Summary:

- Teva Pharmaceutical’s financial performance is not strong, with high debt, lack of margin improvements, and no growth catalysts.

- The company’s margins and profitability have been poor, with ongoing legal battles and declining revenues.

- Uncertainties in the industry, including price pressures and competition, make it a risky investment at the current price.

mego.picturae/Moment via Getty Images

Investment Thesis

Teva Pharmaceutical (NYSE:TEVA) recently announced its FY23 results, so I wanted to take a closer look at the company’s financial performance to see if it would be a good time to start a position. Unfortunately, the financials are not the best, with still a lot of debt on their hands; and with the lack of margin improvements, and no growth catalysts in place, I don’t think it is a good time to start a position right now, therefore I am assigning a hold rating until we see the new pipeline delivering top-line growth and/or margins improve substantially.

Briefly on the Company

The company is a leading manufacturer of generic drugs internationally. Products are used by millions of people around the world, which includes a portfolio of over-the-counter drugs, as well as a wide range of generic and brand-name drugs. Brand-name drugs include Copaxone, which is used for treating multiple sclerosis, and Azilect, used in treatment for Parkinson’s disease.

Financials

As of FY23, TEVA had around $3.2B in cash and equivalents, against roughly $18B in long-term debt. This is a significant amount of debt, which will deter many investors who are not fond of companies that overindulge in leverage. The debt outstanding is higher than its market capitalization as of writing this article, so I don’t blame the debt-averse investors here, however, there are a few metrics I like to look at to determine whether the company is being too liberal in its utilization.

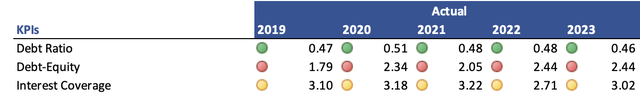

Firstly, in terms of assets, I look for less than 0.6 debt-to-assets ratio, and the company in at least the last 5 years has not been over that threshold yet. Secondly, in terms of equity, I look for less than 1.5 debt-to-equity ratio, and over the last few years, the company has been well over 2.0, which is not ideal. Lastly, I like to look at the company’s ability to meet its annual debt obligation in the form of interest expenses on the debt. Here, I look for at least a 5x interest coverage ratio, while most analysts consider a ratio of 2.0 to be sufficient. The company passes the more lenient requirements of most analysts, however, it does not pass my more stringent requirements, as it has been hovering around a 3x. So, the company got one out of three. What I do in this situation, is use a higher margin of safety in the form of discounts and growth in my valuation analysis. The debt seems to be coming down steadily over the last 5 years, so if it can continue on this path, it shouldn’t be such a big risk.

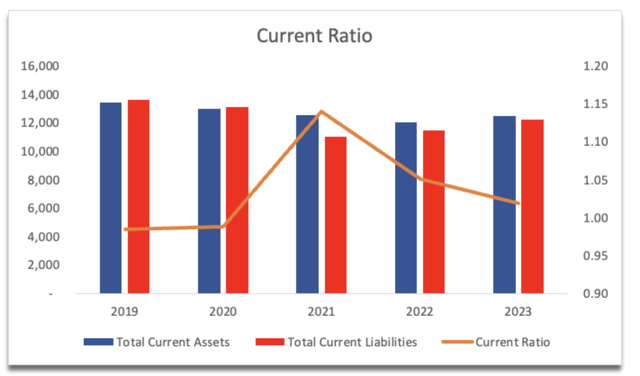

The company’s current ratio has been hovering at the very minimum I accept which is 1. I would prefer to see the company attain at least a 1.5, however, many companies in the industry are barely managing to stay at around 1, therefore, as long as the company can pay off its short-term obligations, TEVA has no liquidity issues.

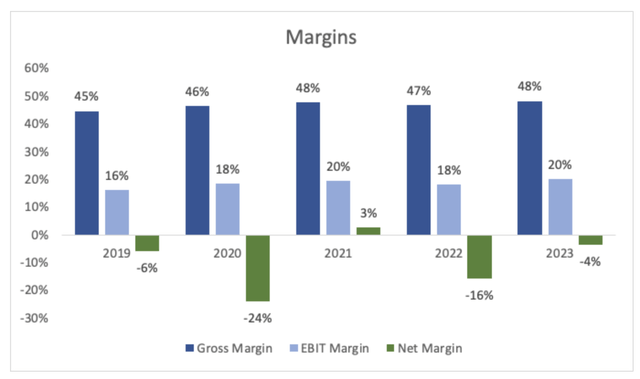

Looking at the company’s margins (GAAP), these have not been outstanding in a long time. TEVA had one profitable year in FY21, and just barely. That year, the company didn’t record any goodwill impairment charges and smaller than average legal settlement fees. As I alluded to earlier, the company’s GAAP metrics are quite poor due to impairment charges and legal expenses. Going back as far as FY13, the company was losing money to lawsuits every year, which to me doesn’t seem like a one-off non-cash expense.

