chorea.

Source: The graph was made by the Author based on 10-Qs and 10-Ks

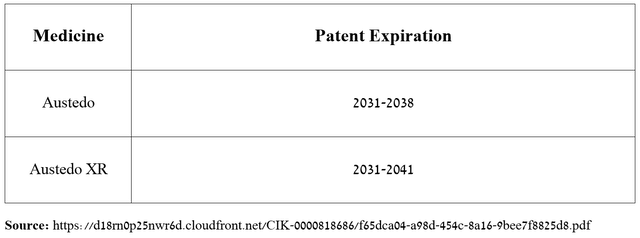

In addition, I want to point out that thanks to the numerous patents listed in the Orange Book, many of which expire only between 2031 and 2041, protecting Austedo/Austedo XR from the introduction of its generic versions into the market, I believe there are no factors that could slow its sales growth rate in the long term.

Source: The graph was made by the Author based on Teva Pharmaceutical’s 10-K

It is equally important to note the optimism of Teva Pharmaceutical management regarding Austedo’s long-term prospects.

AUSTEDO continues to perform really well. $282 million for quarter one, up 67% versus quarter one 2023, and a good strong TRx growth of 28%. And because of this momentum, we are confirming our guidance of $1.5 billion for 2024. But this momentum gives me more confidence and more excitement around our long-term goal, which is to get to $2.5 billion of revenue by 2027.

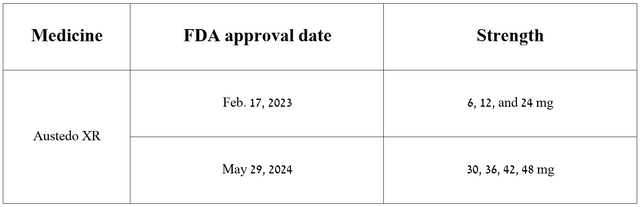

Moreover, on May 29, 2024, the company announced that the FDA had approved new tablet strengths of Austedo XR with a higher concentration of its active ingredient, which will allow doctors to choose a more appropriate treatment regimen and thereby improve the quality of life of patients in a shorter period.

Source: Author’s elaboration, based on Teva Pharmaceutical press releases

Based on Austedo’s historical sales growth rate, its potential approval by the EMA in 2026, the publication of additional clinical trial results by Teva Pharmaceutical demonstrating its extreme efficacy in treating chorea associated with Huntington’s disease, increased competition from Neurocrine Biosciences, Inc.’s (NBIX) Ingrezza, and the rapid expansion of the global tardive dyskinesia therapeutics market, I estimate that total sales of deutetrabenazine franchise will reach $2.93 billion in 2028.

Source: The graph was made by the Author based on 10-Ks

Consequently, I’m initiating coverage of Teva Pharmaceutical with a “buy” rating.

Prospects for Teva Pharmaceutical’s business development in 2024

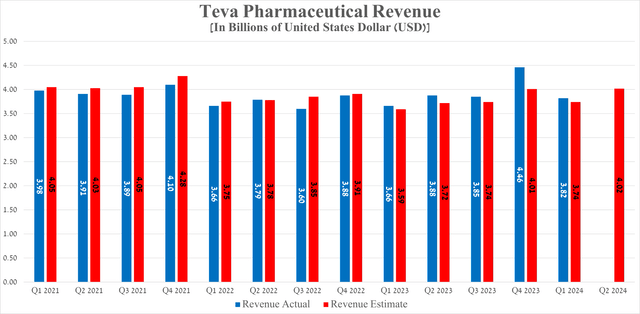

Teva Pharmaceutical’s revenue for the first quarter of 2024 was $3.82 billion, not only up slightly year-over-year but also beating analysts’ expectations by $80 million.

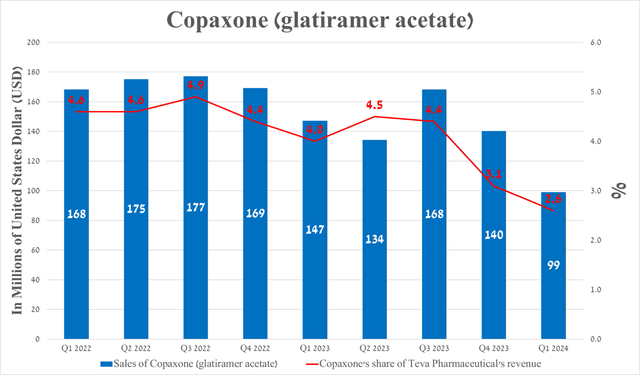

On the other hand, I would like to point out the drop in its total sales compared to the previous quarter, mainly due to the continued decline in demand for Copaxone (glatiramer acetate), as well as seasonal factors, including the provision of discounts to insurance companies at the end of the fourth quarter to stimulate sales of its products during the current year and the decline in demand for generics used to treat colds or flu.

So, Copaxone is a mixture of synthetic polypeptides used to treat relapsing forms of multiple sclerosis. Its mechanism of action is complex and is based, among other things, on the binding of glatiramer acetate to some of the molecules of the major histocompatibility complex class II, which ultimately contributes to the inhibition of the secretion of proinflammatory cytokines, including interleukin 12 (IL-12), interleukin 2 (IL-2), transforming growth factor-β (TGF-β).