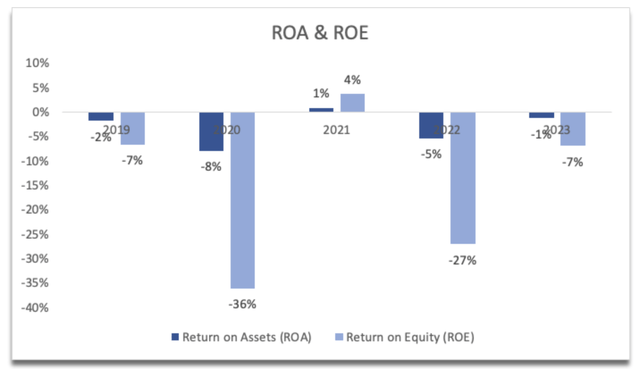

Unsurprisingly, the company’s ROA and ROE have been abysmal over the same period. The management is not utilizing the company’s assets and shareholder capital very efficiently in my opinion, and therefore, not creating value. I look for at least 5% on ROA and 10% for ROE, so the below numbers leave a lot to be desired.

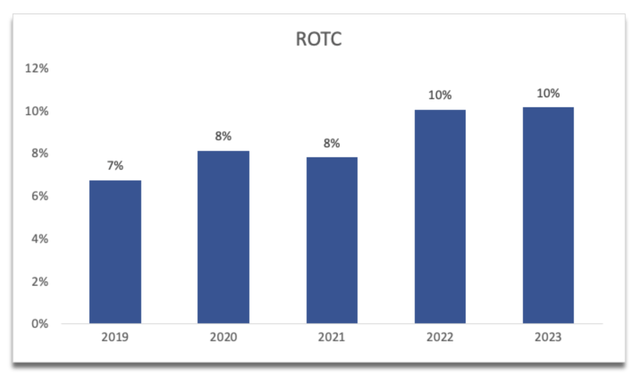

Usually, when the above metrics are bad, the return on total capital, or ROTC is also not great; however, in TEVA’s case, this is on the contrary. Over the last half a decade, the company’s ROTC has been on the rise and is hovering around the minimum I like to see, which is 10%. This tells me that the company has some sort of competitive advantage and a decent moat. Furthermore, the management seems to be able to invest the capital at their disposal into profitable projects, which shows competency.

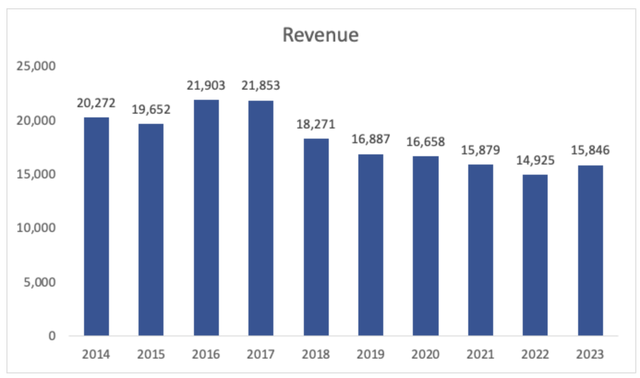

In terms of revenues, the company peaked in FY16 and has been going downhill ever since. That is not the kind of progression I’d like to see from any company. The only exception I allow is if the company is becoming more profitable by margin expansions, but as we can see, this has not happened to TEVA yet.

Overall, there is very little to like here in my opinion. GAAP margins have not been improving much at all, plagued by lawsuits and impairments. The debt is slowly coming down, and I would like to see this continue. The company doesn’t seem to be very efficient, and the bounce in revenues doesn’t give me confidence that it’ll persist. I will be using very conservative estimates and discount intrinsic value substantially, which will act as a decent margin of safety.

Comments on the Outlook

There are a lot of uncertainties in the company’s operation going forward. The first, and the most obvious is how the company is going to rejuvenate its top-line growth. Generic meds are not known to be particularly growth-driven products. Policies and government regulations are putting price pressures on these drugs and many companies that rely on generic medicine products to survive could potentially even go out of business in my opinion if prices drop too low and the business becomes unsustainable. I believe the prices of these drugs are getting too low to be sustainable and that is not going to bode well for TEVA’s top-line growth and will most certainly squeeze the company’s margins.

Speaking of margin squeezing, the company faces a lot of competition in the space. There are many new entrants and many more established ones like Sandoz (OTCQX:SDZNY), Viatris (VTRS), and Sun Pharma. These companies may take market share away from Teva if the competition is going to cut their prices, which could lead to Teva cutting theirs and losing profitability in the process.

I also believe the company’s legal battles will continue to be financial burdens in the long run, which is very common for pharma companies to be involved in, however, it mostly ends in a lot of capital and resources lost and is rarely beneficial in the end. I would like to see much smaller losses and charges, but we can’t predict what is going to happen, therefore, it is better to stay on the conservative end of this and assume the company will continue to be involved in many lawsuits and use resources that could have been used to further the growth of the company.

I would like to see the company somewhat prioritize the repayment of debt, as it is massive compared to its market capitalization. This would improve its financial position substantially and allow for much more flexibility in how the company can allocate its capital, whether that is awarding shareholders through buybacks, dividends, or my favorite, reinvesting in itself to further growth of the company, which will reward shareholders in the long run.

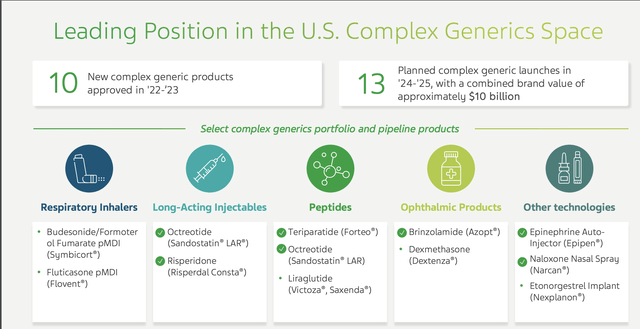

To keep up, the company has to keep churning out new products. The company is looking to launch 13 complex generics between ’24 and ’25, which should drive growth, however, I am on the more skeptical side of things, and I will have to see it to believe it but if these do end up successful, the company will have rejuvenated its top-line growth.

I would like the company to be consistently GAAP profitable, as right now I am not the biggest fan of all these adjustments that in my opinion inflate the company’s value. I am forced to look at non-GAAP metrics as that is what the company and analysts say the “true value” of the company is.

Valuation

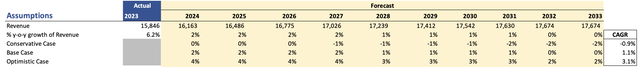

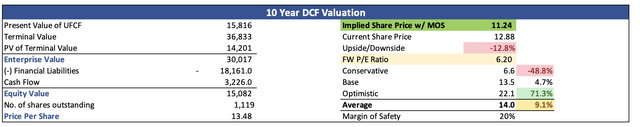

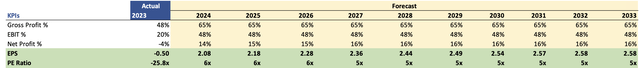

Since there are no major catalysts that I could see that would propel TEVA’s revenues to new highs anytime soon, I have to take a conservative outlook. The new products that will deliver supposedly $10B in brand value have not been proven yet, therefore, I am approaching this with a lot of conservatism. There’s very little analyst coverage of TEVA, so I will have to take these estimates with a grain of salt. I decided to go with around 1.1% CAGR for the base case scenario. The company did see growth of around 6% from FY22 to FY23, and the management expects a 2% to 6% growth for FY24, so I decided to take the conservative end of the range for added margin of safety. To cover all my bases, I also modeled a more conservative scenario and a more optimistic one. Below are those estimates and their respective CAGRs.

In terms of margins and EPS, GAAP estimates threw everything off, and I wanted to give the company a chance at a reasonable value, so I went ahead with numbers that were closer to non-GAAP estimates but slightly lower, to give myself more room for error. Below are those estimates.

Margins and EPS assumptions (Author)

For the DCF model, I also doubled the discount rate because of the reasons I outlined above (lack of growth, high debt, and inefficiencies). The company’s WACC of around 5% was too low, so I went with a 10% discount rate and 2% as my terminal growth rate. Furthermore, to account for now growth in revenues and improvements in margins, I decided to discount the final intrinsic value by another 20%. I believe that after all these conservative inputs and discounts, the intrinsic value I would get would be a decent entry point to start a position and the risk/reward would be enticing. With that said, TEVA’s intrinsic value and what I would be willing to pay for it is around $11.24 a share, which means the company is trading at a slight premium to its fair value.

Closing Comments

The company’s share price has seen quite a rally from the recent lows of last October. The company has overshot its fair value in my opinion, and I don’t think it would be the right time to start a position right now. I may have missed the boat a few months back, but I am not going to jump in right now as I believe the risk/reward is not appealing right now. I’m sure I will get my entry point later on in the year, from either the company improving its operations or the share price coming back down. My price alert has been set at around $11 a share and will re-visit the company’s profile in the next quarter to see how the company’s top-line growth progressed and whether I should adjust my conservative estimates.

There are a lot of unknowns regarding the industry, and I wouldn’t be surprised if many companies will experience further pricing pressures and deterioration in margins. It’s a risky investment in my opinion, however, there is a price I am willing to pay to take on these risks, but it is not the current price. Sure, I could make money if I buy now, but the risks are higher to the downside at this price, therefore, I am assigning a hold rating for now and will be patiently waiting on the sidelines.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.