Its sales were $99 million in the first three months of 2024, down 29.3% quarter-on-quarter.

Source: The graph was made by the Author based on 10-Qs and 10-Ks

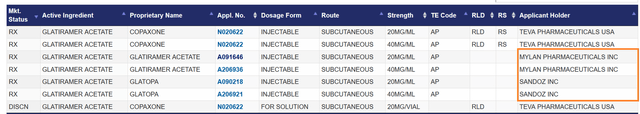

A key reason for the drop in demand for the drug is increased competition from its generic versions made by Sandoz Group AG (OTCQX:SDZNY) and Viatris Inc. (VTRS), formerly known as Mylan Pharmaceuticals.

Source: U.S. Food and Drug Administration

On the other hand, in my opinion, the damage from the drop in sales of this drug to the company was offset by the continued expansion of its portfolio of generics, the launch of Uzedy for the treatment of patients with schizophrenia, as well as the FDA approval of the Humira biosimilar called Simlandi (adalimumab-ryvk) at the end of February 2024.

Although several biosimilars of AbbVie Inc.’s (ABBV) blockbuster are already being commercialized, Simlandi has become the first highly concentrated citrate-free biosimilar with interchangeability status, which allows patients with various autoimmune and inflammatory diseases to get it at the pharmacy instead of Humira without the need to consult prescriber.

Ultimately, this led to not only year-on-year growth in Teva’s revenue but also an increase in its operating income and gross margins.

Besides, the Seeking Alpha platform offers financial data as well as Wall Street analysts’ forecasts for Teva Pharmaceutical’s revenue and EPS for the coming quarters.

So, its revenue for the second quarter of 2024 is expected to be between $3.99 billion and $4.07 billion, up about 3.6% year-on-year.

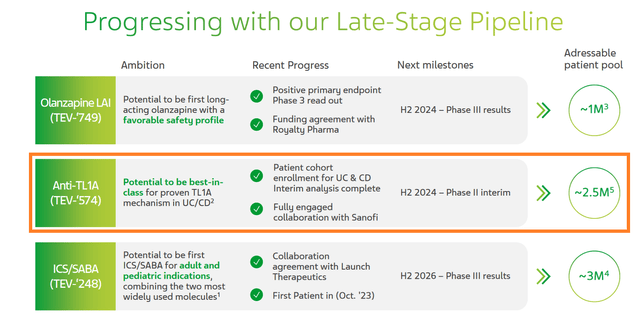

Meanwhile, in the long term, the increase in the rate of growth of Teva Pharmaceutical’s revenue and free cash flow, in my opinion, will depend not only on the pace of expansion of its portfolio of generics and biosimilars, which it is doing well, but also on the company’s success in developing its pipeline of experimental medicines, some of which have the potential to become “gold standards” in the treatment of asthma, schizophrenia, and inflammatory bowel disease.

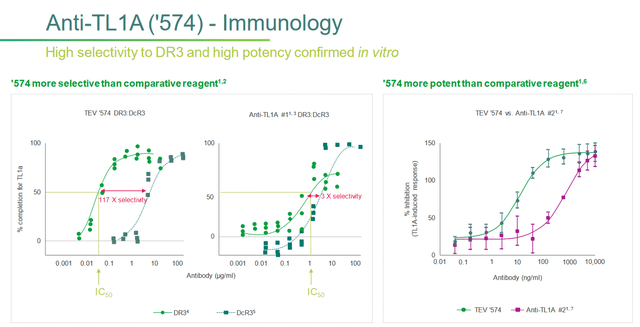

So, in my estimation, Teva’s most promising product candidate is TEV ‘574, developed jointly with Sanofi (SNY) under a $1.5 billion agreement signed on October 4 last year.

It is a monoclonal antibody targeting TL1A, which is being developed to treat two common chronic inflammatory conditions, ulcerative colitis and Crohn’s disease, which affect about 4.9 million people worldwide.

I would like to point out that in addition to the in vitro studies conducted by Teva, which demonstrated higher selectivity and potency relative to other drugs, there is also a growing scientific base according to which inhibition of TL1A promotes the activation of natural killer cells, and also leads to a significant reduction in the number of pro-inflammatory cytokines and fibroblasts.

Ultimately, these factors are strong prerequisites that TEV’574 will pleasantly surprise Wall Street with results from the ongoing phase 2 clinical study, which I estimate will be published in late Q4 2024.

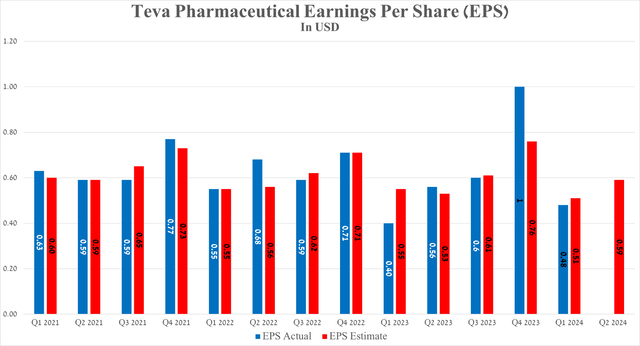

Teva Pharmaceutical’s earnings per share for the first three months of 2024 were 48 cents, up 8 cents from the first quarter of 2023. In contrast, its EPS is anticipated to be between 53 and 61 cents in the second quarter, up about 11.3% from analysts’ expectations for the previous year.

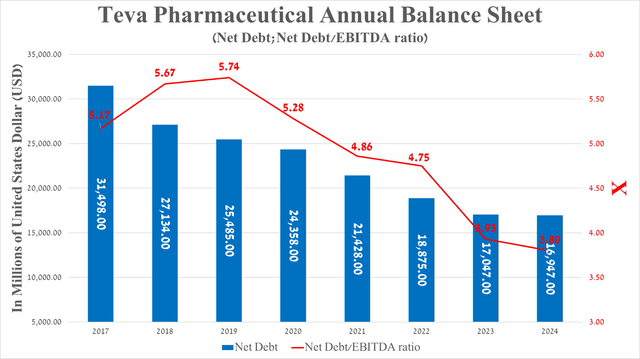

It is equally important to discuss Teva Pharmaceutical’s debt, which is no longer a serious risk to its financial position.

So, its net debt was about $16.95 billion at the end of March 2024, continuing to decline after the completion of the disastrous acquisition of Actavis Generics in 2016.

Moreover, Teva’s net debt/EBITDA ratio has remained below 4x in the last two quarters, which, in my opinion, is one of the strong signals that Fitch Ratings and Moody’s Corporation (MCO) will revise its credit rating upward.

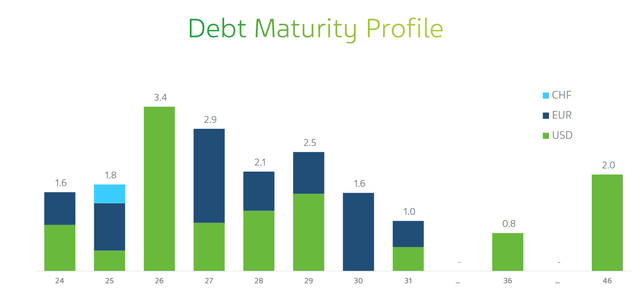

Overall, I believe the company will not have significant difficulties with either servicing or repaying its senior notes for several key reasons, including the launch of its new biosimilars in partnership with Alvotech (ALVO), the successful launch of Uzedy, a strengthening balance sheet, and a significant increase in Teva’s EBIT margin year-on-year.

Risks

Before I conclude, I would like to highlight the following financial risks that could affect Teva Pharmaceutical’s investment attractiveness in the medium term.

These risks include increased competition in the migraine treatment market, which could slow Ajovy’s sales growth, and if TEV-‘574 and TEV’286 show lower efficacy in clinical trials than Wall Street analysts expect.

On the other hand, I believe that the war between Hamas and Israel and the constant shelling of its territory by Hezbollah are not a significant risk since most of its manufacturing facilities are located in Europe, the United States, and China.

Takeaway

On May 8, 2024, Teva Pharmaceuticals, one of the leaders in the pharmaceutical industry, published financial results for the first three months of 2024, which not only confirmed the improvement in its financial position after reaching national opioid settlements in 2023 but also pleasantly surprised me with the progress in the development of its pipeline of experimental drugs.

I believe 2024 continues to be one of the key years in the company’s history as Teva expects to publish the results of various clinical trials evaluating the efficacy of TEV-‘574, which is developing for the treatment of ulcerative colitis and Crohn’s disease, as well as olanzapine, which has the potential to become the “gold standard” in the treatment of schizophrenia.

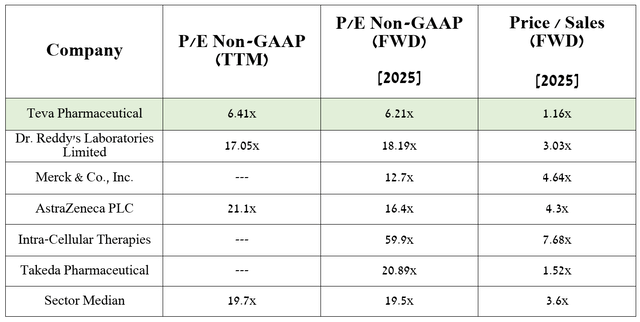

On the other hand, according to my assessment and analysts’ expectations, thanks to the expansion of the portfolio of biosimilars and generics, as well as the growth in sales of Ajovy and Austedo/Austedo XR, the company’s EPS in 2025 will reach 6.2x.

As a result, this shows that Teva Pharmaceuticals is trading at a discount to many of its peers listed in the table above, and given the company’s year-over-year operating income growth, declining net debt, and accelerating development of next-generation drugs, I believe the Israeli pharmaceutical company remains one of the undervalued stocks in the healthcare sector.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.